Taking advantage of what might be a (very) brief window of IPO opportunity.

Betr’s PointsBet bid goes hostile.

Markets: DraftKings’ status remains unchallenged.

Puts+takes: a deep dive into Light & Wonder’s charity case.

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

A window of opportunity

We gotta get out of this place: The news last week that Cirsa owner Blackstone was looking to offload a limited amount of its shares suggests very much a deal being driven less by company fundamentals and more by the needs of its owners to at least start the process of divesting.

“One of the reasons why the IPO market has to reopen at whatever price is that PE needs a debt-to-equity swap in favour of equity because debt is too expensive now,” said one analyst on condition of anonymity.

Exit through the gift shop: Notably, last week it was announced Apollo had finally exited its investment in Lottomatica, which dated back to the purchase of the company’s forerunner Gamenet in 2019, via the sale of its remaining 21% holding.

It took two years for Apollo to sell down its entire holding, a process that Blackstone will doubtless attempt to mimic with Cirsa.

Talking to Bloomberg this week, Michele Rabà, lead partner for European private equity at Apollo, said it had “left money on the table, which is very important in these deals.”

Fingers in pies: Other European-based PE-owned betting and gaming entities include German-facing B&M and online betting operator Tipico and Belgium-based B&M and online gaming operator Gaming1, both owned by CVC.

In the first instance, ownership dates back to 2016 but it was rolled over in 2021, while with Gaming1 the initial investment was made in late 2021.

More recent PE deals include Apollo’s buyout of the B&M and online gaming units of IGT and Everi, set to complete in Q3, and Brightstar’s deal to buy AGS, which will complete imminently.

Liquidity refreshment: Meanwhile, the privately-owned Superbet has received €1.3bn of debt financing from Blackstone. The founder, and once more CEO, Sacha Dragic is known to have ambitions for the company to float, although it is thought those plans are currently on hold.

One recent rumor is that a deal might be sought with Banijay’s Betclic unit. According to sources, that would see the two merged and seek a separate listing, although a Superbet spokesperson denied knowledge of any such negotiations.

Nailing jelly to a wall: Another high-flying potential float would be Kaizen Gaming, the owner of the European and more latterly Brazilian brand of the moment, Betano. But while admitting it is a “phenomenal company,” the analyst source noted the instincts of the founder George Daskalakis appeared to be to keep it private.

“No doubt every time someone prices up Kaizen, it grows again and the previous price feels too cheap,” the analyst added.

There is also the complexity of lottery operator Allwyn’s 37% stake. “Allwyn could itself revive its IPO plans,” suggested another industry source.

London not calling: What seems certain is that none of those potential listings will be taking place in London. The City is currently in the doldrums, in part due to high-profile defections to the US including, of course, Flutter Entertainment.

But a lack of new issues is adding to the gloom. “There haven’t been any IPOs of note,” said Ivor Jones, analyst at Peel Hunt.

He noted that political uncertainty, Brexit-related issues and net outflows from UK equity funds have all dampened the UK’s listing appeal.

The land of the unicorn: In the US – where unicorns are less rare – Fanatics remains the wild card in the IPO conversation. Despite high-profile IPOs in recent weeks such as that of stablecoin provider Circle and Nvidia-based CoreWeave, Casino Reports noted founder Michael Rubin has talked down the prospects of an IPO any time soon.

Notably, Rubin told CNBC 10 days ago, ahead of this weekend’s Fanatics Fest, that there was “no rush to be a public company.”

I read the news today, oh boy: But time might be against all the above, with a fluid geopolitical situation necessarily impingeing on any plans for liquidity events.

“This window will shut again, it’s just a matter of when,” said the sector analyst.

“The background on raising cash from investors is accommodative right now,” they added. “But it won’t last as inflation isn’t falling, so interest rates will remain high.”

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

PointsBet bidding battle

Going hostile: PointsBet’s board reiterated today, Monday, that only Mixi’s offer is “capable of being accepted” by its shareholders after rival Betr launched a fresh off‑market, all‑share takeover proposal late last week.

The new ‘all-scrip’ offer of 3.81 Betr shares for each PointsBet share implies a valuation of A$1.22 (78¢) if Betr shares were valued at A$0.32.

Get out the vote: The votes for the proposal are at present being tallied ahead of an announcement on Wednesday and PointsBet said that, excluding Betr’s 20% of shares, the “early indications” were 90% of shareholders were in favor of the Mixi offer.

Tit meet tat: To sweeten the deal, Betr is offering a selective $80m share buy‑back or up to $200m if it secures over 90% of PointsBet for shareholders opting out of the scrip. This offer is, however, conditional on shareholder approval.

PointsBet said the buyback was “uncertain” and argued there would be “limited incentive” for Betr shareholders to approve it.

Anything you can do: The all-share offer comes after the PointsBet board accepted the A$1.20 or A$402m offer from Japanese gaming-tech firm Mixi.

