Kindred accepts $2.8bn cash offer from FDJ

FDJ Kindred offer, Flutter’s dual-listing boost, New Jersey data dive, startup focus – Testa +More

Kindred board recommends the acceptance of FDJ offer.

Investors warm to Flutter’s imminent dual-listing.

Deutsche Bank provides a deep dive into New Jersey.

Testing startup Testa gets the focus treatment.

We come through with the money and the garter belts.

FDJ Kindred offer

French national lottery operator has a $2.8bn cash bid for Stockholm-listed business accepted.

Sacrebleu: Kindred’s board said this morning it unanimously recommended the SEK28bn ($2.8bn) offer from French lottery operator Française des Jeux (FDJ). The deal is pitched at a 24% premium to Kindred’s closing price on Friday and represents a 10.9x multiple of underlying 2023 adj. EBITDA.

Voulez-vous: The acceptance would bring to an end the independent listed life of Kindred, which has been operating the Unibet online betting and gaming offering since the late 1990s. The company also operates a number of other brands including 32Red and it owns the iCasino developer Relax.

Kindred is also in the process of developing its own OSB platform having loosened ties with Kambi.

According to the company’s capital markets day presentation in late 2022, France was second only to the UK in terms of contribution to revenue.

Les moments difficiles: Kindred has been undergoing a strategic review since April last year after a number of operational mis-steps, particularly around the exit from the Netherlands ahead of the launch of the regulated market in Oct22. The company has lost a number of key personnel in the past year including CEO Henrik Tjärnström.

It said in November, when it announced its exit from North America, that a third-party transaction was on the cards

PJT Partners, Morgan Stanley and Canaccord Genuity had been hired to conduct an open-ended review after the board “unanimously decided to initiate a process.”

The company said today that since the review process had been launched it had solicited and received interest from “several parties.”

Get active: It has been the subject of shareholder pressure from activist Corvex, which has a 15% stake and has been agitating for change for some time. Eminence Capital – which recently secured a board seat at Entain – is also a noted investor.

Fully aware: The press release accompanying the news said the Kindred board recommended the offer after considering the “risks and uncertainties” surrounding the company’s future prospects, including adverse regulatory change.

A source suggested the biggest known unknown is Kindred’s exposure to the ‘gray’ Norwegian market.

Kindred also released Q4 numbers showing revenues up 2% YoY to £313m, saying regulatory measures in Norway and Belgium had “continued to adversely impact” growth.

Underlying EBITDA rose 45% to £56.8m, including a £7.4m contribution from Relax, up 33% YoY. It reaffirmed its 2024 EBITDA target of £250m.

The French revolution: The move from FDJ marks a step-change in its strategy, moving it further away from its core lottery market and more towards the international betting and gaming space.

Listed in Paris, FDJ reported a 6% jump in H123 profit through June to almost €1.3bn.

It recently completed the acquisition of Premier Lotteries Ireland for €350m.

The company said the offer was not conditional upon financing.

Deal talk instant: One corporate advisor noted there would be “real synergies” to be had from the deal given Kindred’s strength in the French OSB market. They also noted “lots of momentum” towards iCasino, which, were it to be regulated, could make it one of – if not the – biggest iCasino market in Europe.

“But there would be questions about cultural fit,” one source added.

“FDJ is a large lottery company and is known to be very bureaucratic – whereas Kindred will be somewhat less risk-averse.”

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

+More

SoftSwiss has announced the acquisition of South African software provider Turfsport for an undisclosed sum.

Fitch Ratings has affirmed IGT’s long-term issuer default rating at BB+ and its senior secured debt at BBB-.

The week ahead

Las Vegas Sands reports on Wednesday. Deutsche Bank said it is expecting management to comment on further buyback plans ,while there will be interest in what the company has to say about its development plans, particularly around the MBS property in Singapore.

Wells Fargo noted the state of the recovery in Macau will also be the subject of questioning given the mixed economic picture for China.

Career paths

Flutter has promoted Rich Hayward to MD of its Betfair business. He was previously UK and Ireland commercial director at the company.

David McDowell, ex-founder of GAN and until the end of 2022 CEO at FSB Technology, has launched a consultancy business, according to a posting on LinkedIn.

EveryMatrix co-founder and CCO Stian Hornsletten will take over as CEO of its Games division from Feb. 1.

Stakelogic has named Edgars Isajevs as its head of live casino. He most recently served as the operations manager at Evolution.

Action Network CEO Patrick Keane is stepping down after more than five years at the helm, during which time he oversaw the sale of the company to Better Collective.

