Cali tribes slam Prop 27 rivals

Divergent Californian narratives emerge at G2E, Betr preferred bidder for WA TAB, Fanatics OSB launch, FanDuel and DraftKings keynote comments +More.

Good morning, on today’s agenda:

Rival ballot camps offer differing views on likely California vote failure.

Betr leads the field in bid for WA TAB.

FanDuel and DraftKings predict further OSB concentration.

Fanatics CEO confirms January 23 launch.

Macau investment demands are more onerous than previously believed.

Thinkin' I'm gon' stop, givin' L.A. props.

Goin’ back to Cali

Tribal leaders pour scorn on FanDuel and DraftKings CEOs promise to return to ballot battle in 2024.

Some dreamers of the golden dream: During their keynote chat at G2E, Amy Howe, CEO at FanDuel, and her counterpart at DraftKings Jason Robins both committed to having another go at getting sports betting on the ballot in California when questioned about it.

Howe said “we absolutely live to fight another day”, while Robins added that it was “hard to imagine California not having sports betting” one day.

Yet in a following session, tribal leaders made it clear they remain impeccably opposed to any renewed OSB effort.

One tribal source suggested they would “black out the sun”. “We’ve eaten their lunch and we’re going to eat it again.”

On stage, James Siva, chair of the California Nations Indian Gaming Association (CNIGA) said the commercial operators should “never underestimate” the tribal opposition.

“Whoever these operators are, this is the lesson they have to learn. Have it tattooed on your body: never underestimate California tribes again.”

Donner party: The war of words between the two camps erupted after The Wall Street Journal reported that the backers of Prop 27, in favor of an OSB option, had pulled $11m of advertising scheduled to run between now and the vote in early November.

Robins said the opponents of Prop 27 had spent “over $100m on false and misleading ads”. “It’s just tough to beat and trying to outspend them just made it worse,” he added.

However, Jacob Meija, vice-president of public affairs, Pechanga Development Corporation, hit back that “if you are fighting tribes, you are losing, period”. “That should be the biggest takeaway.”

Meija suggested the commercial operators had attempted to “hijack” the tribal measure. “The way that Prop 27 undertook their campaign has polluted the atmosphere,” he added.

It was suggested from the stage that the pathway forward would see the commercial operators relegated to technology providers rather than partners.

Background: The latest polls suggest Prop 27 and the retail-only Prop 26 supported by the tribes are heading for defeat in November, with the responses indicating only 27% intended to vote ‘yes’.

Prop 27 raised $402m, according to campaign finance records. However, the blanket advertising it bought arguably backfired, with the polls suggesting the more voters saw the ads, the less likely they were to vote in favor.

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences.

For more information visit: spotlightsportsgroup.com

Betr in the lead in WA TAB bid

Betr reported to be the leading bidder for regional TAB.

Preferred bidder status: Australian media is reporting that the Tekkorp and News Corp-backed startup Betr is “the preferred bidder” to acquire the Western Australia TAB in a deal worth AU$1bn.

Betr reportedly has two weeks to show that it has the financing to see the deal through. Private equity firms Apollo Global Management, Washington H. Soul Pattinson and Blackstone are vying to provide finance to the startup.

Should it succeed, Betr would beat major groups such as Tabcorp and Entain in acquiring the regional TAB.

Both Tabcorp and Entain are said to have been informed of the development, with an official announcement due on Oct 24.

Super TAB bid: Betr is also said to be in talks with the government in Victoria with a view to acquiring its horse racing TAB, known as SuperTAB, with negotiations due to start in Aug24. SuperTAB also provides odds and markets to the WA TAB.

Matthew Tripp, ex-founder of the Sportsbet and BetEasy brands and now Betr founder told WA Today: “We haven’t re-entered this market to play second fiddle to anyone. We want to grow sensibly through M&A and organically.”

“We believe we will be – certainly a tier-one operator very quickly – but in time the most prominent brand in the country.”

Going to Carnival: Recent reports suggested that Betr was set to receive its WA wagering license, today.

Media player: Betr reportedly gained the support of the dominant media group in Western Australia, Seven West Media, which also has racing interests, but it is unclear whether it has an active role in Betr.

