Good morning. In this month’s edition of Due Diligence we take a look at developments in the fantasy sports space. A market once synonymous with FanDuel and DraftKings has some new names at the head of the market.

Plus, a review of the latest analyst takes.

Facts and fantasy

The daily fantasy sports industry was once synonymous with and dominated by DraftKings and FanDuel. But as their attention has shifted to online sports betting and casinos, they may no longer lead the segment.

The industry has evolved and continued to push the envelope on what can legally be called DFS. The newest iteration is the rise of pick’em fantasy apps where users play against the house instead of against other users.

Pick’em contests are the equivalent of player proposition parlays that sportsbooks offer.

The only real difference between a parlay bet and a pick’em entry is their basis for legality, using a combination of federal and state laws that address fantasy sports and games of skill.

They rely heavily on the fantasy carveout in the federal Unlawful Internet Gambling Enforcement Act.

Incumbents FanDuel and DraftKings do not offer these games and have suggested publicly that they run afoul of some laws.

The industry generally serves users 18 and over, whereas sports betting is 21 and over in most of the US.

How does pick’em fantasy work? Any two athletes from two different teams can be used to create a pick’em entry. Here’s an example of how it would function for an entry based on the NFL:

Placing a $20 entry on Patrick Mahomes to throw more than 1.5 touchdowns and Russell Wilson to throw over 0.5 interceptions could result in winning $60.

The industry started by offering these props based on fantasy points, but then pivoted to any two statistics.

The pick’em industry is led by a trio of top-tier operators:

PrizePicks

Underdog Fantasy

Sleeper

There are upwards of 20 operators in the space, including but not limited to:

Betr, Boom Fantasy, Drafters, Jock MKT, Owners Box, ParlayPlay, StatHero, SuperDraft, Thrive Fantasy, Units, Vivid Picks

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Pick’ems and shovels

Some of these companies offer fantasy products other than pick’em contests, but the vast majority of the revenue generated by the niche comes from those games.

Interestingly, one of the first movers in the space was Monkey Knife Fight. It was purchased by Bally’s Corporation in 2021 but shuttered this year.

Another operator, No House Advantage, went dark unexpectedly and had trouble paying player balances. Those balances were taken over by Betr.

