Mar 14: PointsBet predicts more marketing frenzies

SXSW review, New York data, Inspired earnings call, Jefferies brand matrix, Startup Focus - Ultimate Odds +More

Good morning. On today’s agenda:

The best bits from SXSW this past weekend.

The latest data from New York sees the leaders hold position.

Inspired Entertainment is excited about Ontario.

Reeling in the drunken sun. Click below:

March Madness datapoint: A survey conducted on behalf of the AGA predicts up to $3.1bn will be wagered on the upcoming March Madness tournament with 20 million Americans betting via a sportsbook, retail outlet or friendly contest. Up to 36.5 million are expected to take part in bracket or pool contests.

SXSW review part 1

You thought New York was nuts: PointsBet CMO Kyle Christensen said that Texas and California would “absolutely” see the same levels of marketing and promotions as and when they open, as has just been seen in New York.

Losing ticket: Christensen predicted the “scorched earth policy” adopted by the top four in New York would rebound on them.

Kyle Christensen: “I’m afraid it's bringing some bad consumer habits. In New York they handed out thousands of dollars of free bets - and I’m afraid it will turn into promo- chasing and we’ll see a lot of churn.”

Discipline: Christensen insisted PointsBet’s policy was more “disciplined” and would continue tailoring its offer around a “core customer”.

“At the end of the day, we can’t compete with DraftKings and we also don’t want to.”

Deep in the heart of Texas: PointsBet has a partnership with MLS franchise Austin FC and speaking on the same panel, team founder and president Andy Loughnane said that with the legislature not due another session until 2023, the issue will necessarily remain on the backburner.

Major league pressure: Loughnane noted that all the major league sports teams had formed an association to push for sports-betting. Teams such as the Dallas Cowboys, he said, would be keenly aware that they were missing out on the revenue opportunity.

Loughnane: “They want to be on a level playing field with other NFL teams.”

Part of the union: “There is complete unanimity,” said Loughnane. “We’re completely aligned on this particular subject. And I think that is a strength.”

** Sponsor’s message** Spotlight Sports Group, a world-leading technology, content and media company has announced a significant new partnership with U.S. media giant Advance Local. The agreement sees Spotlight Sports Group deliver customised integrated affiliation tools, free-to-play games and national and localised sports betting content for a select number of Advance Local’s network of digital media and websites. Read more on the story here.

To find out more on how Spotlight Sports Group can fully managed, modular solutions for global media at spotlightsportsgroup.com.

New York data

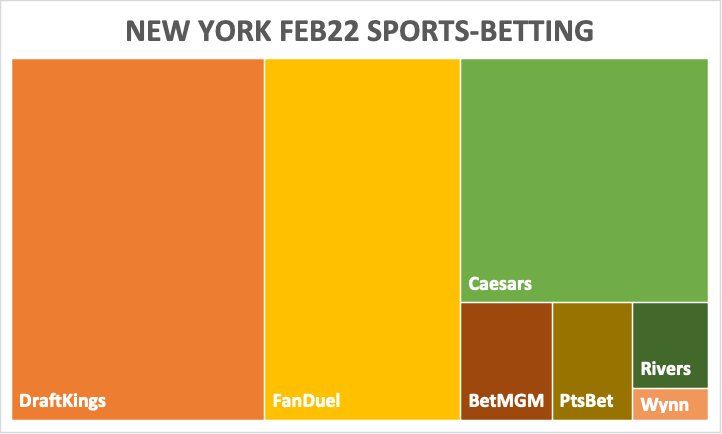

Kings of New York: At $1.53bn, New York in February was the second-biggest ever month in terms of US sports-betting handle, behind only January. By handle, FanDuel led the way with 37%, ahead of DraftKings. But the positions were reversed in GGR terms with DraftKings ahead on 36%.

Inspired Entertainment earnings call

Oh Canada: Speaking to the analysts, CEO Lorne Weil was hugely positive on the Ontario opportunity, noting that the company will launch with 20 customers from day one.

Lorne Weil: “I really haven’t seen anything like this opportunity in my almost 50-year business career, it’s remarkably unique.”

Inspired already services 70% of the igaming markets in New Jersey and Michigan and it is hopeful of adding Flutter and Penn National in Q2 in each to make it 90%. It will also go live in Pennsylvania in Q2.

Beat the Street: Analysts at Macquarie noted Inspired has beaten consensus for the past nine quarters and they believe that will continue with new customers, new geographies and further market share gains.

Macquarie: “We believe management has positioned the company well, with several irons in the fire (iGaming exposure, VLT expansion, iLottery/Sportech) to set the foundation for growth in the coming years.”

Market reaction: The shares benefited from an 11.6% rise on Friday.

Earnings in brief

Lottomatica Q4: Full-year revenues more than doubled to €941.4m while full-year EBITDA was also up more than double at €228.2m. Driving the increases was the gaming machine segment which is now above pre-Covid levels. Q4 EBITDA of €103.4m was 4.6% above the same period two years previous. The company added it was the market leader in online and retail betting.

SXSW review part 2

“You are not investing, you are not learning, you are gambling. Don’t fool yourself.”

Where valuations meet reality: NYU professor of marketing Scott Galloway took the stage on Friday to offer some choice predictions for 2022 and under the title that “fundamental and valuations” would reunite this year, he took aim at trading app Robinhood.

Scott Galloway: “Is Robinhood a growth company? Actually, it is the most overvalued company in the financial services sector.”

