The TL;DR edit

Londoner is the place for me: Las Vegas Sands remains well-positioned for strong growth in 2025, with major expansions in Macau and Singapore set to drive revenue, margin improvements and market share gains.

The Londoner expansion will play a pivotal role in Sands’ Macau strategy, while Singapore’s continued strength in mass gaming and tourism growth provides further upside.

Management remains optimistic about long-term success despite short-term external impacts.

The shares reacted positively, up over 7% in post-close trading. Analysts said the shares were “inexplicably cheap.”

Key financial highlights

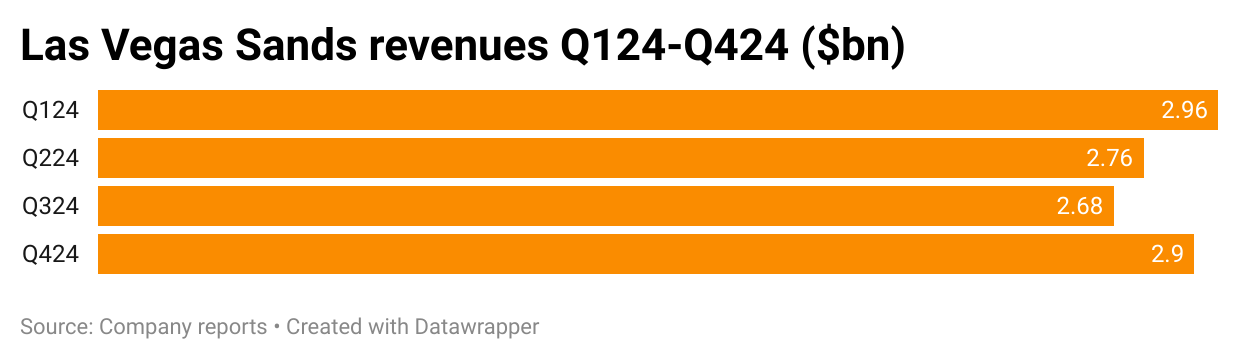

Q4 revenue came in down 0.7% YoY at $2.9bn while FY24 rose 9% YoY to $11.3bn.

Adj. EBITDA for the quarter was down 7.3% to $1.11bn while FY24 came in at $4.38bn.

Macau adj. property EBITDA came in at $571m, with LVS blaming low hold for a $22m shortfall. The figure for Marina Bay Sands was $537m.

The company completed $450m of share buybacks over the period and bought $250m of Sands China shares.

Operational highlights

Kissing with confidence: The Macau market showed continued growth, with gross gaming revenue increasing by 6% YoY and mass gaming revenue up 5%.

The company expects Macau’s total gross gaming revenue to exceed $30bn in 2025.

Sands’ competitive advantage in Macau is driven by scale, quality of assets and access position, which management believes will allow for faster growth than the overall market.

Belief system: CEO Rob Goldstein said the company’s actions “speak loud and we keep investing, investing in buying into Macau, we believe in Macau, we believe in China.”

Rob Goldstein: “We believe the Chinese economy will grow and the Macau market will grow as well. Gross gaming revenue in Macau should exceed $30bn in 2025 and continue to grow. The scale and quality of the assets we’ve built are second to none.”

Tourist hotspot: In Singapore, Goldstein said the operation reported another “strong quarter” with $537m in adj. property EBITDA.

Mass gaming revenue was $746m, flat sequentially but up 28% YoY.

There was a 71% growth in mass gaming revenue compared to Q4 2019, indicating strong post-pandemic recovery.

Singapore’s robust entertainment and lifestyle events calendar continues to enhance its attractiveness as a global tourism destination.

Dare I say… flywheel? Goldstein said the results of Marina Bay Sands reflect the “positive impact of LVS’s capital investment program and the growth of high-value tourism.”

“We’re just at the beginning of a huge growth surge in Singapore. It’s not going to end. We’re the right place, right time with the right products.”

Patrick Dumont, president and COO, added: “The key thing about Singapore is about the quality of tourism. It really is an unbelievable market in terms of the value of the tourists showing up there.”

Capital investment programs in both Macau and Singapore remain key growth drivers, with expansions and renovations expected to increase revenue and market share.

Macau operations and outlook

We are #1: Sands China remains the leader in gaming and non-gaming revenue, market share and EBITDA, management said.

The Londoner Grand Casino opened in late September 2024, with 315 Londoner Grand Suites operational in Q4.

The complete suite inventory (1,500 suites, 905 rooms) is expected to be fully online by May 2025.

Goldstein said the objective with the property was to capture “value, high-margin tours.”

Q4 Macau EBITDA totaled $571m, though lower-than-expected hold in the rolling segment impacted this figure by $22m.

Margins were affected by turnover rents, which were $27m lower YoY, and a 20% reduction in available rooms in Cotai due to ongoing renovations.

Margins at key properties: The Venetian was 36.7%, the Plaza & Four Seasons was 37.2%.

Projected margin improvement is expected as revenue grows, unrated play is better addressed and cost management strategies are refined.

