Aug 8: UK gaming feels the heat

The week ahead, DraftKings, Penn Entertainment and Century analyst reactions, startup focus - BettorEdge +More

Good morning. On today’s agenda:

Earnings attention turns to Entain, Flutter and 888.

Analysts are not convinced about DraftKings’ claims to marketing rationalization.

The startup focus for the week is no-fee social betting marketplace BettorEdge.

The week ahead

Chalk/cheese: Last week, the largest US casino groups demonstrated they were seeing no visible recessionary effect on their businesses with Las Vegas, in particular, apparently seeing revenues accelerating. This week, however, the focus turns to the biggest of the UK-listed operators Entain (Thursday) and Flutter and 888 (both Friday) and here the situation appears very different.

Pressure cooker: In the UK, inflation hit 9.4% and the Bank of England last week warned it would hit 13% next year and remain at above 10% for much of next year.

Chilling: Talking at the start of July about conditions in the Baltics where inflation is running at 20%, Entain CFO said it would be “mad” to think that such inflation levels would not have an impact on trading.

Entain

Where does it hurt? At the start of July Entain said it was already seeing the impact of macro impacts in the UK with a reduced rate of spend among consumers helping to drag online Q2 NGR down 7%.

Getting better: Wood said he hopes Q3 and Q4 would be better than Q2 because of the World Cup.

The exit from the Netherlands will also weigh down H1 revenues but Entain hopes to have addressed the threat of future shortfalls via the €550m BetCity acquisition.

Unfinished sympathy: A note from Jefferies suggested that MGM CEO Bill Hornbuckle’s comment last week about Entain that “you can’t buy what’s not for sale” was a “pointed overture” to Entain’s shareholders, ~50% of which are US-based.

Paperchase: Those shareholders, Jefferies suggest, “may welcome an MGM paper offer to ride a digital re-rating”.

Jefferies note “the world has changed” since the approaches last year from MGM and DraftKings.

Datapoint: MGM’s Jan21 bid of an implied £13.8bn would now be worth £17.4bn due to FX movements and the falling value of sterling.

Flutter

Seal the deal: The latest news from Flutter came on Friday when it said it has completed its £1.62bn Sisal acquisition but the company’s last trading statement was at the start of May which in the current condition feels like an age away.

At the time, it said US revenues were up 45% to £429m driven by sports betting which was up 50%.

However, the UK and Ireland revenue declined 20% due to the imposition of safer gambling measures and tough comparatives in terms of sports margin and peak player engagement in the lockdown-affected prior-year period.

888

Rubber hits the road: The clearest impact of the economic uncertainty to date has come from the debt markets and what we know about the difficulties of raising cash against the current backdrop. So it was that at the start of July, reports emerged that 888 was struggling to find buyers for the debt raised to fund the William Hill buyout.

Inducements: Though the debt was underwritten, the banks were said to be struggling to find buyers despite a yield price at ~10%.

Forecasts: 888 said in a trading statement in early July it expected 888 H1 revenues to come in at between £330m-335m. William Hill revenue for the 26 wks to June 28, meanwhile, was expected to be between £620m-630m.

Also reporting this week: Red Rock Resorts, Wynn Resorts, Light & Wonder, LeoVegas, Genius Sports, Sportradar, Super Group, Catena Media

What we’ll be writing

Deal Talk: Tomorrow we launch Deal Talk, another new monthly newsletter edition this time focusing on what’s being spoken about away from the earnings announcements and analyst calls of the betting and gaming sector.

In the first issue, we will be focusing on Playtech’s M&A woes, take a look at the strategic reviews overtaking the sector and do a deep dive on MGM’s share buyback program.

**Sponsor’s message**: Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy.

Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group (aimsgroup.io).

Get in touch with your pitch or disruptive products to plug into our investment network!

DraftKings analyst reaction

Analysts at Deutsche Bank are still not convinced that the days of unsustainable online marketing spend are over.

Plus ça change: On Friday DraftKings beat guidance and the share price rose 12% at one point before settling at just below 10% (and is up 57% since July 1) but for Deutsche Bank, “not much has changed”

DraftKings share price performance, Aug 5

Not seeing it: The DB team are “not convinced” that the industry is going through a large-scale promotion rationalization as “we frankly do not see that in any of the data”.

