May 2: MGM makes online move with LeoVegas offer

MGM Resorts offers $607m for LeoVegas, betting and gaming's earnings week, Gaming and Leisure Partners Q1, MGM Resorts analyst upgrade, startup focus - OneComply +More

Good morning. On today’s agenda:

MGM Resorts makes a $607m offer for Stockholm-listed LeoVegas.

It’s a big week on the earnings front for betting and gaming.

GLP’s call with analysts restates gaming’s recession-resilience message.

And MGM Resorts gets a very late positive upgrade from Jefferies.

Wimoweh. Click below to subscribe:

BREAKING: MGM makes $607m offer for LeoVegas

The offer of SEK61 comes at a premium of 44% to Friday’s closing price of SEK42.32.

MGM says the offer will “expand our online gaming presence globally.” It will pay for the deal out of current cash resources.

MGM reports its own Q1 earnings later today.

LeoVegas said it has irrevocable undertakings from shareholders representing 15% of its shares while board member and 4.6% shareholder Torsten Söderberg has also indicated his support for the deal.

The game’s afoot: Hints that something was afoot came on Sunday evening when LeoVegas brought forward its Q122 results statement by three days. MGM says the deal offers “strategic opportunities” in online casino and sports-betting with a “strong” ex-US customer base.

In 2021 LeoVegas generated revenues of €393m and €48m in adjusted EBITDA.

In Q1 revenue rose 2% to €98.5m (9% ex-Netherlands) and EBITDA rose 35% to €14.1m.

Sports-betting up 44% due to growth in Expekt brand.

Revenue mix 72% casino, 14% live casino, 12% sportsbook.

Current trading shows revenue of €34m in April, up 4% YoY, 12% ex-Netherlands.

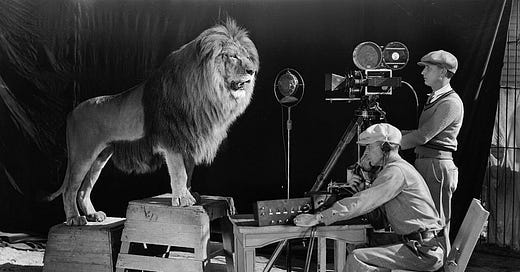

Gustav Hagman, CEO: “What they really like about Leovegas is the lion and the culture we have. This is two lions that come together and culture wise that is very strong.”

Going global: On the call, Gustav Hagman and chairman Per Norman went through some of the thinking behind accepting the MGM offer. “MGM is also very clear in its belief that it will create a unique opportunity for LeoVegas to create a global offer,” said Norman.

Per Norman: “Consolidation is ongoing and size will matter even more in the future. There is an obvious economy of scale.”

The company confirmed it would continue on the Kambi platform for sport.

They added that questions around LeoVegas’ existing market access agreement with Caesars for the US should be directed to MGM.

What MGM is getting into: Hagman had some interesting commentary around the issues LeoVgeas has faced, successively, in the UK, Germany and the Netherlands.

Gustav Hagman: “As you say, it is an industry which has some challenges from time to time. My humble opinion is that it is better for those companies to be in the private sector rather than the listed environment.”

Analyst reaction: Regulus said LeoVegas has “a lot more to recommend it to MGM than a similar leonine logo”. “In an online gaming environment too often driven by bonuses, VIPs, and churn, LeoVegas has built a strong brand and effective growth business by focusing on product and customer service.”

Elephant in the room: “The obvious elephant in the room is the BetMGM JV with Entain. Entain is successfully embedded in all major US states, has joint ownership of the BetMGM brand and is far more capable than LeoVegas in sports-betting and poker product categories.”

“The various corporate jigsaw pieces that have attempted to solve the inherent instability of JVs have all failed… suggesting that this far more simple mechanism might be ‘instead’.

“Entain is not mentioned in MGM’s press release, which perhaps tells its own story.”

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages.

