Superior parlays and pricing give FanDuel OSB dominance, say analysts

In +More: Penn talks ‘separations.’

MGM Resorts enjoys a share price bump as Hornbuckle talks Abu Dhabi.

By the numbers: ESPN Bet’s falling share in Pennsylvania.

Nothin' feels better than this.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

A parlay leg up

3 is the magic number: FanDuel’s OSB dominance is down to a trifecta of a market-leading parlay product, the parlay mix and a market-leading hold that makes it hard to match, according to recent analysis.

The market leader enjoyed a near 500 bps lead YTD in hold over the rest of the market, with 12.5% hold vs. 7.6%.

Notably, FanDuel also has a 270 bps lead over major rival DraftKings, which achieved a hold of 9.8% YTD.

Looking at the data, the team at Barclays pointed out that a large slice of this hold advantage was down to its success in generating a higher level of parlays than its major rivals.

Using Illinois as the proxy – it is the only state to disclose operator level parlay stats – the analysts noted 64% of FanDuel’s handle came via parlays vs. 37% for DraftKings and 31% for the rest of the market.

🥣 Pick and mix: FanDuel’s parlay lead

On hold: As important to the percentage of handle that comes from parlay bets is the extra benefit FanDuel enjoys over the rest of the market in terms of parlay hold.

As the Barclays team pointed out, FanDuel generated 23.5% from its parlays in Illinois YTD.

This compares with 17.7% for DraftKings and 14.7% for the rest of the market.

That’s why we’re champions: The Barclays analysts suggested it is FanDuel’s “superior pricing sophistication” supported by owner Flutter’s decades-strong expertise in backend risk and trading capabilities that helps explain its dominance.

A telltale sign, said the team, is that FanDuel has a lower average bet size, which implies a higher average parlay leg count.

This is displayed in Barclays own parlay pricing tracker, which shows FanDuel offering customers a “stark” average payout premium over the competition during the NBA season just gone – as much as 31% – and a solid lead in week 1 of the NFL.

In the NBA season, the average payout premium rose as high as 88% on eight-leg parlays while being closer to the average on three-leg parlays.

This pricing gap is due to the “inherent difficulty of pricing the covariance of additional legs being added to a parlay.”

Price war: The analysts noted competitors have to date been focusing on the area of pricing in order to compete with FanDuel: DraftKings via its SportsIQ and Simplebet acquisitions, BetMGM via Entain’s Angstrom buyout and Fanatics takeover of PointsBet US, including the Banach technology unit.

“It's hard for us to see competitors easily catching up to FanDuel's pricing without taking on outsized trading risk,” said the Barclays team.

NFL week 2

As if to prove a point: The Jefferies team pointed out that week 2 of the NFL season in New York saw FanDuel produce a record GGR tally of $35.1m, up a whopping 222% YoY, on margins of over 19%.

GGR was also up for DraftKings (+83%) and BetMGM (+63%) but neither could match FanDuel on margins, with DraftKings hitting 12.8% and BetMGM getting to 6.8%

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Meet us at SBC Lisbon & G2E Vegas. Join top operators at www.opticodds.com.

+More

‘Separations’: As disclosed in Earnings+More last Friday, the latest round of job losses at Penn Interactive has been confirmed with LegalSportsReport giving details of a letter from Penn Entertainment CEO Jan Snowden explaining the latest redundancies.

That’s a new one: According to Snowden, the changes implemented at Penn Interactive are designed to “streamline reporting lines, enhance operational efficiencies and leverage shared resources.”

“Unfortunately,” he added, the changes will result in a “limited number of team member separations.”

Accel Entertainment has received permission from the Illinois Racing Board to buy the former Fairmount Park racetrack and rebrand it to FanDuel Sportsbook and Horse Racing. Recall, Accel bought the track in July for $35m and will spend a further $85m-$95m on construction of a temporary, and then permanent, casino.

Betfred is to shutter its Arizona operations in November, its third market exit this summer after Maryland and Ohio. The company is left with operations in Colorado, Iowa, Louisiana, Pennsylvania and Virginia.

OpticOdds has formed a new partnership with Sportsbet.io via the latter’s odds aggregator and risk management platform TradeArt.

The week ahead

While the industry suns itself networks furiously in Lisbon, Flutter Entertainment will be hoping to impress the analysts with its investor day on Wednesday.

Expect more detail on how the ‘Flutter Edge’ will be deployed with recent acquisitions NSX in Brazil and Snaitech in Italy.

Earnings in brief

Virtual Gaming Worlds: The Australian-based private company behind Chumba Casino and other sweepstakes-type offerings saw revenues climb 27% to A$6.13bn ($4.18bn) in the year to June 2024, according to an annual report seen by the Australian Financial Review. Profits rose 30% to A$378m.

The company disclosed it has acquired a near 14% stake in UK-based 99Dynamics, which owns online lottery app Jackpot.com.

VGW said the stake offers “exposure to an attractive adjacent market, diversification and future optionality.”

As previously reported by AFR, VGW paid a dividend of $360m this year, largely to controlling shareholder Laurence Escalante.

