Jun 17: Weekend Edition #51

Playtech delay, Allwyn Q1, Acroud M&A, sector watch - sports data, startup funding news +More

Hello and welcome to the latest weekend edition. It has continued to be a rough ride for investors this week as recession haunts the gaming sector as much as the rest of the world. The longer-term picture remains clouded. We can almost certainly say that the tightening of the money markets accounts for the further delay in the Playtech takeover negotiations. With equal certainty, albeit less visibly, we can be sure that tightening is having an effect elsewhere.

Hanging on the telephone. Click here:

Playtech extension

Playtech saga, part 456: Hoping to keep everyone hooked until the last possible moment, Playtech has this morning granted another extension to TTB Partners saying its independent board committee believes the investor group should be granted ”additional time for discussion to further develop”. The new deadline is 5pm on July15.

Keep me hanging on: Playtech note that the deadline could yet be extended again should the Panel on Takeovers and Mergers agree.

Shut up and dance: Peel Hunt suggest the further delay should be seen as an “encouraging sign that there may yet be an acceptable bid”.

This is the end: Meanwhile, earlier this week the company has announced a completion date of June 30 for the sale of its financial trading business Finalto to Gopher Investments for $250m.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club.

What we’re saying

Pod for your own back: Podcast #12 was sent yesterday and is also available on YouTube, Spotify and Apple.

Datalines

New Jersey: Sports-betting GGR in May was up 16.4% YoY to $61.6 mm and was up 22.3% on a sequential basis. Mobile sports-betting GGR of $58.4 mm was up 21.3% YoY, while land-based revenue of $3.2 mm was down 32.5% YoY. Handle decreased 5.9% YoY to $766.4m and was down 17.3% MoM. iGaming GGR was up 25.7% YoY but down 0.6% MoM.

Leaders: Wells Fargo estimate FanDuel led combined OSB/igaming with 27%, ahead of BetMGM (25%), DraftKings (16%) and Caesars (9%).

Michigan: Sports-betting GGR for May was up 69% to $35.9m on handle that increased 38.2% YoY to $356.1m. Mobile handle was up 40.3% YoY to $333.4m but down 10.2% MoM. OSB GGR was $33.5m. Promo spend was $11.1m or 33% of OSB gross win leaving NGR at $24.9m. Online casino GGR was up 34% YoY to $127.4m but down 3.3% MoM. Land-based casinos generated $106.3m, down 1.5% YoY.

Leaders: Wells Fargo said BetMGM led in aggregate OSB and icasino share 35.7%. FanDuel was second with 21.9%) followed by DraftKings with 14%. FanDuel led in sports-betting with 45.4% followed by BetMGM (26.2%) and DraftKings (15). In igaming, BetMGM led with 36.4% followed by FanDuel (23%) and DraftKings (13.7%).

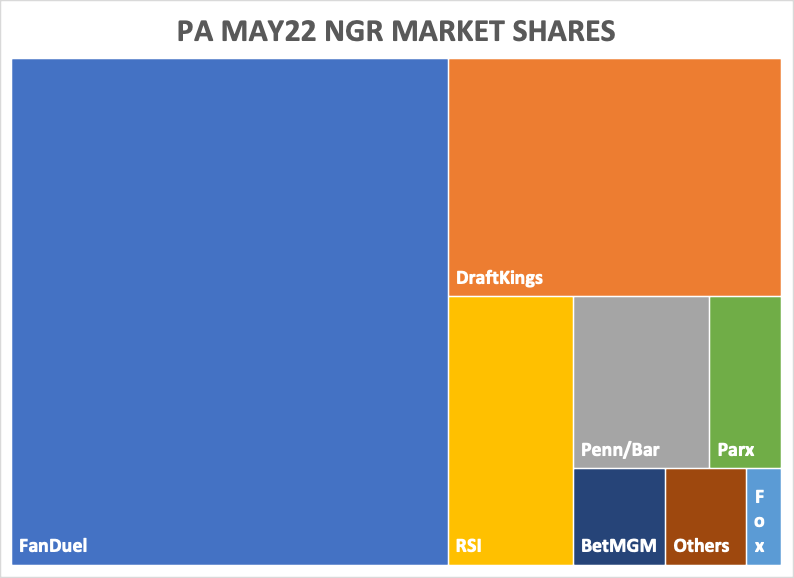

Pennsylvania: GGR in May rose 27.8% YoY to $47.8m, net of promotions betting revenue was up 26.2% YoY and -2.6% MoM to $35m. Handle was up 10.3% YoY but down 13.9% MoM to $493.4m. Online casino GGR was up 11.9% YoY and +0.2% MoM to $113.3m. Land-based casino GGR came to $294.2m, +5.6% YoY and +1.4% MoM.