For more information visit: spotlightsportsgroup.com

Betting and gaming’s big earnings week

The first-quarter earnings season moves into top gear this week with MGM Resorts kicking things off later today, a call which has become just that bit more interesting.

It will be followed by Caesars Entertainment and Red Rock Resorts (Tues), Flutter and Rush Street Interactive (Weds), Penn National, Bally, FuboTV, AGS (Thursday) and DraftKings (Fri) +More.

Things to look out for

Macro backdrop: Commentary so far on the impact of economic uncertainty on the gaming sector suggests it has yet to lay a glove on the prospects for the year ahead.

As Peter Carlino from Gaming & Leisure Properties suggested last Friday (see below) through every recession except the GFC of 2008, gaming revenues went up.

Boyd Gaming CEO Keith Smith said last week that though the company “presumed” there would be a drop in activity, it was “not discernible” as yet.

In its MGM Resorts International earnings estimate upgrade (see below), Jefferies noted last week that Las Vegas trends accelerated through the quarter.

Sports-betting profitability: This is the first earnings season which will give a sighting of how the market is progressing for the major players in New York. Whether this leads to any revenue upgrades is uncertain; Morgan Stanley actually cut its DraftKings Q1 forecast a fortnight back.

The market share performance is known - the latest data shows FanDuel extending its lead - but analysts will be looking for insight on how the promotional environment has settled since launch.

Wider questions around profitability are also likely to be to the fore.

Flutter’s trans-Atlantic balancing act: Best of times/worst of times analogies are appropriate for Flutter which will be facing questions over the future of FanDuel in the US while facing up to the imminent publication of what will be potentially revenue-harmful UK government white paper.

US listing: Analysts will be looking for any mention of plans for a separate listing for FanDuel in the US, a debate that arguably intensifies with each percentage point of sports-betting market share gains the business achieves in the monthly data.

Brace, brace, brace: On the opposite side of the seesaw, industry rumors suggest a mid-May release for the government’s plans for the sector following its Gambling Act review. Slot stake limits, gambling ad bans and affordability limits are all likely to feature.

Share slump: The elephant in the room for FanDuel’s rival DraftKings is the share price performance, down over 50% this year and over 75% down on the year-on-year chart.

Some solace for the management came last week from Tilman Fertitta’s appearance on CNBC where he said that though the value of the al-share acquisition of Fertitta’s Golden Nugget Online Gaming deal was no longer $1.5bn, he remained committed to being a long-term holder of the shares once the deal completes.

“You will look up and it will be just like an Amazon or a Tesla. When they turn the corner and turn profitable, they will become real profitable,” Fertitta said.

DraftKings will likely face questions about the continued no-show in Ontario. The upside to missing out on the marketing and promotional expense of competing from the off has to be balanced by the opportunity cost.

Newsletter schedule: Tuesday, Wednesday, Thursday morning pod, Thursday afternoon Penn and Bally earnings extra, Friday Weekend Edition and Friday afternoon DraftKings earnings extra.

Hoodwinked: Also this Friday’s sector watch will take a look at share trading, focusing on the latest news from Robinhood which has seen revenues tumble and is cutting jobs.

Gaming & Leisure Properties Q1

Revenue up 4.5% to $315m; adj. EBITDA up 10% to $266.6m.

Completed Live! Casino acquisitions during the quarter in conjunction with Cordish.

Bullet-proof: Gaming veteran Peter Carlino, previously CEO at Penn National Gaming and now in charge of the gaming REIT GLP, was keen to emphasize the “bullet-proof” nature of the gaming sector.

Carlino: “Through every recession, except ’08, through every recession our revenues at that facility and most of our gaming facilities went up.”

“If you look at Maslow's hierarchy of needs, it is food, it is shelter and it's gambling.”

“It's a way of underscoring that revenues in the gaming world are highly, highly, highly sticky. People never give up their entertainment. It’s the last thing that goes.”

“We are sleeping well at night.”

Matthew Demchyk, CIO: “As macro uncertainty persists and the capital markets volatility is evident, I want to remind everyone on the call today that GLPIs business model was built with an environment like this in mind.”

