Kindred shutters North America

Kindred’s strategic shift, PointsBet AGM, ESPN Bet analysis +More

Kindred clears the decks for a “third-party transaction”.

Leaner, meaner PointsBet on course for Australian breakeven in 2024.

Analysts run the rule over ESPN Bet.

We hope you enjoyed your stay.

End of the road

Kindred pulls the plug on its never-more-than-nascent North American business.

Signal the retreat: As part of its ongoing strategic review, the company behind the Unibet brand has announced it will shutter its loss-making US and Ontario operations by the end of Q2 next year, subject to due regulatory processes.

On the block: The company added that the board now believed shareholder value “will be maximized” by a sale of the business. It said closing the US business and a reduction in headcount and cost base would be “complementary” to the process.

The North American closure will axe ~300 jobs and will save the company annualized costs of £40m.

Kindred said it would now concentrate on its “core market footprint”, including the UK, France and Scandinavia.

Interim CEO Nils Andén said the move was “necessary and decisive”.

This puts us in a stronger position to secure long-term growth,” he added.

Unsustainable: In explaining the closure, Kindred said the long-term outlook for North America had “changed since entry”. “The competitive nature of the market means significant resource is needed to close the gap to the market leaders and, at our current capacity, this is untenable.”

It added the losses from North America placed pressure on group profitability and targets.

The company said it had already exited its market access agreement in Ohio at a one-off cost of £4m.

In the accompanying Q3 results statement, Kindred said its North American operations generated gross win of £6.4m, down 11% YoY. Market spend was cut back by 19% in dollar terms.

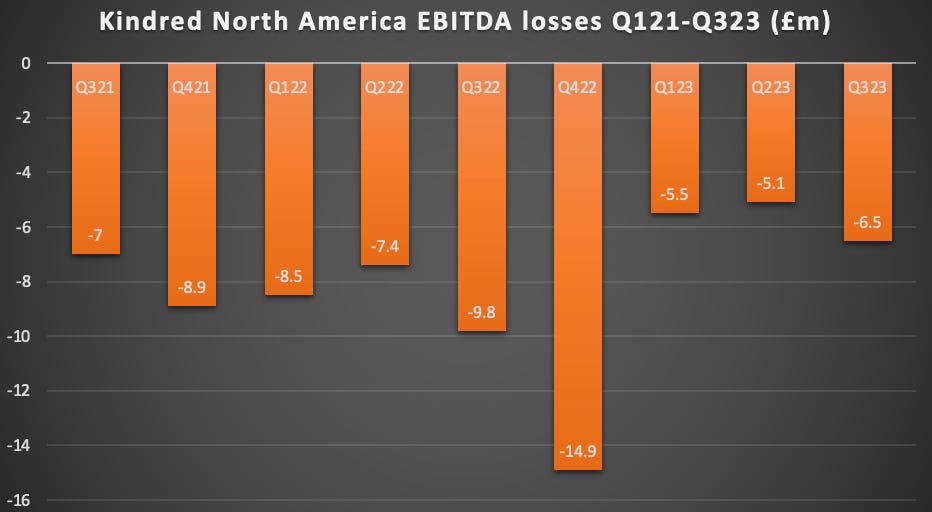

Q3 North American losses came in at £6.5m while cumulative losses since Q121 totalled £73.6m.

😱 Kindred’s North American horror show

Sales patter: Talk of a potential sale of Kindred has been doing the rounds since a strategic review was announced in April. Crucial to any decision will be 15% shareholder Corvex, which has been pushing for a sale since it acquired its stake in Aug22.

Profit squeeze: The North American news came with Kindred’s Q3 earnings, which saw revenues fall 2% to £284m, and, while underlying EBITDA was up 6% to £42.6m, pre-tax profits dived 75% to £15.1m. The company blamed underlying sports margins for the revenue fall.

Kindred estimated underlying EBITDA for 2023 to be at least £200m, while it said it would hit £250m in 2024.

The company said it had regained its number 1 position in the Netherlands and also saw above-market growth of 7% in the UK.

