DraftKings’ hopes in the spotlight

Analysts at Roth look at DraftKings’ long-term prospects, UK online for 2022 examined, Caesars’ Illinois claims tested +More

Good morning and welcome to the debut edition of the latest of our monthly editions. The Data Month hopes to delve further into the copious figures given by operators, analysts and state and national regulators, and to highlight trends away from the headlines.

For the first issue, we take a look at what analysts at Roth MKM believe are the best (and worst) hopes for DraftKings now we have a clearer view of what its expenditures might look like at maturity.

We examine the latest data from the UK Gambling Commission.

And we also review Caesars online ambitions, assessing the importance of Nevada to the business and putting management claims about gaining share in Illinois under the spotlight.

I can see all obstacles in my way.

DraftKings’ profits outlook

The long-term profits forecast for DraftKings is becoming clearer, according to analysts at Roth MKM.

Want, settle for, get: CEO Jason Robins said in DraftKings’ Q4 earnings call that the company had a “great trajectory” as it pushed towards hitting EBITDA profitability in 2024. However, the team at Roth MKM suggested that, while DraftKings had accelerated the trimming of its costs, in terms of operating leverage it would still struggle to reach EBITDA margins of even 20%.

The team pointed out that with high fixed costs and “sticky” gross costs (such as taxes), the long-term EBITDA forecast for the company would likely be at less than $1bn.

Roth added that even if DraftKings’ market share expands to 25% vs. 22% in 2022, they didn’t believe EBITDA margins could reach 20% unless industry GGR reached $30bn, or even higher, when stock-based compensation is included.

Sticking points: Roth pointed out that for DraftKings to reach its long-term gross margin target of 56% (vs. FanDuel’s 45.5-52.5% long-term target), it would need an uptick in newly regulated states to balance out the 51% in New York.

As E+M wrote about last week, the industry struggled to argue a coherent case for lower taxes in New York during a recent legislative committee hearing.

“DraftKings’ more optimistic gross margin expectation vs FanDuel seems aggressive,” suggested the analysts. “FanDuel’s parent Flutter has a longer operating history and greater scale as the largest iGaming operator globally.”

🤔 Roth’s forecasted EBITDA long-term profitability

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Sensitive souls

Market share sensitivity: Notably, Roth is arguably on the high side within its market share forecasts, putting forward 25% as an at maturity market share compared to the actual figure in 2022 of 22%.

E+M’s calculation is that, with a market share of 22%, the low end EBITDA forecast falls to ~$240m while the base forecast comes in at ~$640m.

Both these calculations take on the Roth assumptions about gross margins hitting 50% long-term marketing and fixed costs being limited to $1.8bn at maturity.

🍆 DraftKings quarterly revenues ($m) get a Q4 boost

Cash calls: DraftKings insisted during the Q4 call that it would not need to make any more demands on shareholders this year before reaching EBITDA profitability next year, saying it was projected to have at least $700m of liquidity at YE23.

The team at Roth said they acknowledged DraftKings’ “faster path to profitability has reduced risks towards a dilutive capital raise”.

“Yet, we don’t believe the current stock price reflects the degree to which slowing new state legislation is limiting margin potential,” the team added.

Meanwhile, Roth saw risks to DraftKing’s 2023 guidance, including new entrants (such as Fanatics) and the more effective cross-sell of iGaming by land-based operators.

🎢 DraftKings has lost some of the ground gained this year

UK online

The state of play: The latest data from the Gambling Commission gives a view of the UK market ahead of – eventually – the publication of the government’s White Paper on gambling. The data comes from operators worth ~80% of the total market.

The money maker: According to the data from the Commission, slots produced a total GGY for 2022 of £2.24bn. That represents a slight fall from £2.3bn in 2021.

When grossed up, E+M estimates slots GGY for 2022 at ~£2.8bn.

You bet: Total betting revenue including virtual sports and esports came in at £1.94bn, down 26% from £2.65bn in 2021. Grossed up, 2022 revenues are estimated at £3.31bn.

Steady eddy: Other casino – that is all casino activity including poker but ex-slots – produced a GGY of £626m, down 25%.

Journal of a plague year: Not too much should be read into the YoY declines given 2021 was a year significantly affected by pandemic lockdowns and associated disruptions.

🧀 Maturity: The UK in 2022, according to Gambling Commission figures

IL wind

Caesars’ claims to be a national operator rest on limited markets share ex-Nevada.

Caesars’ online hopes have also been in the spotlight this week. As the team at Regulus Partners pointed out, ex-promotional incentives the business achieved an actual GGR of $6m in 2022 versus the stated $548m, as promotional and incentive spend of $542m took its toll.

The bright spot for Caesars, as identified by Regulus, is its Nevada sports-betting heartland where it controls ~40-50% of a market, which was worth $447m in GGR in 2022.

