Concentrate! Evolution’s top 5 exposure up to 41%

Evolution earnings, PointsBet positivity, AGS debt move, Rank earnings +More

Evolution’s top client exposure rises by a third.

In +More: ’Kings James, Penn online leadership transition, Vegas Dec.

PointsBet hits cash flow positivity for the first time.

AGS reorganizes debt, pre-releases Q4 earnings.

History in the making, part two, it's so crazy right now.

Evolution earnings

The dominant live casino operator sees the revenue from its top five clients rise by a third in 2023.

Less is more: The percentage of revenue that Evolution derives from its top 5 clients rose to 41% in 2023 from 30% in 2022, while the percentage of revenue from its number 1 client fell 1 ppt to 13%. This is from a customer base of 800.

It meant the top 5 were worth €737m of the 2023 total revenues of €1.79bn.

While total revenue rose 24% YoY, top five revenues were up 69%; revenues from the top client were also on the rise, up 15% to €233m.

“Given that this customer has an implied live revenue footprint of over $2bn, we continue to see 1xBet as the most likely candidate, if not a reseller,” said the analysts at Regulus.

Don’t ask, don’t tell: Asked whether the company would consider greater disclosure around the names of its top 5 and whether some of the revenues would come from aggregators, CEO Martin Carlesund demurred, suggesting the company didn't see any benefit in breaking the numbers out further.

Regulus said the concentration percentage demonstrated the “strength of organic and M&A-led consolidation into brands within the casino market.”

🤔 Evolution’s revenue growth from top 5 clients

On air: Live casino continued its growth path in Q4, up 21% YoY to €406m, while the RNG segment continued to be anemic, down 4% to €69.8m. Regionally, Asia was the big driver, up 33% YoY to €182m. Europe was up 9% to €185m, North America rose 5% to €59.1m and LatAm was up 19% to €32.1m.

Carlesund said he was “very happy” with the North American performance.

He said Asia was a “very large number and that can be a bit lumpy,” adding that the growth in the region was ”significant.”

Fat city: Evolution raised its target for EBITDA margins to 69%-71% after margins in Q4 came in at 70.9%, meaning EBITDA was up 21% to €337m.

Fantastic voyage: Carlesund was confident on the call regarding growth in 2024, saying the roadmap for 2024 was “nothing but fantastic.” “Investment for the future will not only continue, it will accelerate,” he added. “As the leading innovator in live casino, we continue to relentlessly increase the gap to our competitors.”

But the Regulus team were more cautious, with a “more challenging” European and North American backdrop leaving a “testing and possibly dangerous Asia market as well as an attractive but small LatAm region to carry the growth.”

Join a Winning Team at InclineBet, the choice of industry leaders like Four Winds Casino, FanDuel, and Delaware North. We’re committed to partnering with you, offering expert User Acquisition, CRM, and Creative Services tailored for the gaming industry. Elevate your brand with our proven strategies. Unlock your iGaming advantage at InclineBet.

+More

King of ’Kings: DraftKings has announced Lebron James as a new brand ambassador. CEO Jason Robins said it was a privilege to welcome one of the “most influential and greatest athletes of all time.”

Penn Entertainment has announced the details of a leadership transition at its interactive business that will see the founders of theScore business, the Levy family, exit Penn Interactive by April.

Caesars has announced it will launch online sports betting in North Carolina on March 11 via a partnership with the Eastern Band of Cherokee Indians.

Meanwhile, WynnBet has become the latest operator to announce it is exiting the Massachusetts market after Betr said last week it would not pursue a license renewal.

The Tropicana Las Vegas will permanently close on April 2 when Bally’s ceases operations, according to the Las Vegas Review-Journal. The intention is that a new Tropicana will be built alongside the Oakland A’s ballpark planned for the site.

Spanish gaming operator Cirsa has priced a €650m debt offering. Proceeds will be used to repay existing debt.

Chilean casino operator Enjoy’s shares slumped as the company admitted it has been unable to pay its creditors and plans its second restructure in the space of two years. See LosIngresos+Mas (English version out tomorrow) for more details.

Genius Sports’ trading division has launched an automated pricing tool, called Edge, which it said “dynamically recalculates odds at a fixture and market-type level,” including for Bet Builder products.

Separately, rival Sportradar said its Alpha Odds automated odds recalculation tool delivered an average profit increase of 10% for clients in 2023, compared to the performance of its conventional odds product.

Stats Perform has announced it will provide its RunningBall and Opta product suite to Kindred’s new proprietary sportsbook platform.

By the numbers

Smashing it: The Las Vegas Strip delivered an all-time record GGR number in December of $905m, up 11% YoY with growth seen across both table games (up 12%) and slots (up 10%). Strip GGR in 2023 came in at $8.9bn, up 7% YoY.

Nevada GGR ex-Strip in December was up 6%, helped by the launch of Red Rock’s Durango locals casino.

Total Nevada revenue came in at $1.43bn, up 9% YoY.

Coming in hot: Macau GGR in January rose 77% YoY to $2.4bn, its second-biggest month since the market reopened and representing 77% of the level from the same month in 2019.

PointsBet positivity

We’re in the money: PointsBet hit cash flow profitability – just, at A$0.1m ($65k) – for the first time in the company’s history in the three months to December, with CFO Andew Mellor saying it showed the company is on the “path to profitability.”

Net win was up 11% YoY to A$69.9m, helped majorly by a 109% YoY leap in Canada to A$10.5m.

Australia was up a more modest 3% to A$59.9m, with promo efficiency a contributor to the improved margins.