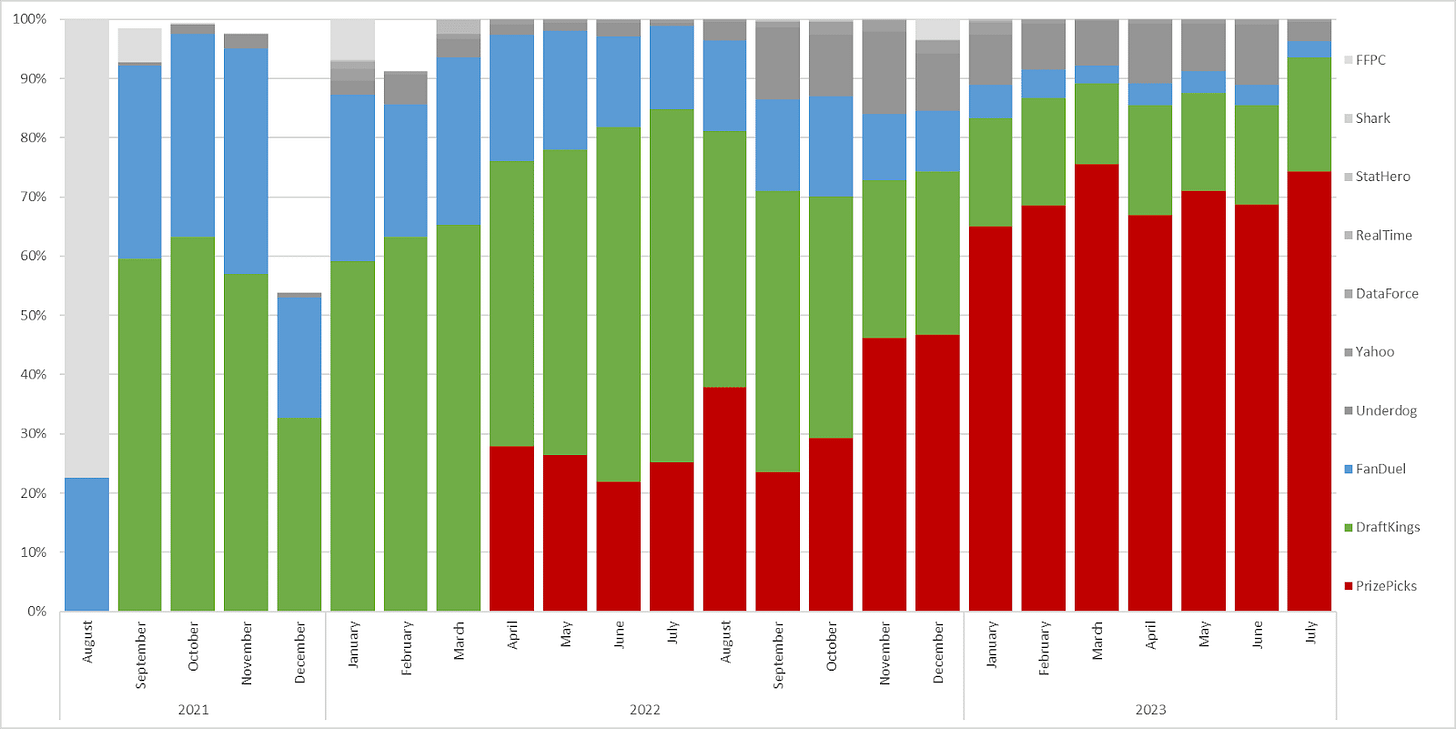

The top daily fantasy sports operator in the country now appears to be PrizePicks. There is precious little official data about how much money is moving through and generated by the DFS industry.

But Vixio collated this data from earlier this year that starts to draw a picture.

Note that there is no pick’em fantasy in Pennsylvania and Underdog didn’t serve Michigan in this time period.

Eyes on the prize

Take your picks: A closer look at Massachusetts and Arizona is more illustrative of recent trends in the market and points to what is likely a PrizePicks lead across the country. Here is gross revenue in Arizona for the DFS segment.

It shows the rise of PrizePicks, DraftKings now in second place and FanDuel and Underdog fighting for third place:

Source: Legal Sports Report’s Eric Ramsey

It’s notable that Arizona also has legal sports betting.

The Massachusetts data is a bit skewed, as that’s DraftKings’ home state. But it again shows PrizePicks fighting for first and Underdog sometimes in the third position:

** SPONSOR’S MESSAGE ** During the Panthers vs Seahawks game that lasted 3 hours and 6 minutes, Huddle had, altogether, 27 minutes and 58 seconds of suspensions, while the market, on average, had 1 hour and 10 minutes of suspension time.

Maintaining top-tier uptime not only enhances the user experience for our clients but also directly contributes to increased customer satisfaction, higher revenue generation, and reducing churn.

Explore more: https://huddle.tech/by-the-numbers-huddles-uptime-performance/

More color on the market

Gimme : The pick’em niche generates more revenue per user and entry. The parlay product holds more money than a traditional DFS contest offered by DraftKings and FanDuel.

App downloads don’t equate to revenue or even market share, but data over the start of the American football season shows PrizePicks, Underdog and Sleeper with the most downloads in the DFS sector. It is likely the market is led by these three operators with Sleeper in the mix for second based on recent trends and user adoption.

Betr, which is well capitalized and recently launched its DFS product, might already lead the second tier of operators.

Stand in the place that you live: Depending on the operator, the pick’em industry serves upwards of 30 states (this would include PrizePicks), most of them without legal sports betting options and no DFS laws. DraftKings and FanDuel and other more traditional DFS apps serve upwards of 40.

Here is where PrizePicks offers fantasy pick’em, for instance, per their website:

This map is now contested after recent events, however:

Regulators in New York, Michigan and Wyoming have recently said that pick’em games should not be offered in their states.

