Jul 7: Macro conditions hit Entain online

Entain trading update, US regionals analyst update, US online preview, Flutter and NeoGames analyst updates +More

Good morning. In today’s edition:

Entain says it is seeing evidence of macroeconomic weakness.

Analysts assess signs of stress in US regional gaming markets.

Fanatics market entry could kick off next promo ramp, say analysts.

Entain H1 trading update

Online NGR down 7% due to tough comps, Netherlands closure and UK affordability measures.

Group NGR up 18%, boosted by retail performance.

Reiterated FY22 NGR guidance of more than $1.3bn, online NGR expected to be flat, excluding impacts from upcoming UK Gambling Review.

In the US Entain expects “to reach positive EBITDA during 2023”.

Macro troubles: Active customer numbers were up 60% vs. pre-Covid levels, retail performed better than expected and sequential NGR was up, but the “weaker macro-economic environment” was reducing spend levels and “moderating overall online growth versus our previous expectations”, said Entain.

CFO Rob Wood said European markets were the most affected by macro conditions.

“Australia is not feeling it yet, but in Europe there is a clear impact, in the Baltic region (where Entain operates Enlabs brands) inflation is nearly 20%, it would be mad to think there is no impact from those conditions.”

“But it is cyclical and we’re not forming a view on when it comes back during the rest of the year.”

“We do see macro impacts in the UK, but the recreational mix is improving at pace due to affordability measures and a pivot towards that audience.”

With the UK government in meltdown (see breaking news below), CEO Jette Nygaard-Andersen said it was unlikely the gambling White Paper would be published before the parliamentary summer recess.

Quarterly improvements: Wood said the group expects to see improved performance throughout the remainder of the year as main sports (European football and NFL) return from Q3.

“We expect Q3 to be better than Q2 and Q4 to be better than Q3 thanks notably to the World Cup in Qatar.”

On reentry: Netherlands reactivation is expected in Q4. “That is the assumption, we don’t know that for sure but that’s our view.”

Retail therapy: While online performance suffered in Q2, notably in the UK where it was down 15% due to affordability measures, retail performed well. Wood said this was down to the group “benefiting from outcompeting on the high street and taking market share”.

With Entain present in “119 out of 124 UK postcodes”, he said it held about 40% of retail market share but discounted new shop openings; the group will instead invest in digitalisation of the estate and quality products.

“Those with the best gaming machines and SSBTs will win out. The average age of users is also similar to online. The revenue is coming from good demographics and good growth prospects. We want to continue with market share gains as the best way to offset macro conditions.”

Affordability impact: Commenting on the implementation of affordability measures, CEO Jette Nygaard-Andersen said they had led to vast increases in “behavioral monitoring, real time data capture and bespoke or hyper-personalized data. It’s a part of our industry as we move forward”.

Wood said the impact of the measure was “hard to unlock” but UK spend per head was down 15%, “how much of that is affordability measures or macro conditions is hard to separate with confidence”.

PoC tax raise: New South Wales in Australia is set to increase its point of consumption tax from 10% to 15% and Wood said this would cause a “£35m EBITDA impact pre-mitigation”. Mitigation efforts will bring the figure to “around half that” but Wood urged caution with regard to increasing margins through higher overrounds.

“You have to be careful with those, more efficient marketing, redirecting customer activity to higher margin products are the best ways to address those. But the best protection is market share growth and we’ll continue to focus on that.”

