BetMGM is not winning market share despite improved metrics.

In +More: Evoke continues to drop post-earnings.

Underdog funding round values business at $1.23bn.

Quick takes: Evoke investors get the fear over Q1 and debt.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

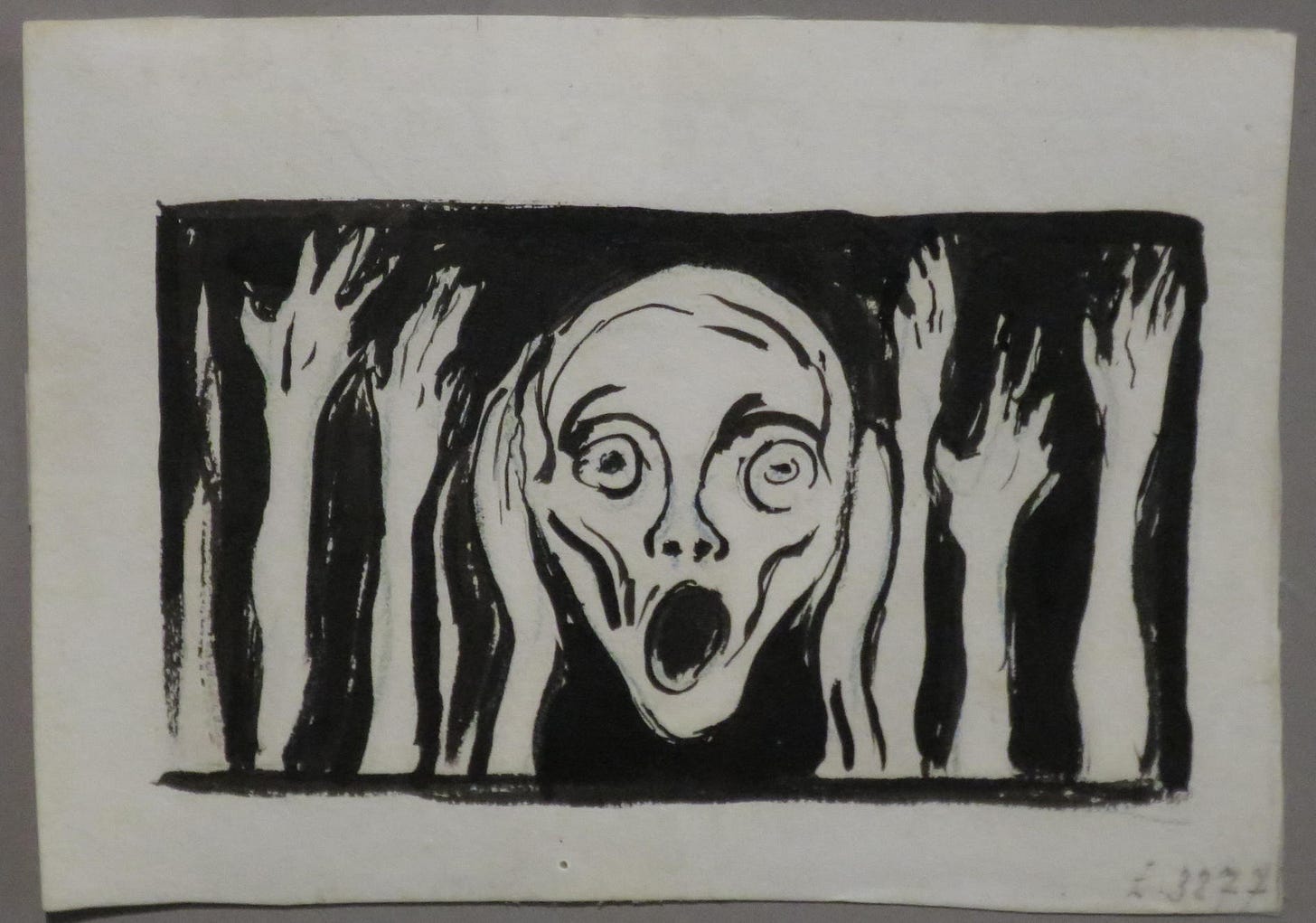

Angst-rom

Whispers in the powder room: Rumors that the integration of Angstrom’s odds-provision offering into the BetMGM consumer-facing proposition has not been a success have been batted back by owner Entain.

