Prediction markets go mainstream despite a US ban.

In +More: Kambi appoints Becker as new CEO, BlueBet exits Indiana.

DB trims DraftKings’ Q2 estimates, questions long-term adj. EBITDA target.

Venture playground has news on another €50m fund.

Take a sad song and make it better.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

SVP – Performance Marketing

Sr. Director – Sports Promotions

And other amazing positions here.

Polling boost

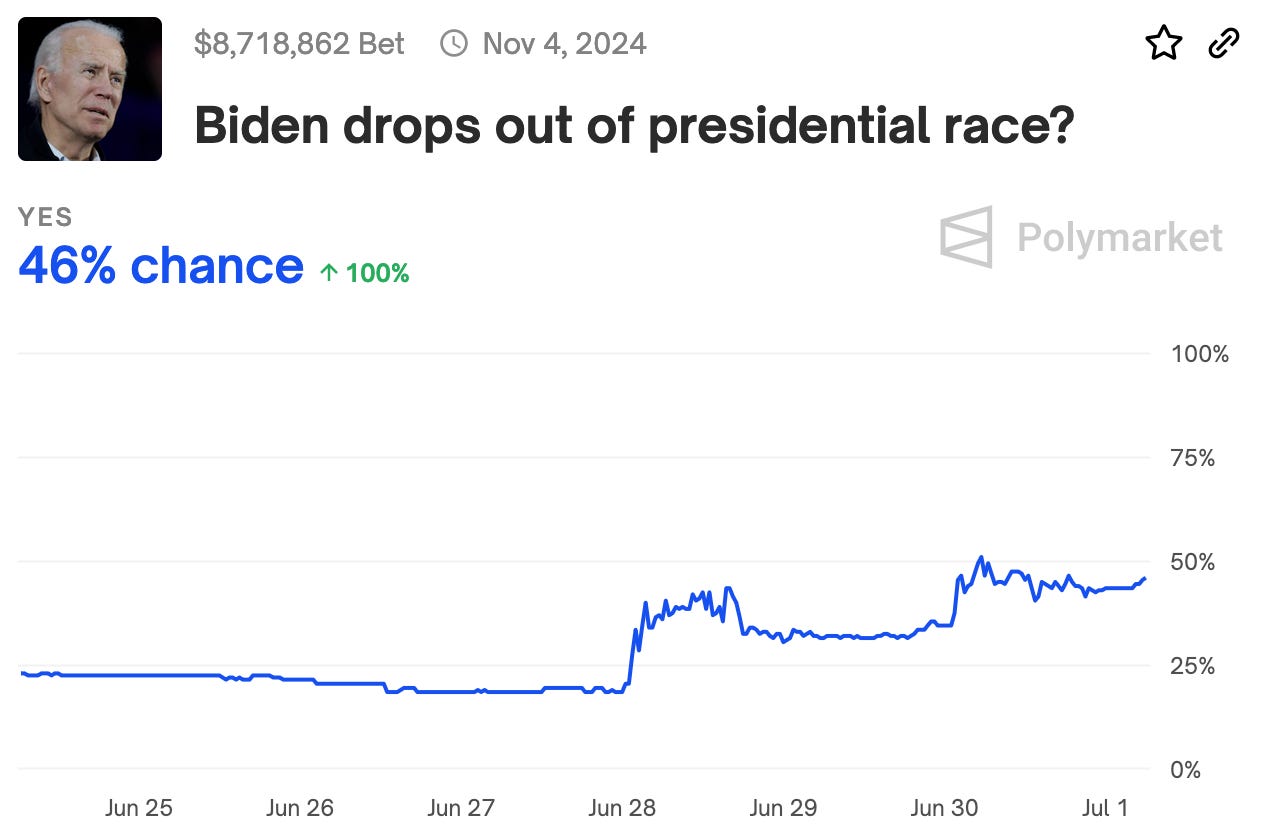

You win some, you Newsom: American democracy may have hit a new low with last Thursday night’s presidential debate but blockchain-based prediction markets operator Polymarket can count itself as one of the winners after its market on Joe Biden stepping down as a candidate was heavily shared on social media.