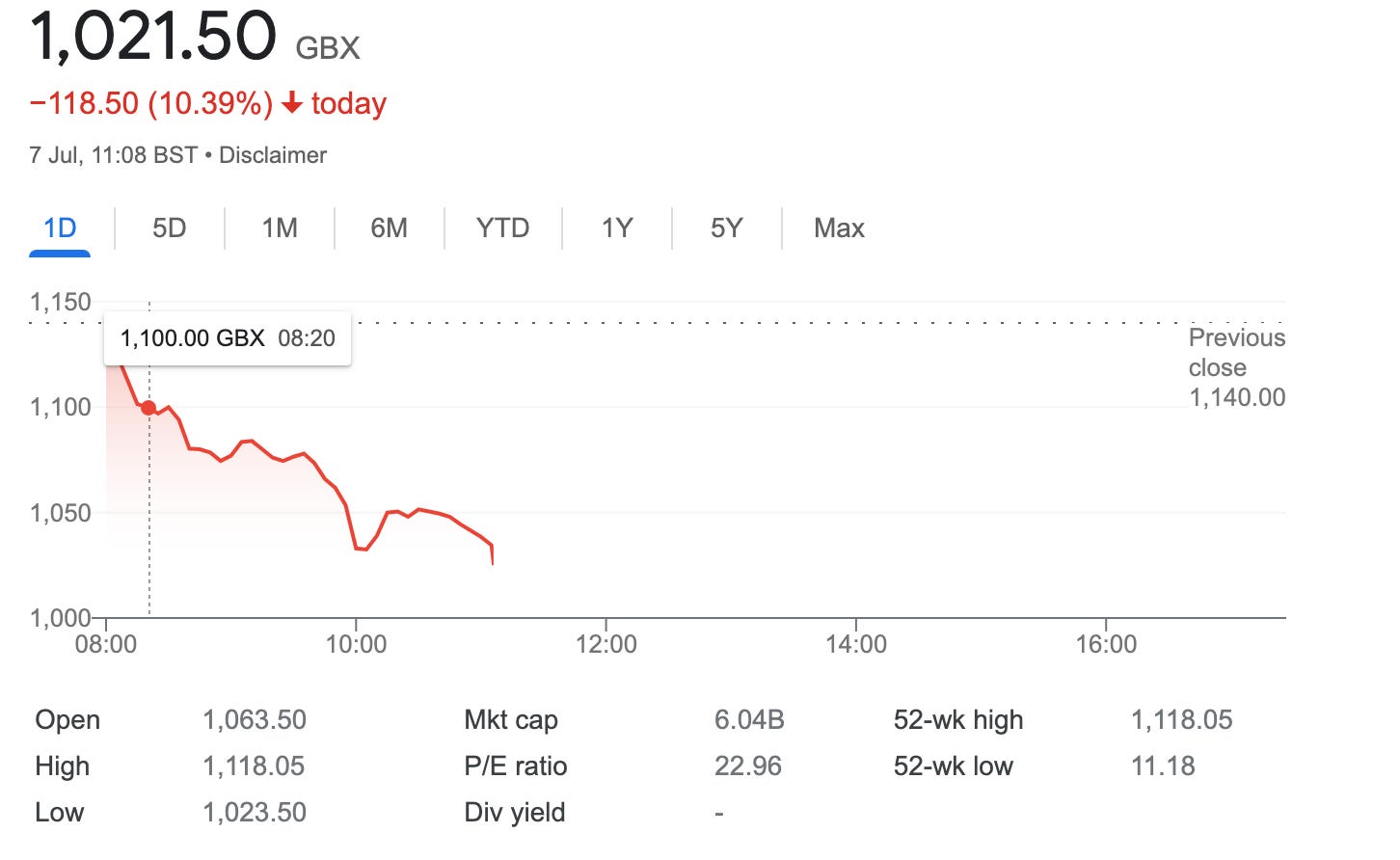

Market reaction: The numbers did not have a positive impact Entain’ share price, it was down 10% at pixel time.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. The company has released its second annual sports betting industry research report. The 2022 edition of ‘BetTech Ecosystem’ has been expanded by more than 60% with the visual now containing seven new sub-segments and 127 new suppliers.

Click here to download the full research report and visual.

For more information visit: spotlightsportsgroup.com

Breaking news - Boris Johnson to resign

Boris Johnson has announced that he will resign as Prime Minister following numerous calls from ministers and Cabinet colleagues for him to step down. The BBC reports that Johnson will stay in post until the autumn to allow for a Tory leadership contest to take place.

