Boyd’s ‘softness’ sparks a rout

Boyd’s wobble, Evolution delays, Betsson’s boost, PointsBet regeneration +More

Good morning. On the early Weekender agenda:

‘Retail softness’ commentary from Boyd causes sector wobble.

Delays to new live casino studios facilities and lackluster RNG are the only blots for Evolution.

The one hangover from the US is a market-leading platform, says PointsBet.

Turkey is the missing word for Betsson.

The Jobsboard includes finance manager and country manager posts.

There's no way to delay that trouble comin' every day.

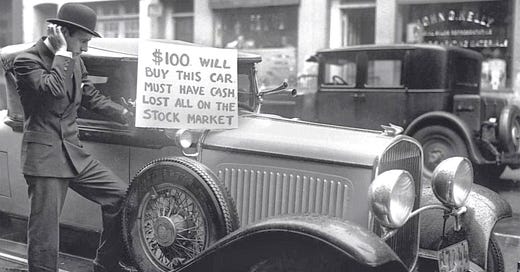

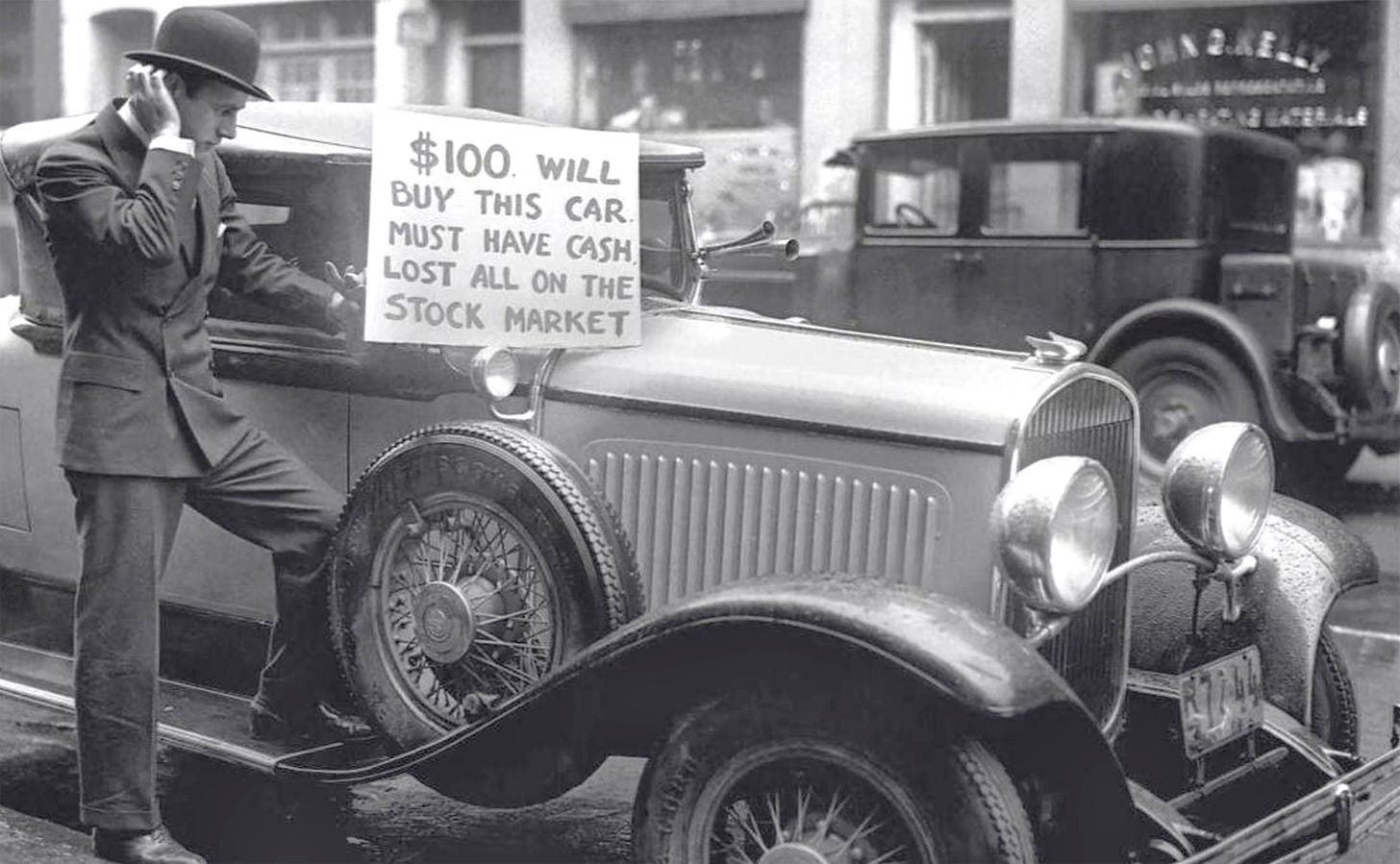

Boyd causes rout

The much anticipated consumer downturn has finally arrived, according to Boyd Gaming’s Q3 statement.

