ESPN Bet on course for second-tier status

ESPN Bet numbers, LiveScore earnings, analysts outlooks +More

Evidence accumulates for partial success for ESPN Bet.

In +More: Flint’s Flutter departure, Vermont launch.

Challengers welcome: LiveScore proves a point in the UK.

BettingJobs’ Jobsboard features three compliance roles.

Said, if you feel like giving me a lifetime of devotion.

ESPN Bet progress

State data and app numbers suggest ESPN Bet has established a second-tier position.

In the mix: The first full month of data from ESPN Bet’s efforts in Maryland and Iowa show Penn Entertainment has seen its new OSB brand establish ~8% share of their market by handle, putting it equal with Caesars and ahead of BetMGM.

In these early stages of ESPN’s launch, analysts believe handle data is more predictive of market share than either GGR or NGR due to the distortions caused by the promo environment.

JMP noted that Penn accounted for 30% of all promos in Maryland during December, for instance.

The JMP team added that promos as a percentage of total handle, “the more important metric at this point”, was 14% and in line vs. their expectations of +/- 10%. “Therefore, 7% to 8% handle market share could be viewed as the true baseline as spending subsides in the coming months,” the team added.

🔍 ESPN Bet ‘established’ as a second-tier player in Maryland and Iowa

WoW factor: The team at JMP also noted that DraftKings and FanDuel regained the top two spots in terms of downloads in week 17 of the NFL season, with 24% and 28% respectively. It left ESPN Bet in third with 19% share, down 49% WoW.

JMP noted that ESPN Bet’s promo offer has been cut back to $100 vs. the $200 previously available.

The team said the WoW decline was the second-largest since launch.

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

+More

Matchbook (an E+M sponsor) has announced its latest partnership with Unabated Sports, which will now add Matchbook’s odds to its odds screen where users can see and compare real-time odds and prop lines from sportsbooks across the market.

Hop off: Richard Flint, ex-CEO at Sky Bet before it was bought by the then Paddy Power Betfair, has opted not to seek re-election to the board at Flutter and will step down at the conclusion of the AFGM in May.

Churchill Downs has raised the purse for this year’s Kentucky Derby to $5m, the largest in the history of the race. The winner will receive $3.1m, with second place to be awarded $1m.

Online sports betting is live in Vermont with three operators – Fanatics, DraftKings and Flutter’s FanDuel.

Genting Malaysia is to inject an additional $100m into its US-facing subsidiary Genting Empire Resorts. The proceeds will go towards paying off an existing bank facility of approximately $58m and general working capital purposes.

On the ball: VaideBet has penned a front-of-shirt sponsorship deal with Corinthians worth $75.9m over the next three seasons. The deal is the largest in Brazilian soccer history.

Betfred will continue its sponsorship of the Derby Festival at Epsom through to 2026.

Elys Game Technology has changed its corporate name to Elys BMG Group.

GAN will hold a shareholder meeting on February 13 to approve the proposed $108m acquisition by Sega Sammy.

Catena Media has received approval from bondholders for a year extension on its 2021/2024 outstanding bond loan, which is now due June 9, 2025.

How much? MGM Resorts has bought a 1.62-acre lot between its Bellagio and The Cosmopolitan properties that was previously being used as a parking lot for $54m.

Challenger brand

Livewire: The Noel Hayden-owned gambling-to-advertising business LiveScore – the company behind LiveScore Bet and Virgin Bet – saw revenues rise 49% to £130m, with the gambling segment rising 57% to £108m, as the group continued to seek to expand its footprint in the UK and Ireland alongside the Netherlands and Nigeria.

The growth came at the cost of an EBITDA loss of £50m as the headcount expanded by 18% to 492.

The company said operating losses of £61.8m were “in line with expectations.” The losses were a 12% improvement on the year previous.

Firepower: The company received £50m of investment for a 9.99% stake in the business in September and October 2022, and in September last year shareholders provided a loan facility of $20m repayable in September 2027.

Never too late: The team at Regulus noted LiveScore has become a “significant UK online gambling challenger in just four years” after being left behind by what is now Bally’s. They added it has done “a lot of expensive heavy lifting”, however, with a cumulative net loss of over £200m

They added its success demonstrates it is “never too late to challenge” and that “difficult macro/regulatory trends” can be overcome via innovation and strong operations management.

“LiveScore is also demonstrating there is still strong growth in an engaged relatively mass-market gambling segment that likes well-delivered sports content and an accessible UX,” the team added.

“By building engagement, LiveScore should not have to bleed money on ‘brand’.”

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Earnings in brief

Meridianbet saw revenues rise by 25% in 2023 with EBITDA growth of 10%, though it did not state any actual figures. The company said it expected to complete the $300m reverse takeover of Golden Matrix in Q124 under the amended terms announced in July last year.

2024 outlooks

Fanatical: Looking ahead, the team at Morgan Stanley suggested one potential “surprise” for 2024 would be for Fanatics to grow market share at the expense of DraftKings and FanDuel.

The team also suggested domestic visitation to Las Vegas could well accelerate this year, alongside the predicted improvement in international travel.

Additionally, they said Macau could outpace the generally gloomy scenarios for Chinese economic growth for this year.

Mean reversion: The team at Truist believe the stabilization of interest rates – and the prospect of lower rates in the not too distant future – could benefit “some of the more levered names” in the sector.

The team added that the interest rate environment also could drive increasing M&A this year to a traditionally acquisitive space.