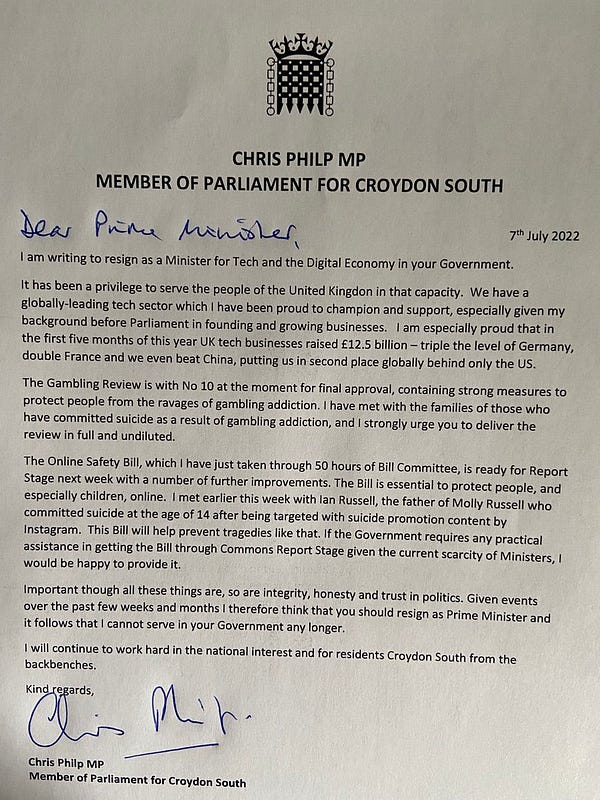

UK gambling minister resigns: Chris Philp, Minister for Tech and the Digital Economy with responsibility for overseeing the UK gambling White Paper, announced his resignation earlier this morning.

In his resignation statement, Philp said: “The Gambling Review is with no10 at the moment for final approval, containing strong measures to combat the ravages of gambling addiction. I have met with the families of those who have committed suicide as a result of gambling addiction, and I strongly urge you to deliver the review in full and undiluted.”

Government meltdown: Around 50 government ministers and parliamentary aides have resigned in the past 24 hours as Johnson battled to save his scandal-ridden premiership.

White Paper doubt: Johnson’s announcement casts further doubt on when the UK gambling White Paper will be published.

Further reading: The Guardian on why the White Paper recommendations may not be implemented “in full and undiluted”.

US regionals analyst updates

Quake warning: Analysts at Roth Capital suggest “early cracks are starting to form in broader gaming demand” in US regional gaming “signs of demand softening” in the last week of May and early June.

Cloudy outlook: Q2 earnings will likely still be strong with EBITDA above forecast, but the Roth team expects more cautious commentary for Q3/H2.

Rebase: “While overall gaming demand still remains healthy, the softening trajectory is causing investors to rebase 2H22 and 2023 forecasts lower,” they add.

Priced in: The team adds, though, that such a scenario is already priced in and that free cash flow yields are above previous dips in the economic cycle.

Resilient, still: They also note that even amid the latest GGR softening, gaming demand has proved resilient vs. other consumer sectors. “We believe this theme will help rerate valuations quickly as concerns over the economy subside,” they add.

Small canary spotted: The team at Macquarie have also looked at Regional prospects. Noting that May GGR was 11% up on May19 by flat YoY they pointed out that slot free-play was up 8% YoY, outstripping the YoY GGR growth and “potentially being a small canary in the coal mine”.

Tweak: In response to recent data - and to higher discount rates - they have “tweaked” valuations across the sector.

Comparison: Looking at what happened post-Great Financial Crisis, the Macquarie team reiterated that an 8% peak-to-trough pullback would still result in margins well above pre-GFC levels.

Hattrick: Lastly, the Wells Fargo team analyzed the data from 17 regional markets for June and found that GGR declined 5.9%, marking the third consecutive MoM decline with May at minus 4.2% and April at minus 2.2%.

Area of concern: “We view declining regional casino visitation as a concern, especially given growing macro uncertainty and consumer inflation pressures,” they added.

Inflection point: The Wells Fargo team believes this “marks an inflection” and provides evidence that gaming consumers “may be feeling increased pressure”. “If this trend holds (or worsens, as many investors anticipate), 2023 regional estimates for mid-single-digit revenue growth over 2019 may need to come down.”

US online preview

Fanatical: Looking ahead to the Q2 results, the analysts at Roth speculate that the ongoing pullback in promo spend - led particularly by Caesars - could be upset should a new entrant such as Fanatics cause another wave of across-the-board spending.

Unspooling: “Any promo easing could be unraveled if a well-capitalized Fanatics enters the market after recent signals point to launching OSB,” the Roth team add.

Tip-ping point: Noting that a rumored deal with Tipico would only bring market access to four states, the Roth team speculate that a further tie-up with Rush Street UInteractive could bring the necessary wider access.

