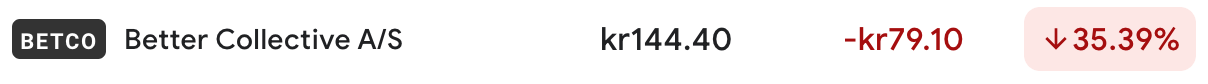

Better Collective share price plummets 35% in early trading after warning.

Boyd Gaming talks up its ‘regional iCasino’ opportunity.

Churchill Downs bangs the HRM drum.

Earnings in brief from GLP, Kindred, Svenska Spel, Zeal and Smarkets.

Tryna find the right time to tell you what you might not like to hear.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Fallen star

The harder they come: Gaming affiliate behemoth Better Collective yesterday issued an after-hours profit warning, saying EBITDA for the year would come in 25% below previous forecasts at midpoint.

Better Collective also announced it would be looking to find €50m of cost savings via unspecified synergies.

The news hit the share price, which dived 35% in early trading in Stockholm.

Better Collective’s warning comes in the same week that rival Catena Media also announced a cost-cutting exercise that will result in 29 job losses.

Throw your hands in the air, if youse a true player: But to further complicate the picture, Gentoo Media this morning sought to steady the nerves of investors in the sector with a trading update, saying Q3 revenue would come in on target at €30.4m with EBITDA margins steady at 46-48%.

It added it was “confident” in achieving its forecast revenues of €125m-€135m for the year.

“Despite market volatility, our disciplined revenue-sharing model continues to drive sustainable success,” said chair Mikael Harstad.

Also this week, Sportradar said it was hoping to mark its entry into the gaming affiliate space via the acquisition of XLMedia’s North American-facing assets.

Keep the faith: Better Collective blamed the downturn on lower revenues from the US and what it said was a “continued slowdown” in the Brazilian market. But, it remained “confident” in the long-term prospects for both markets.

Right sizing: The company said the cost-saving program comes in the wake of recent major acquisitions and “market conditions.” Sources suggested a widespread redundancy program would be central to the effort to achieve the hoped for annualized savings.

CEO Jesper Søgaard said that after completing 35 acquisitions since 2017 the complexity of the business had increased.

In its annual report, Better Collective noted it employed 1,200 people in 20 international offices.

Søgaard added that as “external market conditions shift,” it was important for the company to “recalibrate” its spending and investment strategies.

Roll up, roll up: Among Better Collective’s headline acquisitions are the $240m deal for Action Network in May 2021, the €105m laid out for Futbin in April 2022 and the acquisition of Playmaker Capital for €176m in November 2023.

Its most recent deal was the €42m buyout of AceOdds in May. In total, the company has laid out ~€800m in less than seven years.

By the numbers: Revenue for the year is now expected to come in 11% down at €355m-€375m, down from €395m-€425m. EBITDA before special items is forecast at €100m-€110m vs. the previous target of €130m-€140m.

🍿The company will report its full Q3 earnings on November 13 with the call with analysts taking place the day after.

Whispers in the powder room: In Q2, Better Collective had indicated issues with the North American business, with organic revenue down 18% YoY. Søgaard said on the call that the US was “volatile” and was a “different animal compared to what we're used to given the fewer market participants.”

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Increase your GGR in just one month. Join top operators at www.opticodds.com.

+More

PrizePicks is set to launch its P2P fantasy sports contest Arena in Delaware and Missouri after receiving licenses to operate in both jurisdictions.

Betting exchange Sporttrade has gone live in its fifth state, Virginia. This follows a launch in Arizona in September. It is also available in New Jersey, Iowa and Colorado.

What we’re reading: The EKG newsletter runs through DraftKings’ deal for Dijon Systems’ golf pricing unit and likes what it sees, “given the math” of what the acquisition could do to the operator’s accretive hold.

Read across

Isle of scam: A UN report into organized crime firmly placed the spotlight on various entities domiciled and operating out of the Isle of Man, including King Gaming, and once again looked at the role played by TGP Europe as a white-label provider to Asian-facing bookies with murky backgrounds. See Compliance+More from Thursday.

Counterpunch: Meanwhile, Tuesday’s edition reported on the imminent plans by the new sweepstakes trade body, the Social and Promotional Gaming Association, to put together a self-regulatory Code of Conduct.

It’s a mystery: In The Token Word this week, the blockchain company accused by the Dutch gambling regulator of being the owner of BC.Game doesn’t deny it is the owner of the site, but did say it only learned of the regulatory fine through the media.

+More careers

The big move: James Prosser has been hired as affiliate provider Checkd Media’s first-ever growth director. He was previously at fellow affiliate and publisher business Spotlight Media.

In his new role, Prosser will be responsible for revenue and relationships in both North America and the UK.

Prior to that he was co-founder at Apsley Group International, owner of Myracing and Free Super Tips, which was later sold to Spotlight.

Lottery provider Scientific Games has appointed Matt Lynch as the company’s new president for digital operations. He replaces Sreve Beason who has moved to the position of chief innovation officer. Racecourse Media Group has appointed Nick Mills as CEO to succeed Martin Stevenson. He takes up the reins on November 4. Mills was previously COO at RMG.