Mixi also reportedly has a back-up off‑market takeover bid ready, contingent on shareholders rejecting its offer at this Wednesday’s shareholder vote.

That will be launched within three days of a negative vote.

Board assessment: PointsBet’s board said Betr’s all-scrip value ranges from A$1.04 to A$1.14 per share, which is materially below Mixi’s A$1.20 cash offer.

It previously said due diligence of Betr’s previous offer has flagged overstated cost synergies, integration risks and potential revenue drag.

It reiterated on Monday the “significant customer crossover” between the two player bases.

The Betr offer would also see PointsBet Canada’s player base sold to Hard Rock.

Betr currently owns 19.9% of PointsBet, positioning itself as the largest shareholder. It has said its aim is to consolidate Australian betting under a stronger, unified brand boasting A$1.5bn in turnover with cost synergies of ~A$40m.

Chair Matthew Tripp said Betr was offering “real value” and “execution certainty.”

Further reading: why the small print of the Mixi offer is hard for the PointsBet management team to resist. In the Australian Financial Review.

+More

Penn Entertainment’s theScore operation in Canada is reported to have laid off more than 75 content and sales staff, which Penn told Canadian Gaming Business “reflect[s] the ongoing evolution of our digital business.” Recall, last summer and again in September Penn Interactive laid off staff at its Pittsburgh HQ.

Making tracks: A new prediction market operator called Railbird Exchange has been granted status as a designated contract maker by the Commodity Futures Trading Exchange. The company is a graduate of Y Combinator and was founded by CEO Miles Saffran and COO Edward Tian, who previously worked at Steve Cohen’s hedge fund Point72.

Something in the air: Delta Air Lines is conducting a survey that asks customers if exclusive access to sports-betting opportunities would be a desired service through its Wi-Fi portal on flights, according to travel site View from the Wing.

What we’re reading

The lexicon of love: “People say to me all the time, ‘Hey, there’s a duopoly between FanDuel and DraftKings. You have no chance.’ I fucking love that. Go tell your guy KD has no chance in the basketball game. He’s going to say, ‘fuck you, I’m going to go dominate that game.’ So, for me, people telling us we have no chance in business, that’s love language to me.” Michael Rubin, CEO at Fanatics, interviewed in Boardroom.