Soft touch: Asked about the “retail softness” that affected Boyd’s Las Vegas Locals, Downtown, and midwest and south segments, CEO Kevin Smith said it was “not isolated or unique to any one set of properties” after the company missed analyst forecasts with a near-5% fall in adj. EBITDA to $321m.

The AMC comments on Tuesday were enough to spark something of a mini-rout yesterday across operators with regional gaming exposure.

Boyd itself was down nearly 12% while Penn Entertainment was off by 8.5%, Cesars was down 7.5% and Bally’s was down 6%.

⚠️ Gone soft: Boyd Gaming wilts on consumer softness

Hanging around: Noting the softness occurred largely in the unrated players – which Smith said represented ~40% of Boyd’s casino revenues – he said this was “definitely related to the economic impact”. The company was “trying to paint a picture” of stable expenses and a “stable consumer environment”.

But CBRE analysts pointed out that cost pressures were “sticking around”.

Still, Deutsche Bank gave Boyd a pass. “Frankly, we’ve been surprised by how long the top-line growth lasted,” they said.

Online booster: Revenues rose 3% to $903m, largely down to the 73% rise in online revenue to $90.3m, while Downturn Las Vegas was flat YoY at $49.5m, the Locals segment was down by 1.8% to $222m, and the midwest and south was off by 2.8% to $513m. The managed segment, including the Sky River contract in California , was up to $28.5m.

Smith said the acquired Pala Interactive business – now renamed Boyd Interactive – had progressed well.

** SPONSOR’S MESSAGE ** The 2023 edition of the American Gambling Awards is pleased to announce the full list of 11 winners recognized for their leadership and innovation within the regulated, online U.S. gambling industry. The American Gambling Awards is produced by Gambling.com Group (Nasdaq: GAMB), a leading performance marketing company for the regulated global online gambling industry.

The Group champions the development of a responsibly regulated, competitive online gambling market in the U.S. and the Awards help bring positive attention to the leaders making this a reality.

Earnings in brief

Churchill Downs: Steadying the sector ship, Churchill Downs came in with in-line revenues and adj. EBITDA of $573m and $218m, respectively. The stock rose over 2% in after-hours trading. However, Jefferies noted the figures for gaming suggested a similar “weakness” in some markets. But Wells Fargo analysts said it was a “clean print” and “certainly better than feared”. Note: Churchill Downs’ analyst call takes place later today and E+M will report on what is said on Monday.

VICI: The REIT said its revenues increased 20% YoY to $904m. CEO Ed Pitoniak said the results reflected the company’s “sustained, sustainable commitment to accretive growth and capital deployment through acquisitions and strategic financing activity”. Note: VICI will also be hosting its earnings call later today.

Bet-at-home: Poor soccer margins mean revenues for the period Aug-Oct will be at €44m-€48m vs. previous estimates of €50m-€60m. However, EBITDA for the full year is expected to still come in at the top end of the previously announced estimate of €1m-€3m.

Playgon Games: The live dealer minnow said it saw a 10% QoQ increase in handle during Q3.

Evolution’s supply chain

Hold-ups in planned studio expansions and continuing lackluster RNG performance spoil an otherwise positive report.

Supply and demand: The good news is there is a higher demand for live casino than Evolution can currently deliver, said CEO Martin Carlesund. “We’re in an investment phase, and we will continue to invest as fast as we can,” he added, pointing to new studio developments across the globe.

“To build out hundreds of thousands of square meters of studio is a complex task,” he said. “It’s an 18-month minimum to build a studio.”

Asian contagion: Live casino revenues grew 12% YoY to €386m while RNG games continued its sluggish progress, down 2% to €66.8m. Growth in margins to over 70% helped push adj. EBITDA up 22% to €319m.

When looked at regionally, Asia continued to be the driver of growth.

Revenue was up 35% YoY to €172m and now very close to being the company’s largest region at 38% of revenue, just behind Europe’s 39% or €175m.

Europe was flat QoQ, while North American revenues fell back QoQ to €54.7m.

Fantastic voyage: Carlesund made a pitch for Evolution’s live casino product to be considered part of the streaming revolution. “We need to add product that will go up against streaming services and social media platforms for players' time,” he said.

“We continue to innovate, substantially enhance and refine the player experience.”

The development roadmap looked “nothing but fantastic”, he added.

PointsBet regeneration

The inheritance from the US adventure is a “market-leading” platform, says CEO.

It’s about the journey not the destination: “We’re at an important stage in PointsBet’s journey,” said CEO Sam Swanell as he promised the now ex-US operator would not need any further capital injections from investors. As it stands, the operations in 10 states have already been handed over to Fanatics, with the remaining four awaiting regulator approval.