Dual-listing boost

Shop window: There has been a “considerable uptick” of interest in Flutter from institutional investors ahead of the dual listing in New York at the end of this month, according to US analysts. Flutter will achieve its dual-listing on Jan. 29.

The team at CBRE said the increased attention has occurred in the past fortnight, before and after Flutter’s Q4 trading statement last week.

The shares were up 20% on the week, with Wells Fargo noting the “material outperformance” vs. the FTSE 100, which was down 2%.

🔥 Seeing the benefit: Flutter boosted ahead of dual listing

Value bet: The analysts noted Flutter is currently trading at ~12.5x its own FY25 group EBITDA estimate. Assuming a 10.5x multiple for the non-US business, the team added, then the US element is currently valued at 14.5x FY25 EBITDA, which represents a ~7x discount to rival DraftKings.

This represents a “significant value opportunity” in Flutter, especially ahead of a US listing, “which should draw a larger pool of potential investors,” the team said.

The team at Peel Hunt noted the dual-listing would continue to be a “significant driver of the share price as US domestic investors invest in a local market leader.”

Everything’s coming up roses: Flutter has set up an “encouraging narrative” around its market share gains and promotional efficiency, suggested the analysts at Jefferies. Last week’s update came up short on consensus forecast due to the adverse results in November, but the company was still able to boast of 43% sportsbook share and 26% in iCasino.

This represents a “helpful backdrop into the US listing,” said Jefferies.

“We now see a positive catalyst path around the US listing.”

A little something for you: Wells Fargo said the “bigger surprise” from last week’s statement was the 220 bps improvement in structural hold to 13.5% vs. the ~$343m hit caused by November’s adverse football results.

The team said that, if Flutter can grow its structural hold above its growth rate in promos in the medium term, the LTVs will “remain compelling, and its moat would widen.”

This is exactly what the team at JMP believed, suggesting expected margin would exceed the target in the coming years, with improved flow-through to EBITDA for parlay-focused operators like FanDuel.

Analyst takes

The outlier state: With 2023 being “surprisingly strong” in 2023 from an online perspective, it has cemented New Jersey’s position as the outlier relative to other regulated OSB states, according to the team at Deutsche Bank.

The main metric to explain its special status is the per adult OSB ‘spend’ level, which for last year stood at $145. The analysts put the quote marks around spend because the gross figures they are working off include promos – hence, individual losses are below this headline figure.

New Jersey produced $962m in OSB GGR in 2023 with a population of 6.64m.

The resulting $145 number is some 47% higher than Illinois and more than double neighboring Pennsylvania’s $67.

Notably, the states that report promos (Michigan, Pennsylvania and Connecticut) “materially lag” those that don’t.

The $145 is 30% above the level it stood at in 2021, the year before New York launched.

