Bally ho! CEO ‘feels good’ about UK changes

Bally’s UK optimism, Better Collective’s growth, Churchill Downs' upside, Codere’s shares +More

Bally’s “crafting a bright future,” says CEO Robeson Reeves.

In +More: UKGC announces slot limits, Apple launches Sports app.

Better Collective records 19th straight year of growth.

In shares watch Codere Online’s stunning 55% rise this week.

BettingJobs’ Jobsboard features tax specialist and country manager roles.

I feel nice, like sugar and spice.

Bally’s shrugs off slot limit threat

I feel fine: The changes to the UK regulatory regime including new slot limits announced this morning (see below) “make for a better market,” according to Bally’s CEO Robeson Reeves, after the UK business posted revenues up 5% on a constant currency basis, helping push international interactive revenues to a record adj. EBITDA of $93m.

Bovvered: He added that he was ”not concerned at all” about the regulatory changes, which include limits on online slot stakes of £5 for over-25s and £2 for under-25s.

“Even if there is a degree of displacement from any of the larger operators, this will impact much smaller operators more severely,” he said.

He also noted the company would be rolling out the Bally brand in sports betting in the UK. “This will aid the funnel.”

“When I look at our business performance right now in the UK, I feel great.”

Swing when you’re winning: CFO Marcus Glover noted the North American operation, where online revenue rose 27% to $33.4m in Q4, is predicted to continue to make adj. EBITDA losses into this year of ~$30m.

Reeves said the North American business now had “appropriate investment costs” ahead of the transition to the Kambi and White Hat backends.

But he added the “potential swing factor” would be the launch of iCasino in Rhode Island on March 1 where Bally’s will be the sole operator.

Reeves said the Asian business, which he pointed out was B2B, “stabilized” over the period.

I can see clearly now: Reeves said Bally’s is “crafting a bright future” despite the B&M development challenges for the permanent facility in Chicago and with the Tropicana in Las Vegas, which is set to close at the beginning of April ahead of the construction of the A’s stadium on the site.

The temporary Chicago casino is “several months” behind previous management estimates, according to retail president George Papanier.

Analysts noted the plans for Chicago amount to a spend of ~$1.1bn in 2025/26 where financing is still “undetermined.” But JMP said funding was “not a worry.”

Leak: The good news, however, is the city authorities have approved the updated plans after the discovery of water pipes at the site.

By the numbers: The B&M side saw revenues rise 7% to $342m, leaving total quarterly revenues up nearly 9% to $612m. Group adj. EBITDA was down 11% to $129m.

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

For more info, go to www.kambi.com

+More

BREAKING: The UK government has announced the new slot stake limits this morning, with £5 being the maximum for those over-25 and £2 the maximum for anyone under-25. See Compliance+More next week.

Apple has launched its Sports app featuring live scores and betting odds, as the company said it plans to “amp up” its commitment to live sports. In the US, DraftKings is the odds supplier.

Playtech has announced it will provide live casino to Finnish state-owned operator Veikkaus as part of a six-year contract.

In next week’s Compliance+More

Checks mate: The UK Gambling Commission’s Tim Miller has written a blog giving further details on what the sector can expect in terms of financial risk checks and says a pilot study of four-to-six months will be the next step.

Further reading: This week Compliance+More looked ahead to Monday’s parliamentary debate.

Take a hike: Gov. Pritzker is eyeing a sports-betting tax hike to 35%.

What we’re reading

Give me a reason: ESPN Bet ‘isn’t offering me any reason to make it my go-to sportsbook.’

Sorry seems to be the hardest word: FanDuel admits Cali lobbying mistakes while speaking at the California Indian Gaming Conference.

Tickets are now available for the Earnings+More: Capital Markets Forum taking place at the New York Stock Exchange on the afternoon of Monday, May 6.

Consisting of six panels discussing various pivotal topics impacting the North American betting and gaming sector from corporate development to M&A and investor relations, the event features speakers from:

Caesars, Moelis, PJT Partners, Blackstone, MGM Resorts, Macquarie, Duane Morris, Tekkorp, Citi, Truist, Discerning Capital, GMA, Innovation Capital, CBRE, Houlihan Lokey, Sharp Alpha, Bettor Capital and more.

