CEO Tom Rundle talks about the long game as Dabble hits profitability.

In +More: Fanatics smashes it again in New York handle, not so much in GGR.

Markets: Evolution and Hacksaw hit the skids on LA lawsuit news.

The teardown: What happened in Las Vegas in July?

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

Dabble-decker

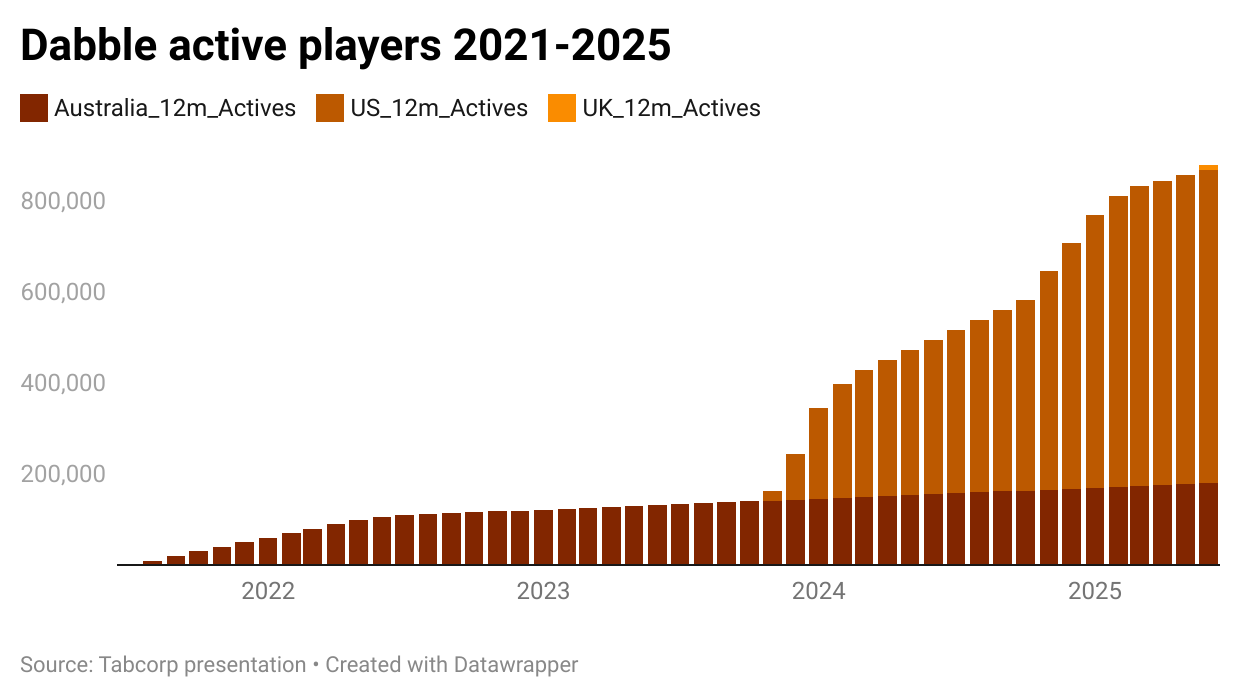

Social networking: Australian DFS+ and OSB operator Dabble is beginning to look like one of the industry’s more intriguing growth stories blending social media mechanics with betting to carve out a distinctive – and now profitable – niche.

CEO Tom Rundle insists the company is “more like Instagram” than a betting site.

“Yes, you can get a bet on, but essentially we are placing ourselves as being community driven,” he says. “We want to create a richer experience”.

Hey, hey, into the black: As revealed by shareholder Tabcorp’s FY25 earnings last week, that proposition has now delivered profitability.

After reaching break-even in 2024, Dabble has achieved what Rundle describes as “control over where we invest our capital,” allowing the business to expand internationally while remaining “capital light.”

The approach is already paying off in the UK, he says, where Dabble is acquiring profitable customers aided by a reliance on referrals rather than costly marketing.

