On current valuation multiple trends, Flutter’s share price more than double by 2028.

Breaking: Entain says AUSTRAC has commenced civil proceedings.

DraftKings CFO wows the team at Morgan Stanley over dinner.

Markets watch: Gambling.com enjoys an M&A boost.

By the numbers: Indiana and New York in November.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Weight gain

Piling on the pounds: Flutter could be worth over $100bn in four years’ time, suggested the analysts at Macquarie while, in the medium-term, the team at Deutsche Bank in London suggested the company would be able to wield a “war chest” of at least $2.5bn a year in free cash.

At a current share price of just shy of $278, Flutter is knocking at the door of a market cap of $50bn, making it by far the most valuable listed gaming entity.

Yet in setting a medium-term target of $340 a share, the team at Macquarie said, on current trends, group EBITDA CAGR of 21% a year would see it reach $8.05bn by 2030 vs. forecast $2.55bn this year.

If the current EV/EBITDA price multiple of 13x is maintained, it implies a price of ~$600 by the end of 2028.

On the up: Since switching to the US for its main listing in May, the Flutter share price has been on a tear, up 47% in the last six months.

Whisper it quietly: The “most compelling, unspoken reason” for getting involved in Flutter, noted Macquarie, is the company's “proven ability” to create shareholder value via M&A, suggesting it has added $200 a share in value since 2019.

Recent deals including the €2.3bn paid for Snai in Italy and the $350m it laid out for a controlling share in Brazilian operator NSX.

The Macquarie team suggested the runway for continued M&A in high-growth markets such as LatAm was “meaningful.”

👀 “For more transformational M&A, we think there could exist an opportunity for the company to enter more retail gaming or lottery in the US,” they added.

Generation game: The theme of M&A was taken up by the analysts at Deutsche Bank, who argued that even with a commitment to buyback $5bn of shares Flutter would still be generating $2.65bn of cash for more deals.

DB said a strategic shift was evident from buying its way into new markets towards consolidating in existing ones.

With a “significantly invested” tech platform, DB said Flutter was “now in a position” to “add value through a significant uplift in cost synergies.”

Similarly, the Macquarie team noted the targeting of local hero podium players was “complemented” post-acquisition by the benefits brought by the ‘Flutter edge.’

DB said this should make Flutter a “more attractive acquirer of assets,” arguing it meant it would be able to generate an attractive ROI.

They cited the Snai deal where Flutter expects to be able to generate $70m of cost synergies on total costs of ~$690m.

Son of TAM: Both sets of analysts made the point that Flutter’s FanDuel seems set to dominate in the US. Yet, casting their eyes over the global landscape, the Macquarie team pointed out Flutter has a global serviceable market of $119bn in 2024, expected to grow to $210bn by 2030.

The analysts suggested Flutter has a current market share of ~16% and that this is forecast to grow to ~19% by 2030.

The analysts noted Flutter’s own TAM estimate for regulated and regulating markets now stands at $368bn.

Meanwhile, a note from the analysts at Wells Fargo suggested investors are better off looking at the digital names in the US gaming sector vs. their B&M rivals, arguing that challenges lie ahead for the land-based sector including increased competition.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Unlock complimentary access until year-end at www.opticodds.com.

+More

Breaking: Entain said this morning that the Australian Transaction Reports and Analysis Centre or AUSTRAC has commenced civil penalty proceedings in the Federal Court against the company.

The proceedings relate to alleged contraventions of the Australian Anti-Money Laundering and Counter-Terrorism Financing Act 2006, identified as part of an enforcement investigation of Entain Australia.

Noting previous actions in the gaming sector, the company warned that any penalty “could be material.” Analysts at Jefferies said the likely quantum would be between £20m and £225m.

Gavin Isaacs, CEO, said the company took the allegations “extremely seriously.”

The share price was off by 3.5% in early trading. See tomorrow’s Compliance+More for more.

Also in Compliance+More tomorrow, the Nevada Gaming Control Board has moved to revoke the gaming license of Scott Sibella, former president and COO of Resorts World Las Vegas.

From the 2025-26 season, Stats Perform’s Opta will be the official insights provider for the English Premier League, the rest of the English Football Leagues and the Scottish Professional Football League and Scottish Women’s Premier League, under an extended partnership with Football DataCo.