Leaders: FanDuel accounted for 45.2% of mobile GGR followed by BetMGM (26.2%), DraftKings (15%), Barstool (5.6%) and Caesars (2.1%). In NGR terms, FanDuel led the market with 56.6% followed by DraftKings (20.3%) and Rush Street (8.6%).

Louisiana: May GGR excluding video gaming revenue was $207.3m, a decline of 9.2% YoY. Deutsche Bank said QTD GGR is down 8.2% YoY. Compared to 2019, GGR was down 4.9%

Mobile sports-betting net revenue for May came in at $22.6m on $142.6 mm in handle.

Massachusetts: May GGR hit $90.9m, up 4.9% YoY but down 11.4% versus May 2019 on a same-store basis. The Wynn Encore generated GGR of $58.0m, up 9.6% YoY.

Allwyn Q1

GGR up 65% to €869.3m, adj. EBITDA up 86% to €268.8m.

Free cash flow hit €249.8m.

On track: Allwyn is on track to complete its New York listing via the merger with the Cohn Robbins Holdings Corp SPAC with CFO Kenneth Morton suggesting the end of Q3 remained the target. Also on the earnings call, CEO Robert Chvatal noted the enterprise value once Allwyn lists will be around $9bn. “A listing will allow us to diversify our sources of capital,” he added.

In line: The company also gave a brief statement on current trading, suggesting it was trading well despite weaker general consumer sentiment.

Camelot is a silly place: Chvatal noted that both the UK Gambling Commission and the DCMS, the UK government department with responsibility for the lottery, “stand by their decision”.

Robert Chvatal: “We feel confident and we strongly believe what we put together in our bid can rejuvenate the National Lottery.”

Acroud M&A

Do you want to know a secret? The affiliate platform and affiliate provider Acroud says it “considering” a €5.5m cash and shares buyout of an unnamed company with assets in the igaming space. Acroud said the acquisition, if completed, would add €9m to revenue and €4m to EBITDA annually.

Acroud said payments would consist of €4.5m of cash, payable from existing cash resources, and €1m of shares.

The deal is still subject to s definitive purchase agreement as well as final board approval.

Las Vegas analyst appraisal

Dear prudence: Having made the road trip to Las Vegas, Wells Fargo analysts suggest that while operators are “yet to see any meaningful change in underlying trends” given the adverse macro backdrop, they were preparing for the worst.

Lively: Having met with management teams at Boyd Gaming, Everi, Golden Entertainment, MGM, Ted Rock and Wynn, WF pointed out the Strip and Locals properties were all “busy and lively”.

Low-end theory: As per recent commentary from Red Rock, if there is any deterioration, it has been seen at the low end, but others suggest there has been “no impact at all”.

It’s the prudent thing to do: That said, WF did note a change of tone from the recent Q1 earnings calls with management teams “acknowledging the increasing likelihood that tougher times may lie ahead” and were “preparing/planning for such”.

The bottom line: One benefit from the recent experience with Covid is that operators have become “increasingly nimble at adapting to change” and forcing them to review their cost structures.

Variables: Despite structurally higher margins any step down in revenue “may not be as bad as some fear” with opex consisting mainly of variable costs.

Startup funding news

Stakes, which hopes to offer sports-betting player NFT rewards, says it has raised $5.3m from investors including Digital Currency Group, FBG Capital, CMS Holdings, LD Capital, Cadenza Ventures, Matrixport Ventures, and Sterling Select Group.

The company also announced the appointment of Sam Li, former vice president at the NBA as a strategic investor and advisor.

Stakes graduated from InterActiveCorp (IAC)’s incubator in January.

Tally ho: Free-to-play game provider Tally Technology says it has raised $4m in a Seed funding round led by venture fund Acies Investments. Tally was founded in 2018 and recently announced deals with the NFL’s Buffalo Bills, Green Bay Packers and Los Angeles Rams. Acies is led by former MGM Resorts CEO Jim Murren.

The new funding will be used to invest in the data platform, expand operations, and introduce new game types for partners.

