Jul 25: Promo spend lowest since start 2021

Promo spend analysis, the shares week, the week ahead, startup focus - STX, Better Opinions funding news +More.

Analysis suggests OSB promo spend at lowest level than for over a year.

Gaming stocks’ good week marred by market ‘Snap’-back.

Our startup focus company for this week is sports-betting exchange STX.

Promo spend analysis

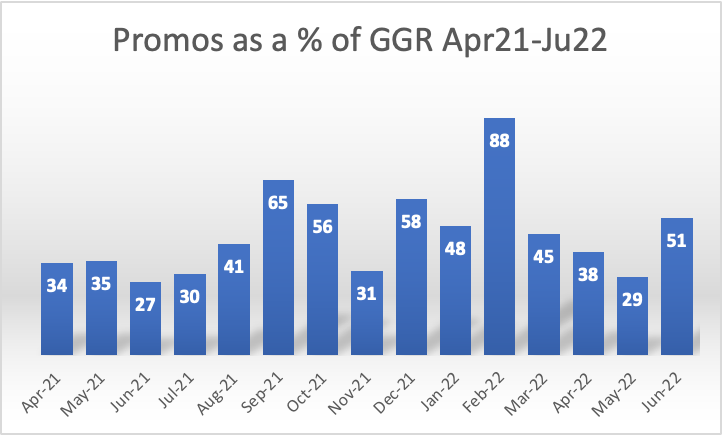

OSB promo spend is at its lowest level since Q121 at around 35% of GGR, according to analysis from JMP.

Tumbling dice: The team at JMP believe that promotional and market spend was “down significantly” in Q2 as operators pulled back from the elevated levels of spending associated with the Super Bowl and March Madness. QoQ promo spend was down between 55%-60%.

Take it easy: While Q2 saw the launch of Ontario, the JMP team believe management commentary suggests a “slower ramp” for new operators to the market vs. other US state launches.

“As a result, we are not expecting promotions to be elevated in that market during the quarter,” they added.

The calm before the storm: Still, promo spend will accelerate once more in Q3. Indeed, June appeared to signal an early acceleration from a May low.

Source: JMP Securities/state data

Flow through: The lower promotions will “should lead to revenue beats” in upcoming earnings with FanDuel $5.6m better off in terms of revenue, DraftKings adding $3.4m and BetMGM able to add ~$2.2m.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. The company has released its second annual sports betting industry research report. The 2022 edition of ‘BetTech Ecosystem’ has been expanded by more than 60% with the visual now containing seven new sub-segments and 127 new suppliers.

Click here to download the full research report and visual.

For more information visit: spotlightsportsgroup.com

The shares week

The shares of the leading betting and gaming stocks were enjoying a decent week until Snap reported its earnings on Friday.

Snap-back: The wider market ‘melt-up’ last week was brought to a halt on Friday when the company behind Snapchat reported disappointing earnings and said it would be cutting staff.

Melt in the mouth: The market reaction saw DraftKings, Rush Street, Caesars and Penn National give up much of their gains for the week and saw them pull back from their intraday highs achieved on Thursday.

DraftKings was up over 10% at one point on Thursday before giving up over 5% of its gains on Friday to end the week up 2.6%.

In comparison, Caesars Entertainment managed to hold on to most of its Thursday intraday gains and despite a 3%+ fall on Friday was still up nearly 11% on the week.

On Point: PointsBet enjoyed a good Friday with its share soaring over 16% and contributing a near 40% rise over the past month. However, the shares gave up around half the gains in Monday trading in Sydney. The Australian-listed firm been the subject of much speculation in recent weeks including rumors of a bid for its Australian business.

Stake building: In late June SIG Sports Investments Corp, an offshoot of Susquehanna International, became PointsBet’s largest shareholder with a A$94.2m stake in the company.

Diary date: PointsBet reports late on Thursday evening ET/early Friday morning UK time. See below for more week-ahead earnings.

PointsBet share price, 22 June

The week ahead

Buoyed up: The health or otherwise of US regional gaming markets will be the focus when Boyd Gaming reports AMC on Tuesday. Consensus has Q2 adj. EBITDA pegged at $339m.

Wells Fargo suggested the focus will be on the health of the consumer within Boyd’s database as well as July trading, growth expectations vs. cost control and its repurchase plans.

The team noted that in early June, the Boyd board authorized a $500m increase in its share buy-back capability.

Still, the Wells Fargo team now “conservatively assume growth gradually begins to decelerate” into H2 and 2023.

Acquiring growth: Churchill Downs reports on Wednesday with the accompanying call on Thursday and analysts will be looking for further word on the upcoming Peninsular Pacific Entertainment (P2E) acquisition which is due to complete in H2.

