EveryMatrix buys its rival provider from private equity owner.

In +More: UK racing asks Beeb for a tips rethink.

Kambi withdraws forecasts, blaming regulatory delays.

Shares watch looks at the decline of Esports Entertainment.

Flutter backs down from UK racing media rights fight.

Just step aside, or pay the price.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

SVP – Performance Marketing

Sr. Director – Sports Promotions

And other amazing positions here.

Enter the ’Matrix

Every bet you take: EveryMatrix has bought rival sportsbook and PAM provider FSB Technology for a sum sources suggested is some way short of the rumored £20m price tag that had been put on the business by private equity owner Clairvest.

The sale of FSB Technology was predicted by Earnings+More back in May when it was noted that Clairvest had hired Oakvale Capital to explore the appetite for a deal. The Ontario-based PE group took ownership of the company in July 2019 when it stumped up £23m to gain full control.

EveryMatrix will take over the operations for FSB’s client list, including UK-facing Fitzdares and QuinnBet.

It will also gain a number of African-facing brands, including NairaBet, BetLion, BetYetu and Paribet, as well as Baltic-facing OlyBet, operated by Olympic Entertainment.

Away win: One partner it won’t be picking up, however, will be The Football Pools, which only this week announced it was switching supplier to GiG, a decision likely in part driven by the uncertainty over the future of FSB.

Off to the races: Alongside the existing partnerships, EveryMatrix will also gain control of FSB’s horseracing product, which will be added to its existing OddsMatrix product suite.

Matrix reloaded

Matrix reloaded: Meanwhile, Golden Matrix has announced a $10m cash injection from the Lind Global Asset Management investment fund. The transaction has seen Lind buy $12m in a convertible note with a two-year duration and a conversion price of $4 a share.

CEO Brian Goodman, said the new cash would put the owner of MeridianBet in a stronger financial position and would enable future “strategic acquisitions.”

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

+More

Cri de coeur: An open letter signed by many of racing’s great and the good – and Harry Redknapp – is calling for the BBC to rethink the decision to drop daily racing tips from its flagship Radio 4 news program Today.

“It seems unnecessarily puritanical for the BBC to drop the racing tips from the Today programme after almost half a century,” the letter said.

It continued that the daily tips “remind us of our nation, taking us for a moment to Musselburgh, Bangor, Down Royal, Beverley and other unexpected acres of green turf and local passion.”

Sportradar has said it added 44 operators to its managed trading services arm in H1, bringing the total to more than 200 companies, including 11 in the soon-to-be-regulated Brazil market.

Historical Horse Racing machines – HHR for short – are coming to Europe for the first time, after suppliers IGT and Churchill Downs’ Exacta offshoot signed a deal with the Malta Lottery to add 80 machines to its IziBingo venues on the island.

Entain has launched a gameshow modeled on popular TV show The Chase in conjunction with Playtech and broadcaster ITV.

Read across

Liberté, Egalité, Stabilité: In The Token Word, Circle’s CEO hailed the company’s success in gaining an e-money license in France as a “major milestone,” meaning customers across the EU can now directly access the USDC and EURC stablecoins via Circle Mint France.

To Finlandia: Compliance+More reported on the news that the Finnish government has set out its plans to liberalize the gambling market, ending the monopoly held by state-owned Veikkaus and signaling it might look at breaking up the organization while leaving the business as the sole lottery operator.

What we’re reading

Was it all just a dream? Some memories of The Mirage from The Nevada Independent.

What we’re watching

You’ll never go in the water again: Lego Jaws.

Head of Casino – Retention – Limassol

Head of Marketing – Remote

Kambi withdraws forecast

Target interruptus: The sportsbook backend supplier has withdrawn its 2027 financial targets, citing slower progress towards regulation in “certain key markets” as meaning a delay in expected revenues.

Back in January 2023, the company predicted an EBIT in excess of €150m from revenues of between €330m and €500m or ~2-3x FY22.

Revenue for 2022 came in at €166m while EBIT stood at €34.8m.

The in-tray: The news of the withdrawn target comes after Kambi this week appointed Werner Becher as its new CEO, who joins from Sportradar. The company said yesterday it still believed Kambi “should have in place” long-term targets and that new numbers would be evaluated once Becher is in place.

