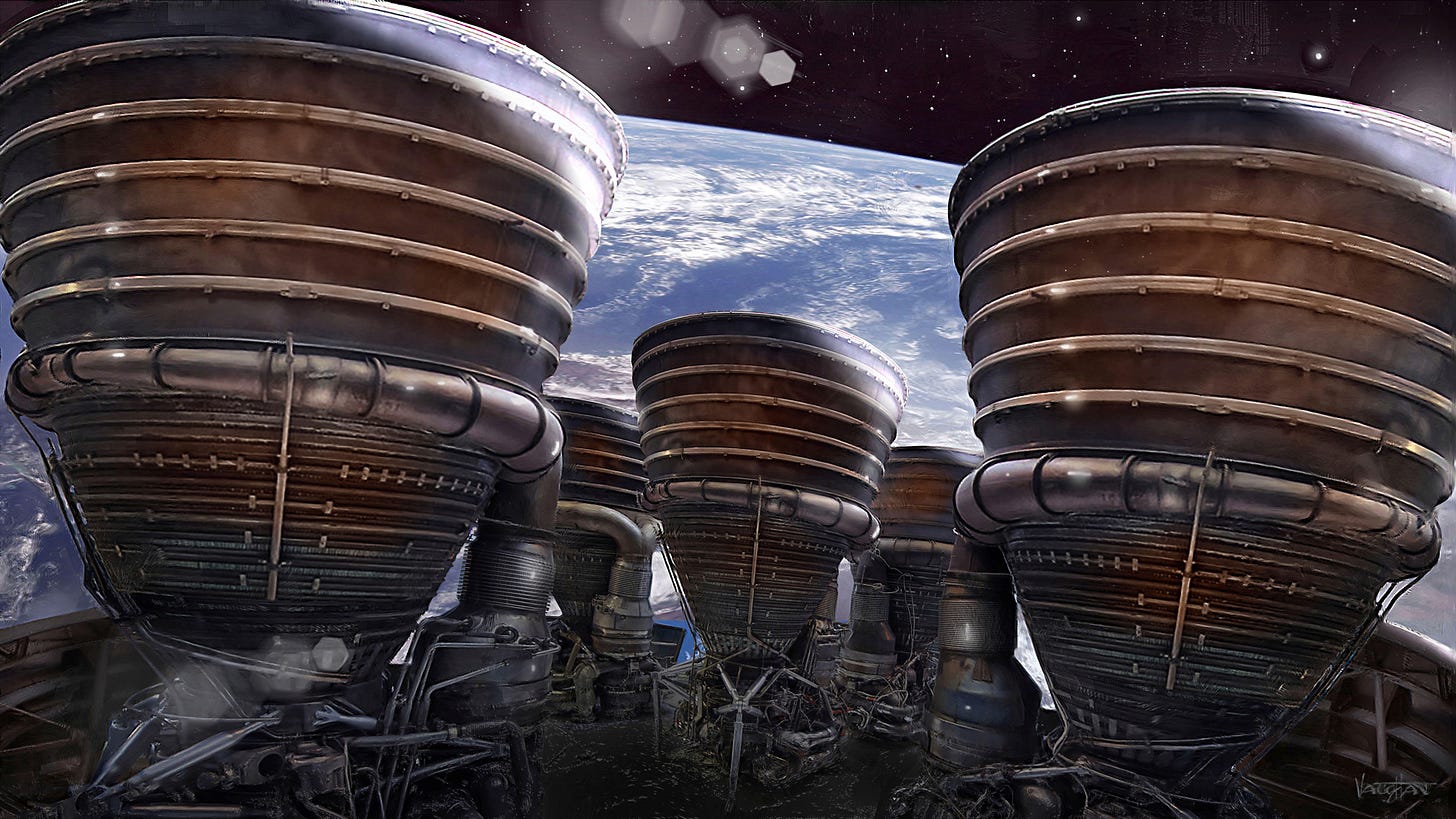

🚀Apollo into orbit

IGT/Everi combination snapped up by private equity giant

The $6.3bn all-cash deal for IGT/Everi builds on previous merger plans.

