Founder and CEO tells disgruntled shareholders to take a hike.

In +More: GAN and Scout Gaming earnings.

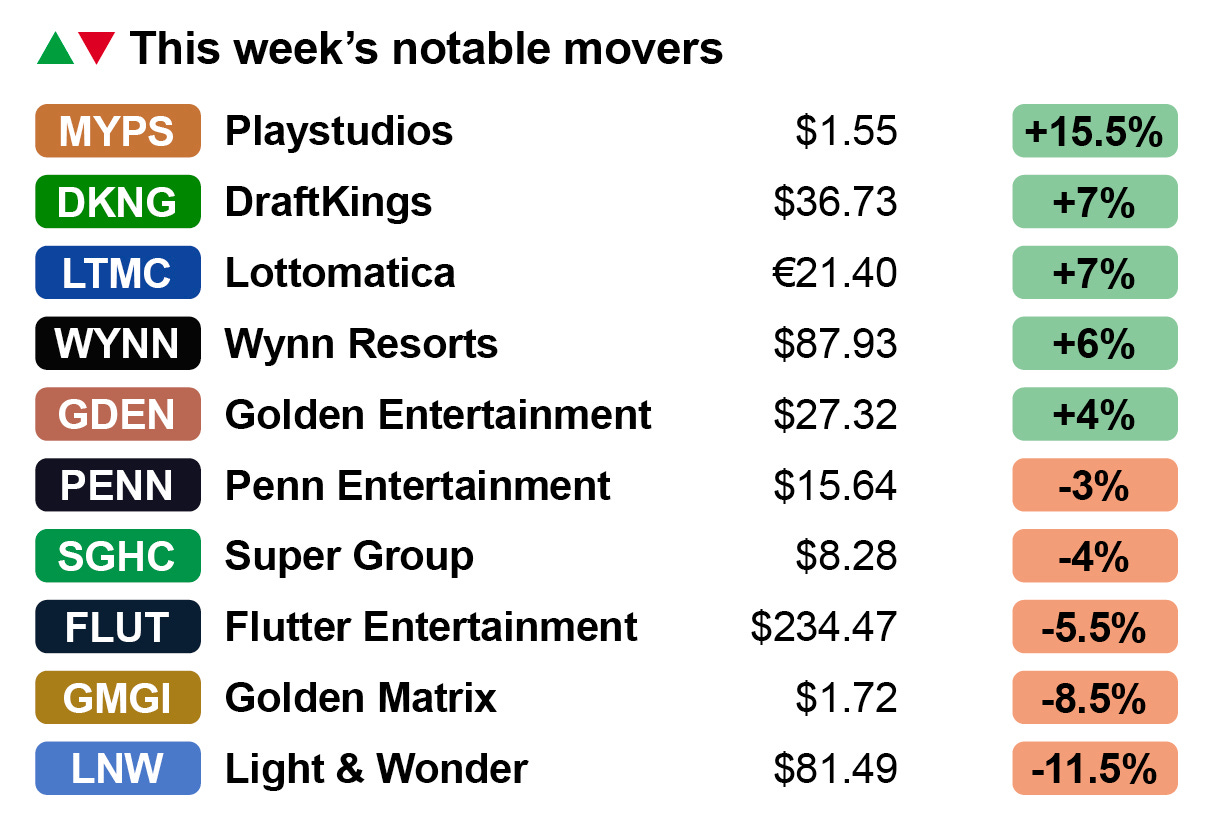

Shares watch: Playstudios investors get swept along.

The teardown: Are DraftKings’ long-term projections achievable?

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

Pressure cooker

Expletive deleted: VGW founder, CEO and 70% shareholder Laurence Escalante told shareholders on a Telegram chat that if they did not trust his judgment they should sell up.

According to the Australian Financial Review, a Telegram chat became heated as Escalante defended the sweepstake operator’s level of financial disclosure.

“We share what we choose to share and avoid legal complications and unequal information,” the AFR quoted. “Don’t trust us, don’t stay shareholders.”

The state of play: In the last financial figures available, the 2023 annual report released in September, VGW showed revenues hitting A$6.14bn ($3.95bn) and EBITDA of A$580m.