Head of BI – Remote

LATAM Affiliate Manager – Remote

Operations Director – Malta

Hanging on the telephone

Call me anything you like but just call: Asked by analysts whether Boyd Gaming was open to further M&A opportunities, CEO Keith Smith said that while the company had “a lot going on” it was always looking to potential expansion opportunities.

“We continue to answer the phone,” he said.

Recall, in early summer Boyd was linked with a move for Penn’s regional gaming business.

To build a home: Smith was speaking after the Las Vegas Downtown & locals and regional casino operator produced well-received numbers, with revenue up 6% to $961m and adj. EBITDA rising 5% to $337m.

He said Boyd’s Nevada properties were benefiting from Las Vegas being “one of the fastest-growing job markets” in the US.

He noted that more than 14,000 new residential units were permitted over the past 12 months, an increase of 23% YoY.

Smith also extolled the value of Boyd’s online partnership with FanDuel and specifically the value of its 5% equity stake in the business.

After what he characterized as a “strong” Q3 performance for that business, Boyd has raised its FY24 online EBITDA guidance to $75m from $65m-$70m previously.

On top of that, Boyd has received $10m of non-recurring market access fees in Q3 and is set to benefit from a further $20m fee in Q4, bringing total online EBITDA to $105m.

Small is beautiful: He also spoke about the “small” acquisition of Resorts Atlantic City’s digital business in New Jersey, saying it complements its strategy of building a regional iCasino business.

Boyd is “trying to position ourselves so that when other states do approve iGaming, we’re ready to expand,” Smith added.

“Once again, we’re not trying to be a national leader.”

A rose by any other name

History making: Churchill Downs CEO Bill Carstanjen hailed the “exciting” soft opening of The Rose in Dumfries, Virginia, which took place this week, and promised the company would have a total of 5,000 HRMs operable in the state by the end of next year.

Carstanjen noted that at the time of the acquisition of P2E in 2022 the acquired company had only deployed 550 machines against the potential for the 5k as allowed by the state.

“We knew there was authorization to go to 5,000 and we’ve been executing on that,” he said.

Qualifying statement: The HRM business is “inextricably tied” to Churchill Downs’ ownership of the Colonial Downs Racetrack. Carstanjen added that, to cement its positioning, Churchill Downs is introducing a significant Kentucky Derby qualifying race, a first in the history of racing in Virginia.

HRM expansion also continues in Kentucky, where the company is looking to open a new facility in Owensboro early next year.

He said HRMs were a “key strategic focus” for the next 5-10 years, adding that they represented “high-growth, high-margin investments.”

He said HRM markets were “immature” and it was “spreading deeper into potential customer segments.”

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt.

Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally.

For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price.

To find out more, visit www.metricgaming.com

Earnings in brief

Gaming & Leisure Properties: Revenue rose 7% to $385m for Q3 while adj. EBITDA was up 6% to $356m. AFFO was up 7% to $268m.

CEO Peter Carlino noted GLP had completed “several accretive transactions” in Q3 with Bally’s, including the $940m financing for the permanent facility in Chicago.

📞GLP will host its call with analysts later today.

Kindred: In its swansong earnings announcement since being swallowed up by FDJ, Kindred said Q3 revenue rose 4% to £295m while underlying EBITDA soared by 49% to £63.4m.

However, the company noted that following the buyout it is set to exit dotcom markets, including Norway, negatively impacting its “ability to reach” its stated underlying EBITDA target of £250m for the year.

It said the French operations had “sustained strong momentum,” while positive outcomes also came in the Netherlands, Romania and Denmark.

Svenska Spel: The ex-monopoly operator said net revenue fell 9% to SEK1.78bn ($168m), a decline that was blamed on the Casino Cosmopol operation, which only had one outlet open during the quarter vs. three this time last year.

However, revenues at the sport and iCasino business were also down by 12% due to the imposition of tighter responsible gaming measures.

ATG: The Swedish horseracing and betting monopoly operator saw revenues fall 5% to SEK1.29bn ($122m) in Q3, saying it suffered from the increase in the country’s gaming taxes.

Zeal Network: The German-facing lottery reseller said revenue and EBITDA had “significantly increased” in the first nine months of the year due to good jackpots at the start of 2024, successful customer acquisition and a higher gross margin.

Revenue is now forecast to come in at €121m for the nine months to September, up 41% YoY, while EBITDA in the first nine months is up ~51% to €35m.

FY24 revenue is now forecast at €158m-€168m vs. €140m-€150m previously and EBITDA is expected to to be in the range of €42m-€46m vs. the prior estimate of €38m-€42m.

Smarkets: The FY23 accounts for the UK-based betting exchange and sportsbook challenger brand showed revenue rising 16% to £21m, despite average monthly active users falling by almost a quarter. The company produced a £2m profit vs. a loss of £17m in 2022.

CEO Jason Trost said 2023 has been a “reset year” after it had reviewed its operations and downsized the year previous.

Betmakers Technology: The Australian-based horseracing betting tech provider said Q1 adj. EBITDA loss came in at A$1.2m ($795k), down QoQ from A$3.2m.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Earnings calendar

Oct 25: GLP (call)

Oct 29: Caesars Entertainment

Oct 30: MGM Resorts,

Oct 31: VICI (earnings)

Nov 1: VICI (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.