BetMGM produces less than stellar H1 numbers.

In +More: Spreadex hit SI roadblock, a big earnings week ahead.

PrizePicks hires Moelis, looks at M&A options.

StakeLogic sells up to Sega Sammy for $130m.

I finally had all my ducks in a row, peace and quiet by means of subtraction.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Apollo swoops

To the Moon: The private equity giant Apollo has reached an agreement to buy the IGT gaming and digital and Everi combination of businesses for $6.3bn in cash. The deal builds on the previously announced IGT/Everi merger, which split gaming and online from IGT’s lottery business.

Settling up: As part of the deal, Everi shareholders get a cash offer of $14.25, which represents a 56% premium to the prevailing share price ahead of the announcement. IGT will receive $4.05bn in cash, which will be used to pay off debt and return some cash to shareholders.

Majority IGT shareholder De Agostini will retain a minority stake in the company.

The remaining lottery business at IGT will change its name and ticker. Vince Sandusky, will continue as CEO of that business while IGT EVP of strategy and corporate development Fabio Celadon will head up IGT/Everi.

Orbital: Sandusky said the new deal was an “evolution” on the previous arrangement and was the “successful culmination” of the strategic review process. He had previously said IGT has “really left no stone unturned” in seeking alternatives for the gaming and online division. In finding Apollo, though, they appeared to have overturned another stone.

Analysts at Truist noted Apollo was previously mentioned as a buyer when the strategic review was first announced.

“It would appear improving capital market conditions and their view on an IGT gaming/Everi combination has driven them to re-engage,” the team added.

Leave it in a safe space: Coincidentally Apollo also bought UK parcel delivery operator Evri on Thursday.

Surprise! The Truist team said the surprise announcement was likely due to the somewhat muted shareholder response to the original proposal as witnessed by the Everi share price, which has languished in the subsequent months before leaping 42% on Friday’s announcement.

🚀 Apollo offer puts a rocket under Everi and IGT

Privacy, please: The analysts at B Riley said the transaction was a “cleaner structure” with IGT now a better capitalized lottery pure-play. Jefferies added that the integration of the two businesses would be better accomplished in the private sphere.

More to come: The B Riley team also hinted at more M&A in the gaming space.

“Active M&A in the gaming industry demonstrates intrinsic values are much greater than current public valuations,” the team suggested.

Satellites: Apollo has form when it comes to owning gaming companies. It is currently the owner of the Venetian Resort, which it bought from LVS for $2.25bn in Feb22 and also owns Great Canadian Gaming, which cost it $3.3bn in Sep21. It also holds a near 60% investment in previously wholly-owned Lottomatica.

Diary dates: IGT reports on Tuesday. Everi will report before August 9 but will not host a call.

** SPONSOR’S MESSAGE ** M&A Opportunity: Integrate Betting into PlayStation, Xbox, and PC Gaming

Explore an exceptional M&A opportunity to acquire a technology that transforms hobby gaming into a sports betting experience. This system lets gamers place bets on their performance on PlayStation, Xbox, and PC. For example, Fortnite enthusiasts can bet on achieving at least 5 kills in their upcoming game. The platform supports probabilities for over 100 different betting scenarios, generating personalized odds with a 20-30% house edge. It doesn't require a gambling license and is compatible with any platform.

Tap into a large millennial demographic with lower customer acquisition costs than traditional gambling. Visit www.betonskills.com to sign up and access a detailed 3-pager!

Not so stellar BetMGM

The struggle: The difficulties of attempting to hold a position in the US OSB and iCasino market appear to be showing after BetMGM announced H1 figures that showed revenue growth at only 6% to $978m. The performance was marginally better in Q2 with net revenue up 9% vs. 3% in Q1.

EBITDA losses for the first half came in at $123m. It said H2 EBITDA would be “similar” to H1.

“Guidance for BetMGM's medium-term profitability also appears to have been pushed out,” said the team at Jefferies.