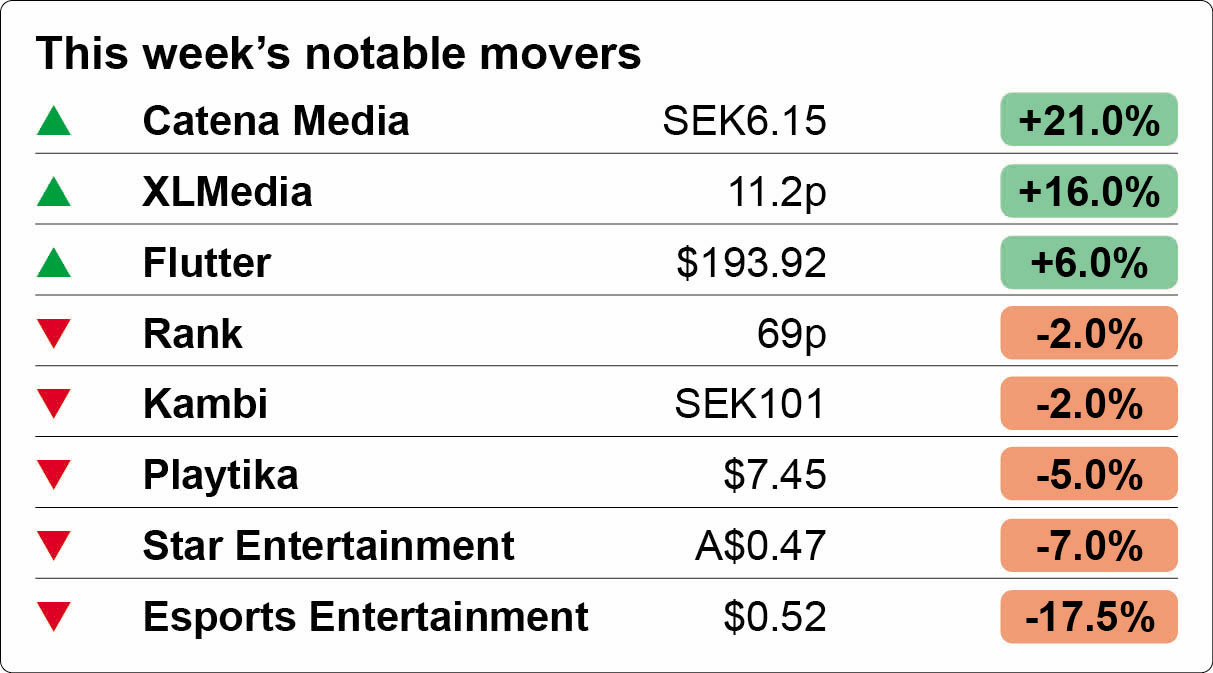

The shares week

Fire sale: Kambi suffered a 6.5% fall on the news yesterday and ended the week down just under 2% However, the biggest loser in what for the US markets was a foreshortened week was Esports Technologies, down 11% on the week after corporate financier Hilco Streambank announced it had been given the task of selling the company’s iCasino and OSB assets.

The deal includes various brand assets such as Karamba, BetTarget and Dansk 777.

Also included is, intriguingly, an “Interest as plaintiff in litigation with potential for an award of substantial damages and shares of certain subsidiaries.”

This relates to EE’s acquisition of the assets from Aspire Global back in Oct21 $65m.

👀 Google it: Catena Media managed a 21% advance this week while fellow gaming affiliate provider XLMedia enjoyed a 16% rise. Both largely now North American-facing providers might have been helped by the news that Google is set to allow ads for lottery couriers and daily fantasy sports.

Also struggling this week is troubled Australian casino operator Star Entertainment, which is down over 7% despite the company resolving its leadership issues with the appointment of Steve McCann as CEO.

** SPONSOR’S MESSAGE ** M&A Opportunity: Integrate Betting into PlayStation, Xbox, and PC Gaming

Explore an exceptional M&A opportunity to acquire a technology that transforms hobby gaming into a sports betting experience. This system lets gamers place bets on their performance on PlayStation, Xbox, and PC. For example, Fortnite enthusiasts can bet on achieving at least 5 kills in their upcoming game. The platform supports probabilities for over 100 different betting scenarios, generating personalized odds with a 20-30% house edge. It doesn't require a gambling license and is compatible with any platform.

Tap into a large millennial demographic with lower customer acquisition costs than traditional gambling. Visit www.betonskills.com to sign up and access a detailed 3-pager!

Media rights fight

Jumping at shadows: Flutter Entertainment backed down from a fight with Arena Racing Company (ARC) this week after initially opting not to price up a six-race card at Bath on Wednesday evening for either of its Sky Bet or Paddy Power brands.

The company said the decision was a commercial one and blamed rising media rights costs for the move.

ARC, which operates Bath and 15 other tracks across the UK, shot back with the threat of legal action.

An offer they couldn't refuse: Martin Cruddace, CEO at ARC, said he was “pleased that sense has prevailed.” He added that the company “very much” valued its longstanding relationship with Flutter and has “always been open in acknowledging the clear symbiotic relationship between the horseracing and betting industries.”

Analyst takes – Entain

Down, down, deeper and down: The team at Investec suggested the negative trend evident in Q1 is likely to have continued into Q2, with online in the UK & Ireland still down a high single-digit percentage and international down marginally.

But they added that the UK is likely to have turned around in Q3 as the impact from the introduction of safer gambling measures from last year leads to easier comps.

Still, with the lack of any news on the appointment of a new permanent CEO and with the conclusion of the capital allocation committee being “less comprehensive than the market anticipated,” it means uncertainties continue.

More takes

Lifeline: The UK General Election brought hopes of a liberalization of the bricks & mortar sector to a shuddering halt with the needed statutory instruments in parliament left in limbo. But the analysts at Peel Hunt still believe, suggesting the measures as proposed had cross-party support and “it is possible that all of the changes will be implemented by the new government.”

Reit off: The share prices of the leading gaming REITs have struggled in the year to date, largely due to the current interest rate environment, according to the team at Truist. But the team suggested that stabilizing rates and potential operator M&A – notably the potential for a Boyd/Penn tie up – could make for a better H2.

Calendar

Jul 19: Evolution

Jui 24: Kambi, Churchill Downs (e)

Jul 25: Churchill Downs (call), GLP (e), Boyd Gaming

Jul 26: GLP (call)

Jul 30: IGT, Red Rock, Caesars Entertainment

Jul 31: MGM Resorts

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.