Aspirational: “If Fanatics does aspire to become a leading operator, it must gain access into license constrained markets such as CT, MI, AZ, IL and NY; however, we don't believe this is achievable without M&A,” they add.

Tsunami: A ‘next wave’ promo push caused by a new market entrant “would likely delay paths to profitability” across the market and, notably, could “accelerate risks for a DraftKings equity raise”.

Flutter analyst preview

Spit and polish: The team at Jefferies said it expects a “lackluster update” when Flutter publishes its H1 results in August saying it expected H122 revenues of £3.19bn and EBITDA of £464m. It expects the upcoming UK white paper reforms to cause ~£30m of EBITDA impact or c.3%.

The US will be positive, but tough comps and a c.4% FY22E EBITDA headwind from tax/M&A delay will cause headaches.

Meanwhile, tough comparatives and new taxes in Australia are expected to cause ~£15m hit to EBITDA

Deutsche Bank for its part forecast FY22 EBITDA of £1.015bn and said license delays in the Netherlands would cause monthly hits of £5m EBITDA. Further headwinds include tax rises in Australia in the state of New South Wales and licensing delays in Brazil.

Italian job: Jefferies said the £1.6bn Sisal acquisition should complete in late August but is two months later than consensus and is expected to cause a c£35m EBITDA timing headwind.

No drag: Market share data for FanDuel in the US remains strong and profitability is expected in FY23, ahead of any potential California legalization.

Two states regulated OSB in 2022, but Jefferies expects the group “to recycle the financial benefit of less new state 'drag' into more customer acquisition activity”.

FOX Bet arbitration ruling is expected in Sept22 with Jefferies suggesting a strategic alignment with FOX in the US “could have material positive implications”.

Save the date: Jefferies will host a conference call with FanDuel CEO Amy Howe on July 14.

NeoGames analyst update

Analysts at Macquarie noted that having completed the deal for Aspire, NeoGames now offers a “complete offering” across ilottery, sports-betting and igaming.

When you’re smiling: “We remain positive on NGMS mostly on the future growth profile for ilottery, in addition to what we view as a very synergistic acquisition,” they added.

Upping estimates: The team raised their 2022 EBITDA estimate to $56m from $36m.

Datalines

Maryland: GGR came in at $162.7mm for June, up 0.8% YoY and a 13.9% rise vs. June19. For 2Q22, GGR was up 3.3% YoY and up 16.3% versus 2Q19. Maryland Live (~34% market share) generated $56m, down 4.2% YoY.

Newlines

FL Entertainment, the group that resulted from the Betclic-Banijay merger and its subsequent merger with the SPAC Pegasus Entrepreneurial Acquisition, has listed on the Euronext Amsterdam exchange. The group listed with an enterprise value of €7.2bn, Betclic has issued FY22 revenue guidance of €850m and EBITDA of €200m.

Shut up shop: Macau’s SJM Grand Lisboa Casino will close until at least July 11 after 13 members of staff tested positive for Covid19. Cases have risen to 1,087 as of Wednesday.

Wynn Macau: Ian Coughlan will leave his role as president of Wynn Resorts’ Wynn Macau in February. Meanwhile, Wynn Macau COO Ciaran Carruthers is set to join rival Crown Resorts as CEO.

This is a Lo: Meanwhile, Suncity - the junket run by now arrested Alvin Chau - has been taken over by director Andrew Lo who now claims he owns 75% of the firm. Suncity has applied for the resumption of trading in its shares.

DraftKings: Ad Age reports that DraftKings was the eighth highest spender on national radio ads in the US last year spending $26m, based on data from Kantar. It was the only gaming operator in the top 10.

IGT has completed its €160m cash acquisition of iSoftBet. The transaction enables IGT to double its PlayDigital content library to around 225 proprietary games.

FansUnite began trading on the Toronto Stock Exchange Wednesday under ticker FANS, closing at 25 Canadian cents.

What we’re reading

The Huddle Up newsletter on why a ban on gambling shirt sponsorships in the English Premier League has ramifications for the US.

On social

Calendar

Jul 21: Betsson Q2, Evolution Q2

Jul 22: Kindred Q2

Jul 26: Boyd Gaming Q2

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com