In comparison, Galloway said he was “quite bullish on NFTs” and suggested OpenSea would be the winner in the space.

Further reading: How NFTs are fuelling a sports memorabilia boom.

Pass the sick bag: One of his big calls (and notably to big cheers from the audience) was that Zuckerberg’s Metaverse will fail. Pointing out the 40%+ of VR headset users who get motion sickness while wearing a device, he added: “Oculus will be the tech hardware failure of the decade.” Instead, the winner will be Apple with its Airpods.

Scott Galloway: “I think Oculus is the ultimate prophylactic. I don’t think the metaverse will be visual. I think the metaverse will be in your ears. There is something about audio that drives intimacy.”

Conference quotes

Paul Condra, head of emerging tech research at Pitchbook, on NFTs: “If you asked people a year ago about NFTs, they will have scratched their heads. Now, they will still scratch their heads but they will have bought some.”

Overheard while walking the floor: “I had some professional wrestler come up to me and evangelize about the blockchain.”

Lauren Washington, founder of Fundr, on venture capital’s resistance to change: “VCs love to disrupt every industry except their own.”

Jefferies digital matrix

Leaders of the pack: The market leaders maintained their social and app-level prominence according to the monthly survey undertaken by Jefferies. FanDuel maintained its lead in MAUs and downloads while DraftKings still led in search interest, web traffic visit and visit duration.

The momentum trend saw second-tier brands catching up slightly on the leaders. Jefferies said this was likely due to the decrease in marketing post-Super Bowl.

Startup focus - Ultimate Odds

Who, what, where and when: Launched in early 2020 by founders Jonathan Bierig and Justin Batushansky, Philadelphia-based Ultimate Odds is a fantasy/sports-betting hybrid which is bringing sports-betting lines directly into the fantasy format.

Funding backgrounder: The company closed its latest round for an undisclosed sum this month. On the ticket are Seth Young at Fifth Street Gaming, Benjie Cherniak, principal at Avenue H Capital, Quinton Singleton, Miami-based VC 305 Ventures and Joey Levy, co-founder at Simplebet.

So what's new? The company recently partnered with Sportradar as a part of its Accelaradar program. It hopes to launch in time for the new NFL season.

The longer pitch: Bierig says there has been a “generational change” in the way sports betting is talked about since the fall of PASPA. Bierig himself is only 21 and having dropped out of college, got involved in the sector initially via an odds comparison site and then eventually the Ultimate Odds idea.

Jonathan Bierig: “Competitive people are always comparing and there was not really a place to go head-to-head other than in group chat. So we built a platform.”

Catching the parlay wave: Bierig says the product is catching the wave of interest in parlay. ‘That is why the lottery got so popular,” he suggests. “People love buying a dream and parlays offer that.” Despite having flunked college himself, he says the College crowd is a key target audience.

“Once it hits the college space, it catches like wildfire,” says Bierig. “Sports-betting has become a topic where people are so intrigued. It is becoming mainstream and this product is a perfect gateway.”

Exit through the gift shop: Bierig is intent on “something that is sustainable” and that founders need tunnel vision when it comes to building a business. But he can see where Ultimate Odds might be an attractive buyout opportunity.

“There are obvious fits - something like Vivid Seats, or a sportsbook or a media business.”

The week ahead

Endeavor is the only company on the schedule this week and analysts will be looking for news on its acquisition of the OpenBet business from Scientific Games/Light & Wonder. Jefferies noted that alongside Caesars’ disposal of (non-US) William Hill to 888, it was a deal that had been achieved when sports-betting valuations were higher than they are today.

“As the Street's enthusiasm for digital wagering faded and valuations compressed, fair debate ensued as to their commitment to closing.”

High conviction: But they added that the deals were “thoughtfully structured” and had been financed with committed funding, suggesting the likelihood of completion is high.

Datalines

Indiana Feb22: Gaming revenue rose 47.7% YoY and 15.3% vs. Feb19 to $193.6m on the same number of weekend days. Sports-betting handle was up 49% YoY but down 18% MoM to $409.1m. Adj. gross revenue was flat at $17m, margins were 4.1% vs. FY21 margins of ~8%. DraftKings led the revenue charts with 43% share, followed by FanDuel (29%), BetMGM (23%, Caesars (16%) and Barstool (10.5%).

Iowa Feb22: GGR was up 36.6% vs. Feb19, +8.8% MoM and +24.1% YoY to $142m, sports-betting GGR was down ~40% to $8.6m MoM (+11.3% YoY), largely driven by a 28.8% drop in handle to $215.9m, said Deutsche Bank.

Maryland Feb22: Retail betting handle was down 21.5% MoM to $25.5m.

Newslines

Breaking rocks in the hot sun: Red Rock Resorts broke ground on its $750m Durango project in southwest Las Vegas Valley. The casino is expected to be open in late 2023 with 2,000 slots, 46 table games, 200 hotel rooms and a sportsbook.

Junk: MGM China said it may be required to pay out $25.8m related to three lawsuits brought by players claiming that two junkets had failed to refund cash deposits.

Map search: Las Vegas Sands CEO Rob Goldstein spoke to the Las Vegas Review-Journal about a new project in an unspecified “top tier” Asian country which will be of the same scale as the Marina Bay Sands.

Gear up: FanDuel has joined theScore, BetRivers and others who have recently been approved to offer online sports betting and casino in Ontario on April 4 when the province opens to regulated activity.

On social

Calendar

Mar 16: Endeavor Q4

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com