Jul 20: BetMGM motors on in Michigan

Pennsylvania and Michigan June data, analyst Q2 previews, Las Vegas Sands preview, stablecoin analyst update +More

Good morning, on today’s agenda:

BetMGM and FanDuel maintain their leadership across iCasino and OSB in Michigan and Pennsylvania.

Jefferies says the Las Vegas market is more resilient to a downturn than during the GFC.

Roth sees an EBITDA margin benefit from the wider adoption of stablecoins.

Datalines

BetMGM continues to lead in combined OSB/igaming in MI while FanDuel continues its OSB dominance in PA.

Pennsylvania

Sports-betting GGR of $22.9m was down 46% YoY and 52% MoM with promos of $10.1m, or 47% of GGR.

Leaders: FanDuel led sports betting with 42.4% followed by DraftKings with an estimated 15.2%, then Rush Street (12.9%) and Penn/Barstool (10.9%). The top four accounted for over 81% of the OSB market.

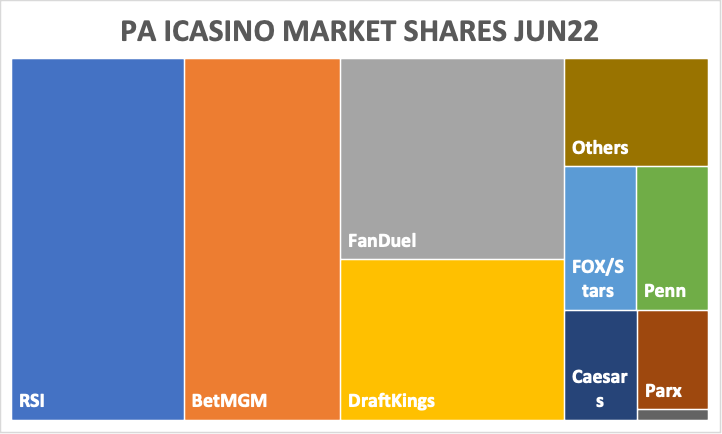

For iCasino, GGR rose 16% YoY to $102.9m. Rush Street led the market with 24.8% followed by BetMGM with an estimated 22.5%, pushing FanDuel (17.9%) and DraftKings (14.3%) into third and fourth place respectively.

Land-based casinos saw GGR rise 3.3% YoY, up 0.5% on Jun19 but down 13.8% on a same-store basis. Penn’s properties led the way, up 29.6% YoY.

Michigan

Rising casino tide: Total OSB and icasino GGR for June rose 19.9% to $136.8m; sports GGR was down 42% YoY to $15.48m but net revenue of ¢5m was down 70% YoY with $10.3m of promos accounting for 67% of GGR. Mobile handle rose 14.8% YoY to $270m.

Leaders: BetMGM’s combined market share hit 38% followed by FanDuel (18%), DraftKings (14.2%), Rush Street (5.7%) and Caesars (4.1%). The top five operators accounted for 80% of the total combined market.

Luck has left me standing so tall: Adding Golden Nugget’s 3.2% total market share gives the combined DraftKings/GNOG 17.4%.

Deutsche Bank noted that the promo spend levels - which were also worth 3.8% of total handle - were “up considerably year over year”.

iCasino of $121.5m was up 36.2% YoY and down 4.6% sequentially. Land-based casino GGR dropped 7.2% to $98.2m with Deutsche Bank noting this compares with drops of between 2.4% and 3.9% in neighboring gaming states.

Leaders: BetMGM extended its lead in online gaming with a market share of 38.9%, followed by FanDuel (15.3%) and DraftKings (14.7% or 18.3% with GNOG).

Going live: Notably, FanDuel announced yesterday the launch in conjunction with Evolution of branded live dealer studios in Michigan and Pennsylvania.

Connecticut: Total GGR rose 25.3% to $88m with slots GGR down 4.7% to $66.9m. OSB GGR was down 35% to $4.3m and handle was down 17.5% to $88.8m. Retail sports-betting GGR increased 18.6% to $521K while iCasino GGR was down 1.6% to $16.3m.

OSB leaderboard: In GGR terms, FanDuel-Mohegan Sun led with $ 2.2m followed by DraftKings-Foxwoods on$1.7m with Rush Street -CT Lottery on $316K.

Tennessee: Sports-betting GGR for June was down 20.5% to $12.8m while handle was up 23.6% to $215.7m.

Montana: Sports-betting GGR in June dropped 28.7% to $275K on handle down 21.3% to Handle $2.9m.

**Sponsor’s message**: Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy.

Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group (aimsgroup.io).

Get in touch with your pitch or disruptive products to plug into our investment network!

Analyst Q2 previews

Out-of-favor gaming stocks in search of a boost.

Can’t catch a break: The team at Jefferies point out the “magnitude of the weakness” in recent stock market performances - with sector names down 30% on average YTD - is down to issues of leverage and digital investment against a worsening macro environment.

In the dog house: Suffering the worst falls are Caesars (down 60%), Bally (off by 45%) and Penn (at minus 40%).

“The market has been focusing on any signs of discretionary spending pulling back given high inflation and rising fuel costs,” the Jefferies team added.

Where the wild things are: The widely-held perception is that Las Vegas is vulnerable to downturns but while acknowledging the potential impact of slowing corporate travel budgets, the Jefferies team suggest Las Vegas is better-positioned than in the wake of the Global Financial Crisis.

A whole new ball game: Importantly, Jefferies suggest Las Vegas today has more sports and entertainment options with more to come.

