Dwarfed

Prediction market raises dominate startup funding in 2025

Startup funding tops $4bn when Polymarket and Kalshi are included.

In +More: Banijay seals Bet-at-home stake sale.

Life of O’Reilly: John O’Reilly retires as Rank CEO.

Venture playground: Pitch ICE competitors revealed.

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

In the shade

How to disappear completely: The soaring valuations of the two leading prediction markets operators Kalshi and Polymarket obscured what was a busy and fruitful year for startups in the betting and gaming space in 2025.

Kalshi raised $1bn in an early December Series E cash injection that valued the company at $11bn and brought the total raised during the year to ~$1.5bn.

Before that, Polymarket raised $2bn via a strategic investment from Intercontinental Exchange, which valued the business at a post-money $9bn and brought its total raised to $2.2bn.

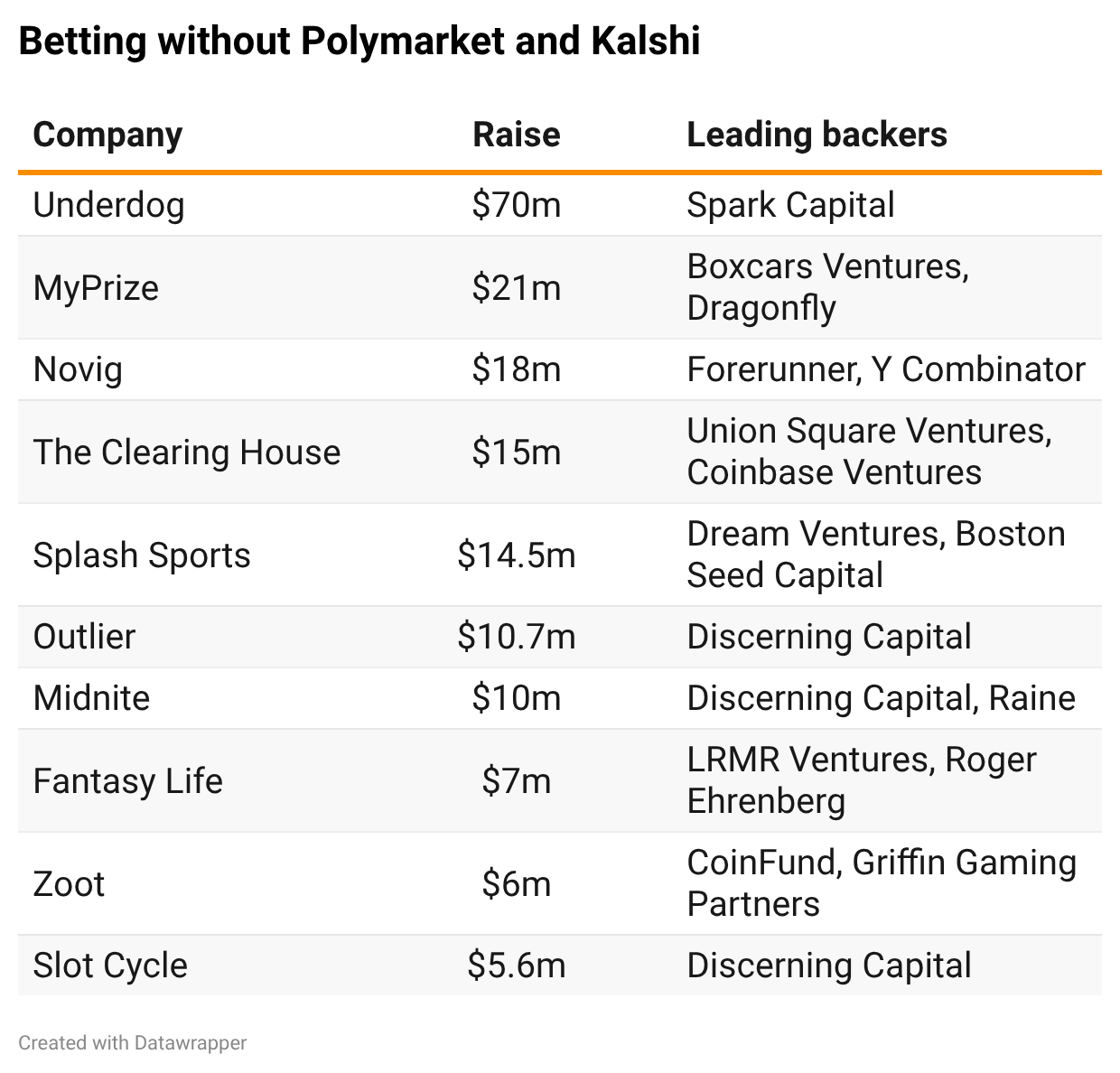

I said ‘pretend you’ve got no money’: To put those sums in context, the biggest raise in 2025 on the part of the rest of the betting and gaming space was the $70m that Underdog achieved in March, with the next biggest being the $21m that sweepstakes turned social betting operator MyPrize notched up in April.

In total, ex-the two prediction giants but including ancillary areas such as gaming payments, regtech and user acquisition funding, the sector gathered in at least $347m.

This compares with $190m of disclosed raises in 2024 and represents an 83% increase.