Hope and glory: So confident is the company about its near-term prospects that Carlino told analysts GLP would be increasing its dividend. Another goal is to “see what monies we can put to work with our strong tenant grouping”.

Peter Carlino: “In the end they set their own priorities, they set their own timing, and our job is to keep in front of them with our little smiling faces and hands in our back pocket where the wallet is to say, ‘We're here guys, we’d like to help.’”

A slice of the sports-betting pie: Asked about whether GLP benefited financially from sports-betting activity taking place on the mobile but on-premises, Demchyk said that they gro-locate activity taking place on the property.

With Penn’s omnichannel focus, he added that it was “important to us with the structure of that lease that that revenue that's taking place in our buildings be captured”.

I eat cannibals: “There is going to be a lot more gambling, that's the reality,” added Carlino.

“The reality is, it’s just going to be a lot more gambling going on, for better or for worse as a public policy point of view, so that's my sense.”

Growth: Carlino noted on the call that when GLP was spun out of Penn National in 2011 it had 24 properties but now it has 55. “That number will surely grow over the next year,” said Carlino.

Further REIT news: VICI on Friday completed its $17.2bn acquisition of MGM Growth Properties and at the same time closed a $5bn senior unsecured notes offering.

MGM Resorts analyst upgrade

I'm gonna keep on the run: The team at Jefferies took the unusual step of upgrading their estimate for MGM a matter of days ahead of the results (due later today), suggesting that the accelerating trends in Las Vegas meant they were out of step with consensus.

MGM takeaway: “With the Strip accelerating, capital position improving, digital execution remaining on track, MGM remains compelling,” they added.

I'm gonna have me some fun: Strip revenue in March of $746.2m was up 35% YoY and 25% MoM, helping Q1 Strip revenue to over $1.9bn, or down just 9% on Q421 despite the Omicron-hit January.

Also, LVS reported occupancy of ~85% for Venetian and Palazzo in the 53 days to late Feb.

LVCVA said March convention attendance was down just 10.5% on 2019 levels compared to a 41% deficit for Feb22.

“We are bullish on the convention and entertainment calendar for the rest of the year and 2023.”

Las Vegas Strip GGR trends ($m)

MGM call guide: Jefferies say they will be looking to get further comment on capital allocation (post-MGP divestiture), greenfield opportunities in New York, and digital developments following Ontario and the “overall path to profitability critical”. LeoVegas and online questions will obviously be the fore.

Churchill Downs Q1 call

PPE: Asked about share buybacks in light of its agreement to acquire the casino and racetrack operator Peninsula Pacific Entertainment for $2.48bn, CEO Bill Carstanjen said:

“You will see that the projects we've announced, as expensive as they are, they've all been designed to allow us to continue to participate in share buybacks, if and as warranted.”

50/50: CFO Bill Mudd said online wagering on horse racing had settled at “close to 50%” of the group’s players from “early-to-mid third quarter” 2021, having gone from 40% to 60% from the outset of the pandemic in 2020.

Bill Mudd: “I would say in terms of the return back to brick-and-mortar, we’re largely through that, we'll see one more quarter. And then I think we'll be kind of back to a consistent year-over-year basis in terms of what we'd see.”

CHDN enjoyed record Q1 revenues and adj.EBITDA of $364.1m (+ 12.3%) and $128.5m (+16%) respectively. The team at Jefferies said all the group’s segments had exceeded expectations and raised its FY23 estimates to $2.5bn in revenue and $1.08bn in adj. EBITDA, from $1.9bn and $911m.

Further reading: Improvements M&A and forecast-busting earnings.

Earnings in brief

Bluebet said Q3 net win was up 55.1% to A$13.2m after a “competitive” prior quarter. The number of first-time depositors was up 86.1% during the quarter while the average CPA was A$312 which the company said was a “healthy” 3.3x ratio to annual customer value. Recall, Bluebet will be launching in the US with its ClutchBet brand in partnership with Rubico Acquisition Corp, the holding company of the Louisiana Downs casino and racetrack.

