Affordability checks one factor among many for sport losing its audience.

In +More: Earnings coming up from Caesars, Penn and Rush Street.

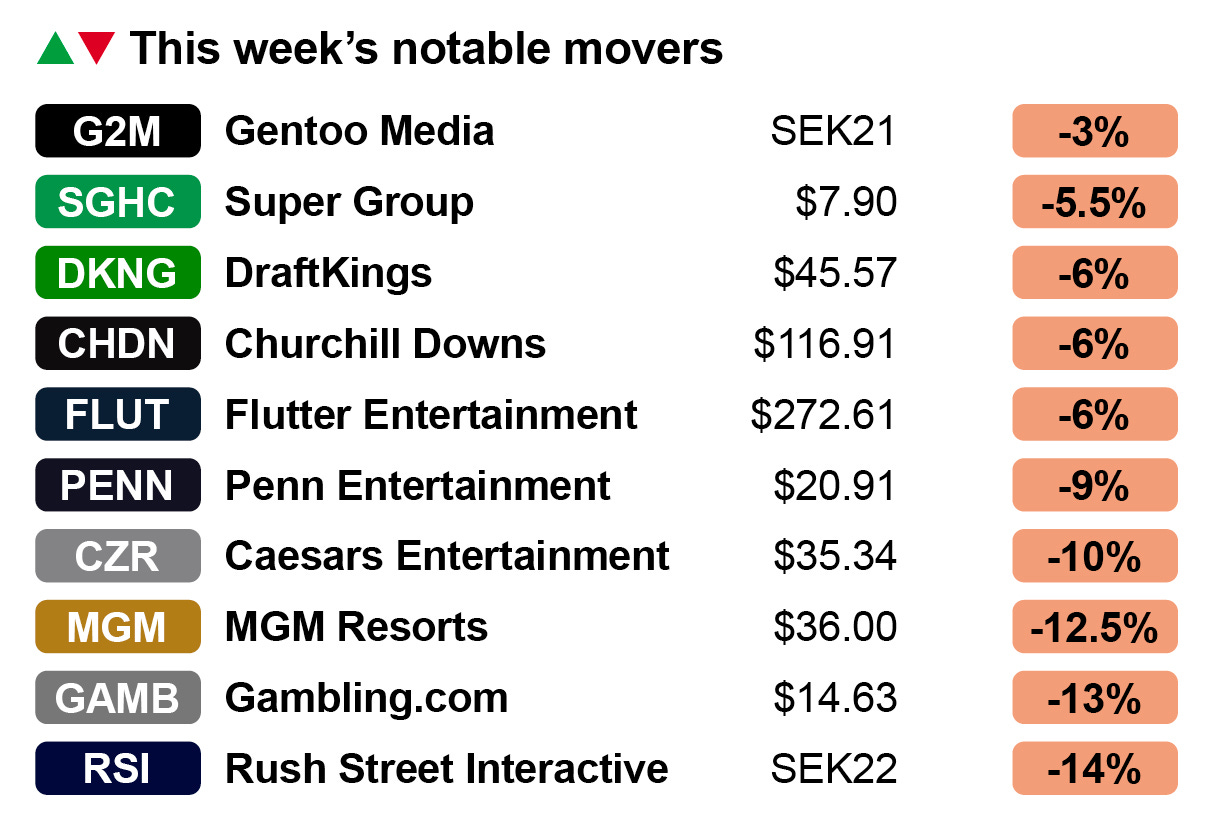

Meltdown: Fears over US consumer confidence hit gaming stocks.

The teardown: Polymarket’s prediction market volumes.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Neigh future

Unseated rider: A report from the British Horseracing Authority published last week appears to confirm that affordability measures instituted by the operators are having a damaging effect on betting turnover. But it is only one of many factors behind the fall in participation.

Turned over: The BHA report did not give detailed figures but said handle in 2024 was down 6.8% YoY and off by 16.5% from two years previous. The headline findings chimed with the data from the UK Gambling Commission for the year to March 2024.

The figures showed horserace betting turnover falling 8% to £11.5bn across retail and online combined.

The comparison between 2022 and 2024 saw a decline of over 12%.

WhatsApp me: Director of racing at the BHA Richard Wayman laid the blame for the falls directly on affordability checks, arguing they had resulted in people either “stopping betting or placing their bets with unlicensed operators where such checks don’t take place.”

Still, there can be no doubt the affordability checks instituted by the operators ahead of the launch of the Commission’s financial risk checks – the watchdog’s preferred terminology – are having an effect.

