Jersey’s handle declines continue

Datalines – New Jersey, GAN’s Wynn deal, Rank analyst takes, startup focus – SimWin Sports +More

Good morning. On today’s agenda:

FanDuel reasserts NJ sports-betting dominance, while run of YoY handle declines continues.

GAN secures a WynnBet deal for sports betting.

Analysts react as Rank shares tank following warning.

Macau’s concessionaires sign new agreements.

FSB Technology is the latest to pivot away from the US.

Datalines – New Jersey

Nearing year-end FanDuel reasserts its dominance in sports betting, while Caesars’ mid-year push for GGR share fades away.

Duel-tide greetings: The market leader FanDuel is back up to 54% sports-betting market share YTD after grabbing 58% of the $80.4m in GGR in November. DraftKings was second with 18%, followed by BetMGM on 10%, and Caesars and PointsBet with 3% each.

In October and November Caesars posted GGR market shares of 4% and 3% respectively after a mid-year surge between June and September of 8%-11%.

🍆 FanDuel sustains its Fall rebound as Caesars falls back

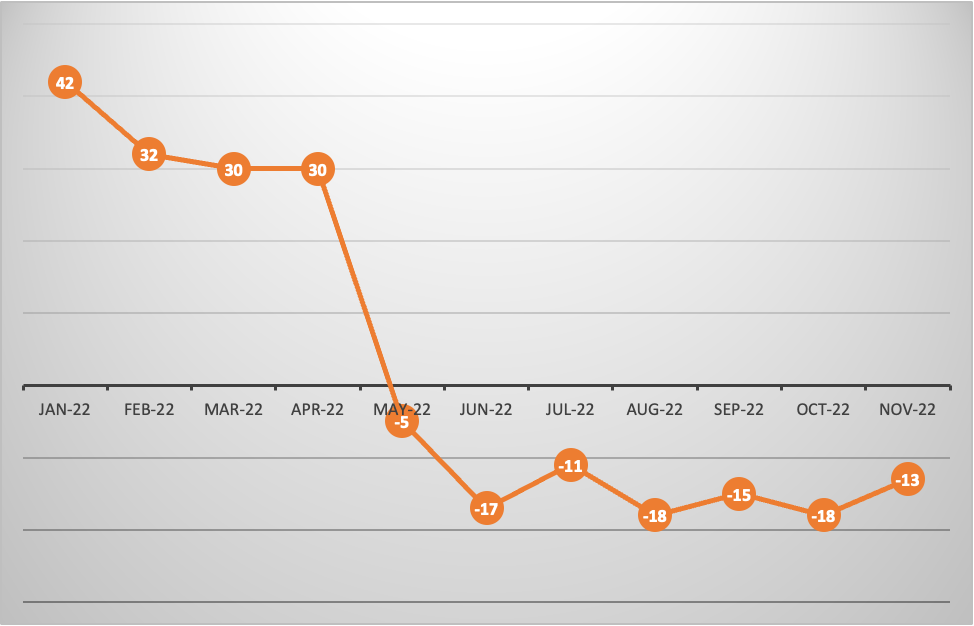

Deutsche Bank noted November’s handle of $1.1m was the seventh successive month where the YoY number declined.

DB suggested the declines were down to a less cutthroat promotional environment and the impact of New York launching mobile.

🎢 New Jersey suffers its seventh successive month of YoY handle declines

** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 19-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

World Cup balls

Very messy: Owning up to technical issues during the best World Cup Final ever… bet365

GAN’S Wynn win

The supplier adds a stellar name to its roster, even if actual revenues are less elevated.

Wynn at all costs: GAN has announced it will be the new sports-betting backend supplier for retail and online operations to WynnBet, including the launch of a sportsbook at the Encore Boston Harbor, Massachusetts. GAN replaces Endeavor’s OpenBet.

GAN will expand on its current supply agreement for its Super RGS content aggregation platform.

The team at Macquarie noted that this would be GAN’s second big sports-betting supply launch scheduled for Q123, alongside its deal with Red Rock retail and online provision to its Station Casinos operation.

Still, Wynn has dialed back on its OSB ambitions this year and is one of the also-rans in markets where it is already live.

Macquarie estimated Wynn might hope to gain ~3% online market share in Massachusetts but could grab up to 60% of the retail market.

The team estimated that would be worth ~$2.6m in B2B revenues for GAN.

🔥 GAN shares receive a boost on the Wynn sports-betting supply news

Coming soon

Rank analyst takes

The casino-to-bingo operator’s statement on Friday balanced good news online with a worsening backdrop for land-based gaming.

Breaking rank: Arguments about the land-based gaming sector having an element of recession resilience suffered a blow after what Rank said last week about both its Grosvenor Casino and Mecca Bingo estates, according to the team at Regulus Partners.

