Flutter Entertainment announces $5bn buyback, upgrades forecasts.

MGM’s Halkyard says Japan is the “biggest opportunity” in gaming.

Analyst takes: Download charts and NFL hold factor discussed.

Sector watch looks at M&A ramifications in social gaming.

So now's a test to see if I got pull, hit the studio, 'cause I'm paid in full.

The $5bn buyback

Money bags: Flutter will commence with a $5bn buyback program in November that will see it acquire more than 10% of the company’s share capital at current prices. The shares rose nearly 10% in early trading before settling 5% up and leaving the company with a market cap of ~$45bn.

The buyback program will take place over the course of the next three or four years

Ample: It comes even as Flutter prepares the way to deploying $3.5bn in upcoming M&A, including recently announced deals for Snaitech in Italy and NSX in Brazil.

CEO Peter Jackson said the company had “ample cash” to pursue its goals of investing organically, value accretive M&A and the buyback.

Asked about entering adjacent markets such as lottery, Jackson was dismissive.

“We don't need to go into adjacent spaces,” he said. “We’re not tapping out in the markets we’re already in.”

TAM lines: The company also produced new medium-term guidance for 2027, with group EBITDA now predicted to hit $5bn from revenues of ~$21bn and producing $2.5bn of free cash flow. This compares with forecasted revenues of $14bn for this year and adj. EBITDA of over $2.5bn

By 2027 revenues from existing operations in the US are expected to hit $9.7bn with EBITDA of $2.4bn.

Operations in the rest of the world will see revenue come in at $11.5bn and EBITDA of $3bn.

Hard to beat: Jackson opened a mammoth four-hour investor presentation by arguing Flutter operates “at a level of unmatched scale” that the competition “simply doesn’t have.”

Urgh: “Our flywheel gives us an advantage that compounds.”

Despite a global TAM that Flutter estimates to be worth $370bn, he said the company’s market share was still “relatively small” and was “very fragmented.”

Work to do: Explaining the 50% increase in US TAM, FanDuel CEO Amy Howe said this was a function of seeing higher player values combined with a greater degree of iCasino penetration in the relatively small number of states that have legalized to date.

She added that the “advocacy work” undertaken by FanDuel was centered around “gearing up” for legalization in some of the biggest states, California and Texas in particular, while at the same time “building momentum” around iCasino expansion.

Jackson said FanDuel had “completely regrouped” after the disastrous California campaign in late 2022.

Raise the roof: Howe suggested consumer engagement with the product was “through the roof.” Noting the recent success in iCasino, she said FanDuel had “materially improved” the customer proposition.

In explaining some of the cohort analysis, FanDuel CFO David Jennings noted the growing revenue stream from existing customers gave the company a “huge moat,” with 85% of revenue coming from pre-2024 customers.

Think local, act global: At the heart of the proposition is what Flutter calls its ‘edge’, which Jackson described as a decentralized model of local teams with full autonomy and a “challenger mindset” but with global capabilities.

“That’s why we’re winning around the world,” he added.

The levers of power: Asked about how increased tax rates impacted the business, CFO Rob Coldrake said the company’s experience was it had “levers to pull in the event that there are some tax changes.”

“If you’re the scale player in the market, you have many more levers to pull to offset some of those tax changes,” he added.

“You’ll find that some of the smaller players have to make their products less appealing, push the prices up and reduce their generosity.”

Recall, rival DraftKings had to swiftly withdraw a plan to add a player surcharge in higher tax states after consumer pushback.

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook.

We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

Flutter analyst takes

A higher plane: The messaging around “continued aggressiveness” in the US is “indicative of a landscape that will continue to favor economies of scale, while also making profitable market share growth challenging for most,” said the analysts at Deutsche Bank.

The team noted the drive for higher gross hold implied promotions would remain “relatively stable or grow,” albeit reducing to ~25% of GGR.