Grit in the system: Multiple industry sources have suggested a recent point of friction between the JV owners of BetMGM has been the difference between what was promised by the ‘Angstromizing’ of the OSB proposition and the reality of what has been delivered.

However, a spokesperson for Entain told E+M that BetMGM had made “meaningful progress” last year and is “stabilising” its market share.

They added that “numerous upgrades” had been made to the product offering including “critical” work on the parlay offering.

“Angstrom is one of several factors driving BetMGM’s pathway to profitability,” they added.

Stress fracture: The spokesperson was keen to stress a selection of performance stats highlighted in BetMGM’s FY24 update in February and from Entain’s own 2024 annual report.

These include the 41% improvement in SGP bets per average user in MLB last summer and the 2.2 percentage points increase in the NFL SGP bet mix.

Meanwhile, during the NFL season just gone, BetMGM offered nearly 1,000 futures markets and 450+ unique ways for customers to wager on each football game.

“These improvements are coupled with the many other improvements to our offer, such as betslip, navigation, UX, stability, speed,” the spokesperson added.

What we’ve got here is a dead shark: Yet, despite these headline improvements, the recent state-by-state data would suggest BetMGM is only maintaining its OSB market share percentage rather than taking share from elsewhere.

As per last Friday’s E+M edition, according to data from HoldCrunch, in the QTD BetMGM’s handle share is around 8%, marginally down on the Q4 figures.

Data collected by the analysts at Citizens, meanwhile, suggested that in January and February BetMGM’s share of GGR fell back to 6.4% from 7.1% in Q4.

Pin the tail on the donkey: Industry sources questioned the extent to which both MGM Resorts and Entain publicly pinned their hopes on Angstrom to drive an increase in BetMGM’s market share.

“The others aren’t stopping innovating,” said one well-placed adviser. “Having Angstrom would only ever have closed some of the gap.”

I did it Your Way: Notably, in recent weeks, FanDuel has promoted its early success with its Your Way multiple offering and announced just last week a new March Madness multi-game single parlay offering and new Bet Back Token.

A note from Citizens last week said DraftKings had noted the developments and that a “similar offering” to the Your Way product was to be expected later this year.

Poacher turned gamekeeper: Entain bought Angstrom in July 2023 for an initial £81m, with a £122m earnout payable over the next three years. It was founded in 2018 and at one point in its lifecycle switched from proprietary trading to being a services provider.

Sold as seen: The Entain spokesperson confirmed the company had not previously worked with Angstrom when it was bought.

Panic buy: One industry source suggested that when Entain bought Angstrom it was in “panic mode.”

“They looked at a number of odds and pricing suppliers, they had made their mind up to buy one, so they did a taste test,” the source added.

Nothing to see here: Asked about rumored tensions between the JV partners over the provision of sportsbook services, the Entain spokesperson said there was “constant contact about the app or product performance and ongoing enhancements.”

“All parties are delighted with the progress being made,” they added.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

+More

I said stop that: New Jersey has sent cease-and-desist letters to both Kalshi and Robinhood over their prediction market offerings. But Kalshi confirmed to E+M it will be ignoring it. “Kalshi believes in the value of regulation and operates under the comprehensive oversight of the Commodity Futures Trading Commission,” a spokesperson said in a statement. See Compliance+More next Tuesday.