Sector watch – financial trading

BTC ETF: The approval of a spot Bitcoin ETF is a signal moment for the crypto world, even if the SEC made it plain it remained distinctly skeptical over the whole idea.

Gray market: The SEC had its hand forced by a US appeal court ruling late last year in a case bought by asset manager Grayscale.

That decision said it was wrong for the SEC to reject an application for a Bitcoin ETF.

Gritted teeth: In the statement accompanying the news, SEC chief Gary Gensler said that “while we approved the listing and trading of certain spot bitcoin [exchange traded product] shares today, we did not approve or endorse bitcoin.”

“Clearly, he didn’t want to do this,” Ian Katz, financial policy analyst at research firm Capital Alpha Partners, told the FT.

“He felt like he had to because the court put him in a position where he really didn’t have any other options. And even at that, he waited until the last possible moment to do it.”

Hope you’re happy now: Grayscale Bitcoin Investment, BlackRock, Fidelity Investments, Invesco and Ark/21Shares may begin trading as soon as next Thursday.

ETF specialist publication ETF Stream said investors and crypto aficionados “hailed the SEC’s decision, which comes more than 10 years after Cameron and Tyler Winklevoss first applied to create the funds in 2013.”

“Spot ETF approval today is a true milestone moment for the crypto asset class,” Sui Chung, CEO of CF Benchmarks, said, which operates the underlying indices for seven issuers, including BlackRock.

“A spot ETF has always been important because it stands to open bitcoin up to a much broader swathe of investors.”

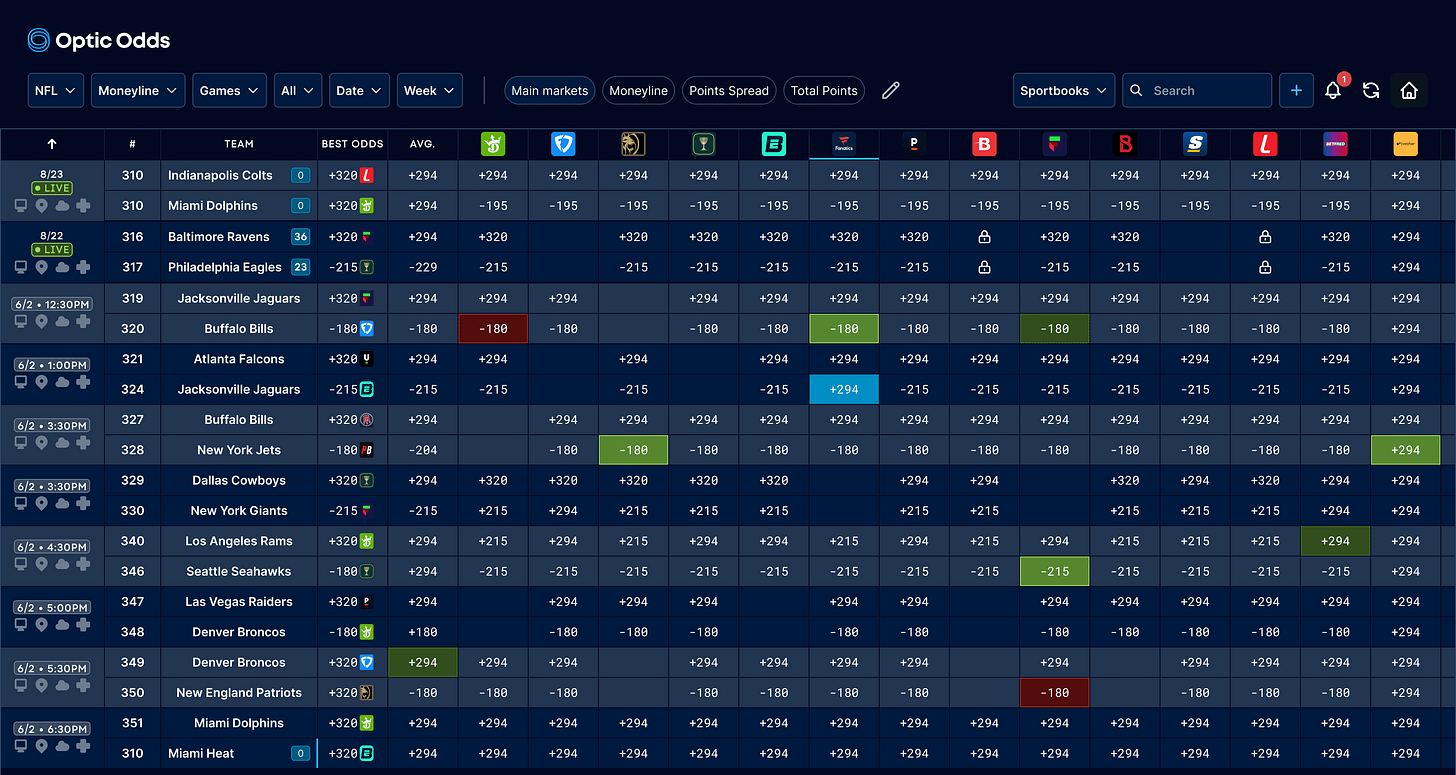

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

Calendar

Jan 17: 888

Jan 18: Flutter

Feb 1: Rank

Feb 6-8: ICE

Feb 7: Disney

Fraud / Payments / Risk / AML Compliance Executive (Assurance Executive for Financial) – Abu Dhabi

Head of Compliance – Ireland, UK

Technical Compliance Executive (Assurance Executive for Process) – Abu Dhabi

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.