Plugging leaks: CEO Sam Swannell said the company had managed to stop “unnecessarily leaking value” to bonus chasers. Asked about the competitive environment in Australia, he said it was “very rational,” adding that the major competitors in Australia – Sportsbet and Entain – are part of “global groups and need to operate within the bounds of their global strategies.”

Nearly there: Swannell noted ownership of 13 of the 14 licenses in the US had now been transferred to Fanatics. The final sale completion is likely due in April.

“With the final closure of the sale of the US business imminent, we're obviously at an important stage in PointsBet's journey,” said Swanell.

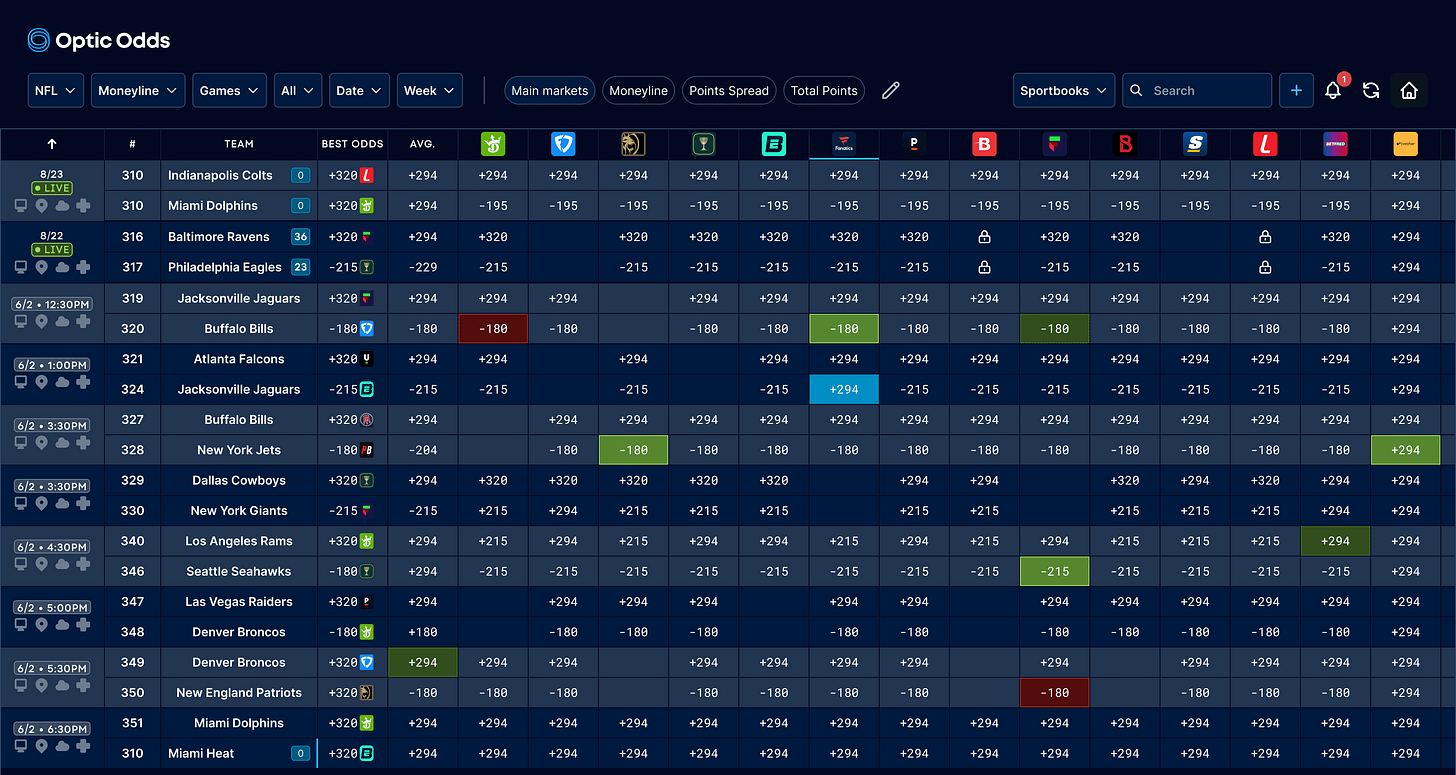

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

AGS refinance

Cheap at the price: Gaming supplier AGS received a share price boost after it announced it was exploring a refinancing of its term loan facility and will voluntarily repay $15m of its ~$549m of outstanding debt. Analysts at Truist suggested the company could save itself ~25 bps in its cost of debt.

The company also pre-released its Q4 earnings, saying it expected adj. EBITDA to come in at $41m-$43m on revenues of $92.5m-$94.5m.

Both are ahead of Street expectation by up to 9%. Macquarie attributed the figures to better-than-expected unit sales.

💵 AGS enjoys a decent week on refinancing news

Earnings in brief

Rank: The operator behind Grosvenor Casinos and Mecca Bingo said trading over the Christmas period had been robust but with a normalization in January. In the six months to December, it said like-for-like NGR rose 9% to £363m, with the venues business up 10% to £254m and digital up 8% to £108m.

The company returned to profit in H124, bringing in £10.4m in pre-tax profit vs a loss of £109m in the same period last year when its venues business were still affected by pandemic restrictions.

Groupe Partouche: The French casino operator said GGR rose 10% YoY to €701m, while operating profit rose 18% to €27.4m. Updating on its iCasino plans in Belgium, where it has previously struck a deal with Betsson, the company said it had gained a license via its Casino Middelkerke property.

Calendar

Feb 7: Kindred, Disney

Feb 8: Boyd Gaming

Feb 13: MGM Resorts International

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.