Apr 20: 888 buffeted not beaten

888 Q1 trading update, LVS US Integrity investment, Pennsylvania and Michigan analyst commentary +More

Good morning. On today’s agenda:

888’s Q1 statement details the forewarned year-on-year declines.

Las Vegas Sands makes an investment in anti-match-fixing technology startup U.S. Integrity.

Analysts pour over the promotional spend data in Pennsylvania and Michigan.

It covers the hillsides. Click below:

888 Q1 trading update

Total revenue down 18% YoY to $224m, QoQ was up 1%.

Decline led by B2C betting, down 42% YoY to $24m.

B2C gaming was also down 14% to $191m.

Shock resistance: For all the warnings about Q121 being an outlier in terms of outperformance, today’s figures won’t be welcomed by investors who have just laid out £162.9m to pay for the William Hill acquisition.

Against the strong prior-year period, betting stakes declined 28%.

Lower revenue per active was “driven by the heightened focus on safer gambling”, particularly in the UK. Recall, 888 was recently fined £9.4m by the UK Gambling Commission for social responsibility and AML failures.

As with many others across the European sector, the forced exit from the Netherlands last October when the market regulated is also pinned as a key negative.

North American adventures: 888 spoke about an unquantified “strong” performance in the US. The company has launched in Michigan with the WSOP poker brand in partnership with Caesars Interactive and in Ontario with 888. A launch of the SI Sportsbook JV brand in Virginia is planned in May.

The company said it was “excited” by the potential of Michigan’s plans for a liquidity compact for poker.

It announced the hire yesterday of former Bleacher Report’s CEO Howard Mittman to head up its US operations.

Made in England: 888 spoke about the recently launched ‘Made to Play’ ad campaign in the UK that “unites” the 888 brands under one umbrella ad that it hopes will “increase advocacy” as well as lower customer acquisition costs.

Recent raise: The recent cash raise came after 888 renegotiated the price for its William Hill international business buyout with vendor Caesars Entertainment.

Analyst reaction: Peel Hunt said the UK performance was affected by the greater focus on safer gambling as well as the reopening of retail. “Given the prospect of a winter World Cup, we expect revenue to be weighted to H2 this year.” Regulus Partners said of the William Hill deal that strategically “the group could not have picked a better time to get transformative”, but added that operationally “the timing could not be more challenging”.

NOTE: There was no accompanying earnings call.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in

fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club.

Las Vegas Sands U.S. Integrity funding

Integral investment: Las Vegas Sands has placed an undisclosed "strategic investment" in the match-fixing analytics firm U.S. Integrity as part of its strategy to invest in the B2B segment of the US online gaming and betting space.

B2B focus: LVS, which has divested itself of its US brick-and-mortar assets to focus on the international market, has ruled out trying to compete in the B2C online space in the US and has instead been assessing investment opportunities among suppliers to the industry.

Investors in U.S. Integrity also include SeventySix Capital and New York Angels, the company is based in Las Vegas and New York.

Davis Catlin, Senior Managing Director at LVS, commented on Linkedin: “I couldn't be more excited to see all the great things U.S. Integrity can do with this investment. Great people attacking an important issue - so we were excited to fund the next generation of sports betting integrity.”

Inside the Pocket fundraising

Pocket rocket: Free-to-play gaming aggregation platform Inside the Pocket says it has secured $4M of investment from a consortium led by WinSure Global. The financing will be used to further develop its proprietary platform for international growth. The company said it will be announcing a Series A funding round later in the year.

ITP is headed by former NFL executive Hussain Naqi. Also taking part in the funding round is The Rokker Network and CEO Andy Rogers.