“The black market is very well run,” said a betting industry veteran source. “It’s enabled by WhatsApp and Telegram, you get paid, you get on easily and they don’t ask too many questions.”

Ahead at the turn: As Alun Bowden, analyst at EKG, pointed out on LinkedIn, at first glance the data on GGR from the Commission figures would appear to contradict the message that betting on racing is in decline.

As he noted, horse race betting GGR, retail and online combined, went up just under 5% between March 2023 and March 2024.

Margin was also up from 9.5% to 10.8%.

Handicap hurdles: But for racing this isn’t the good news that it would appear at first blush. Bowden argued “what is actually happening” is that with racecourses moving to a turnover charge for data and streaming rights, the operators have responded by increasing their overrounds and decreasing generosity levels.

“The net impact is increased margin and lower turnover,” he added. “Racing faces a huge number of problems in the UK but many of them are of their own making.”

The whip hand: Sources spoken to by E+M agreed that racing is not blameless when it comes to the decline in the attractiveness of the product from a betting perspective. “There are so many different factions in racing, all with their hands out,” said the industry veteran.

“So many people want to wet their beak all along the chain,” said another industry source. “And the main way to do that is the data and media rights.”

Track record: Against this backdrop, it is also clear that the relationship between racing and betting is fraying. Last year, Flutter got into a spat with Arena Racing over the costs of the racing coverage from the latter’s 16 racecourses.

The now departed CEO at Flutter UK & Ireland, Ian Brown, wrote an opinion piece in the Racing Post saying racing was an “unprofitable product with a shrinking audience.”

Festival bankers: For the time being, both the bookies and the horseracing authorities will be looking ahead to the Cheltenham Festival – one of the highlights of the racing calendar. But the relationship between the two is far from stable.

“I don’t see them abandoning the sport,” said one well-informed executive with knowledge of both industries.

“But it is a slow bleed of the customer base and there will come a push-comes-to-shove moment. It might be years hence, but it will bring big changes.”

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

+More

Bally’s management, including chair Soo Kim, are reported to have met with Australia’s Star Entertainment as well as its lenders and shareholders to discuss a potential buyout. According to the Australian Financial Review, Bally’s was said to be "finally in a position” to consider an offer. Bally’s recently completed the take-private transaction with major shareholder Standard General and the simultaneous merger with Queen Casino & Entertainment.

Better Collective institutional shareholder BLS Capital Fondsmæglerselskab has raised its stake in the gaming affiliate provider to 15%.

Thai a yellow ribbon: Macau gaming giant Galaxy Entertainment has indicated its interest in getting involved in the Thai market as and when the chance presents itself via the filing of a number of trademark applications in Macau, including Galaxy Thailand, Galaxy Bangkok and and Galaxy Hotel Bangkok.

Earnings this week

Reporting into the teeth of investor fears over the health of the consumer is Caesars Entertainment, which publishes its Q4 earnings AMC Tuesday. The analysts at Jefferies cut their estimates last week, suggesting it was due to competitive pressures in its regional casinos business and the impact of punter-friendly sports results late last year. The team sees Q4 digital adj. EBITDA at $28m vs. the previous estimate of $63m.

Penn Entertainment reports BMO on Thursday. Whether the management says anything about the ongoing proxy battle for boardroom representation launched by activist investor HG Vora is debatable. However, there will be further examination of the evident lack of success for ESPN Bet and doubtless the analysts will have questions about what happens next.

Rush Street Interactive reports AMC on Wednesday. As noted below, the latest news from the company concerned the government’s plan to impose 19% VAT on player deposits. The analysts at Citizens noted last week that RSI generates ~13% of its revenues from Colombia but made the point it was the players, not the operators, that are subject to the new levy.

More Earnings Extras this week will report on IGT, Light & Wonder, Super Group (all Tuesday), Kambi (Wednesday) and Golden Entertainment (AMC Thursday).

Market watch

Fun while it lasted: The problem with riding the crest of a wave is that waves, eventually, crash. So it was one week after a sector-wide wash of enthusiasm, which saw the leading lights enjoy double-digit gains, much of the ground was given up as investors took fright at the suggestion that the US consumer was not as healthy as was previously believed.

The S&P 500 fell 1.7% on Friday while the Nasdaq was off by 2.2% after a double hit from poor housing sales and consumer sentiment data.