Recall, Tekkorp Capital teamed up with Matthew Tripp and News Corp for an Australian-facing sports-betting venture, with BetMakers Technology as the exclusive sports-betting platform provider.

Fanatics confirms launch date

CEO says the group will launch in every major state except New York.

Ready for launch: Fanatics CEO Michael Rubin told an audience at the CAA World Congress of Sports in New York that his company will launch its real-money sports betting offering in January 2023 to coincide with the NFL playoffs.

Rubin said the group would launch in every major state bar New York, where it missed out on one of the first nine licenses handed out at the end of 2021.

Fanatics OSB plans: In June reports suggested the group was in talks to acquire the German betting group Tipico, but the parties hit a block over pricing.

More from G2E day 2

The culling of the herd: FanDuel’s Howe and DraftKings’ Robins both predicted that the centrifugal forces in the US OSB market would continue. “It’s not inconceivable that the top two or three in the market will control 60-70% of the market,” said Howe.

She added that for any subscale operator it was a “question of how long you want to keep funding” a loss-making business.

Robins agreed that the advantages of scale were “more and more apparent” and that it made sense that there would be more consolidation.

Asked directly about the rumors of a partnership with ESPN, Robins played a straight bat. “We have an exciting partnership with them, which we think is a great relationship,” adding that there was “nothing else to talk about at this moment”.

Glazing over: On an earlier keynote Soo Kim, chair at Bally’s Corporation, suggested it was clear the economy had overheated, but he suggested that short-term slowing would be succeeded by a “long-term growth pattern”.

In the same session, Penn Entertainment CEO Jay Snowden indicated that when he sat in front of investors he was confronted by “glazed-over eyes” and a “narrative that things are going to get bad”.

But he added that Penn could “walk and chew gum”. “We’ve fortified the balance sheet, we can buy back shares and we can generate free cash flow.”

He said that once investors turned their attention away from the recession, “we know the next question is ‘what’s your growth strategy?’”

Playtech debt move

Playtech has announced an amended €277m revolver and has redeemed €330m of a €530m October 2023 debt facility.

Take that to the bank: The combined refinancing moves will save Playtech €12m in annual interest payments and when the rest of the bond is paid off, either at or before the October 2023 due date, the savings total per year will amount to €20m.

Following the early redemption, Playtech will have more than €200m of available cash on its balance sheet. Playtech's only other material debt obligation is the €350m senior secured notes maturing in 2026.

Macau concession scare

Details of the concession renewal demands means the process is not as straightforward as was previously hoped.