Follow this link for more information on how to obtain your ticket. Use the code EARNINGS100 for a $100 discount available to E+M subscribers.

Collective effort

N-n-n-n-nineteen: The CEO of gaming affiliate giant Better Collective, Jesper Søgaard, kicked off the call by noting that 2023 was the nineteenth year straight of top line and EBITDA growth. As was pre-announced earlier this month, Q4 revenues came in ahead of target at €85m, albeit flat YoY.

Mag 7: Søgaard noted the company had made seven acquisitions over the period with the last being the second largest in the company’s history as it swallowed up Playmaker for €176m.

Søgaard said the company’s sports audience across its various sites had risen to more than 400m monthly visits.

Cutting out the middleman: He added it was “no secret” that large parts of the sports media industry were “struggling” at present, but Better Collective sees itself as the “key acquirer and optimizer moving forward.” The company “sees an opportunity” in building out and scaling its internal adtech platform and had an “untapped potential in brand advertising.”

“If we are successful, the platform will optimize our third-party agency relations and will rid ourselves of most of the intermediary fees,” he said.

The long-term ambition, he added, was to become the “go-to partner for brands searching for sports audience exposure and sports fan engagement.”

By the numbers: CFO Flemming Pedersen said the North American business managed organic growth of 5%, up 9% overall, despite the headwinds of the continued transition to revenue-share agreements over CPA. Group EBITDA fell 16% YoY to €30m.

FY24 revenue rose 21% to €327m while EBITDA was up 31% to €111m.

Ups and Downs

Racing certainty: Boasting “one of the strongest balance sheets in the industry,” Churchill Downs CEO Bill Carstanjen said the company was well-positioned for growth in the year ahead and beyond.

That includes the expansion of the TwinSpires pari-mutuel B2B business where FanDuel and DraftKings are currently the only clients.

The company also hopes to expand its HRM business in Virginia following the ban on skill gaming machines late last year.

Carstanjen said he thinks the US Gaming environment “generally is fairly dynamic.”

By the numbers: Q4 revenue rose 17% to $561m while FY23 revenue was up 36% to $2.46bn. Q4 adj. EBITDA was up 21% to $219m and FY23 rose 34% to $1bn.

Derby days: Looking ahead to May's 150th running of the Kentucky Derby, Carstanjen said though it was the oldest continuously run sporting event in the US, to Churchill Downs, it’s “still a young, young property with a lot of opportunities.”

JMP noted the “tone around the event is coming in more positive compared to past years.”

With HRMs, he said scale has been an important factor. “We find that as we achieve scale, we’re more efficient, we get smarter, our teams work better, they get more done.”