However, regulatory issues in Belgium and Norway continued to bedevil the company.

Belgium revenues were down 25% in local currency terms after new deposit limits and other safer gambling measures were introduced.

Nordic segment gross win declined 17%.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

Adelson unloads: Miriam Adelson has announced she is selling down a $2bn portion of her Las Vegas Sands shares via a secondary offering, with the company stating she intends to use the cash to buy a 57% stake in the Dallas Mavericks from current owner Mark Cuban.

LVS will not receive any proceeds from the sale but will purchase $250m on the stock up for sale.

Lottomatica has announced a €500m floating notes offering, which it says will partly go towards funding the recently announced €639m acquisition of SKS365. The company also added a further €50m headroom to its revolving credit facility.

Australian-based OSB startup Picklebet has announced a A$15m (~$10m) Series A funding round led by Discerning Capital, with participation from Drive by DraftKings, Manifest Investment Partners and wagering and media investor Jeff Sagansky.

EveryMatrix has agreed to a partnership with Caesars Digital to bring its casino content to Caesars Palace Online Casino and Caesars Sportsbook & Casino in North America.

What we’re reading

RIP Charlie Munger: “The world is full of foolish gamblers and they will not do as well as the patient investors.”

A Soho house: What Noel Haydon did next.

PointsBet update

Streamlined: Meanwhile, the chair of another potential sale prospect, PointsBet’s Brett Paton, said in the company’s AGM statement that the newly streamlined PointsBet had an “exciting new chapter ahead” following the sale of the US business to Fanatics for $225m.

The company reiterated the message from its recent FY23 earnings that it was on course to achieve positive EBITDA in FY25, with monthly EBITDA breakeven forecast for Apr24.

In a trading update, PointsBet said the performance during the recent Spring Carnival had been strong, with net win up 26% YoY to A$48.2m (~$32m) for the period Oct. 1 to Nov. 25.

“Our strategy is clearly working,” said CEO Sam Swanell.

Recall, E+M recently reported on rumors circulating of a potential bid for PointsBet from Matthew Tripp’s Australian Betr operation. Sources suggested at the time that a “subscale” Australian business and a ”very subscale“ Canadian arm were ripe for a takeover.

Analyst takes – ESPN Bet

Pay retention: The team at JMP suggested the history of downloads-to-player retention implies ESPN Bet will achieve between 7-9% and 5% player retention from its record-breaking download total depending on the efficiency of the app.

The team indicated that, based on its data sources, approx 35-40% of players go from the initial download to a first session on the app.

“The low conversion rate is attributed to friction points along the way, including providing personal information,” they added.

“We estimate only 25% of those same players that make it to a first session actually become a first-time depositor (FTD), and a first-time player.”

Beyond the first click: The JMP team said DraftKings’ retention data implied that 83%/88%/96% of those FTDs are retained in years one to three, respectively.

“ESPN Bet has been downloaded 1.6m times since its initial launch and, assuming a competitive product, our back-of-the-envelope math implies ~112k long-term monthly active users (MAUs) or $162m of recurring revenue,” they argued

“In the coming quarters, MAUs will skew higher off the cycling of new players to the platform, but our estimate is what we believe Penn will be able to retain through loyalty/product.”

Sportsbooks! Checkout some of Matchbook’s latest quotes across NFL, NCAAF, MLB & NBA:

NFL: NY Giants/LV Raiders O37.5; $107k @1.95

NCAAF: Marshall +3.5 (vs Appalachian State); $34k @ 1.83

MLB: ARI Diamondbacks ML (vs TEX Rangers); $36k @ 1.99

NBA: NO Hornets +12.5 (vs DAL Mavericks); $170k @ 1.90

Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins.

Stop being forced to limit customer stakes due to market liability.

Stop being caught out by stale prices and one sided markets.

Matchbook B2B, because the best price is for everyone.

Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com

Calendar

Nov 29: Jefferies Sports Betting & iGaming Summit, New York

Nov 29: Kindred, Rivalry

Dec 4: BetMGM investor meeting

Dec 5: Allwyn

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.