This month’s issue of Deal Talk is devoted to the market leaders in the US sports-betting and iCasino space and asks the question: to what extent does the fact of DraftKings and FanDuel moving towards profitability change the nature of the market?

Within two years, the market leaders are expected to generate adj. EBITDA in the range of $1bn each.

But what are they going to do with their growing cash piles?

Options for each differ due to their current, and future, circumstances, but they include stockpiling for use in a still-growing US market, handing some of the profits back to shareholders and, of course, M&A.

You've got the world but baby, at what price?

The turning point

A hugely significant moment has been reached in the development of the US sports-betting and iCasino market.

Wall of money: The tilt toward profitability in the US market has finally arrived and confidence levels in the predictions for what this means for the market leaders in particular are increasing, not least within the companies themselves.

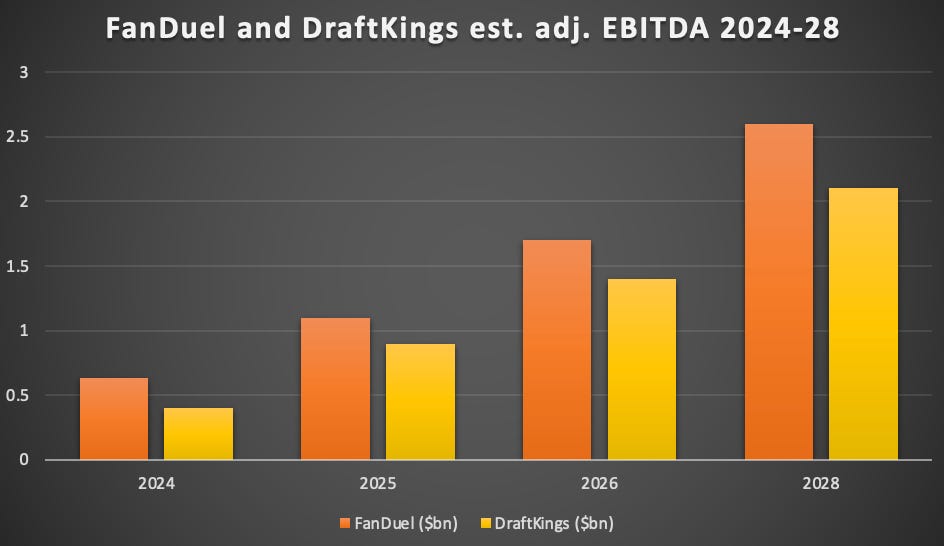

During its investor event last week, DraftKings predicted it would be generating $900m-$1bn in adj. EBITDA in 2025, rising to $1.4bn in 2026 and $2.1bn in 2028.

Crucially, this is from the current roster of states and doesn’t include potential future expansions of both OSB and iCasino.

Meanwhile, with Flutter the consensus expectation is for its US operations to be generating $630m next year and ~$1.1bn in 2025

Finger in the air: Analysts who follow Flutter are yet to forecast FanDuel beyond 2025. But, using the crude measure of the percentage increases at DraftKings, E+M has filled in the gaps for 2026 and 2028 at ~$1.7bn and $2.6bn respectively.

🤑 FanDuel and DraftKings makin’ bones

Weighing machine: For all the short-termism that comes with assessing quarterly earnings statements and monthly state-by-state data, there is an emerging sense of clarity over the profits that will soon be produced by the top two in the market.

“We see material EBITDA upside from the growing US market,” said the team at Jefferies about FanDuel following Flutter’s recent Q3 trading update.

It has “cemented itself as the crown jewel” for Flutter, added the analysts at Wells Fargo.

Overs/unders: Similarly, last week’s investor event saw the analysts praising what the team at Macquarie said was the “stronger profit story” being told by the company. Moreover, given DraftKings’ record of under-promising and over-delivery, the forecasts are likely on the conservative side.

The team at JMP noted the guidance based on the current legislative footprint means that projected 2028 adj. EBITDA of $2.1bn could be “massively understated”.

Unveiling the Costly Truth: Half of Your Sports Betting Campaign Budget Is Lost to Advertising Fraud.

In the high-stakes arena of sports betting, a startling reality looms….

Up to 50% of your digital marketing investment could be vanishing into thin air due to invalid traffic and advertising fraud, never translating into valuable customer conversions.