Doubling: Analysts at Jefferies said in a recent note that “ultimately” EBITDA and cash flow will double by 2024.

Stables: Further growth will come from the ongoing $275m-$290m of development going on at Churchill Downs itself for the Kentucky Derby.

Stable: With Twin Spires, the analyst said they are hoping for a meaningful B2B contribution “to come”. “Our impression is that this business should become active in the near term,” they suggested.

Also reporting this week: Kambi, VICI, Gaming and Leisure Properties and Lottomatica.

Listing: Mobile Global Esports, A California-based company developing an esports platform for competitions in India and South Asia, is likely to list this week on Nasdaq, raising $17m via the sale of 3.8m shares at between $4-$5.

Startup focus - STX

Who, what, where and when STX is a Chicago-based sports-trading exchange founded in 2020 by Justin Deutsch and Hari Gopalakrishna. Deutsch says the aim of the company is to turn sports betting into a multi-trillion dollar tradeable asset class via technology and a “new demographic” of sophisticated sports traders.

Funding backgrounder: STX’s most recent fundraise closed last August when it collared $5m in a round led by XV Venture Capital with participation from members of the Chicago trading community.

So what's new? Ontario is the focus with Deutsch saying that STX hopes to launch there later this year. Expansion into the US would follow. “Liquidity is the heartbeat of our platform, so we are constantly working with professional traders, betting syndicates, and other sports aficionados to ensure each of our market participants has the tools they need to trade effectively,” says Deutsch.

The longer pitch: Technology is of prime importance to STX and is “at the core of everything we do”, says Deutsch who says that his team has so far spent two years “shadow building” the tech platform that he believes the industry has “yearned for”.

“Low latency, high concurrency, and ultimate reliability are the foundation of what makes the STX platform attractive to sophisticated bettors while mitigating the burden of large operating costs and overhead,” he adds.

Although the initial use case for the platform will be as an exchange, Deutsch adds the infrastructure was built with the intention of offering traditional sportsbook and casino as well, “enabling STX to become the most scalable all-in-one online gaming platform in the world”.

Better Opinions fundraise

A prediction market startup focused on the Indian market called Better Opinions is seeking to bring Meta on board for a new $3m funding round that will value the business at $25m, according to Techcrunch.

Bettor Opinions has previously raised $2.5m in seed funding from names including Metaplanet VC, YCombinator, Taurus VC, Original Capital, Tremis Capital, Goodwater Capital and Super Capital.

The company is building ‘the prediction market’ for India, allowing users to trade their opinions on everyday topics and win cash based on how those predictions turned out.

A matter of opinion: Alongside topics such as the future price of cryptocurrency and the box office take of new releases the app also allows users to “make predictions on results of cricket matches as well as specific outcomes of certain events in the game such as runs in an over, according to an analysis of the app”.

But that’s… betting, isn’t it? According to the Better Opinions website, users can set prices, hedge and trade. Co-founder Samay Jain told Techcrunch that the app has 600,000 users who have so far traded over $1.25m on the platform.

Dream baby dream: The report notes that Better Opinions is similar to startups in the same space such as Kalshi and Dream11 which Techcrunch suggests have amassed millions of users.

Coming soon: E+M startups

Startup newsletter launch: Next Tuesday and every subsequent first Tuesday of the month, Earnings+More will run our new startup month edition of the newsletter with the aim of highlighting broader trends for growth companies working in and around the betting-and-gaming space.

The debut issue will take a look at how the funding crunch caused by the worsening macro backdrop is affecting the flow of new money in startup and scale-up companies within the sector.

Expert commentary comes from Benjie Cherniak from Avenue H, Chris Grove from Acies, David McLeish from the law firm Wiggin, Lloyd Danzig from Sharp Alpha plus more.

The edition will also take a look from the inside of the recent fundraising from Future Anthem with CEO and founder Leigh Nissim and will take a (re)focus on SnapOdds.

Plus there will be more news involving the sector’s growth companies.

Newslines

This town ain’t big enough for the both of us: Circa Sports has announced its first Northern Nevada “outpost” at the Legends Bay Casino in Spark. An opening date will be revealed later this month.

Riot act: Riot Games has banned 13 Chinese players from any event or league associated with them after being found to have been involved in match-fixing. The investigation concerns the ImbaTV Fearless Invitational Cup, which took place in July last year.

What we’re reading

Broadcast news: FanDuel is set to rebrand TVG to FanDuel TV, according to Legal Sports Report. The move is set to take place in September.

Fool me once: Bill Gates says NFTs and Crypto are “100% built on the greater fool theory”.

On social

Calendar

Jul 26: Boyd Gaming Q2

Jul 27: Churchill Downs

Jul 28: VICI, PointsBet, Churchill Downs (call)

Jul 29: Gaming & Leisure Properties

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com