A global market leader faces the question of what happens next?

In +More: Entain reiterates 2024 guidance for BetMGM.

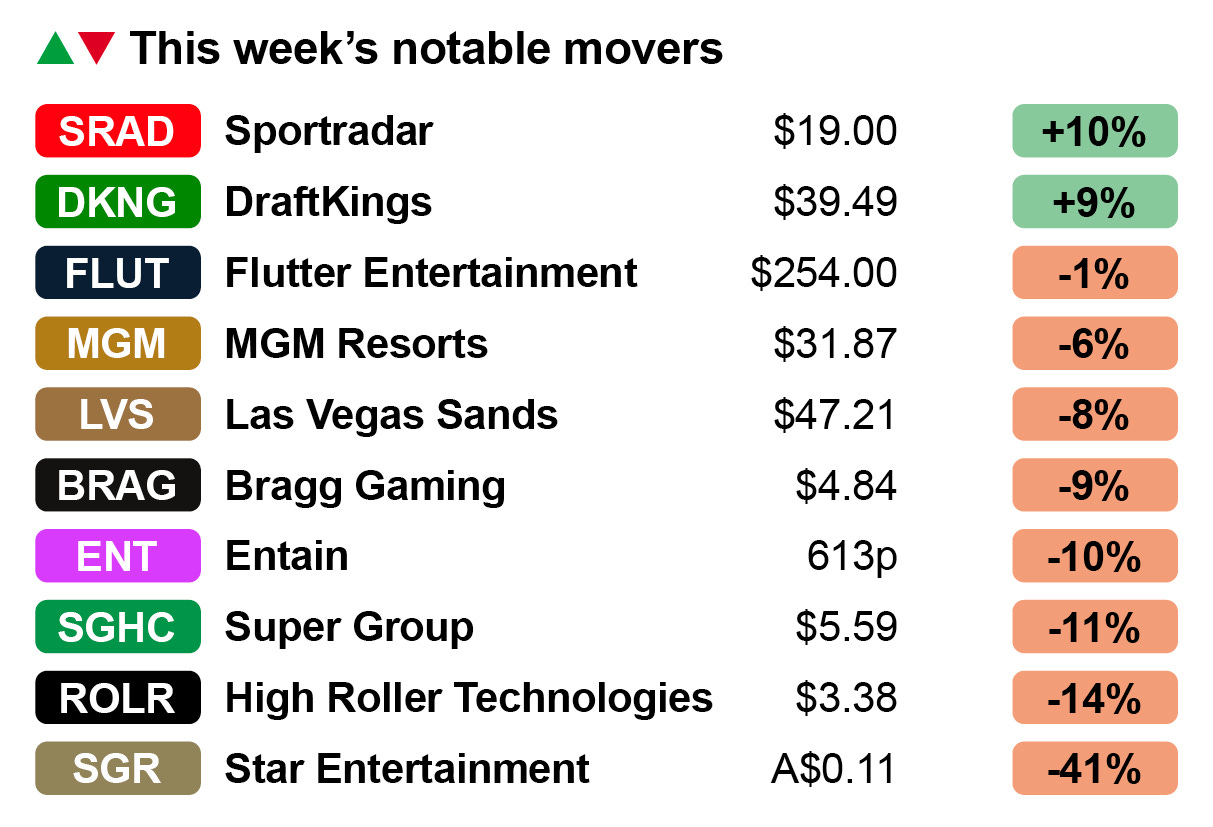

Markets watch: Investors lose their faith in Entain, again.

By the numbers: Fanatics makes a mark in New York.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Next steps

Uncertain smile: Bet365 controls an enviable place in the global betting and gaming space and has a remarkable history. But its recent annual results have prompted questions among observers over what happens next at one of the UK’s greatest modern business stories.

The Stoke-on-Trent firm is hardly a company in trouble: Revenue in the year to March was up 9% to £3.7bn and operating profit rebounded to £396m.

As the analysts at Regulus pointed out, the company has cash on the balance sheet of £1.8bn.

Off the pace: Hence, any disappointment at lackluster growth is “perhaps therefore relative.” Yet, the team suggested bet365 is “only” growing single digits in a double-digit growth environment amid increasing signs that it is off the pace.

Namely, competitors have caught up with in-play, it is less geared to mass market parlay growth, it is poorly positioned in gaming and it is seeing an unwinding of VIP and gray market positioning.

“The future of bet365 has never been more clouded,” suggested one corporate advisor, who requested anonymity.

Another argued that results showed “the once mighty bet365 is not as invincible as it once was.”