As such, the team suggested that with promotional dollars remaining elevated, they didn't see the operating leverage story for FanDuel as a net benefit for industry peers.

They also noted DraftKings expected promos at maturity as a percentage of GGR to stand at 22% or 300 bps lower than FanDuel despite a likely lower gross hold percentage.

Phasers set to stun: On the buyback news, the analysts at JMP said Flutter was now entering a “new phase whereby it can execute on investing in current markets, investing in growth markets, M&A and now capital allocation.”

Are you watching this? The team at Truist suggested the international story told by Flutter should be looked at closely by DraftKings, which itself could “look to grow its business overtime especially once US growth slows.”

+More

The board of Star Entertainment is set to sign off on the company’s accounts after it secured funds from its lenders in exchange for security over assets, including properties. The earnings will be announced next week.

Name’s on the list: Underdog has been placed 15th in LinkedIn’s top startups for 2024, the second year in a row the company has appeared. Underdog is the only betting and gaming sector company to be named.

Stats Perform has signed a new partnership with the Scottish Professional Football League and the Scottish Women’s Premier League for exclusive rights to distribute live video streams for both leagues to licensed international sportsbooks outside the UK.

The US OSB market will be worth an annualized GGR of $24.2bn-$27.8bn by 2028 while the total online market will be worth $38.2bn-$41.8bn, according to VIXIO GamblingCompliance.

Read across

The Token Word reported this week on BetConstruct’s unveiling of a new blockchain-powered digital assets platform called Ortak, which it said will integrate NFTs with game development companies and partners such as Pragmatic Play and Evolution.

In Compliance+More, the NFL and the NBA appear to have woken up to the fact the SAFE Bet Act introduced by Rep. Paul Tonko and Sen. Richard Blumenthal will see the introduction of a ban on sports-betting advertising during live sporting events.

+More careers

The big move: Justin Geiger has joined gaming affiliate Catena Media as head of commercial, leaving the post of chief revenue officer at Betsperts. He said on LinkedIn he was looking forward to “making a lasting impact at this prestigious firm.”

Recall, Catena Media has recently seen wholesale changes at the top under new CEO Manuel Stan.

Marcus Berry, formerly at Sportcast, has joined Superbet as head of in-play. Kevin Furlong has joined EveryMatrix as the company's new chief product officer. He was previously product director at Entain. Rank’s Grosvenor Casino has appointed Chris Edgington as CMO. Edgington was most recently chief customer officer at ATG Entertainment.

Senior Football Trading Manager – Sofia, Bulgaria

Japan Country Manager – Remote

Marketing Manager – Lima, Peru

Halkyard’s credit chat

The sun also rises: Japan is the “single best development opportunity in gaming globally right now,” said MGM Resorts CFO Jonathan Halkyard this week during a fireside chat at a Deutsche Bank credit conference.

Having recently paid his first visit for two years to the prospective site of MGM’s IR in Osaka – a JV with local developer Orix – Halkyard was enthused about the work taking place.

Recall, the same land will be used ahead of construction of the casino property as the site of the World Expo 2025.

“It is a massive market with 30m people within a three-hour rail trip to Osaka,” he added.

“It's also an area that’s closer to northern China, Beijing and Shanghai than is Macau.”

In a New York minute: Halkyard expressed frustration over the delays in licensing in New York, pointing out he had the $500m licensing fee budgeted originally for 2022 and then 2023.

“It's gotten pushed and pushed,” he said of the decision over who gets the three downstate casino licenses.

But he noted MGM would be able to turnaround its existing facility in Yonkers “very quickly” to accommodate table games even while construction of an expanded facility was ongoing.

Cold bath: On the potential for large-scale digital M&A, Halkyard dampened down speculation over large-scale online M&A, saying MGM was “right now very busy” with LeoVegas, expanding into Brazil with the Globo JV and integrating the Tipico technology.