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

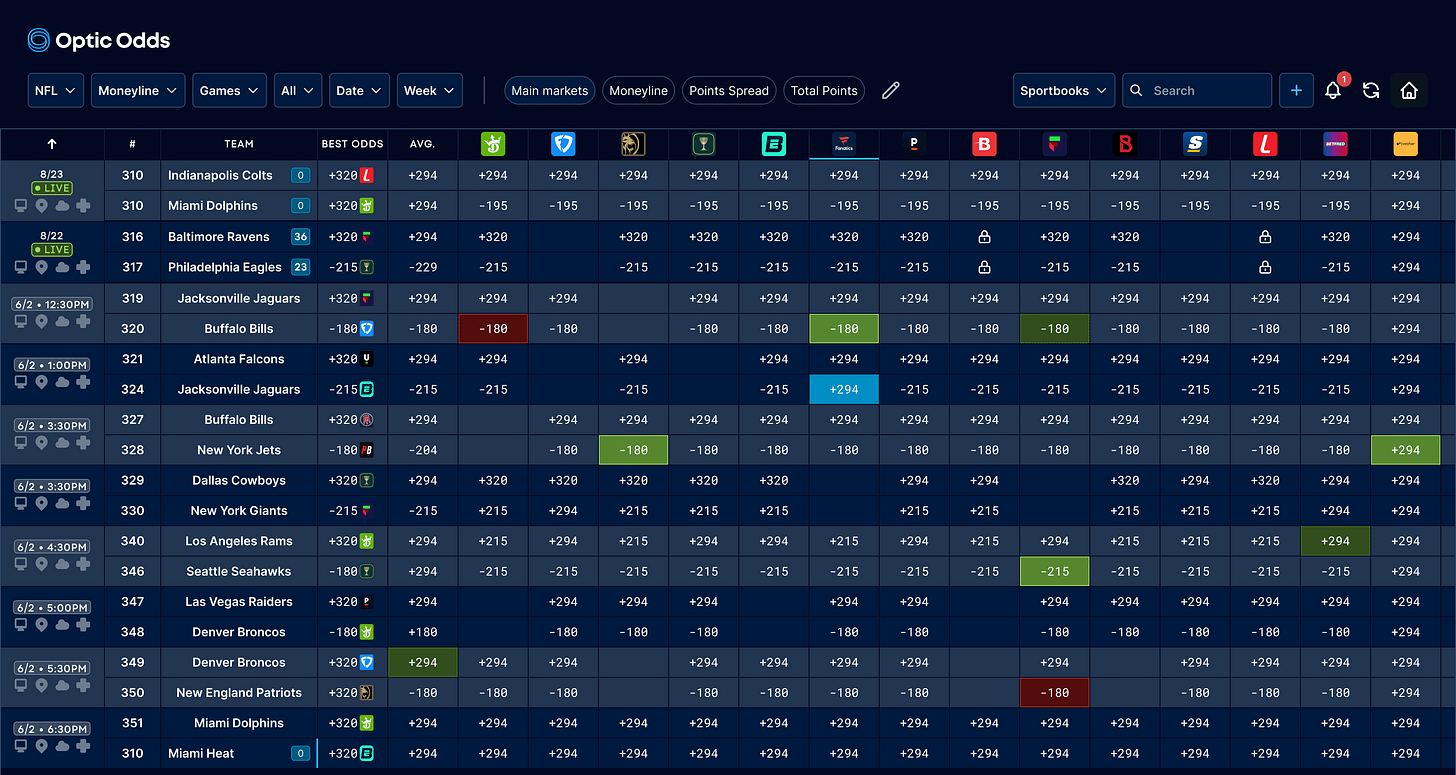

Optic Odds includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Get in touch at ryan@opticodds.com.

Earnings in brief

VICI: Revenues increased 21% to €932m while AFFO increased 17% YoY to $570.4m in Q4, while in FY23 total revenues increased 38.9% YoY to $3.6bn. VICI’s call with the analysts is this afternoon.

Cirsa: The Spanish and LatAm-facing gaming operator saw Q4 revenue rise 8% to €515m while revenue for FY23 rose 14% to €1.99bn. Q4 operating profit rose 5.5% to €163m while on a full-year basis it rose to €630m.

It said the slots division in Spain had enjoyed its best-ever quarterly performance.

Scout Gaming: Q4 revenues rose 9% to SEK8.7m ($841k) as the now almost wholly B2B provider of F2P games and fantasy products added Duelbits as a customer and continued to expand its partnership with bet365 in North America. EBITDA improved to a loss of SEK3.6m.

The shares week – Codere Online

Something's happening here: The Spanish and LatAm-facing operator enjoyed something of a banner week this week as it climbed to successive 52-week highs through the week, ending at close on Thursday up over 55%.

All eyes will be on what the company says when it reports its Q4 earnings next week.

👀 Codere Online storms the charts

Calendar

Feb 23: VICI (call)

Feb 27: Light & Wonder, Gaming and Leisure Properties (e)

Feb 28: Gaming and Leisure Properties (call), Accel

Feb 29: Codere Online, Golden Entertainment

Senior Accountant – US Tax Specialist – Remote from US time zones

Japan Country Manager – Taipei

Senior Creative Director – Malta

InclineBet provides performance-driven digital marketing services to the global regulated iGaming market. Our team bring unrivalled expertise in digital marketing, online casino and sports betting to deliver high-performance UA, CRM and Creative services.

iGaming isn’t merely another market we serve, it’s the only market.

Click to learn more about what we do and how we can help.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.