D&A: With almost any other large company in the sector, the answer to any hint of malaise is M&A. But this has never been the answer at bet365, noted the sources who spoke to Earnings+More.

“It has never bought big before,” suggested the corporate advisor. “The view has always been that it can do stuff better organically.”

Name recognition: Most M&A in the sector involves buying another brand name, but bet365 has no need for this because “it already has the top brand name in the sector,” said another corporate consultant with extensive experience in transactions, who added “Flutter would kill for a single global brand like this.”

Bet365 “doesn’t have a multi-brand approach and I don’t think they ever will,” said another source with extensive industry knowledge.

“Buying competitors has just never been part of its DNA.”

Not for sale: Conversely, a buyout seems implausible, at least for now. The closely held company has a flat management structure and sources suggested that only if either Denise Coates or brother John “fell out of love with the game” would an exit be contemplated.

“You don’t build a business like this without real drive and passion,” said the corporate consultant.

“They don‘t need the money, so unless they become fed up and disheartened, I don’t see a sale happening.”

The big what if? A disinclination to sell on the part of the Coates doesn’t mean, however, that it isn’t eyed "covetously,” as one source put it.

“If the stars aligned, DraftKings would be first in line,” they added. “But there would be others: Fanatics would be high up the list, that is private right now, of course. And MGM.”

“For any of the Americans, it would be massive.”

Overpaid, oversexed and over here: Such a dramatic turn of events wouldn’t come with its controversies. Asked what the likely reaction would be to DraftKings CEO Jason Robins walking into bet365’s Stoke headquarters as the new owner, one source simply laughed.

“I think the Coates have possibly had approaches,” said the corporate advisor.

Making an exhibition of yourself: The other route would be a public offering, with bet365’s evident progress in the US market being crucial. “It has the nexus to support a US listing,” said one source.

But another industry source suggested that neither of the Coates “would want to be public company executives.”

Any arrangement along those lines would have to be in “conjunction with some sort of succession plan,” they added.

Unwelcome attention: The company’s position as one of the UK’s most successful private companies hasn’t stopped the criticism in the press of, in particular, Denise Coates’ pay.

The attention has been shouldered to date but that might change. “Ultimately, it comes down to what the Coates want,” said the corporate consultant.

“What do the Coates family actually want out of this?” asked another advisor. “I'm not sure there are any next-gen leaders there. Legacy becomes important.”

As you were. For now: Asked whether bet365 is faltering, the corporate consultant said they “don’t think there is a black and white answer.” Similarly, the Regulus team concluded the company’s future might be a toss-up.

“Whether a management team famous for its operational effectiveness chooses a different strategy to deliver growth or whether the UK’s most successful online family business will remain a cash machine remains to be seen.”

“I’d love for it to be in play,” said one sector advisor. “But I haven't heard anything to suggest they are thinking about that right now.”

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Visit GeoComply at ICE Barcelona (booth #5L16, Jan 20-22) and learn how our advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

+More

Breaking: Entain has issued a trading statement reiterating its 2024 guidance, including that of BetMGM, saying that despite customer-friendly results in Q4 it is sticking with its previously communicated FY24 EBITDA losses for BetMGM of $250m.

Recall, Flutter blamed historically bad NFL results for a profit warning last week.

In line with Flutter’s statement last week on its rest of world business, Entain said that following operator-friendly sports results in Q4, it now expects group EBITDA to be at the top of the £1.04bn-£1.09bn range.

BetMGM will report on February 4 and Entain a month later. See market watch below for more on Entain.

Las Vegas Sands said on Friday it has made a $963m payment to the Singapore government in return for a lease on the land earmarked for its MBS II expansion.

DraftKings announced a partnership with Delta Air Lines at last week’s Consumer Electronics Show in Las Vegas. A travel industry blog noted that gambling on aircraft remains illegal, but that a “SkyMiles-earning for sports betting” might be plausible.

J&J Gaming has completed the acquisition of Leisure Gaming, a Nevada-based route gaming operator, following the approval of the regulators.

Sportradar has announced it will be showcasing its AI capabilities through a live 3x3 basketball demonstration at ICE Barcelona.

Markets watch

Unlucky general: All the good work being done by CEO Gavin Isaacs to steady the ship following the uncertainties of the Nygaard-Anderson era at Entain are in danger of being undone by shareholder apprehension over what comes next, going by recent share price movements.

From a low point in August, the shares soared by over 60% in the subsequent four months to hit 820p in mid-December.