PA, MI, NJ analyst reaction

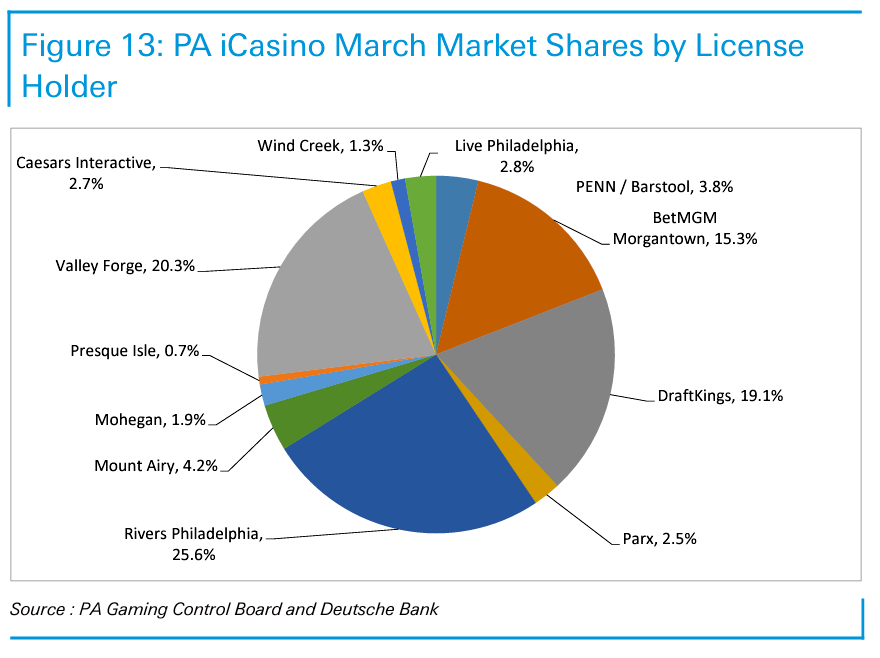

Promo drop: Deutsche Bank focused on operators’ promotional spend in Pennsylvanian and Michigan as it dropped considerably in March.

PA promotions were down from 107% of GGR in February to 41.6% in March (+31% YoY).

Promotions as a percentage of handle were down ~130 bps MoM and up ~40 bps YoY to 2.7%.

The DB team noted the differences in promo spend efficiency among the leading OSB brands in PA.

"When comparing the promo efficiency of Barstool and BetMGM to the market leaders from Jan21 to Mar22, Barstool and BetMGM promotional activity represents 3.1% and 6.4% of their respective handles, while FanDuel promos as a percentage of handle are 2.5% and DraftKings promos, as a percentage of handle, stand at 1.9%."

In Michigan operators’ promotional spend was down to 3.5% of handle vs. 6.6% in Feb22 to $15.8m and made up 51.9% of mobile GGR compared with 117.5% in Feb22.

NJ (keeps on) rising: With New Jersey clearing the $1bn mark in betting handle for the sixth time in the past seven months, the team at Wells Fargo noted:

“With New York's OSB launch in early January and a general concern that there will be some cannibalization, we note that March's report shows the third consecutive month of year-on-year handle growth in excess of 30%."

As you were: In online casino, BetMGM continues to lead in Michigan with 36.9% market share, DraftKings is second with 16.2%, FanDuel is third with 15.9% andWynnBet fourth at 3.9%. In Pennsylvania’s icasino segment BetRivers leads with 25.6% share, FanDuel is second with 20.3%, DraftKings third with 19.1% and BetMGM fourth with 15.3%.

Macau Q1

Macau’s GGR splits for mass market and VIP players during Q1 showed that mass-market GGR including slots was down 66.8% vs. Q119 and -8.8% QoQ, while VIP GGR was down 87% vs. Q119 and -1.2% QoQ. Mass table games accounted for 71% of total table revenue vs. 72.7% in Q421), VIP table games contributed 29% vs. 27.3% in Q421.

iGaming NEXT New York

The iGaming NEXT New York conference will take place on May 12-13 and will bring together the leading OSB/iGaming executives, institutional investors and leaders in the Web3.0 space. The event is supported by the likes of Morgan Stanley, Playtech, Spectrum Gaming and Evolution and is limited to 700 high-level delegates.

To register with a special 10% discount, use the code: 10UNL050.

Conference agenda, ticket purchases and registration details: www.igamingnext.com/nyc22

Newslines

Greek to me: OPAP has announced it has sold its minority interest in Kaizen Gaming’s interests outside Greece and Cyprus for €50m to Allwyn (formerly SAZKA), with a potential further earnout based on the performance of the unit over the next three years. OPAP will retain its 84.5% combined stake and sole control over the Greece and Cyprus-facing Stoiximan online gaming business.

House to Senate: Missouri could put forward an online and retail sports betting bill this week, according to local press reports. State Senator Caleb Rowden said a bill that passed in the House of Representatives could be sent to the Senate this week. Tax rates are still to be determined, but the bill is supported by professional sports franchises and most casinos in the state, who would be eligible for licenses.

Oktopussy: The fintech provider Okto will provide advice on optimizing digital payments to the 900 casinos represented by the European Casino Association (ECA) as part of a drive to introduce new payment solutions for European casinos as it aims to expand into new markets.

What we’re reading

Netflix: People really didn’t like the second series of Bridgerton.

John Authers: “Netflix was a great place to shelter, but it was never a great idea to assume that its growth would continue.”

On social

Californikation: Ballot wars

Calendar

Apr26: Boyd Gaming Q1

Apr27: Kambi, Churchill Downs Q1

Apr28: Kindred, GLP Q1

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com