Across the industry, marketing teams are hemorrhaging millions due to the absence of robust ad fraud measures.

TrafficGuard stands at the forefront, collaborating with over 30 top-tier sports betting and iGaming companies, addressing the budget-draining scourge of bots, bonus abuse, and invalid clicks head-on.

Discover how TrafficGuard is reshaping the game for sports betting enterprises: Learn More: https://www.trafficguard.ai/protect/industry/sports-betting

Tipping the scales

Sweeney Todd: The scale of the success of FanDuel and DraftKings is already having an effect on the rest of the market and that will be amplified in the next few years. Analysts at Regulus noted recently that, while the path for a challenger “looks credible”, with the top two fighting hard for top spot the market is likely to go through “an even more competitive phase”.

“Operators that do not have the scale or operational wherewithal to sustain a tier one product, or do not have easy customer access to create a sustainable niche, are likely to face a remorseless and value-destructive meat grinder,” Regulus wrote.

Wave of mutilation: The next “wave of competition”, to use DraftKIngs CEO Jason Robins’ words, comes from ESPN Bet, Fanatics and, to an extent, bet365. As the team at EKG wrote last week, these names come with “scale ambitions, deep war chests, competitive product and increasingly sophisticated operations”.

Spend, spend spend: But it is already clear that FanDuel and DraftKings have the means to spend as much as, if not more than, each other and all of the competition should they so desire. “They are both definitely set up for success domestically,” says Josh Swissman, managing director at GMA Consulting. “They can reinvest more than their competitors in their product and offering.”

“They are now in a position where they can reinvest profits from the existing business into new customer acquisition,” says Christopher Lynch from the gaming and leisure investment banking team at Citizens.

“Those with less investable cash flow will have less resources to compete for a diminishing pool of new customers.”

“Clearly high cash generation leads to incremental marketing spend, which could overwhelm competitors,” says another investment banking source.

Yet, even with the likelihood that each of the market leaders will be using some of their excess profits to throw their weight around in the market, that won’t account for all of the cash flow each will be generating. Here, their options over what to do next differ.

The options…

… for FanDuel

Hand on delever: Hoarding cash might not be an option for FanDuel. It has to answer to its parent Flutter, which has net debt of ~£2.8bn and might look to use some of the proceeds from FanDuel’s success to pay an element of that down. “The shareholders will be delighted to see the cash come through and deleverage the balance sheet,” says one investment source.

When two become one: But complicating matters for the company is the looming US dual listing, due to be completed in Q124. The aim of the move is to broaden the US investor base and, thereby, to also achieve a better valuation within the whole for the US operation.

Analysts have speculated the move could be the precursor to a full listing within a year.

In that scenario, the potential for M&A remains open but, as various sources spoken to for the article point out, it is difficult to see what “moves the needle enough”.

As with its rival (see below), there aren’t really the targets available in the US that would bring a meaningful addition in terms of revenues or market positioning.

“It would have to be something in new markets or new verticals,” said one consultancy source.

… for DraftKings

Brass in pocket: On the investor event call, CFO Jason Park said DraftKings would be exiting this year with “north of” $1.2bn of cash and on the Q3 earnings call a week earlier, one of the analysts asked a question that “just has never come up until now”, namely what the company planned to do with its growing cash resources.

Robins answered that management had “actually been spending increasing time” on looking at all different options.

These included capital structure optimization, share buybacks and “organic investments”.

Split opinion: Sources are split on whether buybacks will be a route DraftKings explores soon. “I do not expect either DK or FD to return cash to shareholders in the next year or two,” said one investment advisor. “I would guess they have investment opportunities with high enough return expectations that make more sense.”

But another was more convinced, suggesting the market “absolutely expects” DraftKings will return cash to shareholders via buybacks and dividends.

Indeed, Robins’ comment about capital structure optimization might be construed as a broad hint that DraftKings could borrow in order to hand some of the proceeds to investors.

Burning ambition: An option that DraftKings and its ambitious CEO and top management team are likely to pursue is M&A and, given the share price performance this year, this could be sooner rather than later. “The shine has come back,” says one investment adviser. “Jason [Robins] for sure is going to try and do deals [now] he can raise capital again.”

🔥 DraftKings has enjoyed a stellar share price performance in 2023

Vote of confidence: The performance is important not only because it shows investor faith in the prospects for what remains the leading pure-play listed online gaming entity has returned. It also signals that DraftKings can once again contemplate using its re-energised paper in any prospective transaction.