However, the news of the investigation launched by the Australian authorities into Entain’s operation there has knocked confidence in the company.

Hit and hope: The shares are now trading over 20% below that level and were down nearly 10% last week. No surprise then that there should have been a note from the analysts at Peel Hunt last week suggesting investors should “go on, have a look, you might be surprised.”

“Most of Entain’s value is in the US and UK: BetMGM appears to be on track for profit and the UK regulatory environment is settling down,” the team wrote, no doubt with crossed fingers.

The team at Jefferies said today’s trading update should act as a restorative and provide a positive catalyst for the shares.

🪃 Back where we started: Entain’s last six months

Fallen at the first: Leading the fallers last week was Australia’s Star Entertainment, a company for which the appellation ‘troubled’ has become permanently attached.

The shares were down 41% on the week after the company issued a statement on Thursday that appeared to show cash reserves dwindling even after the receipt of the first tranche of a A$200m rescue package.

A report in the Australian Financial Review last week suggested the company could be in voluntary liquidation “within months.”

The dog that didn’t bark: Perhaps surprisingly given last week’s news from Flutter about Q4 sports-betting margins, DraftKings ended the week up 9% after it signally failed to issue its own warning.

At least for now, DraftKings is sticking with its guidance from early November when it lowered estimated 2024 adj. EBITDA by 30% at midpoint to $240m-$280m.

Last week, the analysts at Wells Fargo slashed their Q4 adj. EBITDA forecast to $63.9m from $183m and took a knife to their FY24 estimate, down from $275m to $157m.

Recall, Flutter said adj. EBITDA would be 7% down at $505m. Its shares were down 1% on the week.

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

Analyst takes

Asp bite: Wynn Resorts’ acquisition of Crown London announced last week was welcomed by the team at CBRE.

While the decline in London casino VIP is long-standing and pre-dates the pandemic, the Aspinalls Mayfair casino still caters to an international crowd from countries including India.

“Aspinalls hosts a regular Bollywood Night, and India is one of the top feeder markets for tourism to the UAE,” said the analysts.

They added that “importantly” Aspinalls is a high-end gaming asset with high-intent customers, making it a “more deliberate customer acquisition channel relative to a branded hotel strategy or partnership.”

By the numbers – New York

Friendly fire: Weekly handle came in at over $600m in the week to January 5, the largest ever total since the market opened three years ago. The figures for December, meanwhile, showed handle of $2.28bn but GGR coming in at a lowly $150m.

Recall, Flutter blamed consumer-friendly sports results on December 30, in part, for its profit warning last week.

Despite posting handle of $925m, market leader FanDuel generated GGR of just $70.6m or an implied hold of 7.6%.

Fan pleasers: In market share terms, FanDuel held on to 46% market share while rival DraftKings generated $46.5m for 31% share.

But it is notable that Fanatics once again claimed third spot with $9.8m in GGR for 6.5% share, ahead of BetMGM on 6% and Caesars with under 6%.

Since taking over the license from PointsBet in April 2024, Fanatics has substantially improved upon its existing market share, more than doubling from 3% in April to 6.5% in December.

Fanatics’ highest ever level of share came in October when it earned a 7% share of GGR.

Its highest single month take, however, came in November when it earned $13.8m in GGR.

What we’re reading: Michael Rubin, Fanatics’ founder, in the London Times on why the company is really going “all-in” on gambling and says the company will eventually IPO but only after sports betting is profitable.

“In commerce we are a leader, in collectables we are a leader, but in gaming we are a challenger. And I f***ing love that. I love all the people who say Michael Rubin’s going to fail in gaming. Great. Keep talking your sh*t. Let’s see what happens.”

ESPN Bet watch: Struggling in New York with a GGR total of a mere $1.3m, or less than 1% share, was ESPN Bet. The picture is, if anything, worse in Iowa, which also reported December numbers last week where it made zero GGR, leaving its grand total for 2024 at $5.5m or 2.5% share.

Things look brighter in Indiana where ESPN Bet managed a 6% share in 2024 and an 8% share in December, up from over 6% in November.

It should be added these are still small numbers. That 8% share was worth $2.5m in December and the 6% in November came from GGR of $4.4m.

The analysts at Deutsche Bank noted, though, that handle share was at 3.5%, putting it in sixth place.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Earnings calendar

Jan 22: Las Vegas Sands

Jan 23: PointsBet

Jan 29: BlueBet

Jan 30: Evolution, Rank

Jan 31: Red Rock Resorts

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Unlock complimentary access until year-end at www.opticodds.com.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.