Obviously, both figures are dwarfed by the $4bn+ total when the prediction duo are included.

Payment accepted: Alongside the rise of prediction markets, other themes evident last year in the growth company space included significant raises by the gaming-centric payments names Edge Markets, raising $17.9m; PayNearMe with $50m; and Yaspa with $12m.

Meanwhile, a handful of gaming regtech providers – including Birches Health, with a $20m raise; ClearStake; BettorWatch; and at the very end of the year, Xpoint (see ‘Venture playground’ below) – also brought in new money.

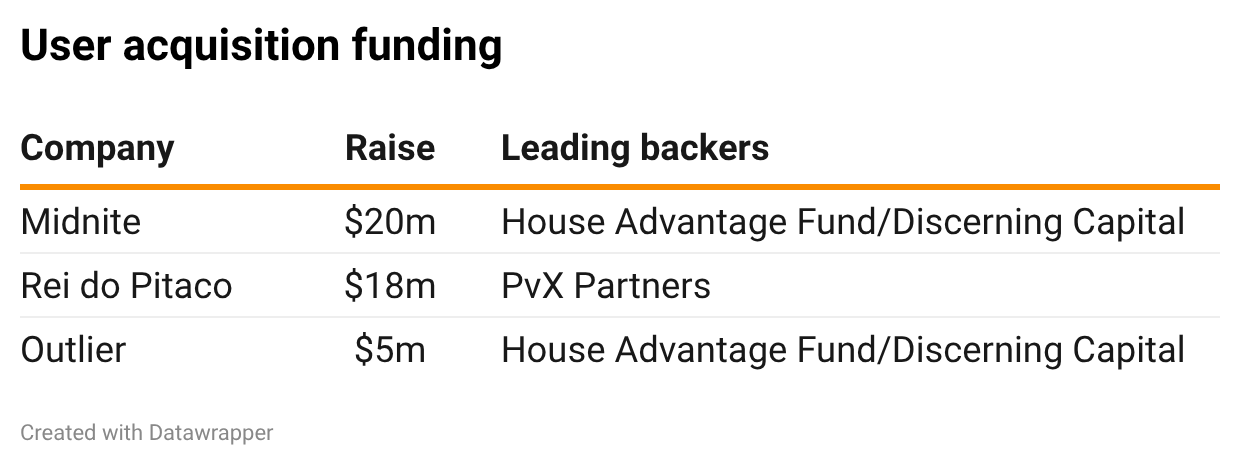

Lastly, the year also saw the emergence of user acquisition funding, largely through Discerning Capital’s House Advantage joint venture with PvX Capital.

Look busy: Speaking of Discerning Capital, the Davis Catlin and David Williams-led firm was among the busiest names in the betting and gaming startup space last year.

User acquisition funding aside, it participated in funding rounds for Yaspa, BettorWatch, Midnite, Outlier and Slot Cycle.

Other notable names involved in the sector this year were Y Combinator and Coinbase Ventures, which both participated in The Clearing House raise in August.

The company was subsequently snapped up by Coinbase for an undisclosed sum in December in order to further its own predictions ambitions.

What we’re reading

Hitting the jackpot: “Venture funding for fintech firms rose in 2025 for the first time in four years, with prediction markets emerging as the sector’s biggest winners, riding a wave of enthusiasm around online gambling.” Via Bloomberg.