Look before you leap: Dabble began in Australia in 2021 with fixed-odds horse racing before broadening into sports, but it was the leap into the US in late 2023 that was its defining test, competing in the DFS+ space against PrizePicks and Underdog.

As per last Friday’s E+M, DFS+ is currently contested regulatory territory.

Notably, rival PrizePicks, rumored to be on the verge of being sold, recently moved from DFS+ to P2P across its whole offering.

Rundle says Dabble is a “pre-regulated” offering in anticipation of further clarity on fantasy and betting delineations.

Expansion will continue in 2025 and beyond: Ireland is due to launch within six months, with North America OSB, Canada, Brazil and parts of Europe firmly on the radar.

But Dabble’s long-term ambition is not modest. “We want at least 5% of the global betting business,” Rundle says.

Keeping tabs: One factor enabling this steady expansion is Dabble’s shareholder base. Tabcorp acquired 20% of the company in 2022 for A$33m ($21.6m), taking a board seat but otherwise adopting what Rundle calls a “hands-off” stance.

“They have always been a very hands-off investor,” he says, noting the freedom this has given management to chart their own course.

A star in the making: Tabcorp, for its part, highlighted Dabble as a bright spot in its FY25 results last week. CEO Gillon McLachlan told analysts the investment remains “just a passive financial investment,” but one that is turning out to be a good one for Tabcorp.

CFO Mark Howell went further, pointing out that FY25 marked the first time Tabcorp recorded a share of Dabble profits.

McLachlan added that no further cash injections were envisaged. “We don’t think there’s going to be any more capital required from us,” he said on the call.

Focus: Rundle is candid that potential corporate activity will remain on the table, but he cautions that M&A can be a distraction. “So you really have to be careful about whether the synergies are there,” he says.

Still, he acknowledges that in the US, where state-by-state restrictions complicate market access, M&A “might be the route to get access.”

Destination X: Beyond that, an IPO is under consideration. “It’s definitely something we are having ongoing discussion about,” Rundle says. “The question then would be: which exchange?”

But Rundle points out the founder group still controls close to 50% of the business, alongside Tabcorp and early VC backer Yolo.

This gives Dabble both the independence and the financial flexibility to pursue global ambitions without rushing into dilution.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

Game time: The AGA estimates that $30bn will be wagered legally in the US on the NFL this coming season, representing an 8.5% YoY increase.

Family viewing: MGM Resorts and Playtech have announced an expanded live casino offering, with the launch of the classic game show Family Feud to be streamed from a studio located on the MGM Grand’s casino floor.

Bitterly contested: Novomatic has launched a full takeover offer for Ainsworth Game Technology after a significant bloc of the current ownership of Ainsworth rejected the previous scheme of arrangement. Novomatic now controls nearly 53% of the shares and the Ainsworth board has unanimously recommended the new takeover bid.

By the numbers

New York: Fanatics is starting to dominate the New York OSB handle landscape, once again grabbing top spot in the week to August 24, with a take of $213m or 39% of the total handle of $544m. Jefferies noted that reports suggested Fanatics’ success the week previous (to August 17) was down to a single wager of $100m, and the analysts suspected the same this week. Notably, however, Fanatics managed a mere $441k in GGR, while DraftKings was in top spot with $15.5m, followed by FanDuel on $14.2m.

Macau: The summer’s momentum continued into August with GGR hitting another post-pandemic record at $2.76bn, just exceeding the high set in the prior month of $2.73bn and up over 12% YoY.

Earnings extra

Intralot

A new day dawns: At some point in Q4, assuming the announced deal to buy Bally’s international interactive business for €2.7bn in cash and shares goes ahead, Intralot said during Friday’s earnings call that the company will be almost completely transformed. Once completed, Intralot’s pro forma earnings profile will be distinctly skewed to B2C, with 73% coming from that segment.

See this morning’s Earnings Extra edition (PRO subscribers only).

