Finders keepers: FanDuel tops for retention in Pennsylvania

Player research in PA, Flutter’s fund flows, F2P data from Brazil +More

Betting Hero customer research shows how FanDuel’s position at the top in Pennsylvania looks secure as it beats the competition in terms of most recognized brand, most popular app and the highest levels of customer retention.

Meanwhile, research on the potential fund flows once Flutter achieves a primary listing in the US shows what it gains in terms of institutional investor interest.

Lastly, F2P data from provider Inside the Pocket gives a flavor of the Brazilian market ahead of regulation.

Pennsylvania research

FanDuel comes out on top in customer research in Pennsylvania.

Fan favorite: FanDuel’s lock on the number one spot in sports betting, in Pennsylvania at least, looks secure, according to research from Betting Hero, which shows it is the most recognized brand, the most popular and the app with the highest levels of customer retention.

An engaged audience: Involving interviews with 121 highly engaged respondents in the state of Pennsylvania between the ages of 18 and 55, the team found 71% bet at least once a week, on average actively using 1.8 apps.

When asked which apps come to mind when thinking of online sportsbooks, FanDuel was the clear winner, prompting an overall response rate of 82% with 56% of respondents naming it first.

The findings suggested clear blue water between FanDuel and nearest rival DraftKings, which, although it received 79% overall mentions, for first mentions it stood at 31%.

Meanwhile, there is quite some distance to the rest of the chasing pack, with BetMGM on 31% total recognition and only 5% first mentions, while Penn’s app at the time (pre-ESPN Bet) was on 28% and 3% respectively.

BetFanatics, bet365, and ESPN Bet were not live in Pennsylvania at the time of conducting this study.

Popularity contest: FanDuel comes out on top in terms of OSB choices

The findings match up with the state’s NGR data; for the 11 months to November, FanDuel achieved 48% market share, while DraftKings was at 25% and BetMGM and Penn

The data matches with Betting Hero's findings on favorite app where FanDuel leads on 55%, with DraftKings on 27%, Penn on 7% and BetMGM on 5%.

Showing favoritism: Betting Hero data tracks state NGR data

Soft2Bet is delighted to announce the launch of its redesigned gaming portal CampoBet in Sweden.

The revamped CampoBet app offers a native, user-friendly experience with a host of enhanced features and a sleek design that promises to elevate the online betting experience for Swedish players. With an expanded reach, official reviews from the App Store and Google Play and top-level design, players will enjoy a faster and best in class performance tailored to their devices

https://www.soft2bet.com/news/soft2bet-brand-campobet-announced-a-redesigned-mobile-app

Sticky notes

First mover: The extent to which FanDuel has managed to keep hold of its audience is key to its market leadership position, with 79% of respondents that have the FanDuel app saying they still actively use it. This compares with 67% for DraftKings.

The data about usage is also enlightening, with the question of apps downloaded versus apps used showing 45% use only one app and a further 38% only have two active apps.

While 31% may have downloaded five+ apps, the responses show that only a minority of 2% actively use five or more.

App-solutely: the more you download the less you use

That was then: The big question is how Penn’s ESPN Bet will fare when it comes to the consumer reaction. The Betting Hero research was undertaken pre-launch but it did ask the respondents how the partnership would affect their betting.

For Penn, some encouragement comes from the finding that 21% of respondents were more likely to bet with ESPN Bet vs. Penn’s previous Barstool offering, while only 4% said they were less likely to do so.

39% of respondents said the move would have no immediate influence on their betting patterns, while a further 36% were unaware of the partnership at the time of the study, presenting an obvious opportunity for the brand moving forward.

Brand unawareness: ever heard of ESPN?

Notably, FanDuel achieves similar levels of app recognition in other states, with Betting Hero noting the research shows it hitting between 74% and 87% across six key markets.

It’s popularity also extends to iCasino, albeit to a lesser degree, with 60% in total giving it a mention and 44% giving it first mention, while the metrics for DraftKings are 50% to 23%.