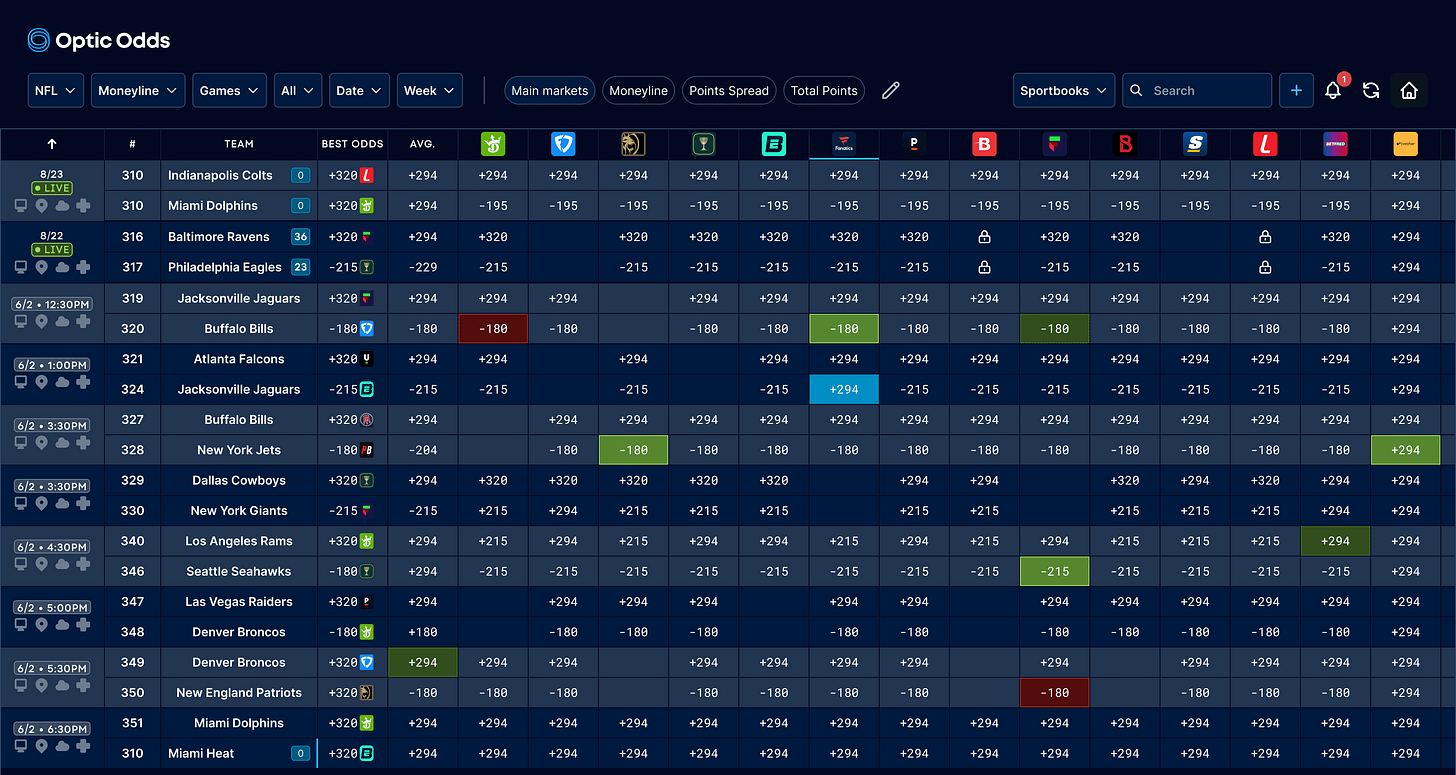

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

Growth company news

Micro-betting provider ParlayBay said it has raised €3.5m in follow-on investment from an unnamed group of investors to further the group’s geographic expansion plans.

What we’re reading: Investment firms are raising billions to buy into distressed tech startups.

Startup focus – Testa

Testing, testing: Founded by serial entrepreneur Kyle Wiltshire, Testa is a crowdtesting service built specifically for the iGaming industry, with a “mission to increase product quality in the sector by giving iGaming businesses visibility into what’s happening on the ground” via improving the software and reducing time to market.

Funding backgrounder: Currently bootstrapped – spun out and funded by Wiltshire’s Taiwan-based technical consultancy Jigentec – the company is looking to bring in a select few strategic investors in 2024, but “no large capital raises,” says Wiltshire.

Crowd pleaser: Crowd testing has been an essential part of software development over the last decade, but “the challenge,” says Wiltshire, “is that iGaming is a unique industry in many ways – and testing companies really don’t understand this.”

Boots on the ground: Operators are often “quite disconnected from the markets they serve,” Wiltshire argues.

“Business and development will be in one location, development another… but often gambling companies have no staff in the actual target markets.”

This can mean they – and often their suppliers – are blind to localization and UX requirements in the market.

Grasp the nettle: Wiltshire says the company has been “very surprised” at how quickly operators and providers have grasped the concept. “Everyone seems to be aware of this problem, but few have done anything to provide a solution,” he says.

The company has just transitioned operations to a new test platform, which “will allow us to define, execute and manage far more tests in a given week than our legacy system.”

“December was an exceptionally busy month, we executed over 3,000 individual tests over a dozen different markets.”

Test of time: While 2023 was a “fundamental year” in establishing Testa, this year “is about truly getting our name out into the online gaming world”. “We want to be the industry tool for market testing,” says Wiltshire.

“It’s too early to think about exits, we have a fundamental problem we want to see solved, at scale first and foremost.”

Calendar

Jan 24 Las Vegas Sands

Jan 30: PointsBet

Feb 1: Rank

Feb 6-8: ICE, London

Feb 7: Disney

QuickCasino is Soft2Bet’s latest iGaming offering in Sweden!

A fully optimized website featuring the best betting products and casino games, QuickCasino is an innovative, mobile-first gaming portal that is set to revolutionize the industry in this key Nordic market. The website also supports a multitude of payment methods and an extensive library of more than 4,500 titles from leading developers like NetEnt, Yggdrasil or Quickspin.

https://www.soft2bet.com/news/soft2bet-unveils-quickcasino-se-its-next-gen-b2b-igaming-solution

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.