Confidence booster

Soup to nuts: After breaking bread with DraftKings CFO Alan Ellingson, the analysts at Morgan Stanley felt that by the time it came to the cheese course they had a “greater appreciation” of the company’s product planning and its financial targets.

On the first point, the MS team noted that in the past 12 months DraftKings has improved its uptime and cash-out flexibility.

Both have helped DraftKings claim #1 in terms of usage in the recent MS player survey.

Addressing the issue of Flutter’s apparent advantage when it comes to an international model, MS said DraftKings management remains “steadfast in its focus” on attempting to wrestle the #1 slot from its rival.

Ellingson & Co told the MS team that recent acquisitions – Jackpocket and Simplebet – were all about lower customer acquisition costs and/or improving the product domestically.

“As such, international expansion is likely beyond the near-to-intermediate term horizon,” said the MS team, with excess cash likely to end up being returned to shareholders.

Storm in a teacup: After the “sizable” headwind of hold in October, trends in the subsequent months have been more in line with expectations. But engagement throughout Q4 was reported to have been both “continuous” and “deeper.”

“Importantly, Q4 handle growth was said to be running well ahead of 2025 guidance,” said MS.

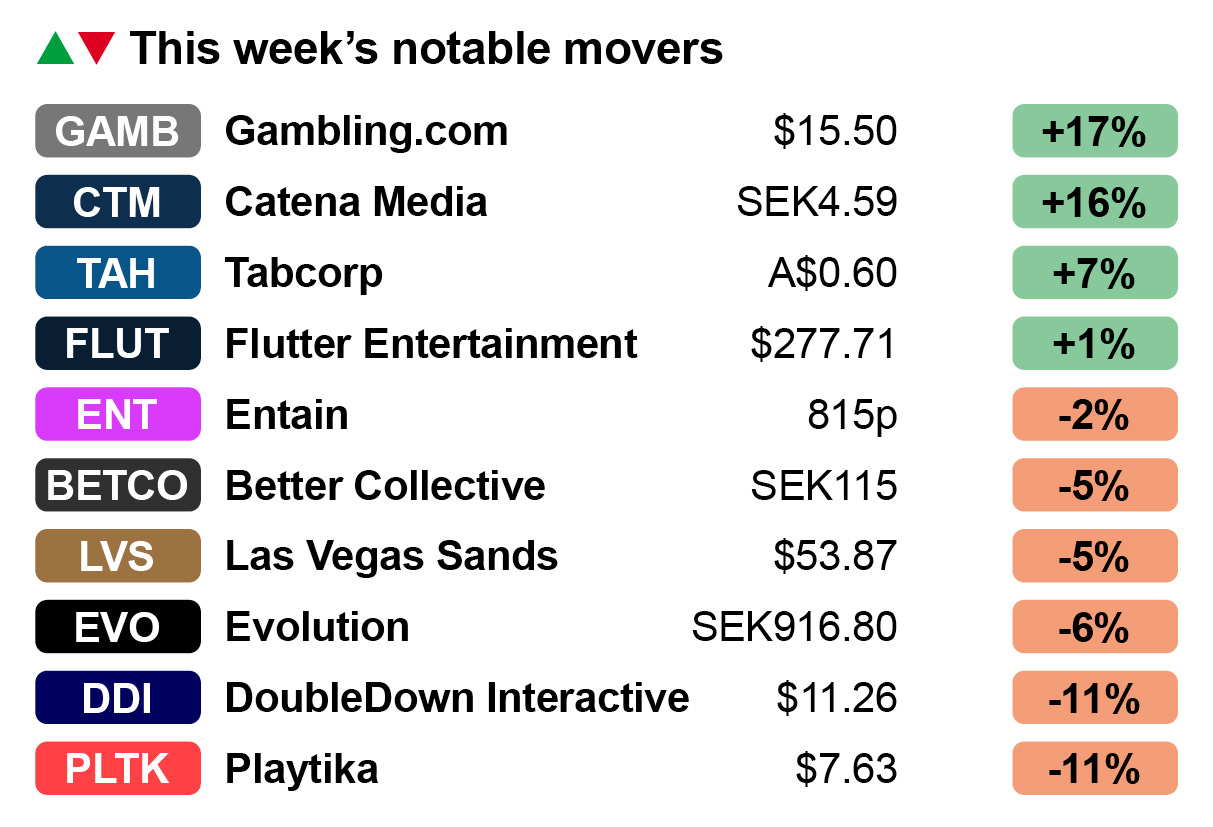

Shares watch

Give me a G: Ahead of this morning’s share price fall, Entain had suffered a 2% loss last week despite a supportive note from the analysts at Peel Hunt, who suggested new CEO Gavin Isaacs has enjoyed a solid three-month honeymoon period.