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

Flutter fund flows

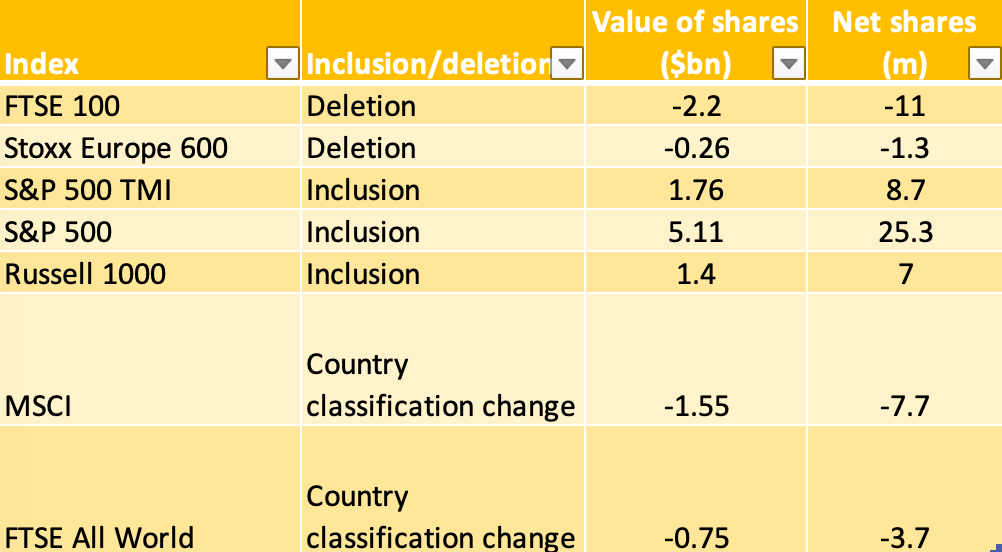

You win some, you lose some: With Flutter seemingly on the path to making New York its primary listing, Jefferies has done some calculations of what a move might mean in terms of institutional fund flows.

The figures for fund flows are obviously only estimates and they come with various caveats regarding when and whether the primary listing will have an effect.

For instance, a current consultation on the part of the London Stock Exchange could yet pave the way for ineligible UK-listed shares to rejoin the FTSE UK Index Series.

Meanwhile, inclusion in the S&P 500 is not a given either with inclusion at the discretion of the Index Committee.

Still, as can be seen, net-net Flutter could expect a large inflow of share buying as institutions buy into the stock on its inclusion in the S&P 500. While losing FTSE status would see an outflow of $2.2bn, it would be balanced by inflows of $5.1bn should it gain S&P 500 status.

This would be on top of the estimated $1.76bn that would come from initial market inclusion (TMI).

Flutter would also see an estimated benefit of $1.4bn should it gain Russell 1000 inclusion.

🇬🇧➡️🇺🇲 Flutter’s likely fund flows post-primary listing change

Brazilian F2P pointers

Filling in the gaps: Data is unsurprisingly somewhat scarce on the nature of the Brazilian market ahead of the imminent regulation of OSB and iCasino. But adding some color to the market is free-to-play games provider Inside The Pocket, which has been running campaigns on behalf of clients in-country for some time now.

ITP founder and CEO Hussain Naqi noted F2P game mechanics work effectively at attracting players, resulting in a very low cost of registration.

“The strong return-to-play numbers delivered an engaged audience and provided operators with brand recognition, effectively establishing an owned-and-operated ‘affiliate’ program,” he said.

From working with a handful of operators and a leading affiliate, ITP has found the market is young, with 80% of registered users aged between 24 and 44 years old. The company also found that 60% of users played multiple games.

The conversion rates are just shy of 14%, while the cost per registration is €2.25.

The full range: “Diversity in game types is well received,” said Naqi. “Fans have shown a strong preference for various game formats, including our perfect score predictor, fantasy provision through our partner BOA Gaming, and our 1x2 game.

Games, leaderboards, points and prizing fostered significant engagement. “Aggregation played a crucial role, allowing us to leverage third-party content that resonates with our audience,” he added.

The last World Cup was, unsurprisingly, a big draw. “Big tournaments drive substantial registration numbers,” said Naqi.

“We saw significant engagement throughout the tournament and we anticipate a similar global interest in the Euros.”

Naqi concluded by pointing out platform data plays a crucial role in driving insights. “Adopting a platform approach allows for comprehensive data analysis, unveiling valuable insights spanning game providers, player activity and geography/demographic categories,” he said.

“This approach enables a holistic understanding of user behavior, preferences and trends, empowering informed decision-making and strategic planning.”

Calendar

Jan 30: PointsBet

Feb 1: Evolution, Rank

Feb 7: Kindred, Disney

Feb 8: Boyd Gaming

Feb 13: MGM Resorts International

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.