Laurence has joined the chat: The paper reported that Escalante popped up on a VGW investor chat where participants voiced their concerns over the Chumba owner dragging its feet on the setting up of an online investor hub.

The report added there were complaints about VGW moving to an annual reporting schedule having previously released figures every six months.

Privately owned companies over a certain size in Australia have rules around financial reporting.

Sweary Mary: Escalante, who admitted he had been on the chat for “years” but had previously stayed silent, suggested the company was within its rights to decide what information it wished to share publicly.

Escalante then went on to accuse another chat member of “talking shit,” saying the individual involved should “shut the fuck up” and “get off my register.”

He added that none of the participants on the chat had “any idea what the fuck we deal with.”

All talk: Sources close to VGW suggested the chat included 180-190 participants, of which around 30-40 were active. “They share articles, they talk about performance, they talk about Laurence, they talk about everything,” the source added.

In a statement, VGW said while the group was “not created by VGW, nor is it controlled by the company, we apologise if any recent commentary caused offence.”

The statement added that the changes in relation to the financial reporting were made in order for the company to remain as “efficient and focused as possible in a dynamic environment.”

Feeling the heat: The operator of Chumba Casino and Luckyland Slots has been under regulatory pressure in recent months and has received a succession of cease-and-desist letters, including in Maryland, Connecticut and Delaware.

However, sources suggested the Telegram chat was unrelated to the regulatory news and was more concerned with recent revelations surrounding Escalante’s personal life.

Push back: There was the suggestion, however, that the company might become more active in pushing back against the regulatory moves. In April, the company said it was “disappointed” with being issued with a cease-and-desist letter in Delaware.

Fincore delivers tailored tech solutions for the gaming industry. For 25+ years, we’ve helped clients modernise legacy platforms, accelerate product roadmaps, integrate complex systems, and turn AI into real-world impact.

+More

Ontario Lottery and Gaming Corp has selected Caesars Entertainment to continue as the operator of Windsor Casino following the OLG’s gaming modernization initiative, extending an original agreement that dates back to 1994.

Earnings in brief: GAN said Q1 revenue fell 4% YoY to $29.4m while adj. EBITDA losses widened to $1.5m from $0.6m, largely due to a 58% collapse in B2B revenues to $5.1m. B2C rose 32% to $24.3m, with growth in LatAm and Europe. The acquisition by Sega Sammy Creation is expected later this quarter.

Scout Gaming saw revenues climb 56% YoY to SEK12.4m ($1.3m), with B2B up 17% to SEK8.8m and B2C rising 56% to SEK1.9m. EBITDA losses more than halved to SEK1.2m.

Quick takes: Having distributed €1.8bn to shareholders or 60% of the then market cap, Deutsche Bank has reassessed Playtech and suggested its current multiple of 6x FY25 is “too cheap for a pure-play B2B technology company growing double-digit with nearly 80% of revenue now from regulated and taxed markets.”

The week ahead

The pace of earnings releases slows this week, starting with Sportradar later today, reporting barely a month since its investor day in April. Bank of America recently upgraded the stock to a Buy, saying the team now had “higher confidence” in the revenue outlook,

Also on Monday, Bally’s will release its earnings but, if Q4 is any guide, it is unlikely to host an analyst call. On Tuesday, IGT will report alongside Catena Media, which is opting for an after-hours analyst call. It will be followed on Wednesday and Thursday by fellow gaming-led affiliates Gentoo and Gambling.com. High Roller, also on Thursday, and Codere Online on Friday complete the week.

The earnings edit

DraftKings

A random walk: Having blamed hold issues for the cut announced overnight to its 2025 guidance, CEO Jason Robins was keen to stress this was an element of the business performance that was ultimately not fully within the company’s control.

See Friday’s Earnings Extra (PRO subscribers only).

Super Group

The player: CEO Neal Menashe said Super Group’s Betway brand had achieved a market dominance in key African markets, including South Africa, Ghana, Zambia and Mozambique, that was akin to the OSB duopoly in the US.

See yesterday’s Earnings Extra (PRO subscribers only).

Shares watch

Play for today: Top of the list this week is social gaming operator Playstudios, which reported last week. Investors are clearly enthused by what the company had to say about sweepstakes, with CEO Andrew Pascal telling the analysts it was “hard at work” on a move into that arena.