Deutsche Bank: “We are also not convinced that marketing spend has rationalized greatly, beyond the retrenchment from one operator and the normal seasonal shifting of advertising spend.”

Super-heating: In addition, both marketing and promotions “could heat further” should new entrants emerge.

Unpredictable: Truist pointed to the promo-heavy start of the NFL season suggesting DraftKings does “not have predictable numbers” on the extent of the upcoming activity.

Hide your light: The team at Wells Fargo suggested the Q2 performance was better than it seemed at first glance.

The full-year revenue guide reflects a better SB/iGaming outlook, the team says, offset by lower Marketplace/NFT relating to a change in revenue recognition.

Point/counterpoint: Wells Fargo suggest they “grapple” with the potential for upside stemming from a meaningful reduction in expenses - something they suggest is “increasingly plausible” - versus “the reality” that Q3 EBITDA losses will exceed the YoY comparison due to Q2 expenses being pushed into the second half.

The tech difference: JMP suggest H2 will be the “last large-scale push” before DraftKings enters into a “more mature operating environment” in 2023 and beyond.

They posit that SBTech will be instrumental to retaining customers instead of handing out free money.

Top of the pops: They add they believe DraftKings has an industry-leading technology stack which will result in their ability to “sustain their top-three market share moving forward”.

The shares week

The genius switch: As noted above, also reporting this week is Genius Sports and likely to be top of the agenda for the analyst will be the performance of the share price in the past week, up over 42%.

👀Genius Sports share price, week of Aug1-Aug5

Bounce: This marks something of a return for one of the most poorly-performing stocks of SPAC float stocks. Despite the one-week bounce, in the YTD the shares are down over 52% and off by nearly 83% since float in April last year.

Eat my shorts: The team at Jefferies suggested the performance of both DraftKings (as noted above up 32% on the week) and Rush Street Interactive over the week (up 8% on the week) was better than most land-based gaming stocks.

Risk-on: They suggest this could be driven by the return of a risk-on movement in the markets generally or by short covering. Both stocks had short interest of over 10% of their shares heading into last week.

Referring to the impression given over marketing (see DraftKings analyst analysis above), they add that the idea that marketing is rationalizing is underpinning the short covering.

In other words, the market reaction could turn one again should evidence emerge of the marketing taps being turned back on in a major way.

Analysts in brief

Penn Entertainment: Roth analysts suggest it is hard to find catalysts that move the needle, suggesting the mature portfolio of casino properties will be hard pressed to grow better than inflation even with initiatives such as cashless gaming.

Underpowered: While online has proven it can “generate industry-leading profitability”, its market share persists at less than 5% in the US while theScore “isn't proving to be a major revenue generator either”.

Century Casinos: Macquarie said the underlying fundamentals remain strong and were helped by a stable promotional environment with marketing spend remaining below pre-COVID levels.

“Century expects this dynamic to continue as they have not seen any negative impact on gaming volumes from these lower levels of advertising.”

Century playbook: The group is in the process of integrating the Golden Nugget Sparks venue and JMP said it expects to see a “similar playbook” of cost-cutting at The Nugget as was seen with three Eldorado assets it acquired in 2019.

Golden Entertainment: Analysts at JMP note that while Golden Entertainment maintains 100% of its real estate, the value of the company’s assets and the proximity to the Strip has been noted by investors.

While management believes it creates more value for shareholders at current levels to keep the real estate, JMP notes:

”If we see the cap rate compression story continue to play out for REITs, it could warrant selling off the real estate of these assets. We believe a sale of the STRAT’s land to a REIT could result in $600M- $700M of proceeds for Golden.”

Playtika: With Playtika missing Q2 revenue forecasts by 3% and social casino performance much weaker than expected, the team at Macquarie acknowledged the group’s product and personnel changes. But they note that stemming the tide is “unlikely to be an immediate event”.

No more surprises: While the company is focusing on pulling back on marketing, hiring and consolidating game studios, Macquarie said there have been “too many negative surprises” and Playtika needs to show it can set and meet (or beat) expectations.