The first $175m installment has already been paid to PointsBet, with a further $50m to come.

The company had adj. cash at the end of the quarter of A$83.5m ($52.7m), having handed the first tranche of the US sale proceeds back to shareholders.

Recall, PointsBet said a major reason for the sale of the US business to Fanatics was to prevent it having to make another cash call to fund further US losses.

Back of the net: With the remaining Australian and Canadian business, total net win rose 18% to A$58.2m, helped by a more-than-doubling of iCasino net win in Canada to A$3m. In Australia, an “improved generosity” backdrop helped towards an 11% increase in net win to A$52.8m. A pullback on promo spend meant gross win fell 2% to A$72m. Canadian net win rose 212% to A$5.4m.

The upside from the US experience, Swanell noted, was that PointsBet built a “market-leading” platform, which he suggested would “continue to drive out success”.

Swanell said PointsBet’s current market share in Australia was ~5%. “We think we can push above 5% and grow from there,” he told analysts.

Swanell also said the company was eyeing Canadian profitability in 2025. “We want Canada profitable,” he added.

Missing word competition

Turkey is not mentioned by Betsson despite being a key revenue and profit driver.

Not talking turkey: While there was no mention of Turkey in either the report or the earnings call, the central and Eastern European and central Asia segment was the key driver in Betsson’s Q3 uplift. CEECA revenues rose 23% to €97m, helping to boost total revenues to €238m. Group EBITDA rose 42% to €68.9m.

Betsson’s Turkish revenues come through a B2B arrangement with Realm.

While also not specifically cited, the company did say that licensing revenue from system delivery was up 24% to €55.9m.

No(r)way: Problems continued in the Nordics where revenue was down 14% to €46.1m. Betsson was one of the brands the Norwegian authorities said had exited the market in September. Better news came from the LatAm region, up 33% to €51.7m. However, in Chile a recent Supreme Court decision means the company will be forced to end its sponsorship of the local soccer league.

In western Europe revenues rose 57%, helped by the addition of the betFIRST business in Belgium.

On the call, CEO Pontus Lindwall said M&A and B2B were “two key pillars” of Betsson’s strategy.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

Datalines – Michigan

Half-way to a three-way: Total OSB GGR for September fell 13% YoY to $44m on handle that rose 19% to $458m, implying hold of 9.6%. Promo expense was $25m, representing 4.4% of handle and 62.5% of GGR, while NGR came in at $18.7m, a YoY drop of 37%. iCasino came in up 29% at $166.4m.

BetMGM retained leadership across both products by a sliver at 27%, with both DraftKings (26%) and FanDuel (25%) in its slipstream.

For iCasino, BetMGM was top on 29%, followed by DraftKings (26%) and FanDuel (21%).

Fourth wall: In OSB, DraftKings outspent FanDuel in promos by $9.4m to $7.7m or 81% of NGR vs. 46%. FanDuel’s AGR came in at $9.1m, nearly quadruple DraftKings’ $2.3m. Indeed, DraftKings was beaten into fourth place in AGR terms by both BetMGM and Caesars, with each generating $2.8m.

Analyst take

ESPN Bet: Looked through the lens of download data, the team at JMP suggested the effectiveness of the marketing campaign for the upcoming launch will show through in the very early weeks.

“We expect app downloads to give a good gauge of how customer acquisition is trending for the newly launched platform and the effectiveness of its cross-sell channels,” the team added.

What we’re reading

You just want to see his face: DraftKings, FanDuel and others have given the Nevada sports-betting market a swerve due to the regulatory requirement for in-person registration.

** SPONSOR’S MESSAGE ** Calling all sportsbooks! Are you:

Forced to limit customer stakes due to market liability?

Suffering one-sided markets?

Caught out by stale prices?

Turning away large staking players?

Stop falling behind your competitors! Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins. Matchbook pricing is proven to be resistant to market changes. Matchbook B2B, because the best price is for everyone.

Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com

Newslines

This is Latvia calling: Playtech has signed a deal for live casino provision with FanDuel for which Playtech has built a dedicated studio in Riga, Latvia.

Light & Wonder said on Tuesday it has completed its previously announced acquisition of the remaining approximately 17% of SciPlay it didn’t already own for $22.95 per share in cash.

Sportradar will power the launch of Sinclair’s Tennis Channel’s direct-to-consumer streaming platform. Meanwhile, the company also announced it had reached an agreement with BetMGM for the provision of NBA optical trading data for use in prop markets and same-game parlay offerings.

Calendar

Oct 26: Churchill Downs (call), VICI (call), GLP (e)

Oct 27: GLP (call)

Oct 31: Lottomatica, Caesars

Nov 1: Kambi, Sportradar, Bally’s, RSI

Nov 2: Entain, Penn, DraftKings (e), Golden Ent.

Nov 3: DraftKings (call)

Senior .NET developer – North America

Finance manager – Cyprus

Country manager for Greece – Europe

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.