Earnings in brief

Rivalry: The GenZ-focused betting site saw some immediate returns from the restructured business model it initiated in late 2024, with net revenue up 24% sequentially to C$1.6m ($1.16m) despite flat marketing spend, and with a 62% YoY drop in operating expenses. Net revenue per player rose QoQ by 49% while CAC payback has been shortened to 1.5 months.

Markets

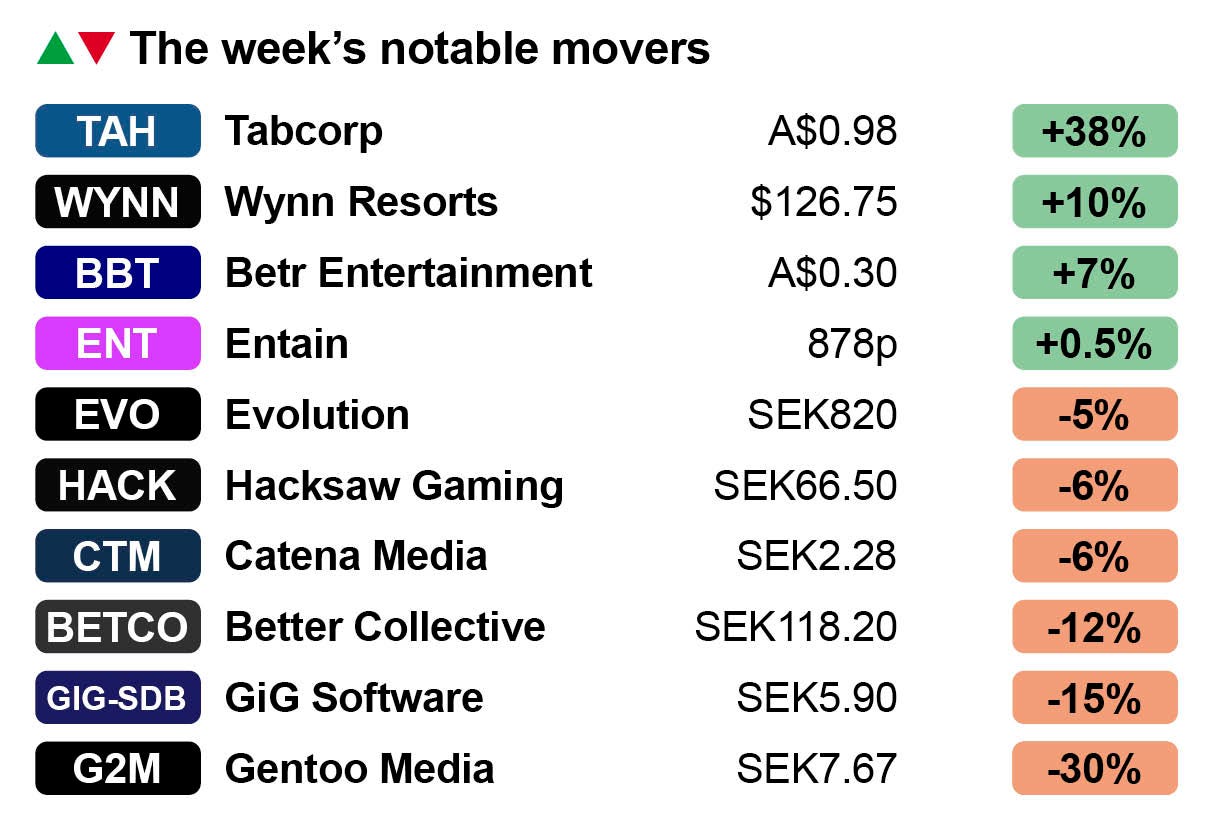

LA law: Evolution and Hacksaw Gaming saw their respective share prices come under pressure late on Friday after news emerged that both had been named as co-defendants in a suit brought by the Los Angeles city attorney against Stake.us.

Evolution fell nearly 5% on the news while Hacksaw Gaming saw its shares ship 6%.

Alongside Stake and its related streaming site Kick, city attorney Hydee Feldstein Soto’s suit also names games studio suppliers.