Patrick Dumont: “We continue to expect margin improvement as our revenues grow as we use our scale advantages to better address the unrated play in the market and as we focused on managing our costs including refining our reinvestment to optimize cash flow.”

Upcoming Londoner expansion is expected to increase Cotai room inventory by 20% and Londoner rooms by 47% by May 2025.

Management remains confident in Sands’ ability to attract high-value, high-margin tourists.

Rob Goldstein: “Our objective is to capture high-value, high-margin tourism. We have a unique competitive advantage in terms of scale, quality and diversity of product offerings.”

Singapore performance

Got it all going on: The Marina Bay Sands business enjoyed strong EBITDA performance, driven by capital investments and high-value tourism growth.

Ongoing investments are expected to continue yielding strong returns, with management noting significant runway for growth in 2025.

“I like the building,” said Goldstein. “There’s just nothing like it. It’s got the room product, it’s got the suite product, food and beverage, retail, its got it all.”

Subscribe to Earnings Extra

This is your first free Earnings Extra edition. The second free edition looking at Evolution’s Q4s will be released later this morning.

To receive further Earnings Extra editions, you can upgrade to paid.

A subscription to Earnings Extra costs £99 a month (~$120) or £999 for the year. To upgrade click the button below.

Impact of external factors

Xi may be the face I can’t forget: Macau tourism in Q4 was impacted by the 25th-anniversary celebration of the special administrative region’s reunification with China.

The visit of Chinese President Xi Jinping in December resulted in a noticeable but unquantified impact on revenues.

Dumont said: “Unfortunately, I really can’t give you an estimate. All I can tell you is that there was a noticeable change.”

“But the important thing is that we’re looking forward to a great 2025.”

Despite these short-term fluctuations, management remains optimistic about growth prospects in 2025.

Strategic Outlook

Maybe it’s because: Sands will continue leveraging its scale, quality and diversity of offerings to maintain market leadership.

The completion of the Londoner expansion in May 2025 will significantly enhance the company’s competitive advantage.

Holding back the years: Grant Chum, CEO and president of Sands China, said the strategy “remains leveraging our core products, leveraging the quality and scale of what we have.”

“And the upcoming online of the rooms in Londoner Grand is the perfect opportunity for us to really drive home that strategy.”

He added that management remains focused on EBITDA growth, profit share gains and operational efficiency.

Dumont added that the Londoner should be viewed as a “30-year asset.”

Grant Chum: “If you look at the Q3 results, when all the results came out from all of the operators, I think those who gained revenue share didn’t necessarily see that translate into profit share gain. And I think we continue with our strategy.”

Opportunities elsewhere

Congestion zone: Goldstein said LVS believes New York, where the company has a bid lodged, will be a strong market but added that iCasino will be an “inevitability.”

“You could be faced with a high gaming competitive tool, which dilutes the value of the product,” he warned.

“The results coming out of neighboring states of New Jersey or Pennsylvania or as far away as Michigan underscore that concern.”

See yesterday’s E+M for more on the cannibalization debate for US regional casinos.

WLTM: Dumont was more positive on Thailand, which he said was an “unbelievable tourism destination” with “very desirable attributes.”

“I think it has a great opportunity to add destination resorts and create a very large-scale industry there,” he added.

Thais that bind: Although it would serve a somewhat similar market as MBS, Dumont said there was an argument it actually “strengthens our ecosystem.”

Longhorn longshot: Asked about Texas, Dumont said it has “great potential as a market for our business, but there’s really nothing to report at this point. This [legislative] session just began, and we’ll see how it goes.”

Key management quotes

Rob Goldstein: “We are investing in high-quality assets that also have scale. Our approach will enable us to grow faster in the long term, grow our share of EBITDA in the Macau market and generate industry-leading returns for invested capital.”

Patrick Dumont: “We continue to expect margin improvement as our revenues grow, as we use our scale advantages to better address the unrated play in the market and as we focus on managing our costs.”

Grant Chum: “Our constant is that, yes, our strategy remains leveraging our core products, leveraging the quality and scale of what we have, and the upcoming online of the rooms in Londoner Grand is the perfect opportunity for us to really drive home that strategy.”

Analyst takes

Inexplicably cheap: The team at Deutsche Bank said the results themselves were not a catalyst for the post-close share price reaction, albeit the “reacceleration” in Singapore was “impressive and encouraging.”

“We think the stock catalyst, stemming from the quarter, is exactly the type of momentum LVS, and the Macau complex more broadly, needed,” the team added. “We see LVS shares as inexplicably inexpensive.”

The team at Macquarie said they expect 2025 to be the “turnaround year” for LVS as it finishes its renovation programs, “removing disruption headwinds and positioning the year ahead for solid growth.”

Share price reaction

I like it like that: Investors reacted warmly to the earnings with the shares up over 7% in post-close trading.

Earnings calendar

Jan 30: Evolution, Rank

Jan 31: PointsBet

Feb 4: BetMGM

Feb 6: Betsson, Boyd Gaming

Feb 11: Catena Media, Red Rock Resorts

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.