Rank’s “early softness” was in line with Regulus’ expectations for casino, in particular, being hit by “consumer discretionary cyclicality”, with consumers worried by fears over disposable income and falling property prices.

While the team at Peel Hunt believed it was just a matter of time before the Grosvenor audience returned, Regulus was less sure.

While the UK gaming audience has become even more familiar with online over the past three years, the “amenity value of UK land-based gambling has been slowly eroded for decades”.

In revenue terms, land-based and online are broadly at parity at £3.9bn vs. £4bn but with online obviously growing, up ~£1bn since 2019.

“Unless customers are prepared to spend more on gaming overall, something has to give, and it appears to be giving in the land-based casino market as well as in higher spending bingo customers,” said Regulus.

“Twenty years of low inflation and slow customer adoption of online has created the impression that online growth is independent of land-based resilience,” it concluded. “This is a false impression, which Rank is now demonstrating.”

🦆🦆 Rank suffers a near 10% decline following its Friday warning

Macau concessions

On the dotted line: The six Macau licensees have all signed their new concessions, ending a years-long process and finally bringing some certainty for investors. Between them, the six are now committed to spending a combined $15bn, with the largest contributions coming from Sands China and Galaxy.

Meanwhile, the Macau government continues to loosen Covid restrictions with people traveling from outside China now able to quarantine at home instead of at a centralized facility.

FSB’s US retreat

The sportsbook backend supplier says it will be “de-prioritizing” the US as it refocuses on the UK, Europe and Africa.

Pivot: Following a strategic review, FSB Technology’s chief revenue officer Ian Freeman said the prohibitive cost of the US market had led to the decision not to pursue US opportunities. It will now concentrate on its “bedrock” of the UK, Europe and Africa.

As it stands, FSB does not have any US clients but it does have a toehold in Ontario via a deal with Fitzdares.

FSB is owned by the Toronto-based Clairvest, which bought the business in 2019 for £23m. FSB said Ontario remained a “committed focus”.

The news came as the company appointed head of delivery Adam Smith as interim CEO, replacing Dave McDowell who has moved up to the board.

Analyst takes

AGS: Analysts at B Riley suggested consensus estimates for the machine supplier for Q4 and next year are likely on the conservative side. They noted that the new Spectra UR43 cabinet continues to outperform and could help accelerate market share.

Las Vegas searches: Macquarie analysts said November search data saw an acceleration, with overall searches up 8% MoM. They added that current demand bodes well for Q4.

The week ahead

Tomorrow E+M releases Due Diligence #2, which looks at the pivot to iCasino being spoken about by many operators in the US. The last newsletter of the year will come with Friday’s Weekend Edition.

Startup focus – SimWin Sports

Who, what, where and when: The LA-based SimWin is a fantasy sports operator founded by CEO David Ortiz in early 2019. It offers daily, season-long and in-play tournaments that also allow players to collect as they play by ‘selling’ sports franchises as NFTs owned by a host of celebrities.

Funding backgrounder: Funding to date has not been disclosed but its backers include 1 Up Ventures, Animoca, YOLO, Magic Johnson Enterprises, David Levy and Fubo’s CEO David Gandler.

The pitch: Ortiz says SimWin is a “first-of-its-kind” around-the-clock league allowing players to engage in contests without waiting on leagues to actually commence, while leveraging Web3 tech and the whole concept of sports in the metaverse.

“Fantasy sports contests in the world’s only sports league that is never out of season, while interacting with our team of celebrity owners is a unique opportunity,” says Ortiz.

“This is nothing like the Web3 gaming experiences you’ve seen to date; it’s a living, breathing sports ecosystem that presents revenue opportunities at multiple levels.”

He notes that the recent crypto clearout has created space for “simple collector projects” and presented a “tremendous opportunity to those Web3 projects with utility at their core”.

“It’s about the demographics of this rapidly expanding market as the desire for sports gaming in the metaverse continues to climb.”

What will success look like: Ortiz says SimWin is still working on closed beta with American football simulations and 24/7 fantasy sports contests set to launch early in 2023, and he is looking forward to “virtual player and asset drops” as well.

Newslines

Hard Rock International’s acquisition of MGM’s Mirage on the Las Vegas Strip is expected to close later today after receiving final approval from the Nevada Gaming Commission.

Scout Gaming finalized a restructuring process of its B2B operations, with 13 B2B operators under contract, eight of which are integrated and five others planned to be in full operation in the first quarter.

Make your mind up: The Norwegian gaming regulator Lotteritilsynet has once again paused daily fines against Kindred having decided the company’s Unibet operation has not been targeting Norwegian customers.

What we’re reading

Evolution gets a vote of confidence from a substack analyst.

On social

Vote early, vote often.

Calendar

Dec 20: Due Diligence #2

Dec 23: Last E+M newsletter of the year

Jan 2: E+M is back

Jan 3: The startup month #6

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com