Markets

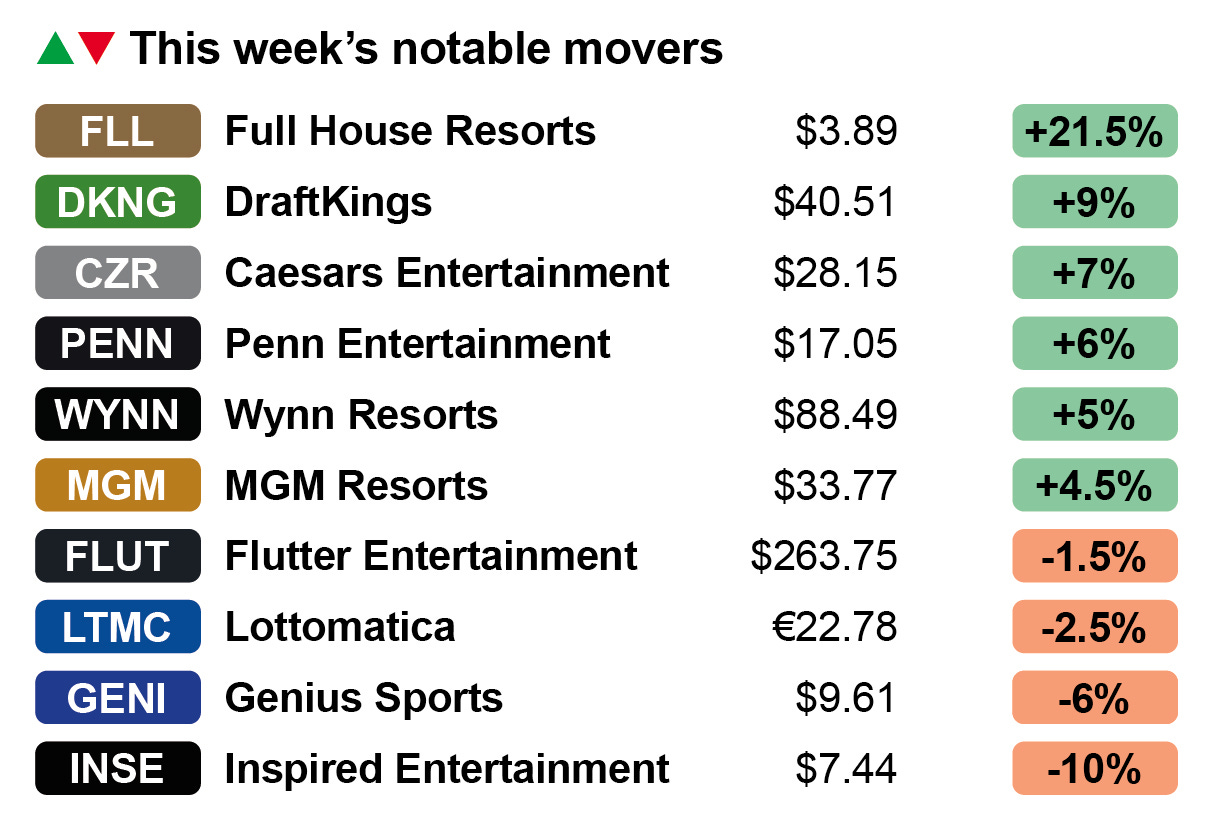

The king of vibes: DraftKings status as the bellwether stock for the online sector remains unchallenged and is exemplified this week by the 9% uplift on essentially no news, other than that it has launched its own Political Action Committee (see tomorrow’s Compliance+More).

In comparison, its nearest analog in terms of digital footprint, Flutter, saw its share price meander to a 1.5% loss on the week.

Buying a house: The winner this week was regional casino operator Full House Resorts, which jumped 22% after it was announced midweek that CEO Dan Lee had bought over $1.27m worth of shares.

On-board entertainment: Penn Entertainment was up 6% on the week after its AGM last Tuesday, which saw activist investor HG Vora successfully get two new board members, Johnny Hartnett and Carlos Ruisanchez, installed.

However, the market is still awaiting news on the tally for a third candidate, Bill Clifford.

What happened in Vegas: Caesars Entertainment enjoyed a good week, up 7%, alongside Wynn Resorts, up 5%, and MGM Resorts, up 4.5%.

A recent note from Truist summed up meetings with operators by suggesting that, while Las Vegas might endure a relatively “choppy” summer, all was set fair for a return to growth in Q4.

Regional commentary was “fairly positive” with potential tailwinds from consumers trading down should the macro situation deteriorate.

Omnigame is reshaping iGaming by offering a full-spectrum service—game studio, platform provider and operator in one. It creates unique, player-focused games with integrated mechanics that engage recreational players. This approach is proven with success on pip.dk.

Ready to partner with the innovators? Explore more at Omnigame.com.

Puts+takes – L&W acquisition

Faith, hope and charity: Light & Wonder’s acquisition of charitable gaming provider Grover Gaming is a “strategic pivot” that strengthens its content and platform ecosystem while offering “promising adjacencies” outside of its core operations, according to Macquarie.

It is a “calculated entry” into a vertical that has historically operated at arm’s length from the commercial and tribal casino sectors.

Grover Gaming specializes in electronic charitable gaming, providing systems and content to thousands of licensed venues across the US, particularly in Ohio, Virginia and North Dakota.

The games support nonprofits, veterans’ organizations and fraternal orders.

Macquarie described it as a “highly cash-generative” business, operating in a segment with “limited competition, strong regulatory barriers and highly sticky B2B customers.”

Small but perfectly formed: The note highlighted Grover’s EBITDA margins in the 40-50% range, which would be materially accretive to LNW’s group margin profile.

Macquarie said this “smart bolt-on” would bring immediate synergies via improved distribution, access to IP and enhanced compliance infrastructure.

Seeing the light: All this in the context of Light & Wonder’s broader transition from a hardware-led legacy supplier to being a software and content-centric enterprise. In this light, the Grover deal is seen as “tactically consistent.”

“Charitable gaming has similarities with iLottery and land-based slots, but also features fewer regulatory hurdles and faster deployment cycles,” the team added.

… and wonder: Operationally, the integration of Grover Gaming appears low-risk, said the analysts. The management team at Grover is expected to stay in place and the business already has a vertically integrated supply chain.

The team believes Grover Gaming will act as both a revenue and margin enhancer from FY25 onwards, and forecast annual double-digit growth in the segment over the next three years.

The business is expected to generate high-teens EBITDA by the end of the period, while maintaining low capital intensity.

Gambling.com Group [Nasdaq: GAMB] is fueling the online gambling industry with unmatched performance marketing solutions. Leveraging proprietary technology, a diverse portfolio of premium websites, and the newly acquired consumer-facing OddsJam and B2B service provider, OpticOdds, $GAMB connects operators to high-value players across the globe.

Positioned as a dynamic leader in the sector, Gambling.com Group is an engine of growth and profitability, backed by a proven track record of driving revenue for operators in sports betting, iGaming, and beyond.

Visit our investor page to see why it’s the platform behind the industry’s most successful operators.

Upcoming earnings

Jun 24: FDJ United investor meeting

Jul 17: Evolution

Jul 18: Betsson

Jul 23: Kambi, Las Vegas Sands, Churchill Downs

Jul 29: BetMGM

Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, chief strategy officer: Matthew@edgemarkets.io

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.