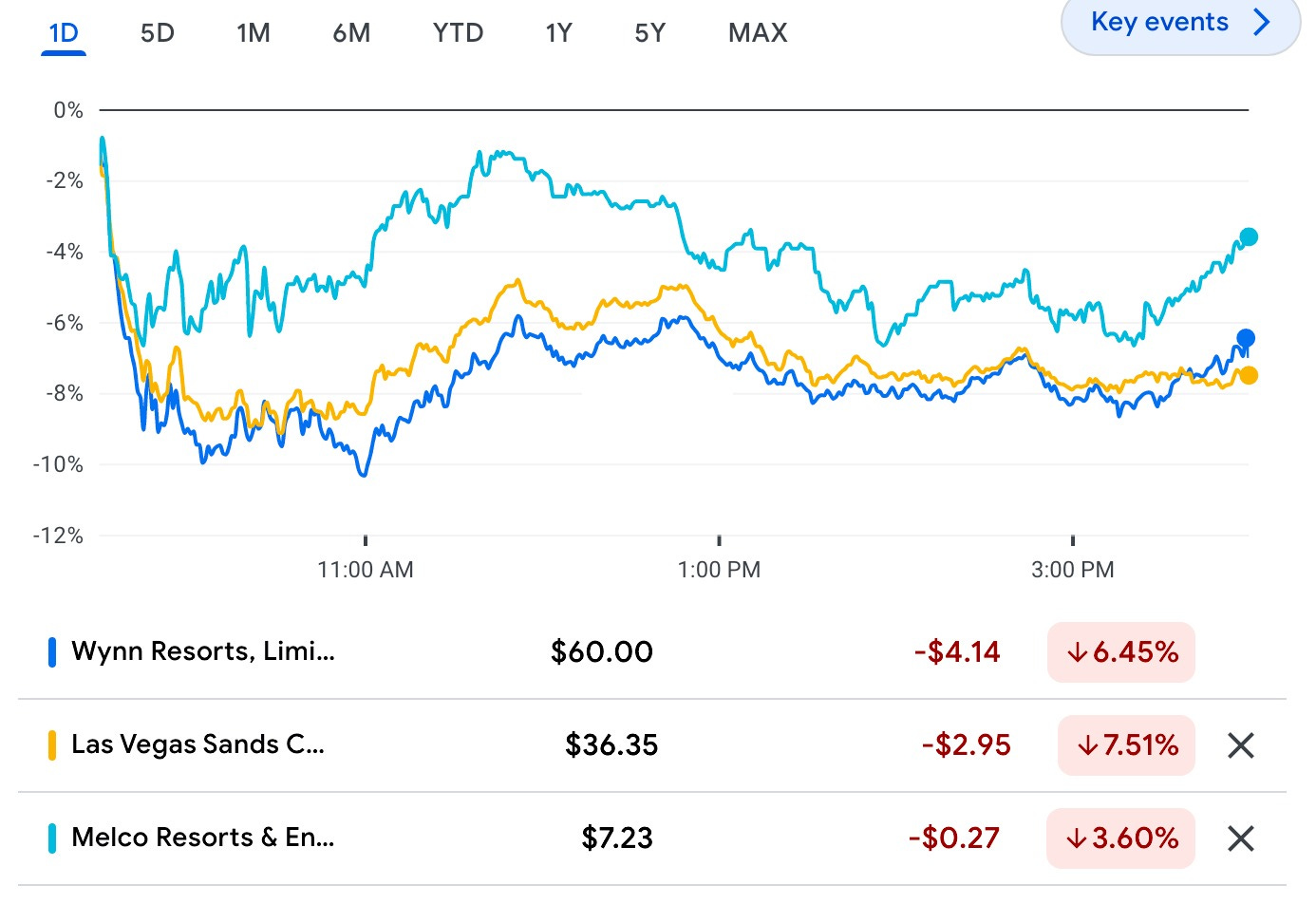

Mr Devil, meet Mr Detail: Analysts at Credit Suisse suggest that demands around non-gaming investment will be worse for some operators than was thought to be the case. “Most operators need to lift their proposed spending when they meet with the government this week,” the CS team wrote. “We see pressure on already stretched balance sheets and long-term margin.”

🚨LVS, Wynn Resorts and Melco shares respond to the Macau news

Datalines

Missouri: Casino GGR in September was up 3.6% YoY to $157.4m. Market leader Penn Entertainment’s properties reported combined GGR of $55.1m, up 4.5% YoY.

Newslines

GeoComply has announced that Resorts Digital will become the first operator to launch its chargeback integrator product to deal with the escalating problem of credit card chargebacks.

KeyStar Corp has acquired OSB and esports operator, digital currency and ID software provider ZenSports for an undisclosed amount. KeyStar said the transaction would enable it to expand B2C and B2B sports-betting offerings in the US.

BetMGM has been announced as the official sports-betting partner of the Cincinnati Reds.

** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 19-year track record supporting the iGaming industry, and with a team of experts and world-class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results.

Our industry recognised recruiters will be attending G2E Las Vegas, from 10th - 13th October 2022. Contact info@bettingjobs.com to arrange a meeting with our consultants during the event, who will be delighted to discuss any queries you may have.

What we’re reading

Matt Levine on the trend for anti-ESG: “You can walk into Peter Thiel’s office wearing a clown suit and say ‘high-frequency trading, but anti-woke’... or whatever, and he will write you a big check.”

Politico: “The so-called ‘Operation Rolling Thunder’ of announcements has jokingly become ‘Operation Shitstorm’ and is not kicking off today as planned because [UK Prime Minister Liz] Truss wouldn’t agree to the most radical deregulation plans drawn up by Business Secretary [Jacob] Rees-Mogg.”

The Economist on Truss: “Take away the ten days of mourning after the death of the queen, and she had seven days in control. That is the shelf-life of a lettuce.”

On social

Calendar

Oct 12-13: E+M@G2E

Oct 13: Entain Q3

Oct 18: E+M Deal Talk

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com