Here we go round the mulberry bush: Meanwhile, Sports Illustrated has teamed up with UK-based media company Galactic to launch a sports-based prediction market offering called SI Predict. In a press release, the pair said the aim was to “foster conversation, debate and engagement… without the complexities of gambling.” Galactic CEO Stuart Stott said SI Predict would be a “non-custodial platform” and hence would not be regulated.

Revulsion: The Evoke share price continued to suffer yesterday, down 11% on the day. On top of the 17% decline from the day of its earnings on Thursday, it leaves the shares down 25% for the week so far and suggests investors are deserting the stock, even as the company talks up its stabilizing performance. For more on Evoke, see ‘Quick takes’ below.

VICI Properties has announced a $1.3bn offering of senior unsecured notes, which will be used to repay two separate tranches – $500m and $600m – of existing debt due this year. The new debt will have maturity dates of 2028 and 2035. The remainder of the new debt after the repayments will be used for general corporate purposes and potentially acquisition.

Endangered species: Rhino Bet, a brand owned by Playbook Gaming, which is itself owned by Star Racing, informed its customers earlier this week it has ceased operations in the UK. The company cited increased competition for the move.

Comes around quickly: Caesars Entertainment has confirmed its Q1 call will take place on April 29 while MGM Resorts announced its own earnings call on the day after, April 30.

Read across

Bonus abuse: The latest move on the part of the UK Gambling Commission has marketing practices in its sights. From 19 December, operators must not include more than one gambling product in a single incentive. Meanwhile, bonus playthroughs will also be limited, with punters not able to wager more than 10 times before bonus winnings become withdrawable. In Compliance+More.

Event planning

G2E has extended its deadline for its call for speakers and panel subject submissions by a week. Anyone interested in putting forward innovative ideas can submit them here.

+More careers

The big move: Sun International has unveiled former William Hill chief exec Ulrik Bengtsson as its new CEO, replacing Anthony Leeming, who is to retire at the end of the year after 25 years at the company. Bengtsson had announced last week he was leaving Raketech, where he was chair, for an unspecified international role.

Rush Street Interactive has moved to increase the number of board directors from nine to 11 with the election of Jack Markell, former Delaware governor, and Andrew Bluhm, the founder and managing principal of Delaware Street Capital. Sue van der Merwe will be retiring as CEO of the Lottery Corporation at the end of this year. The board will immediately begin searching for her replacement. Svenska Spel has appointed Eva-Lotta Sjöstedt as chair, replacing Erik Strand.

FairPlay Sports Media has appointed Andrew Smith as CFO and Jerome Underhill as COO. Smith previously worked as the CFO for Playtech and Underhill served as international general manager for Xandr. Fincore has appointed Dave Watkins as CCO.

Chief Technology Officer – San José, Costa Rica

Head of Talent Acquisition – Remote

Product Director – San José, Costa Rica

Hot ’dog

Take the over: Underdog has announced it has closed $70m of an expected $100m Series C funding round via a deal with Silicon Valley VC Spark Capital at a valuation of $1.23bn, representing a tripling of the valuation at the time of the Series B round in 2022.

Jeremy Levine, CEO and founder at Underdog, said Spark’s money would be a “real accelerator” with the cash being deployed “as fast as we can.”

“There is so much more to build and we’re going to keep building,” he added.

Bright spark: Will Reed, general partner at Spark Capital, said the company was attracted to Underdog because of its “unwavering focus on product and customer experience.”

The press release noted Underdog has 4 million customers to date and is currently the fourth most downloaded sports-betting and DFS app.

This is the one: Analysts at Citizens had said in early February there were “rumors of a blockbuster deal” within the sector and E+M has confirmed this is the deal referenced.

Edge funder

Close to the Edge: Meanwhile, gambling industry fintech Edge Markets (a sponsor of the E+M newsletter) has announced it completed a $17.9m seed funding round in December, led by Bullpen Capital with contributions from Step Stone Group, Suro Capital and others.

The new money comes on top of $32m previously raised.

