Feb 28: #StandWithUkraine

Ukrainian update, New York week 7, Bally downgrade, Startup focus: Xpoint Tech, Week ahead, data/newslines +More

Good morning. It is sometimes easier to watch events taking place in the world and either want to switch off, feel completely powerless or simply wish it away. As Feda Mecan said in a LinkedIn post this past week: “I can't just watch what's happening in the Ukraine and no one should just watch.”

In this spirit, we are doing our bit. Mecan said that anyone seeking help with visas or legal advice should contact him via his LinkedIn profile and that he will “take it from there”. WE+M has been in touch with him and he is willing for any approach to go through his LinkedIn profile.

Meanwhile, Wunderflats is helping people fleeing the warzone with temporary accommodation.

Also on LinkedIn, Kyiv-based operator Parimatch has a posting where it says “we stay in Ukraine, we work here and we want to be here”.

For those looking at donating money, the Kyiv Independent is probably the first port of call.

Assessing the situation: There are, of course, many business implications from the worsening situation over the weekend. One of the first analysts to look into what the war in Ukraine might mean for the gaming sector are Regulus Partners. We can’t locate a link to a web page but those interested can read their views via the SBC news link.

Giving away margin: Las Vegas bars are pouring Russian vodka down the drain.

Further reading: John Authers says the Ukraine narrative has changed.

Further, further reading: Adam Tooze via his substack on sanctions and MAD.

** Sponsor’s message** Spotlight Sports Group, a world-leading technology, content and media company has announced a significant new partnership with U.S. media giant Advance Local. The agreement sees Spotlight Sports Group deliver customised integrated affiliation tools, free-to-play games and national and localised sports betting content for a select number of Advance Local’s network of digital media and websites. Read more on the story here.

To find out more on how Spotlight Sports Group can fully managed, modular solutions for global media at spotlightsportsgroup.com.

New York wk.7

Super Bowl hangover: Online sports betting handle dropped 25% for the week ending Feb20 to $353m but GGR was up ~$10m to $25.4m. Margins were 7.2% vs. 3.3% during Super Bowl week.

New York market share

New York regulatory update: NY Senator Joseph Addabbo has introduced a bill to regulate online casino in the state. With the tax rate set at 25%, the bill claims a regulated online casino sector could generate c$475m in annual tax revenues and $150m in licensing fees for the state. The current OSB regulation could also be expanded, a proposal for fixed-odds horse racing wagering to be included on mobile apps and within sporting venues has advanced to the senate finance committee.

Bally rating downgrade

Impatient: The Jefferies team have downgraded their rating on Bally to Hold from Buy, driven, they say, by “the change in the market’s patience” for digital profitability allied to Bally’s “anticipated protracted investment cycle” for its land-based business.

Their pessimism is tempered, however, by the “long-term optionality” and the “tethering” of the share price by the current bid from major shareholder Standard General.

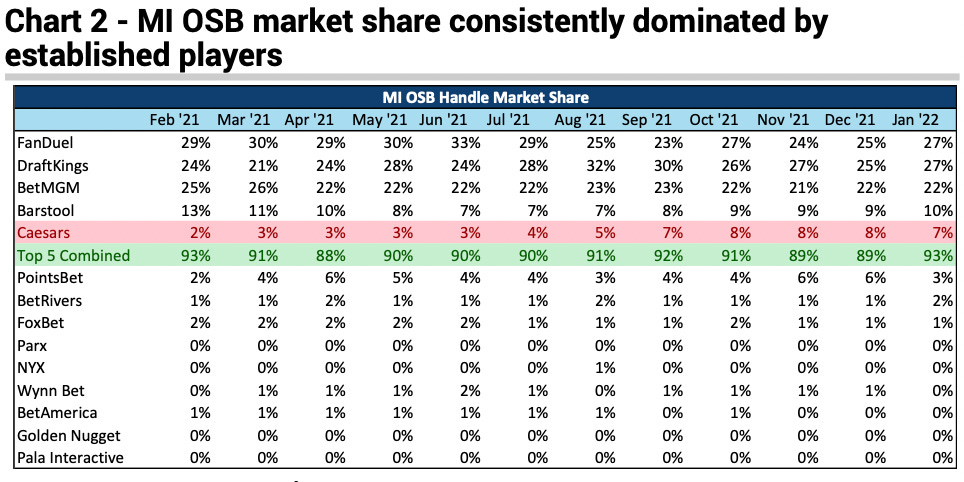

First-mover matters: The Jefferies team add that an “important observation” from developments in the digital space is that first-mover advantage is “critical”. They point to the Michigan market share where 90% is concentrated among the top five players.

The Caesars example is instructive, Jefferies suggest. In New York and Arizona, where it has been present from the off, its market shares in each as in the mid-20% and mid-teen% respectively whereas in Michigan, where it was late to market, it has struggled to get to double-figures.

Flutter analyst update

Derisked: Ahead of results tomorrow, the team at Peel Hunt suggest the fall in the share price over the past year (~40% down) is a buying opportunity. Pointing to its market leadership in the US and recent acquisitions (Sisal and Tombola), the analyst noted the company is “increasing its exposure to lower-risk, lower-staking players”. “Regulatory uncertainty remains in the UK, but clarity in the shape of the White Paper is expected shortly,” they added.