The analysts noted the Entain share price has been on a decent run since Isaacs took over the reins.

“Leadership, and cheerleadership, should be clear throughout 2025 and beyond, after a prolonged period of turbulence,” the team wrote.

Since the start of September the shares are up 27.5%, though YTD they are still down over 17%.

However, the early 4% drop this morning signals, perhaps, that Isaacs’ honeymoon period is definitively over.

Handbags and gladrags: Gambling.com headed up the list of gainers this week, climbing 17% after the announcement late on Thursday of its acquisition of Odds Holdings, the parent company behind the consumer-facing OddsJam, DailyGrind Fantasy and the enterprise business.

Riding its coattails was fellow gaming affiliate Catena Media, up 16%, which tends to rise whenever there is talk about M&A in the space.

For better, for worse: The other major listed gaming affiliate name, Better Collective, fell 5% on the week. The company has failed to regain any ground since its late October profit warning and, indeed, it has since fallen a further 12%.

Our platform empowers operators to scale efficiently in highly-competitive and regulated markets utilising a unique set of capabilities, including:

Total Brand Autonomy: The freedom of having your own in-house sportsbook

True Personalisation: Pricing and product tailored to every customer's expectations and preferences

On-demand User Observability: Access to every single customer interaction, helping you make more informed decisions

Operate Multiple-Jurisdictions Quickly & Easily: Purpose-built tech to effortlessly scale internationally

Grow faster. Reduce costs. Challenge market-leaders with confidence.

Find out more today, book a demo.

By the numbers

Too hot to handle: The numbers for November continue to trickle in and they are not looking great for ESPN Bet. Indiana, for instance, showed that the Penn-owned brand remained stranded on handle share of 3%, up from 2.9% sequentially.

This was after handle rose 20% YoY to $614m, while GGR was up 123% to $68.6m. By handle, FanDuel was on top with 36% share while DraftKings had 34% share.

By GGR, however, DraftKings was on top with 38% while FanDuel had a 34% share for a combined 72%.

In New York, November’s total GGR of $232m, up 31% YoY, was the highest monthly total since the market legalized, while the handle figure of $2.27bn was just shy of the record amount set in October.

FanDuel led the market by GGR with 44%, followed by DraftKings with 33%, BetMGM, Caesars and Fanatics on 6% each and ESPN Bet on 1.5%.

Recovery position: Looking across the 12 states to have reported November data so far, the team at Jefferies noted GGR has rebounded on a YoY basis, up 83% from handle that has risen 8%. This was down to margin recovering to 10.9% compared with the poor hold of 6.4% in Nov23.

The analysts pointed out BetMGM has enjoyed the biggest YoY GGR bounce, up 109%, with FanDuel up 103% and DraftKings up 79%

Spain: Q3 online GGR rose 14% to €348m, with operators taking the opportunity to bolster revenues after the country’s supreme court verdict reversed the ban on gambling ads. Marketing spend increased nearly 10% to €132m.

Casino GGR was up 17% to €188m, or 54% of the total, while sports betting was up 20% to €136m.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Events calendar

Jan 20-23: iGB Affiliate, Barcelona

Jan 20-22: ICE, Barcelona

Feb 23-25: SIGMA, Eurasia Summit, Dubai

Feb 25-27: SBC Summit, Rio de Janeiro

Mar 12-13: Next: NYC 25, New York

Seamless Onboarding, Happy Players. It's That Simple.

Experience the perfect balance between stringent identity verification and effortless onboarding with IDComply, a groundbreaking solution from GeoComply. Optimized to deliver pass rates up to 95% while fighting fraud at registration.

Connect with us to learn more.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.