Does your Bet Builder supplier or in-house Same Game Multi solution support 12 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 200 operators are using the Algosport Bet Builder solution today.

+More

São Paulo lottery: Brightstar Lottery and Scientific Games have teamed up for a joint venture to operate a new lottery on behalf of the government of the state of São Paulo in Brazil. The 15-year concession will run under the name of the newly formed SP Loterias. Meanwhile, Brightstar has also announced it is to provide instant lottery ticket products to the California Lottery as part of a new six-year agreement.

Part and parcl: House price indices provider Parcl has partnered with Polymarket to launch real-estate prediction markets that settle against Parcl’s daily housing price indices. Polymarket will list and operate markets while Parcl will supply independent index data for transparent verification.

Fliff has launched Superstars, a real-money, P2P DFS contest format, in California and 10 other states just as sweepstakes-style play went offline under new state rules. As reported by Sweepsy, the product mirrors pool-based DFS formats offered by PrizePicks and Underdog.

Deal talk

Banijay has completed the sale of its controlling 54% stake in Germany-based gaming operator Bet-at-home for an undisclosed price. The move was prefigured at the time of the announcement of the merger of Bertclic and Tipico in late October.

Xtremepush has announced the acquisition of US-based loyalty platform Scrimmage, which the company said would accelerate the launch of its XP Loyalty offering. Dan Taren, Scrimmage’s CEO, has already joined the Xtremepush team as head of loyalty product. Xtremepush raised €12m in new funding in October.

Digging in: An investment vehicle chaired by Lawrence Ho, the CEO of Melco Resorts, called Black Spade Acquisition III has raised $150m via an NYSE listing. The company said it sees the leisure and entertainment space as one of its core focus areas and is encouraged by how the application of AI, robotic and quantum computing “elevates user experience in this field.”

Puts+Takes

Macau’s gaming market opened 2026 with strong momentum, citing industry checks showing MOP800m ($99.7m) per day in the first four days of January, up 36% YoY, boosted by the New Year holiday. Mass GGR rose 15-18% MoM while VIP was up 16-18%, with win rates normal at 2.8-3%. With results slightly ahead of expectations, Jefferies expects strength to continue through the first half on easy comps and a favorable calendar.

Careers+More

Penn shake-ip

Skewer: Shuffling pieces on the chessboard, Penn Entertainment has announced a structural reset to reflect the new focus on iCasino and Canada following the termination of the ESPN Bet partnership.

Out go Todd George, EVP of operations, and chief information officer Rich Primus whose roles have been eliminated.

Meanwhile, CTO and head of interactive Aaron LaBerge will assume responsibility of all of Penn’s IT functions and will report directly to Penn CEO Jay Snowden, as will CMO Jennifer Weissman.

The analysts at Stifel said they were not surprised by the changes, except for the departure of George who has been with the company more than 13 years and is “viewed as a strong B&M operator.”

But the team were encouraged by LaBerge’s role being enhanced “despite strategic focus on rationalizing fixed costs.”

Rank CEO transition

Big shoes to fill: John O’Reilly, CEO at UK casino to bingo group Rank, has announced he is retiring from the role as of the end of this month, with the company announcing that current CFO Richard Harris will succeed him on an interim basis.

O’Reilly, who joined Rank as CEO in 2018, said it had been a “privilege to lead the company for the past seven-and-a-half years.

“I am proud of all that we have accomplished in that time,” he added.

John H. Ott, chair, said O’Reilly’s “extensive gambling industry knowledge and experience, as well as deep operational skills have combined to ensure that Rank is well positioned to build on the direction he established.”

The company is now undertaking a search process to identify O’Reilly’s permanent successor.

E+M PRO

Earnings preview – Las Vegas Sands

Get smart: The narrative surrounding Las Vegas Sands is all about the differential in the pace of growth in Singapore vs. the still somewhat stuttering recovery in Macau. The first will doubtless continue to do the heavy lifting while Macau remains a work-in-progress and still a distance away from the pre-pandemic highs.

See today’s Earnings Preview edition (PRO subscribers only).