DraftKings will be happy enough with the response to its earnings call on Friday, with the shares up 2.5% on the day and 7% ahead for the week. See ‘The Teardown’ below.

Lottomatica will also be pleased with its earnings week performance, up 7%. Deutsche Bank said its forecasts look “well underpinned by a particularly strong start to the year.”

DraftKings’ rival Flutter Entertainment will be less happy with the week’s work, down 5.5% after a relatively disappointing Q1 report.

The team at CBRE said investors have become “accustomed” to beat-and-raise growth stories, but the lackluster response this week leaves room for future outperformance.

Light & Wonder will be more worried by the reception for its Q1 report, with the shares down 11.5% for the week. Despite the company insisting it is on course to hit its 2025 adj. EBITDA target of $1.4bn, Macquarie noted the growth trajectory is “choppy, not linear.”

GeoComply: Where advanced geolocation fights advanced fraud.

Gone are the days when detecting IP spoofs and blocking VPN use is enough to tick the “fraud prevention” box. Not when cybercriminals are using state-of-the-art tech and stolen identities to exploit iGaming operators through bonus abuse and fraudulent chargebacks (often to the tune of six to seven figures a month).

These aggressive attacks require forceful solutions. GeoComply’s Risk Research and Data Science teams have been using machine learning and adaptive intelligence to identify fraudsters masquerading as “real” players, immobilizing them before they can get away with stolen funds.

Ready to dismantle the fraudsters' playbook? GeoComply gives you the tools to stop them—all without having to onboard a new vendor or disrupting your legitimate players.

Visit the GeoComply booth (#D445) at SBC Summit Americas this week, or book a demo to schedule a deep dive.

The teardown – DraftKings

Rocky road: Are the long-term projections of DraftKings and its online peers achievable? Such is the question from Deutsche Bank, who suggested the “bumpy path to get there cast more doubt on the availability of said target.”

Moreover, the “every shifting” point of relevance and/or focus make it clear that “fundamentals mean little in this sector, with narratives, stories and nuances driving the majority of the trading dynamics.”

Is it something I said? The team added they often end up fielding questions along the lines of ‘why do you dislike these guys? Which, they said, “strikes us as odd.”

“For starters, we view the DraftKings management team very favorably, on both a personal and professional level, and we believe, from our end, the relationship is good,” the team added.

Agree to disagree: But, given their role to analyze trends and make an opinion, there are occasions when their views will differ from those of the management, and right now is, again, one of those periods. Three of these differences are sectorwide.

First, they pointed out the online sector is seeing “very little momentum” on iCasino expansion.

Second, there are multiple tax increases.

Third, handle growth is slowing and “should continue to slow into the single digits.”

Rosy cheeks: Finally, DB argued that DraftKings’ guidance ranges – albeit cut last week – still “look aggressive, notably beyond 2025.”

They added that they are also predicated on “add-back friendly" hold percentages, which they said they “don’t believe to be based in historical reality and have derivative pitfalls if they are eventually achieved.”

“All of this is taking place, while valuation multiples remain at levels that would make casino operators blush,” they team concluded.

DraftKings quick takes

Citizens also noted the ‘add-back’ issues, pointing out that between 2023 and Q125 there had been ~$800m of “lost” revenue from hold issues. The team added that DraftKings current multiple of ~12x 2025 EBITDA represents a drop from the 21x it was trading on last year and is a “sign of frustration” on the part of investors.

Truist said they thought there was “no sweat on the delta between structural vs. actual hold” and believed the company when it said it saw the “severe hold-related weakness” as being “truly random in nature, and still sees structural and actual hold converging over time.”

The social dumpster

An ill wind: Michael Schindler from Four Corners Advisors’ is none too impressed with Bally’s plans for a permanent casino in Chicago. “This is ill-planned, late and riddled with bad juju.” Pope markets: Prediction markets and the conventional wisdom have limitations when they become feedback loops, says Nate Silver. GOAT headline: ‘Rider at Giro survives encounter with run-away goat.’

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Upcoming earnings

May 12: Sportradar, Bally’s (earnings)

May 13: IGT, Catena Media

May 14: Gentoo Media

May 15: Gambling.com, High Roller

May 16: Codere Online

May 20: Light & Wonder investor day

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.