SAZKA said GGR of €3.1bn, up 51% YoY while adj. EBITDA increased by 80% YoY to €966.8m. The company said it had seen continued strong growth in online sales and was also delivering on its inorganic growth strategy through acquisitions and participation in tenders.

Startup focus - OneComply

Who, what, where and when: Co-founded by CEO Cameron Conn, a third-generation gaming industry executive in September 2019, the automated compliance business has offices in Vancouver and Las Vegas.

Funding backgrounder: The business has recently completed its Seed financing round, led by Warner Investments with participation from gaming industry experts including Katie Lever, Benjie Cherniak and Quinton Singleton.

So what’s new? OneComply is enhancing its functionality for licensing management, to provide oversight and automation for a company’s occupational licensing and certifications, plus any technical/product licensing required to operate their business.

The longer pitch: “The expansion of gaming and sports betting has created a highly interrelated industry, where your license can be impacted by your partner’s or vendor’s non-compliance,” says Conn. “Whether it’s key persons, licensed employees, the entity itself or the critical systems and platforms a company utilizes, they all have an ongoing compliance component that needs to be effectively managed and monitored.”

OneComply has created a centralized portal to tie these pieces together, giving customers a way to manage all their licensing and operational compliance.

Until very recently, licensing and operational compliance has been a largely manual and highly-siloed process with responsibilities spread amongst various departments including legal, compliance, HR, operations and finance.

OneComply is a scalable SaaS model that provides clients with a centralized data portal, automated workflows and visual dashboards.

Cameron Conn: “The ultimate goal of this strategy is to enable all gaming companies to raise their compliance capabilities and standards and subsequently, raise the benchmark for compliance throughout the entire industry.”

Regulatory roundup

The Kansas legislature passed a sports betting bill in the early hours of Friday morning, meaning Gov. Laura Kelly merely needs ot sign the bill for it to become law. The Massachusetts Senate passed a sports betting bill on Thursday, but the legislation diverges from the bill passed by the House last year in several significant ways. Steve Ruddock at Wagers.com suggests the pathway to legalization isn’t obvious. Meanwhile, a near-4-hour filibuster by Sen. Denny Hoskins killed two sports-betting bills in MIssouri. A Minnesota sports-betting bill passed through the House ways and means committee with its next stop being the House floor.

Datalines

Macau: GGR of ~$335m was 68.1% down YoY and a 27.1% sequential decline. The total also represents an 88.7% decline on Apr19.

Newslines

Cheerio: Marco Blume, the long-standing trading director at Pinnacle, is set to leave the company, he has confirmed to WE+M. It is not known where he is heading next.

Can’t pay, won’t pay: The Seminole Tribe has stopped its quarterly payments to Florida as part of its revenue-sharing agreement with the state, citing the unresolved situation regarding its 2021 gaming agreement.

US Integrity Partners has announced a comprehensive partnership with Penn National Gaming.

What we’re reading

Make it mean more: The NY Times on how sports seems secondary. “The solution to… sports’ failure to satisfy our diminished attention spans or the modern expectation that we somehow be involved in everything we watch — lies in the gamification of ‘every drop, jab, hook, hit, steal, save, knuckle, meat,’ as the narrator proposes.”

Wheels within wheels: The NFL has swapped its 32% interest in luxury hospitality company On Location for a 1.5% stake in Endeavor. In Sports Business Journal.

Chart of the week

John Authers: “The extreme punishments meted out to Meta Platforms Inc. and Netflix Inc., both trading below their pre-pandemic prices, have also shown that the market had somehow assumed that lockdown-like conditions would continue indefinitely.”

On social

The last word on earnings

Calendar

May 2: MGM Q1

May 3: Red Rock Resorts, Caesars Q1

May 4: Flutter, RSI Q1

May 5: Bally Corp, Penn National Gaming, VICI Properties, AGS Q1

May 6: DraftKings Q1

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com