Preview calendar

Jan 9: Evolution

Jan 12: BetMGM

Jan 14: Caesars Entertainment

Jan 16: MGM Resorts

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments’ Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Venture playground

In focus – Pitch ICE

Undirty dozen: ICE Barcelona 2026 hopes to shine a spotlight on the next generation of gaming innovation through its Pitch ICE program, featuring a cohort of 12 early-stage startups from nine countries.

The live competition takes place on January 20 on the Pitch ICE Stage, where each startup will deliver a three-minute pitch followed by a live Q&A with a panel of seasoned judges.

The event culminates in the awarding of €15,000 in AWS credits and the Pitch ICE 2026 Trophy to the winning entrant.

The 12 shortlisted startups are eyeDP, Whizdom AI, Tugi Tark, The Casino Factory, PROMOFY, Research iGaming, Complianceplay AI, THNDR, Master Affiliates Network, Swiss Shufflers, Fantasy Gambling League and Loserball.

Funding news

Xpoint: As was reported at the end of December, Xpoint has secured a new growth funding round led by Bettor Capital to accelerate research and development, expand its product and engineering teams, and support global market expansion in regulated real-money gaming.

The investment will fast-track delivery of advanced geolocation, geofencing and fraud-detection capabilities that help operators stop spoofing, block unauthorized wagers and ensure compliance.

Xpoint’s platform is live with major partners in North America, and is also deployed with clients in Brazil and the UAE, positioning the company for broader international rollouts and enhanced regulatory support.

CEO Manu Gambhir said: “This new funding lands at the perfect time for our growth. We’re scaling up our teams to ship a wave of new capabilities that help operators defeat location spoofing, streamline compliance and convert more good users – without compromising on precision, scale or speed.”

Powering Tier 1 operators, sweepstakes, market makers and apps worldwide.

Global coverage, sub-second latency, and comprehensive trading tools to keep you ahead of the competition.

More funding news

Rocket: The crypto prediction-markets startup has secured $1.5m in pre-seed funding as it pushes its novel “redistribution markets” model, a continuous, non-binary trading framework aimed at rethinking how event-based outcomes are priced and traded on-chain.

The round was led by Electric Capital, with backing from Amber Group, Bodhi Ventures, Jsquare, Ludlow and Tangent, among others.

Rocket’s platform is being built on the MegaETH network and incubated by MegaMafia.

It distinguishes itself from traditional prediction markets by allowing users to trade continuously against live price feeds for assets or signals without fixed settlement dates or capped upside.

Betlabs: The sports-betting supplier has closed its seed funding round, fully backed by SportsContentCo. The investment will help Betlabs scale distribution of its Dynamic Parlays product, which offers partial payouts based on correct selections, reducing variance, and boosting engagement, volume and retention.

Sharp Alpha has announced an investment partnership with FDJ United Ventures, the corporate venture arm of the eponymous European operator. Pierre Brousseau, director of FDJ United Ventures, said via LinkedIn that the new partnership would enable the two to “anticipate emerging uses and technology that will transform the gambling industry.”

Growth company news

Betting Hero founder Jai Maw has stepped down from the CEO post at the now GeoComply-owned business to take up the position of non-executive chair. “While I’ll miss the buzz of daily operations and problem solving, I couldn’t be more confident in the entire Betting Hero family to continue our transformation in 2026 and beyond,” he posted on LinkedIn.

Ebaka Games said its November launch hit over 5 million worldwide, secured BMM Testlabs certification and will expand in 2026 with launches via “major brands”. Its initial portfolio includes Plinko, Mines, Tower, Limbo and crash games live with Menace, and the studio aims to grow its footprint next year.

Upcoming earnings

Jan 22: IG Group

Jan 27: Evoke

Jan 28: Las Vegas Sands

Jan 29: Rank

Feb 5: Evolution, Betsson, Boyd Gaming

Circle Squared is the leading product and technology consultancy focused exclusively on betting and gaming.

With decades of industry experience, we are the people to speak to whether you need technical due diligence on an acquisition target, vendor due diligence to prepare for investment, a product evaluation on your own stack, an independent assessment of your tech organisation, assistance with vendor selection, tailored performance testing, support with product development… you get the idea.

Whatever your tech and product needs we’re here to help. Meet us at ICE 2026 and contact us today queries@circle-sq.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.