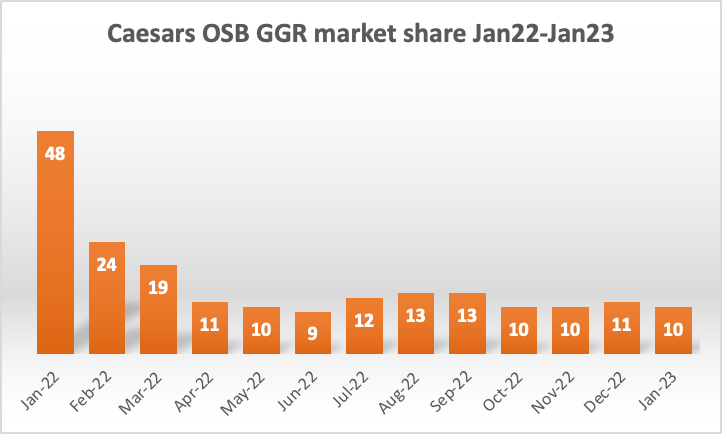

The picture is less rosy elsewhere. In New York, GGR market share dropped from 48% in Jan21 to 10% a year later.

🤮 Caesars struggles to hold its ground in New York

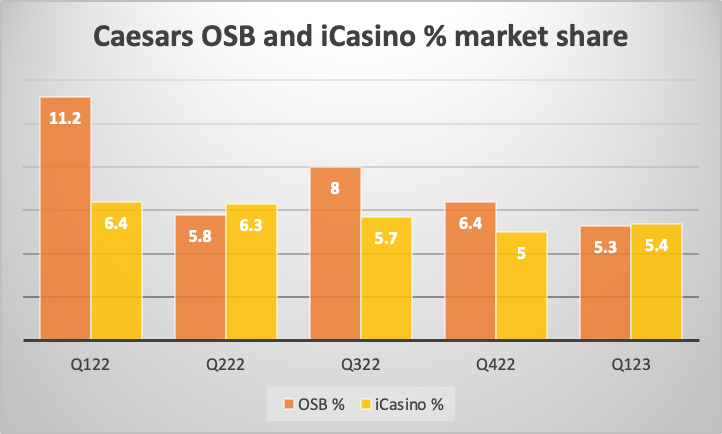

The drop off in New York affected Caesars’ national positioning, As was detailed by Deutsche Bank analysts in their monthly online review, Caesars’ OSB market share ex-Nevada fell from 11.2% in Q122 to 5.3% in the current QTD.

iCasino market share has also slipped slightly to the 5.4% level in Q123 QTD vs. 6.4% in Q122.

🛑 Caesars national GGR market shares across OSB and iCasino

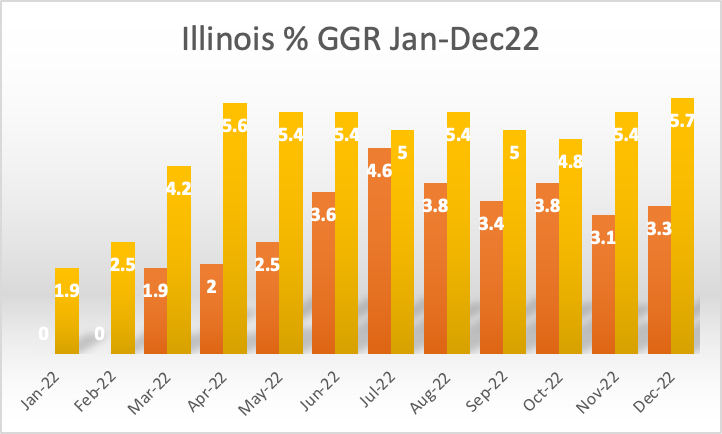

IL behaviour: One market singled out for comment on the recent Q4 earnings call was Illinois, where CEO Tom Reeg suggested the company had seen evidence of market share gains.

“You’ve seen even in this environment where we’ve not been aggressive at all from a promotional perspective: I’d go back and look at what’s happened in Illinois market share for us.”

Taking a look at 2022 by month, it can be seen that Cesars did indeed notch up some gains earlier in 2022.

By handle, its market share moved up to 5.6% in April last year and remained in that bracket for the rest of the year.

In GGR terms, the advance was less obvious, climbing to a high of 4.6% market share in July before falling back to 3.3% in Dec22.

All of which only confirmed Reegs’ admittance on the call that the company’s GGR market share in Illinois was “nothing to write home about”.

🤏 Caesars market share gains in OSB in Illinois in 2022

** SPONSOR’S MESSAGE ** The Fastest Sports Betting Data In The World: OddsJam offers real-time odds from over 150 sportsbooks in the United States, Canada, Europe, Australia, and more. See why tier 1 operators, affiliates, and DFS companies turn to the power of OddsJam sports betting data & screen to work smarter, not harder.

Book a demo or drop us an email at enterprise@oddsjam.com.

Datalines

Denmark: Total GGR for 2022 was up 8% YoY to DK6.7bn. Within that, iCasino rose 3% to DK2.9bn while sports betting was up 4% to DK2.3bn. Land-based slots rebounded 48% to DK1.2bn.

Italy: iGaming revenue of €323m in November was up 6% YoY. In terms of market share, Lottomatica/Goldbet led sports betting with 16%, followed by Sisal on 15% and bet365 on 11%. Lottomatic/Goldbet also led iCasino on 12.7%.

Calendar

Feb 28: IGT, Codere Online, Endeavor

Mar 1: Everi, Light & Wonder, Golden Entertainment, Rush Street Interactive

Mar 2: Flutter FY

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.