This hasn’t been the case since it acquired Golden Nugget in an all-stock deal back in Aug21.

But, as with Flutter/FanDuel, it is unlikely DraftKings will be seeking to augment its US positioning, although acquisitions to bring more tech in-house might be an option.

“I would think DK's management is looking at their internal cost structure to identify areas where they can in-source and extract more margin,” says David Williams, partner at Discerning Capital.

“Investing in pricing or risk management could make sense, or looking at places where their media spending could come in-house.”

But sources also believe it is likely DraftKings will look internationally for significant enough deals. “Thirty-eight states on the geography slide of the investor deck is great but putting a few stars on international markets is what analysts are going to want to see in the coming years,” says Williams.

Swissman from GMA agrees and suggests DraftKings will also have the tailwind of its brand strength.

“It has already got such great brand recognition domestically, which means there's already some decent brand recognition internationally, just because of how big they are,” he adds. “Latin America would be an obvious stepping stone.”

Over the horizon: Further afield, Europe would be the obvious next stopping-off point. The recent news story with regard to DraftKings being in some way interested in 888 – at the time of what turned out to be the farrago surrounding the FS Gaming bid to install Kenny Alexander as CEO – were dismissed by one source as being nothing more than “a chat that would have gone nowhere”.

More definite, of course, was the speculative bid lodged in Sep21 for Entain, which eventually came to nothing.

Be quiet, Mt. Heart Attack: There are plenty of other options and with the potential of there being very little competition, with Entain having sworn off bolt-on acquisitions and Flutter likely to be busy with its corporate re-housing. Names mentioned include the CVC-owned Tipico in Germany, Superbet (if the company opted to sell instead of seek a listing) and the Blackstone-owned Cirsa.

But if DraftKings really wanted to make a splash, one name sticks out.

“They could do a deal with bet365, if Denise [Coates] ever wanted to sell,” says one corporate adviser.

“But if they did, maybe the rest of us would simply have to pack it all in and go home.”

Propus Partners is a consultancy business specialising in sports betting with a specific focus on trading, trading technology, product, operations and the supplier marketplace.

Since launch in 2017, Propus has worked with clients across five continents, including operators, platforms, feed providers, regulators, data rights holders and sporting organisations.

Please contact us through www.propuspartners.com to speak to us about ways we could support your business.

The month in transactions

Mars attacks: The biggest deal of the month came with Lottomatica’s winning bid for SKS365, which values the target at €639m. The Italian-facing operator had been the subject of a bidding battle, with Playtech (publically) and Flutter (rumored) among the parties vying to snap up the company behind the PlanetWin365 brand.

Once the deal completes, Lottomatica will be able to claim top spot in the Italian online market, adding ~9.6% market share in sports betting and ~6.4% in iCasino.

In its recent earnings statement, Lottomatica claimed a combined market share of 21% across its existing Lottomatica, Goldbet and BetFlag brands.

Affiliate deals

Making a play: Needle-moving M&A is taking place in the gaming affiliate sector and, naturally, it was sector leader Better Collective that once more led the way with its €176m cash-and-shares deal for Toronto-listed sports media and gaming affiliate business Playmaker Capital.

The Americas-focused Playmaker owns the media sites Futbol Sites, Yardbarker and the Nation Network as well as the affiliate Wedge.

The deal involved 65% shares with the remaining 35% being settled in cash.

Based on trailing 12 months EBITDA of €15m, the multiple is over 11x.

Get your rocks off: The next day GiG snapped up KaFe Rocks for a total of €15m upfront, with a further €20m to be paid in four installments over the next two years with an earnout element included. KaFe Rocks is expected to generate revenues of €23m in 2024 and an adj. EBITDA margin of 45%, equating to ~€10.4m and giving the deal a multiple of ~3.6x.

Shedding: Meanwhile, in news this morning, Catena Media continued the offloading of its European baggage with the sale of its Italy-facing online sports-betting and iCasino assets for €19.8m to two separate buyers.

The news came with the company’s Q3 earnings, which showed revenues down 28% to €15.9m, which is suggested was due to the “strategic transition” to more revenue-share agreements.

Calendar

Nov 21: Catena Media

Nov 29: Kindred, Rivalry

Dec 4: BetMGM investor meeting

Dec 5: Allwyn

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.