ESPN Bet’s September data suggests things are getting worse, not better.

Breaking: Sportradar enters the affiliate space.

FanDuel is the new name of 16 regional sports networks.

By the numbers: The promo ball keeps rolling in Michigan and Pennsylvania.

September gurls, I don't know why.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Slipped from their grasp

Missing the snap: The worst fears of Penn’s investor detractors that it might flub ESPN Bet’s opportunity for a second bite of the cherry at the start of this football season appear to have been realized.

🚧The September data from three of the biggest OSB states showed ESPN Bet’s key metrics heading in the wrong direction, while the data from the delayed New York launch suggested it has failed to set the market alight.

In New Jersey, where total GGR rose 8% to $120m, ESPN Bet’s GGR fell 7.5% to $2.5m.

In Pennsylvania, total market GGR was up 46% to $89.5m but ESPN Bet’s share remained marooned at $3m or 3.3% share. Its share of handle declined from 4.6% to 4.2%.

In Michigan, which saw GGR rise 33% to $58.4m, ESPN Bet managed to nearly double its GGR – but to a mere $1.9m, while sequentially its share fell back to 3.1% from 4%.

Can’t make it there: In New York, meanwhile, where ESPN Bet only belatedly launched in mid-September, it generated GGR of just 0.1% or ~$100k on handle of just over $4m or 0.2% share.

Mission accomplished: Analysts reported from Penn’s recent investor event at the start of G2E it would be purposely avoiding any “considerable push” in the market due to the high tax rate.

The whole of the moon: A recent roundup from the analysts at JMP for the combined OSB and iCasino market shares across 70% of the total US market showed ESPN Bet performing poorly in September, at 1.5% vs. 1.7% in August.

Recall, ESPN Bet launched to much fanfare in November last year and initially appeared to grab double-digit download share and mid-single digit share of handle.

Kicking the can down the road: The poor performance has occurred against a backdrop of an interactive operation apparently in turmoil with further layoffs last month and after an investor presentation at the start of G2E, which sources suggested was not well received by investors even if the buy side (publically) remained positive.

“They haven’t learned anything,” suggested one investment insider of the Penn management team.

Left a bit, right a bit: The source went on to claim that Penn is “already laying the groundwork to move the goalposts once again” by suggesting the new target is the long-promised account linking with ESPN, which is set to debut in November.

“I’m not a buyer of that,” the source added. “Management has moved every goalpost consistently since ESPN Bet launched last November and before that with Barstool.”

🚨Home state blues: Handle in Pennsylvania

Can’t take my eyes off of you: Recall, during the recent investor day held ahead of G2E, analysts suggested Penn management’s confidence over ESPN Bet “has not wavered.”

However, the analysts at Truist said at the time they would “closely monitor” the September data for signs of progress.

Jefferies said that Penn insists it can achieve profitability at 6% OSB share and 4.8% iCasino share, but even such lowly targets still appear beyond the operation.

Your Fast Track to Platform Ownership

At Fincore, we believe ambitious operators should control their own platforms and customer data.

Meet TRI///, our modular software suite including Sportsbook, RGS, PAM, Payments and Bonus.

Each service works brilliantly alone, integrates seamlessly with your tech stack, or functions as a complete solution.

Join us on a 3-step journey to owning your own platform:

1. Choose a module and we’ll customise it to your needs.

2. We’ll run it with you, acting as an extension of your team.

3. When ready, you can take full ownership and control.

Find out more here

Breaking news

The means of production: Sportradar has bought its way into the gaming affiliate space via the conditional asset purchase of XLMedia’s North American assets for up to $30m.

XL’s brands include Sports Betting Dime, Saturday Down South and Crossing Broad.

The business generated revenue of $27.5m and adj. EBITDA of $5.5m in 2023. The deal represents a multiple of 5.5x the 2023 North American revenues.