Forecast earnings: For FY22 Peel Hunt suggests EBITDA ex-US and before taking into account the acquisitions of £1.35bn.

Earnings in brief

Revenues for the Australian OSB operator BlueBet were up to AU$28.6m (vs. AU$17m YoY) in H1, but EBITDA losses rose 106.4% -AU$300K. The group has secured market access in Colorado and will seek to enter other states in the coming months. CEO Bill Richmond said the group was also developing its betting solutions platform with a view to providing it to the industry on a SaaS basis. Genting Malaysia returned to profit in Q4 with +$29.5m vs. losses of $51m last year. The group said US growth benefited from a strong demand at Resorts World New York City and had returned to pre-COVID levels. SJM saw NGR rose 31.5% to HK$9.6bn while adj. EBITDA losses improved to HK$1.58bn, 24% better than in the prior-year period.

Regulatory update

The Puerto Rico Gaming Commission has awarded three new casino licenses to hotels in the island, all three are expected to eventually offer online sports-betting.

The week ahead

Flutter Entertainment reports on Q4 results Tuesday. For FanDuel’s parent company further comment on New York and Ontario prospects are likely, while in Europe its integration with Italian betting giant Sisal will focus attention. Melco Resorts also publishes its Q4s on Tuesday day and Rush Street Interactive follows on Wednesday and Entain on Thursday.

Show me the money: DraftKings holds an investor day on Thursday and analysts at Jefferies said the “singular focal point should be on the cadence and trajectory to profits and the capital resources to fund the business along the way”.

It’s a big week for… gaming equipment manufacturers: Jefferies note that IGT, Scientific Games and Everi report this week. For IGT, the Jefferies team say they will be on the lookout for commentary surrounding efforts to potentially spin out its digital business and the outlook for the gaming segment as operators ramp up capex. For SciGames, the analysts will be looking for insight on the outlook on digital growth and land-based gaming for 2022 and also the capital allocation following the lottery and sports-betting divestitures.

The shares week

Bouncebackability: The digital betting and gaming sector enjoyed a decent week, according to Jefferies, with their index of leading names seeing a 4.7% gaing on the week. They were led by Sportradar which was up 10.3% and Rush Street Interactive which bounced back from recent lows with a 9% week-on week improvement.

Startup focus: Xpoint Tech

Who, what, where and when: Founded by CEO Marvin Sanderson in 2019, XPoint offers geolocation and compliance technology to online sports-betting and casino operators in the US. The company is based in Dubai and has offices in Miami and Toronto. Sanderson is a former professional soccer player whose multi-sector experience has included leadership roles in tech, sales, operations and finance in North America, Australia and the UK.

Funding backgrounder: Xpoint’s most recent funding round saw sports and betting-focused venture capital fund Courtside Ventures invest, the group did not disclose amounts. Other investors include David VanEgmond’s Bettor Capital.

So what's new? Xpoint has signed partnerships with New Jersey-licensed betting exchange SportTrade and challenger casino brand Playstar Gaming and is set to announce “a partnership with a well-known DFS platform, the first time Xpoint will be live in-market”, the group says.

The longer pitch:

Sanderson: “Xpoint is ramping up quickly to transform the US geolocation industry, move it away from box-checking and make it a core business function by turning a utility into an asset to enable operators to better engage with, and create value for and from, their consumers.”

The US is where all the focus is because “that’s where the real growth is” and “where the state-by-state landscape needs companies like us who are dynamic and bring innovation” to the market. With regard to exits, Xpoint is “zeroed in on our immediate priorities” currently, but “when the time is right” or if a group “decides they want to add us to their mix” this might change, Sanderson says.

Datalines

Nevada Jan22: The Silver State recorded ~$1.07bn in gaming revenue, a 41.5% rise vs. Jan21. Strip GGR rose 76.4% YoY and +6.6% vs. Jan19 to $567.2m. Sports-betting handle was up 71.8% to $1.1bn, GGR was $50m, 71% mobile and 29% retail), implying gross win of 4.5% according to Wells Fargo. Mobile GGR was $15.2m (1.9% hold), retail was $34.8m (10.7% hold). Visitation levels were up 91% YoY to 2.4 million in January although that was still -27.5% vs. Jan19.

Newslines

Positivity: Ahead of its earnings tomorrow, Flutter Entertainment has announced the launch of its inaugural sustainability strategy. Its Positive Impact Plan has identified three key areas of focus including, by 2030 aiming to have 75% of our active online customers globally using one or more of our Play Well tools.

Postponement: Scout Gaming has postponed its Q421 earnings announcement until March 11.

Island life: IGT has signed a 20-year extension to its contract with the Rhode lsland Lottery. The group will upgrade its draw-based and online systems in the next 18 months and again in 2033-34.

Chair replacement: As announced in January, former Ladbrokes CEO Chris Bell has stepped down as non-executive chair of XLMedia. Julie Markey, currently a non-executive director with the company, has been appointed as interim chair while the group looks for a replacement.

What we’re reading

The Brazilian gaming bill faces a perilous pathway through the Senate.

On social

Calendar

Mar 1: Flutter FY, IGT, Playtika Q4, Scientific Games Q1

Mar 2: Rush Street Interactive Q4

Mar 3: Entain Q4, DraftKings investor day

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com