A sea of red: With the wider markets taking fright, it dragged down the gaming sector’s leading lights, with MGM Resorts falling 12.5%, Caesars Entertainment off by 10% and Penn Entertainment down 9%.

Sector leader Flutter Entertainment, which last week burst through the $50bn barrier, was by Friday back down to $48.5bn after a 5% fall on Friday.

DraftKings also shed nearly 8% on the day, dragging its market cap down to $22bn.

Rush downwards: The biggest faller on Friday, though, was Rush Street Interactive, which fell over 11% on the day, leaving the shares down 14% for the week, as the consumer gloom added to stock-specific fears from earlier in the week over the impact of a new tax in Colombia. RSI reports AMC Wednesday.

Back in Europe, gaming affiliate Gentoo Media also suffered a negative week despite continued buying from board member and major investor Mateusz Juroszek.

Via three separate transactions last week, Juroszek’s MJ Foundation Fundacja Rodzinna added a further 800k of shares via three separate trades.

The Juroszek family now own 24.9m shares or 18% of Gentoo.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

Meet the GeoComply team at SBC Rio this week (booth #A250) and learn how their advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Earning TL;DR

Diverging traffic: VICI Properties and Gaming & Leisure Properties put their best feet forward on Friday in consecutive earnings calls, but the messaging from each diverged in both tone and substance.

Glamour: While GLP’s CEO Peter Carlino spoke about his company’s “commitment to the gaming space,” the first part of the call from VICI dealt with what Carlino’s peer Ed Pitoniak described as the “meeting of minds” around his company’s $300m investment in the One Beverly Hills project.

Pitoniak said One Beverly Hills was “among the most compelling American luxury hospitality, retail and residential developments in recent history” and stressed the shared conviction in “the secular strength for years to come of experiences.”

Over at GLP, chief investment officer Matthew Demchyk reiterated the company’s strategy was “rooted in a conservative financial approach.”

Operationally, there were also differences, with VICI guiding to an increase in AFFO while GLP said its guidance was slightly down.

GLP said Q4 revenue rose 5.6% YoY to $390m while AFFO grew 5.1% to $270m. VICI reported revenues up 5% YoY to $976m and AFFO up 5.4% to $601m.

For more on the REITs, see the Earnings Extra being sent later today.

The teardown – Polymarket

Nothing can stop us now: The expectation with the frenzy caused by the rise of prediction betting during last November’s presidential election was that consumer interest would soon wane. That was, at least, until the main providers Kalshi and Polymarket made the leap into sports-based markets.

As can be seen from Polymarket’s volume data from the past 13 months, the election peak in October and November is clear.

Breaking down the data, the Presidential Winner market was worth $1.54bn in volume in October and a further $733bn in November.

The lives of others: The focus shifted post-election, and the Super Bowl became the prime sports market at the tail end of last year and into January, with monthly volumes of $187m in November, $125m in December and $31m in January.

But in each month the total was eclipsed by the somewhat opaque ‘other’ category – i.e. every other political, financial and cultural markets available on Polymarket.

‘Other’ was worth $1.2bn in November, $1.4bn in December, $1.3bn in January and accounted for all but a tiny sliver of the $448m in February to date.

These levels of volume come from a global user base that, according to Token Terminal, has risen from a mere 3.5k this time last year to over 419k now.

A brief history: It is worth emphasizing that the crypto-based Polymarket is a different concept to Kalshi and exists outside of any regulatory regime. CEO Shayne Coplan has had a run-in with the FBI who raided his Manhattan home post-election.

The French and Singaporean authorities are the two countries that have attempted to block access to the site.

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

Upcoming earnings

Feb 24: Playtika, Ainsworth

Feb 25: Sportradar, IGT, Super Group, L&W, Caesars

Feb 26: Kambi, Galaxy Entertainment, Star Entertainment, Rush Street

Feb 27: GiG Software, Penn Entertainment, Golden, Accel

Feb 28: Melco Resorts

Gambling.com Group [Nasdaq: GAMB] is fueling the online gambling industry with unmatched performance marketing solutions. Leveraging proprietary technology, a diverse portfolio of premium websites, and the newly acquired consumer-facing OddsJam and B2B service provider, OpticOdds, $GAMB connects operators to high-value players across the globe.

Positioned as a dynamic leader in the sector, Gambling.com Group is an engine of growth and profitability, backed by a proven track record of driving revenue for operators in sports betting, iGaming, and beyond.

Visit our investor page to see why it’s the platform behind the industry’s most successful operators.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.