Florida’s regulator sent cease-and-desist letters to PrizePicks, Underdog and Betr, saying their games are sports betting offerings under state law.

The future of the market centers around a few questions:

What does the DFS customer want? It seems clear a mix of product, focus, marketing spend and aggression has paid off for PrizePicks, resulting in a lead that is sustainable. While Underdog offers a variety of fantasy games, the singular focus on pick’em games works for PrizePicks; many have followed that path.

What is clear is users are picking these games over traditional DFS.

Will someone push the envelope even further? DFS has evolved to the point where it’s indistinguishable from sports betting, other than its legal basis. Will someone try to iterate it again?

For example, it looks like a DFS game with slot machine mechanics will make its real-money debut soon.

What will happen in Florida, California and Texas? The legal status in the three largest states in the country is what makes or breaks the industry. There is no DFS law in any of them; no one has actually pulled out of Florida after the letters sent to operators.

The industry is likely not viable without the populations of California and Texas, but it’s also not clear if there will ever be regulatory/legal pushback in either state.

Affirming legislation or regulation in any of these states, and in the rest of the country, seems unlikely, making holding ground on the current market crucial.

What do DraftKings and FanDuel do? It’s clear the two sports betting giants do not like ceding the market to the upstarts. In the status quo, California and Texas look like longshots to legalize sports betting.

Absent further regulatory action, would one or both eventually enter the pick’em segment? The presence of either company in this niche would also bring a higher level of scrutiny of the industry than exists even now.

Analyst takes

Caesars iCasino: Looking into its online operations, DB reported the feedback on the standalone Caesars Palace iCasino app has been “strong”, even though the company is yet to embark on a full marketing program. They added that they expected Caesars to deploy additional skins in certain iCasino states for further brand rollouts.

Penn Entertainment: Wells Fargo met with Penn and ESPN’s top teams at G2E for the launch of ESPN Bet next month. The team noted the confidence of Penn in what they expect to be a “deep integration”.

“When ESPN chose an OSB partner, it was adamant the product carry the ESPN brand, which it believes will enable more seamless integration between its betting and media product,” the team added.

“Penn/ESPN believe the product will stand out due to the deep media integration, as no other US OSB products have effectively combined sports content and betting.”

VICI: Q3 earnings are “expected to be quiet”, suggested the team at JMP earlier this month. They noted that despite closing several transactions over the past three months, including the Rocky Gap Casino, four casinos in Western Canada and a financing transaction with Canyon Ranch, deployment was only $506m.

The big news involving VICI was the decision not to participate in the Bellagio stake sale in August.

The team pointed out that VICI’s yield for its Las Vegas portfolio compares favorably to the low 5% yield on the deal that Realty Income will receive on its 27% stake.

DraftKings: The company will benefit from a continued increase in market share that comes from the higher hold rates caused by a higher parlay mix and risk management as well as improved customer loyalty, according to the team at JPM.

Customer acquisition costs are also decreasing due to national scale having been achieved alongside a predicted “precipitous” drop off in sales and market expense.

“These translate to better flow-through and rapid EBITDA margin expansion,” said the analysts.

JPM has upped its DraftKings’ 2024 revenue and adj. EBITDA forecasts by 3% and 5% respectively to $4.36bn and $310m.

** SPONSOR’S MESSAGE ** Calling all sportsbooks! Are you:

Forced to limit customer stakes due to market liability?

Suffering one-sided markets?

Caught out by stale prices?

Turning away large staking players?

Stop falling behind your competitors! Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins. Matchbook pricing is proven to be resistant to market changes. Matchbook B2B, because the best price is for everyone.

Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com

Calendar

Oct 18: Las Vegas Sands

Oct 24: Boyd Gaming

Oct 25: Churchill Downs (e), VICI (e)

Oct 26: Evolution, Churchill Downs (call), VICI (call), Reputation Matters, London, GLP (e)

Oct 27: GLP (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.