Recall, in February the company said revenues for 2023 rose 14% to $1.95bn and a full-year EBITDA loss of $67m.

Ground game: BetMGM CEO Adam Greenblatt insisted in the accompanying remarks that H1 was “very important for laying the groundwork” for the company. He said the company had exceeded its goals for player acquisition and retention.

The company said its Q2 iCasino average monthly activities grew 18% YoY vs. 9% in Q1.

It added it saw “encouraging” online sportsbook CPAs of FTDs driven by a “successful Super Bowl campaign.”

+More

The UAE has formally announced the formation of its General Commercial Gaming Regulatory Authority and has awarded the lottery concession to a company called The Game, a subsidiary of Abu Dhabi-based company Momentum. See Compliance+More tomorrow for more details.

Spreadex has hit a definitive road bump in its efforts to buy rival spread better Sporting Index from FDJ after an independent panel set up by the Competition and Markets Authority has confirmed there are “serious competition concerns.”

Among the CMA’s worries are that the buyout means there is only one sports spread-betting operator within the UK market.

Possible remedies mentioned by the CMA include the potential sale of “all or some” of the SI business plus potentially elements of the Spreadex business itself.

And then there were four: Entain’s Sportingbet is the fourth company to apply for a license in Brazil. It follows in the wake of Betano, Superbet and Rei do Pitaco.

Super Group’s Betway is now an official betting partner with EPL club Manchester City.

Earnings in brief

Française des Jeux saw revenues climb 11% in H1 €1.43bn helped by a 40% increase in online. EBITDA rose 23% to €370m. The company reconfirmed its targets for 2024 with revenue growth of ~8% and EBITDA margins at ~24.5%. The company said it hoped to complete the acquisition of Kindred in “the near future.”

The week ahead

BetMGM kicks off the week with a H1 report on Monday while joint custody parent MGM Resorts gets to chat with the analysts on its own account on Wednesday. Splitting the two is Caesars Entertainment, IGT and Rush Street Gaming who all report on Tuesday and DraftKings and VICI close the week on Thursday after hours with the DraftKings call on Friday.

Career paths

Andy Wright, formerly head of trading at Fanatics and Sky Bet, has joined sports intelligence provider Twenty First as chief betting officer.

QTech Games has appointed David Camacho as account manager with a focus on expansion in the Latin American markets.

Beter has appointed Alina Mihaela Popa as chief commercial officer. Popa previously held management and business development positions at Pragmatic Play and Skywind Group.

Take your Picks

Moel hills: PrizePicks has hired Moelis to explore potential strategic options for the company including a potential sale of part of the company. Sources close to the company have confirmed the Bloomberg story from last week about the advisor hire but suggest that speculation of even a minority stake are wide of the mark.

The Adam Wexler-founded PrizePicks has previously raised less than $15m from various funding rounds.

Publicly, it last raised money in late 2021 in a funding round led by existing investor Phoenix Capital Ventures and with the participation of Astralis Capital and a host of sports and gaming names.

Before that, it closed an $850k bridge founding round in the summer of 2022.

What’s the plan, Stan? PrizePicks is looking at identifying “areas of growth,” according to insiders. Sources point out this could include a need to raise cash to compete in OSB, possibly via a minority partner. Moelis could help the company understand the value of DFS+ in the current market.

“There is a massive range of opinion regarding what the multiples should be,” said one corporate advisor who opted to remain anonymous.

Stakelogic sale

Privately-held iCasino slots and live casino provider Stakelogic has been bought by Sega Sammy for $130m as the Japanese gaming outfit looks to augment its online footprint ahead of the completion of its GAN buyout.

Stakelogic was founded by CEO and majority shareholder Stephan van den Oetelaar in 2018. Among its investors is Bettor Capital.

The Netherlands-based provider generated revenues of €29m in FY23, more than double the total from the year previously while net losses improved significantly from €12.2m to €1.48m.

Footprints in the sand: Sega Sammy noted Stakelogic had built up a significant position in the Netherlands market since launch in 2021 and is expanding its market share in the UK and Italy.