Shares week

Deserted: The lack of a casino within MGM Resorts’ Dubai plans might account for the muted response of the shares last week to CEO Bill Hornbuckle’s comments regarding the opaque process in the UAE around gaming.

Indeed, in his comments in New York late last week, Hornbuckle suggested that “ultimately” Abu Dhabi looked like the most likely statelet for MGM to gain a license.

Recall, in late July the UAE unveiled the country’s General Commercial Gaming Regulatory Authority website and announced the formation of a national lottery.

Hornbuckle said that after spending some time “on the ground” in Abu Dhabi, MGM believed the “opportunity still exists” and that “to the extent there is a submission to be had, we may participate in that.”

Serve and volley: Sportradar served an ace this week and got a 3.5% uplift after announcing a new set of micro-betting markets for ATP tennis.

The uncertainties in Australia over the future of gambling advertising continue to weigh down on stocks with the shares of BlueBet, down 14%, and PointsBet, off by 3.5%, both struggling this week.

The latest news over the weekend suggested the Albanese government will propose banning ads for an hour either side of live sport and prohibiting digital advertising altogether. See tomorrow’s edition of Compliance+More.

Seamless Onboarding, Happy Players. It's That Simple.

Experience the perfect balance between stringent identity verification and effortless onboarding with IDComply, a groundbreaking solution from GeoComply. Take your pass rates to new heights and shield your business from fraudulent activities.

By the numbers – Pennsylvania

Playing catch up: Bet365’s debut month in Pennsylvania saw it manage $28.5m of OSB handle in August for over 6% market share, although including promo spend saw it record a negative $0.5m of GGR.

Total OSB handle rose nearly 25% YoY to $458m. Including retail betting, GGR was up 48% to $45.5m while iCasino revenue was also up nearly 27% to $184m.

FanDuel led the market by GGR with 40% share, followed by DraftKings on 24%.

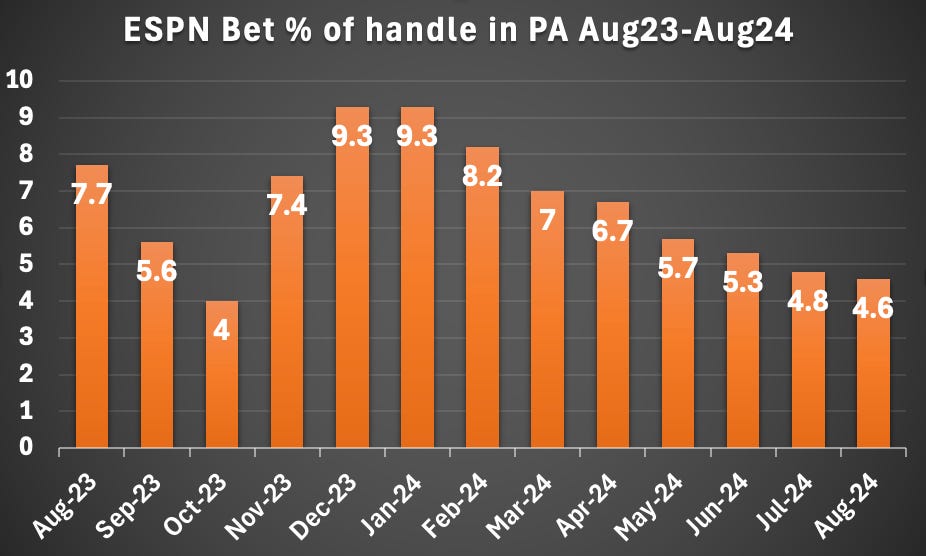

Limping in behind the leaders was ESPN Bet with a mere $1.6m of GGR for a <4% share from a 4.6% share of handle.

Indeed, in terms of handle ESPN Bet is now almost back to the levels it was at when the business was branded Barstool Sportsbook, with 4.6% share this past August vs. 4% in October last year.

😱 ESPN Bet’s sliding handle in Pennsylvania

Michigan iCasino: The top five dominance in iCasino in Michigan is clear when the last six months of GGR activity is tabulated. Adding the Golden Nugget share to DraftKings and WynnBet to Caesars, it can be seen that in the six months to August the top five between them have on average grabbed 88% market share.

That total reached 90% in August with BetMGM leading on 27%, followed by FanDuel (25%), DraftKings (23%), Caesars (8%) and Rush Street (7%).

🥧 Share of the pie: top 5 dominance in Michigan iCasino GGR

Louisiana: Total GGR was up 9% YoY to $280m in August, with B&M casino up 8% at $193m while sports betting (B&M only) hit $27m, up 49% on handle, which was up 52% to $235m.

Spain: Online GGR rose 11% YoY in Q2 to €346m, with iCasino up 15% to €172m and OSB GGR up 9% to €146m.

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook.

We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

Earnings calendar

Sep 25: Flutter investor day

Sep 30: Playtech

Oct 17: Entain

Oct 24: Betsson, Evolution

Oct 25: Kindred

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.