Shell like: The sale of the assets will leave one of the erstwhile gaming affiliate leaders as a cash shell listed in London. It follows the disposal of its mostly European assets to Gambling.com completed in April this year.

XL said today that the growth of its US assets “did not match” the company’s ambitions.

Meanwhile, constrained by having to fund any deals from cash generated from trading, the company found it had “limited its ability to participate in further acquisitions.”

+More

Light & Wonder’s appeal of the injunction suspending use of the Dragon Train title has been withdrawn after the company realized the court’s ruling on the appeal would not be received prior to October 23, the day by which all Dragon Train installations are to be removed or replaced.

Blackstone-owned Crown Resorts in Australia has sold the site of its planned One Queensbridge development in Melbourne for A$85m ($57m) as part of an ongoing program of non-core asset sales.

What we’re reading: The financing plan covering a $1.5bn baseball stadium on the Strip “is in place,” according to sources close to the (still) Oakland A’s who have spoken to The Nevada Independent. But the paper reported that any public discussion of funding would wait until December.

The week ahead

Earnings season picks up a head of steam this week with Churchill Downs, Evolution, Las Vegas Sands and Boyd Gaming among the big names coming to the plate.

Not coming up roses: The first of these is Churchill Downs where the analysts at Jefferies lowered their estimates late last week on some signs of regional softness and delays in the opening of the company’s Rose Gaming Resort.

Still, the analysts only trimmed their numbers and still see 2024 revenue as coming in at $2.7bn and adj. EBITDA at $1.15bn.

For Las Vegas Sands, the analysts at JP Morgan recently reiterated their overweight rating, suggesting LVS was enjoying market share growth in Macau now that recent renovations have been completed at The Londoner.

Also reporting will be Evolution, where commentary can be expected on its industrial strife in Georgia.

Naming rights

They call them the Diamond Dogs: FanDuel will replace Bally’s as the title sponsor for the Diamond Sports network of 16 regional sports stations, which will now go under the moniker FanDuel Sports Network.

As part of the deal, FanDuel will also get linear TV and digital media placement across all live NBA, NHL and MLB games on the network.

The two companies will also work on a “unified DTC app experience,” which will involve the ability to syndicate FanDuel TV programming across the network.

Financial details of the deal were not disclosed.

A new chapter: Diamond Sports was originally Sinclair when it signed an exclusive deal for naming rights with Bally’s in early 2021. Diamond Sports filed for Chapter 11 bankruptcy in 2023 throwing the future of its RSNs into doubt.

But the company has since renegotiated its terms with a number of the teams that it broadcasts as well as calling a halt to a number of contracts.

FanDuel will now have the option to buy 5% of the business once it emerges from its bankruptcy proceedings.

Mike Raffensperger, president of sports at FanDuel, claimed a “large cohort” of FanDuel customers were “devoted RSN viewers.”