With licenses in Rhode Island, Michigan and Pennsylvania, the acquisition of Stakelogic fits with Sega Sammy’s long-term aim to build on GAN’s North American presence.

It said the combination of its own sales network, the GAN iCasino and OSB PAM and Stakelogic content would “create synergies” and build its gaming business.

Partis ran the sales process for Stakelogic.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

REIT of way

Win-Win-Windy City: CIO Matthew Demchyk said Gaming & Leisure Properties’ recent comprehensive $1.59bn package with Bally’s to fund the permanent casino in Chicago and the sale-and-leaseback of two further properties was a “multipart win-win transaction.”

He noted GLP has completed $2bn of new investments in the last six months with four different counterparties.

“We have done each of these deals with a healthy yield in an unpredictable macro environment,” he added.

Then you go and spoil it all by saying something stupid like…“the flywheel effect has been to our benefit.”

I told you I was IL: Asked about his previous skepticism over building a casino in Illinois, CEO Peter Carlino said “our tenants are doing business in Illinois now – none of them died. We’re not afraid to invest money in the state.”

General counsel Brandon Moore was keen to point out that GLP wasn’t “under the tent” on the news last week of Bally's go-private deal with Standard General.

But while GLP was “looking to understand more about it,” he didn't believe it changes anything “to date” and GLP has not been approached by either Bally’s or Standard General to make any alterations to the deal.

“I'm not saying that might not happen, but it hasn't happened today,” Moore added.

Wallflower: Asked about the prospects of more M&A, specifically around Boyd Gaming and Penn Entertainment, Carlino said that “with a jaundiced eye” GLP would be “very reluctant to see anything change.”

“I am not well-disposed” to a deal, he added. “But we'll do what we must.”

“I'm not going to speculate on what might or might not happen, but we would not look particularly favorably on anything that would break up our beautiful arrangement.”

Venture playground

Funding news

Data insights startup PlayAIO has secured an investment from Astralis Capital. PlayAIO was founded by CEO Josh Gibbs in 2023 and launched in May and recently hired Steven Farrugia, ex- of ComeOn, as CTO.

Startup focus – bwise Media

Who are you? Led by CEO Christian Czerko and COO Sebastian Paris, bwise Media was founded in November 2018 in Switzerland; with additional offices in Brazil, Uruguay, Austria, Italy and India.

What’s the big idea? bwise offers a wide range of marketing services for acquisition and engagement tailored to iGaming clients, bolstered by strong partnerships with global media partners. It sees the biggest opportunity in adtech and data/product-driven innovation.

The in-house-built tech platforms and products, including innovative adtech solutions, are the foundation for bwise’s “growing ambitions” in iGaming affiliation.

A particular focus has been South America, specifically Brazil, and it plans to enter the North American market.

It is also closely monitoring the Asian market, which it believes has “incredible potential.”

What they say: “bwise’s innovative advertising solutions allow betting clients to cut through the noise of monotonous promotional creatives and instead focus on pre-match and live betting products, real-time odds, match/game predictions and much more,” says Sebastian Paris.

Funding backgrounder: bwise is privately funded.

Growth company news

A new betting exchange, SBX, has announced a multi-year market access agreement with The Gilpin Casino that will see it launch a P2P exchange in Colorado following regulatory approval from the Colorado Division of Gaming.

The Chicago-based SBX says it has has been developing its proprietary exchange-wagering technology since 2022 and officially stood up its business operations this year.

Meanwhile, SuperBook has shut down operations in eight states, leaving it a retail operation at the Westgate in Las Vegas Nevada. The company told its – likely handful – of customers in Arizona, Colorado, Iowa, New Jersey, Tennessee, Ohio, Maryland and Virginia it was shuttering operations.

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

Calendar

Jul 29: BetMGM

Jul 30: IGT, Accel, Caesars, Lottomatica, PointsBet

Jul 31: MGM Resorts, Rush Street, Codere Online, Bally’s

Aug 1: DraftKings (earnings), VICI

Aug 2: DraftKings (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.