Sector watch - sports data

New balls please: A previously little-known manufacturer of a machine for firing tennis balls in practice sessions has pivoted towards producing sports data in the specialized area of racket sports and listed on Nasdaq in the process.

Bad day to list: Previously known as Slinger and now listed as Connexa, the company debuted on Wednesday and swiftly saw its shares fall nearly 64%.

Watch and learn: Under the company;s banner are three more businesses. One is Playsight which produces AI-powered cameras that can produce, score and stream live sports. The next is GameFace.ai which uses computer vision and machine learning for video analysis while the third is Foundation Tennis, a software tool.

Who dares wins: Connexa says it is “pioneering sports as a service”, with industry-leading AI, automated video and live-streaming production and data insights across tennis, pickleball, padel, baseball, softball and cricket.

The company says it will deliver analysis, live streaming, video and coaching insights, tips and practice drills :desired by today’s consumer across our core sports verticals”.

In case you were wondering: The company has its eyes on sports-betting as an ancillary revenue stream, saying its sport-specific apps and proprietary AI could deliver “strategic partnerships to access the growing sports betting sector”.

Regulatory roundup

Texas: The US Supreme Court has ruled that the two tribal operators in Texas can legally operate Class II casinos on their tribal lands. The state had previously insisted that a 1987 land agreement had banned them from operating any gambling prohibited in Texas.

Analysts at Truist said the sector might eye further growth opportunities as Texas tribes “presumably contemplate expansions” while the ruling might also open up discussions around the eventual legalization of Class III gaming in the state.

Yin meet yang: On the same day a Colorado audit office report was released into what the auditors viewed as a lack of “effective process” in its sports-betting regulations, the Maryland governor Larry Hogan urged his state regulators to get a move on with the launch of online sports-betting.

Not happy: In an open letter, Hogan lambasted the regulators from “(allowing) the process to stagnate and become mired in overly bureaucratic procedures that have needlessly delayed the state’s ability to maximize the revenue potential of this emerging industry”

Further reading: On Wagers.com, Steve Ruddock delves into the Colorado report.

Malta: The Financial Action Task Force is reported to have removed Malta from its gray list on Wednesday, a year after first being found to be an untrustworthy financial jurisdiction by the global financial watchdog. A formal announcement is due today, Friday.

Macau gaming law: The details of the new gaming law have been published which allows for a maximum of six gambling licenses to be issued following a re-tender and with gaming taxes increasing to 40%. The maximum gaming concession is 10 years, with a three-year extension to be granted by the Macau chief executive.

Earnings in brief

Groupe Partouche said its business rebounded in Q2 with GGR coming in at €148.2m from €25.1m in the same period last year when most of its casinos were temporarily closed. However, the company noted that in the period from Feb-Apr various restrictions remained in place and attendance was 19.7% below 2019 levels. Online gaming operations in Switzerland achieved GGR of €3.3m from €1.1m.

Newslines

A Pick’em first: FuboTV will launch free-to-play pick’em games via live TV streaming which the company claims is a first. Pick’em players in regulated markets will then have the ability to access the Fubo sportsbook by scanning a QR code to place real-money wagers aligned to their picks. Fubo will make pick’ems available prior to the start of select live sporting events each Sunday.

Tilman Fertitta has completed the $270m acquisition of a parcel of land on the Las Vegas Strip, according to the Las Vegas Review-Journal. Fertitta also owns the Golden Nugget in downtown Las Vegas.

Bond offer: Betsson has issued €90m in senior unsecured bonds within a framework of up to €250m in issuance with a maturity in Jun25. The company also announced the competition of a tender offer for €94m in outstanding senior unsecured floating rate bonds which mature on September 26.

IMG Arena has acquired the streaming and data distribution rights to the German Football Association’s 63-game DFB-Pokal tournament starting this upcoming season.

Scout Gaming won the license to exclusively supply fantasy sports to Norway’s state-owned gaming operator Norsk Tipping.

NeoGames has completed the $476m acquisition of Aspire Global,

What we’re reading

The art of conversation: Entain CEO Jette Nygaard-Andersen sits down with Sports Handle for an hour. Says nothing.

Slack chat: Elon Musk talks to Twitter staff. Talk aliens.

On social

Watt have you done for me lately?

Calendar

Jun 20: Rush Street Jefferies conference chat

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com