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

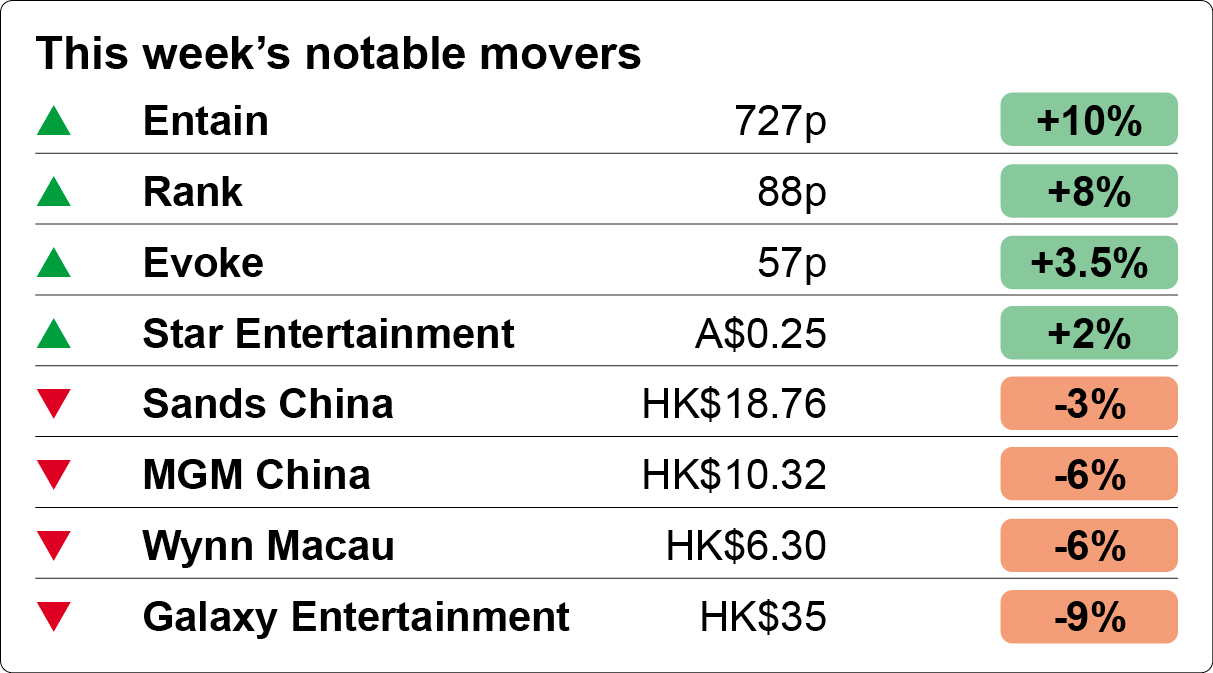

Shares watch

Bounce: Entain tops the leaderboard this week after benefitting from the dual benefits of a well-received Q3 trading statement and from returning investor confidence that the tax scare story is just that, a scare.

Analysts at CBRE noted post-Q3 call that CEO Gavin Isaacs’ focus “appears to be on execution rather than any material change in strategy.”

This in itself has “instilled greater confidence that the turnaround is already underway.”

Bark/bite interface: On the tax increase, CBRE echoed the thoughts of others that any UK tax increase will likely be “more modest than speculated.”

Wind beneath our wings: Similarly benefitting from a rare UK tailwind were Evoke and Rank, which also issued statements last week.

The Investec analysts noted that for Evoke this was the first quarter of positive growth – up 3% YoY to £417m – since Q122.

The numbers were a “step in the right direction,” the team added, while also noting the fear factor for the tax increases.

The Hong Kong-listed subsidiaries of the major Macau operators were the biggest fallers for the week, hurt by once again faltering confidence. A note from Bank of America this week made the point that the “Macau fundamentals never really reflected the underlying macro softness.”

By the numbers

Spending addiction: It is abundantly clear there has been no let up in the competitive atmosphere surrounding US OSB at the start of the new football season, and proof of this comes from the figures for promo spend in Michigan and Pennsylvania.

As a percentage of GGR, promo spend in Michigan stood at 53% vs. 57% this time last year while in Pennsylvania the percentage stood at 47% vs. 48% in Sep23.

Ahead of getting a sight of the September data, the analysts at Bank of America noted the data from Kansas for September showed promo spend as a percentage of handle only down marginally vs. the market launch period this time last year.

BoA said this “elevated level of promo is consistent with guidance for continued customer acquisition spend.”

👀Moreover, they noted FanDuel recently increased its generosity, now offering $300 of bets for every new $5 deposit vs. $200 previously.

Just trying to keep my customers satisfied: Promo spend in September

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Increase your GGR in just one month. Join top operators at www.opticodds.com.

Earnings calendar

Oct 23; Churchill Downs (e), Las Vegas Sands

Oct 24: Betsson, Evolution, Boyd, Churchill Downs (call), GLP

Oct 25: Kindred

Oct 29: Caesars Entertainment

Oct 30: MGM Resorts

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.