E+M wrote recently about how regulatory uncertainty continues to dog Evolution.

Ahead of the game: Wynn enjoyed a good week, rising nearly 10%, off the back of indications that the Macau numbers for August – see ‘By the numbers’ above – would indeed be quite as good as they proved to be.

The analysts cautioned that the start to this month would be “critical” to see whether there is some continued strength ahead of October’s Golden Week.

Tabcorp enjoyed the best week as investors warmed to its profitability messaging on Dabble. The news came with the company’s FY25 earnings, which showed Tabcorp reporting a sharp turnaround for the year to June.

Staying in Australia, Betr Entertainment was also up 7% post-earnings and despite it looking unlikely its all-share offer for PointsBet will beat Mixi Australia’s all-cash offer.

Entain will be happy that its share price barely moved on the news that former CEO Kenny Alexander and 10 others have been charged by the Crown Prosecution Service over criminal allegations related to Turkish gambling operations.

It was a bad week for the listed gaming affiliates. Gentoo Media was down 30% after it followed up Better Collective’s negative messaging on Brazil with similar comments about the disruption in the newly regulated market.

Better Collective was itself down 12%, while Catena Media was off by 6%.

“My new VIP will have a quick, smooth, seamless journey, please. Extra sugar.”

“Coming right up. What about that potential fraudster?”

“Hmm. Let’s make it extremely diligent with a little more friction—throw in a side of IDPV.”

IDComply’s intelligent KYC process triggers 800+ risk checks at the very beginning of the player journey, gathering rich device, location, and user intelligence as soon as a new user knocks at your door. This instantly gives you a clearer picture of who is entering your platform—so you can tailor your onboarding experience to match their intent.

From there, you can decide whether to roll out the red carpet by streamlining their onboarding experience or take a closer look by triggering step-up verification. We’re helping top operators achieve industry-best pass rates of 90% to 95%—get in touch for a deep dive on what this looks like for your platform. Let’s grab coffee?

The teardown – Vegas paradox

Saved by baccarat: July’s Nevada prints delivered a split screen: casino win on the Strip rose 5.6% year over year to $749m, yet the hotel side sagged with double-digit declines in both visitation and RevPAR.

This was less like a broad-based demand surge and more like a month saved by baccarat math.

Slots were steady with handle up 5% and GGR 2.2% ahead YoY. Non-baccarat table revenue fell 8.9% despite a slight uptick in drop, while baccarat revenue jumped 79% on a big hold rebound, up 17.5% vs. 8.8% this time last year.

In short: Higher win rates, not broader play, did the heavy lifting, a framing that is echoed elsewhere. Truist noted that Strip GGR was down 2% when you take out baccarat, and likewise down 2% on a normalized-hold basis.

Citizens went further, saying hold-adjusted Strip revenue would have fallen 3%, with a soft mass backdrop partially masked by better VIP luck.

Now the other screen. Truist pointed out that July visitation was down 12% YoY and Strip RevPAR also fell 12%, with weekend occupancy down 4% and midweek off by 9%.

While convention attendance rose 11%, it wasn’t enough to offset leisure softness and Truist pointed out that August month-to-date data continues the trend: RevPAR was down 8% and ADR was off by 5%, while occupancy was down by 4%.

Citizens also flagged a three-month skid in air traffic, with May down 4%, June off by 7% and July down 6%, consistent with a summer slowdown.

No accounting for taste: The analysts noted two nuances to the data. First, July 2024 had an accounting quirk that pulled a full Fri-Sun of slot revenue into that month, creating a tougher slot-revenue comparison this July.

Second, baccarat’s “easy comp” – last July’s historically low hold – made this July’s hold-driven bounce look better than underlying demand.

Adjust for both and the picture is one of mass-led moderation, not momentum.

Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, chief strategy officer: Matthew@edgemarkets.io

Upcoming earnings

Sep 4: MGM Resorts @ BofA conference

Sep 5: Genius Sports @ Citi TMT conference

Sep 11: Playtech FY

Sep 18: Super Group Investor Day

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.