Relevant datapoint: The Raiders brought in the most in ticket revenues in the 2021 season with $119m in net gate receipts.

Uh-oh: Analysts at Stifel have halved their target price on Ceasars as the team is now pricing in a full-blown recession including a dramatic slowdown in consumer spending and travel next year.

Pulling back: Meanwhile, looking at the gaming suppliers the team at Macquarie say they are “slightly more cautious” on 2023 and 2024 and are taking a “prudent approach given the macro backdrop.

Reality check: The team have also lowered their valuation multiples across the board “to reflect a more accurate depiction of the space”.

Don’t stop me now: Nevertheless, they still expect Q2 earnings beats and expect companies to maintain guidance or “fall in line with broad market commentary”.

Endurance race: Jefferies, meanwhile, suggest exposure to lotteries and regional gaming, product momentum and “all-time best capital set-ups” suggest gaming suppliers “should endure if not flourish through economic cycles”.

LVS analyst preview

Deutsche Bank will be looking for more color on how Singapore is ramping up.

Through a glass, darkly: Las Vegas Sands will report AMC today and the team at Deutsche Bank said they expect “little in the way of new news” with clarity around Macau “remains fleeting”.

Your LVS bingo card: They expect the focus will be on the ramp in Singapore - which they believe is a “likely template” for the trajectory of Macau, cash burn rate in Macau, update on potential Marina Bay Sands expansion and color on Macau gaming law developments.

Stablecoin analyst update

Roth Capital suggests the online sector could gain from wider ‘firm’ stablecoin adoption.

Peg: Looking at the potential for the use for digital deposits of stablecoins that are “firmly” (analyst emphasis) pegged to the dollar or the euro, the team at Roth suggest the benefits would include an 8% boost to EBITDA margins via less payment processing costs.

The bottom line: The benefits would also include a transaction acceptance rate of 99%+, instant withdrawals and negligible chargebacks.

Glad to be gray: Roth estimates crypto wagering accounts for ~10%-15% of gray market GGR although adoption in regulated markets is “beginning to pick up”.

Bank run: The Roth team suggest that mainstream adoption of crypto as a means to wager will depend on central bank-backed stablecoins which would be able to “apply the efficiencies of blockchain with the stability of traditional currencies”.

Curveball: The Fed may be lagging” but the Roth team suggest there are 25 central banks looking at stablecoins including the ECB.

You don’t say: “Other stablecoins were less firmly pegged to the USD, such as Terra (UST) which was backed by less liquid and secure assets,” the team noted.

Macau update

Doom-laden: The data for Q2 was understandably gloomy given the current backdrop with VIP revenues down 94.3% vs. 2019 and off by 87% QoQ to $246m. VIP was worth 23.4% of overall gaming revenue vs. 50% in 2019.

Morgan Stanley have cut their outlook for Macau by 38% to $7bn for 2022 and $16bn next year, down 30%. The team’s marketwide EBITDA estimates for 2022 are at 40% of 2019 levels.

Macau casinos are expected to reopen on Friday.

Lottery.com

Overenthusiastic accounting: The Nasdaq-listed Lottery.com is working with external auditors to review its cash reserves and revenue forecasts after it found that it had overstated its available cash balance by c$30m.

Just not right: As a result, it had “improperly recognized revenue in the same amount” in the prior fiscal year.

Swift exits: The group’s board previously sacked president and CFO Ryan Dickinson and it has now accepted the resignation of CRO Matthew Clemenson with immediate effect.

Recall, in May the company said Q1 revenues rose by $15.7m to $21.2m while adj. EBITDA came in at $7.7m. The shares fell over 27% on Monday before recovering slightly yesterday, up 1.8%.

Kindred harmful gambling

First, do no harm: The percentage of revenue Kindred generated from harmful gambling stood at 3.3% in Q2, the same as Q1. The improvement after interventions was 84.7%. Over the period, Kindred entered a new collaboration with QuitGamble.com.

Diary note: Kindred will report its Q2 earnings on Friday.

Earnings in brief

Nagacorp H1: First-half EBITDA increased to $130.1m from 2021’s pandemic-stricken $4.5m. Average daily volumes for the mass and premium mass market in Q2 recovered to 80.3% and 71.8% vs. FY19 respectively.

Newslines

Spotlight Sports Group will launch a microsite for Sky Bet to mark the start of the English Premier League season on Aug 5. The site will be integrated into Sky Bet’s desktop site and native app. Spotlight also launched fantasylife.com earlier this month in partnership with ex-EXPN presenter Matthew Berry.

Duel appointments: FanDuel has appointed Christian Genetski as president and Mike Raffensperger as chief commercial officer.

Beach Point Capital Management will provide the debt financing for Broadway Gaming’s $46m acquisition of 888’s online bingo divisions.

Betsson will start trading the €90m debt it raised via senior unsecured bonds on Nasdaq Stockholm after receiving approval from the Swedish Financial authority.

What we’re reading

Every cloud: FTX’s Bankman-Fried makes the most of the crypto winter.

The road to riches: It took 49 months for US sports-betting revenue to top $10bn.

Wagers of fear: The Betting & Gaming Council rails against the nanny state.

On social

Perception is reality when sports betting is not gambling.

Calendar

Jul 20: Las Vegas Sands

Jul 21: Betsson Q2, Evolution Q2

Jul 22: Kindred Q2

Jul 26: Boyd Gaming Q2

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com