Startup focus - BettorEdge

Who, what, where and when: BettorEdge is a Minneapolis-based no-fee social betting marketplace connecting sports fans to trade bets founded by Greg Kajewski and James Seils that launched in early 2021. In the first 18 months of operation, BettorEdge has grown to a community of users who have bet $40m in orders collectively.

Funding backgrounder: BettorEdge has raised over $1M to date backed by a network of friends and family.

So what's new? In March this year, BettorEdge saw more than $3m in orders on NCAA Conference Tournament Basketball games and NCAA Tournament games. Upcoming new features include a ‘discover’ page with personalized suggestions for games, bets, competitions and more.

The longer pitch: Kajewski says BettorEdge’s opportunity lies in creating a platform that “aligns to how bettors actually engage”.

“As consumers are constantly looking to bet with or against friends and the community, having the opportunity to do so, fee-free, is a revolutionary innovation not seen before in the industry,” he adds.

Well received: Kajewski says the community reaction to the concept has “proved there’s a strong demand” for BettorEdge offers. “We’ve seen a ton of interest in all markets in the US,” he adds. “We started our marketing in our home state of Minnesota and saw great adoption there, as well as neighboring states like Wisconsin and South Dakota.

The takeaway: There’s a strong desire for social betting with no hidden fees across the community,” says Kajewski.

Datalines

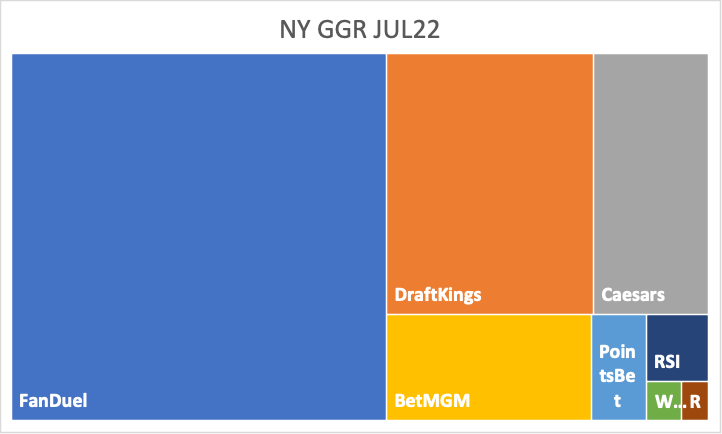

New York: Flutter’s FanDuel led New York’s online sports-betting market in July with 54.5% of GGR followed by DraftKings (21.5%), Caesars (11.9%), BetMGM (8.6%), PointsBet (2.3%), Rush Street (1.6%) and Wynn (0.5%). Resorts World was less than 0.5% and BallyBet has only just launched.

Maryland: Casino GGR in July was up 0.8% YoY at $181.5m. MGM National Harbor led the market with 42% share and GGR up 6.8% YoY at $77.2m.

Newslines

Party like it's 1999: US elections website BallotPedia reports that the two sports-betting bills in California have raised the most money since reporting of ballot measure sponsoring came into being in 1999. Those for and against both ballots have raised a total of $256.4m, BallotPedia reported.

Rebrand: Blackstone’s Great Canadian Gaming rebranded as Great Canadian Entertainment and has launched a new loyalty rewards program for its 12 Ontario destinations.

Bounty hunter: Peer-to-peer DFS provider Bounty Sports and Inside the Pocket have entered into a strategic content partnership that will see Bounty Sports’ fantasy product portfolio join ITP’s distribution platform to grow its reach to a new network of operators, affiliates and media partners.

What we’re reading:

Twitchfinder general: “These days, ‘slots’ is the seventh most popular content category on Twitch, ahead of the video game Fortnite.”

Not in Kansas now: Legal Sports Report reports the state Racing and Gaming Commission Director of Wagering as saying sport-betitng won’t launch until the NFL season is underway.

Wall of money: Esports comes to the Commonwealth Games.

On social

Calendar

Aug 8: AGS

Aug 9: Light & Wonder, Red Rock Resorts, Wynn Resorts

Aug 10: NeoGames, Accel Entertainment

Aug 11: Entain, LeoVegas, Acroud, Super Group, Endeavor

Aug 12: Flutter, 888

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com