Analyst takes

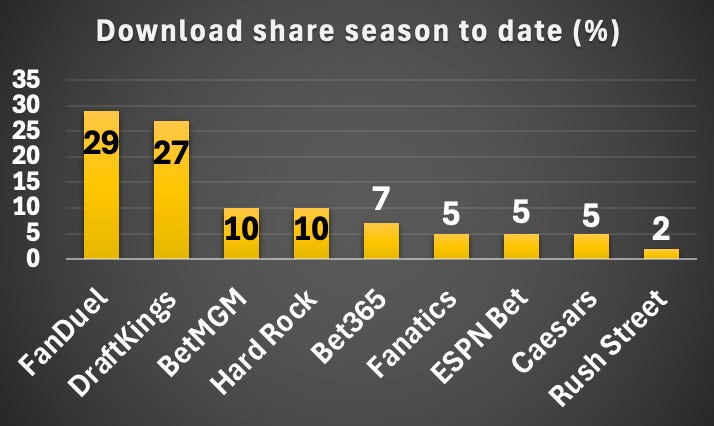

Keep up with the download: The trends for the NFL season when it comes to downloads in the North American market seem set, with FanDuel and DraftKings well out in front, BetMGM solidifying its place as the third biggest and Hard Rock apparently making the most of its Florida exclusivity.

NFL hold: The books enjoyed a decent return in the third week of the season with NFL hold coming in at 15%, well above the long-term average of 9%, according to the analysts at Macquarie. The team estimated that overall hold for the week was 12%.

Notably, for the week previous New York reported hold of 14%, again above the long-term average. FanDuel led the way with 19% hold for the week.

Macau stimulus

Bazooka: The policy measures unveiled by the Chinese government this week may not have an immediate impact on Macau revenues, suggested the analysts at Seaport. But they did believe the wider Chinese economy would show signs of improvement in the medium term.

The team added that a key driver of better Macau revenue in 2025 would be a stronger recovery in base mass GGR and overall revenue growth.

That will be “tied to improving economic conditions in China, along with improving consumer sentiment and spend.”

Back to base: The team expected premium mass would continue being an important driver of growth in Macau but base mass strength could lead to better than expected 2025 revenue growth in the market.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Meet us at SBC Lisbon & G2E Vegas. Join top operators at www.opticodds.com.

Sector watch – casual gaming

Pedal to the metal: Following Playtika’s acquisition of SuperPlay last week for up to $2bn, the team at B Riley believe the mobile gaming sector could see an acceleration of M&A, giving a boost to sector sentiment.

23andMe: The team estimated there have been ~23 M&A deals in the mobile gaming space since 2021.

However, the bulk of these occurred in 2021 – 14 in fact – while there were four each in 2022 and 2023 and just the one in 2024 to date.

The team argued that the usual suspect of a rising rate environment since mid-2022 was behind the slowing pace of consolidation in the sector. “SuperPlay could be the beginning of sector M&A reacceleration as rates now fall,” they added.

“We believe accelerated M&A should work to improve overall sector sentiment.”

Double up: One company that should see some support for its share price with such a backdrop is DoubleDown Interactive, which, the B Riley team pointed out, has continued its social casino YoY peer sales outperformance with a “strong focus” on paying users and ARPDAU growth.

Further, the analysts noted that DoubleDown “continues to increase direct-to-consumer efforts, according to checks.”

Meanwhile, the shared resources with the real money iCasino business should lead to product and operational enhancements.

Seamless Onboarding, Happy Players. It's That Simple.

Experience the perfect balance between stringent identity verification and effortless onboarding with IDComply, a groundbreaking solution from GeoComply. Take your pass rates to new heights and shield your business from fraudulent activities.

Calendar

Sep 30: Playtech

Oct 17: Entain

Oct 23: Churchill Downs (earnings)

Oct 24: Betsson, Evolution, Churchill Downs (call)

Oct 25: Kindred

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.