Signal Boost: The news of the funding round came with the full release of the company’s Edge Boost gambling-only debit card, which while segregating a consumer’s gambling spend also allows them to set betting limits and employ ‘cool down’ periods.

Bullpen founder Paul Martino said the company has had a “front-row seat” in RG matters via its previous investment in FanDuel.

“We view Edge as the next step in that equation by giving bettors a dedicated account for their gaming transactions,” he added.

The earnings edit

Playtech

Picking up my boots: Playtech is returning to its roots following the sale of the B2C Snai business to Flutter, said CEO Mor Weizer. Set to complete in the current quarter, the deal will see a monster special dividend of €1.7bn-€1.8bn shared between shareholders.

Metamorphosis redux: Weizer said the company’s transformation back to being a pure-play B2B business was “well underway,” with revenues from continuing operations up 10% to €848m. Adj. EBITDA rose 22% to $215m.

The Americas was the biggest growth region, up 19% to €252m, while within that North America experienced a 126% uplift to €29.8m.

Going in Hard: The company’s partnership with Hard Rock is paying off, with iCasino and live casino in New Jersey. Playtech said the fair value of its equity slice nearly doubled over the period to €141m.

Playtech recently settled its dispute with Caliente over Caliplay and now controls a 31% stake in the business, while in Brazil it has a 40% ownership of Galera Bet.

An Earnings Extra for Playtech was sent to E+M Pro subscribers yesterday.

Protect your players and grow your tribal gaming business with GeoComply.

Go beyond simple compliance, delivering seamless player experiences and ironclad security. Discover how you can enjoy the rewards while GeoComply’s cashless and Class II solutions can minimize the risks they can bring to your casinos.

Book a meeting at the Indian Gaming Tradeshow & Convention (Booth #2541) and discover how you can bring in more customers, fight fraud, and protect your revenue.

Quick takes – Evoke

One direction: Writing ahead of yesterday’s continued share price falls, the analysts at Deutsche Bank suggested that while the direction of Evoke’s share price on Thursday was justified the “magnitude was an overreaction.”

Investors would likely have found the current trading update causing some wrinkled foreheads after the company admitted the performance was softer than expected.

The DB team noted this was likely down to a “flat at best" performance in the UK.

Investors have to take it on trust that management will be able to accelerate growth enough to meet FY25 consensus guidance.

Getting the retaliation in first: Perhaps equally, or maybe more, concerning is the “higher for longer” guidance on the company’s still somewhat eye-watering leverage ratio and which DB said was a “key investor pushback.”

The company pushed out the target date for getting leverage down to 3.5x from the current 5.7x by one year to 2027.

But DB said this was effectively in line with consensus forecasts, which had suggested it wouldn’t have hit the target date anyway.

Connections

The big deal: Genius Sports has signed partnerships with two esports providers, Bayes Esports and Grid Esports. In the case of the latter, Genius will integrate its streaming and data visualizations and live data from esports leagues, including League of Legends, Valorant and Rainbow Six. From Bayes, meanwhile, Genius will receive official live data for Counter-Strike 2 and Dota 2.

Stats Perform has become the official data partner of the Confederation of North, Central America and Caribbean Association Football or CONCACAF under a multi-year agreement.

DoubleU Games has completed its $29.9m acquisition of 60% of Turkey-based game developer Paxie Games. It is set to acquire the remaining 40% via a three-year earnout.

Are payments getting in the way of your progress? A poor payments experience can lead to many operational problems, including higher fraud, increased player churn, low conversion rates and more.

PayNearMe is a payments experience management platform that enables you to streamline deposits and withdrawals, increase acceptance rates and radically drive down your total cost of acceptance—all with a single, modern platform.

Take the first step toward progress: www.paynearme.com

Upcoming earnings

Apr 1: Sportradar CMD

Apr 23: Churchill Downs (earnings)

Apr 24: Churchill Downs (call)

Apr 29: Caesars Entertainment

Apr 30: MGM Resorts, Evolution

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.