Poly wobble: As the President stumbled, the odds on him being replaced as the Democratic candidate soared.

As one X poster put it, “polls will take weeks to understand what happened last night, Polymarket knew within minutes.”

Ride the wave: The company itself said last Thursday night was when Polymarket “went mainstream.” Early on Friday, the company posted that the traffic it was receiving was “insane” and a “tsunami.”

Fit but you know it: A senior engineer at Coinbase, Yuga Cohler, posted on X that Polymarket’s “astronomical success” in being so much cited by the media was “monumental” for crypto. “The seamlessness with which this happened speaks to its product market fit,” he wrote.

See me, Thiel me: As per The Token Word, Polymarket raised $45m in a mid-May Series B funding round led by Peter Thiel’s Founders Fund and with the participation of Ethereum creator Vitalik Buterin. The company has now raised over $70m.

Polymarket is built on the Polygon blockchain, allowing for users to buy and sell tokens without network fees. Bets are settled using the USDC stablecoin.

We want in: Prior to last week, Polymarket said it had already seen more than $125m traded on the presidential election despite being locked out of the US market following a settlement with the CFTC in 2022.

The company recently hired veteran futures industry executive Richard Jaycobs as its head of market expansion, with responsibility for exploring the prospect of US-regulated activities.

Wanna bet? In the UK, meanwhile – where political betting has been a feature for many years – the ongoing rumpus over Conservative insiders with privileged information allegedly betting on the date of the election is testing the limits of the adage that all publicity is good publicity, as the campaign finally comes to a close on Thursday.

Where politics mix with bingo and tits: The high-profile scandal has thrown the spotlight on whether politicians should face similar curbs on their betting as sports people.

The scandal has also drawn in the UK Gambling Commission and the Met Police. See Compliance+More.

** SPONSOR’S MESSAGE ** The Future Of Gaming – Exciting M&A Opportunity!

Explore an M&A opportunity to acquire technology that brings sports betting to hobby gaming. This system lets gamers bet on their PlayStation, Xbox, and PC gameplay. For instance, Fortnite players can wager on killing at least 5 opponents in their next match. The technology offers probabilities for over 100 betting markets, generating individual odds with a house advantage of 20-30%. No gambling license is needed, and it can be integrated into any platform.

Tap into a large millennial market with lower CACs than traditional gambling. Sign up at www.betonskills.com to access a 3-pager and learn more!

+More careers

The big move: Kambi has announced Werner Becher as its new CEO replacing the outgoing Kristian Nylén. Becker was until recently head of the EMEA and LatAm business for Sportradar. He will take over the reins officially on July 25, the day after the company publishes its Q2 earnings.

Becker has been with Sportradar in various roles for the past four years and prior to that ran the German-facing sportsbook Interwetten.

Frying pan: Steve McCann has been appointed as CEO at the regulatory-challenged Star Entertainment. He was formerly CEO at Crown Resorts where he helped lead it through its own regulatory issues.

McCann replaces Robbie Cooke whose continued tenure, the company said at the time, was “not conducive” to Star retaining its license in New South Wales.

Chair David Foster was also ousted in late April.

Elsewhere, sports-betting and fantasy sport supplier Skokastic has appointed Daniel Haight as its chief operating officer. Churchill Downs has named Michael Lilly as president of TwinSpires Horse Racing. Codere Online has appointed Gabriel Saenz de Buruaga, Taavi Davies and Claude Noesen to its board of directors, while Gonzaga Higuero, CEO at parent group Codere, will serve as chair.

Rivalry: The esports and GenZ-focused operator has made a number of staff redundant as the company undergoes some “strategic shifts,” according to a LInkedIn posting from CEO Steven Salz. The posting includes contact details for those affected in order to help them find new roles.

Breaking

Deal me out: Australian-listed BlueBet has announced it has terminated its market access agreement in Indiana with the Horseshoe Casino with immediate effect, as the company continues a strategic review of its US operations.

For the time being, BlueBet – which trades under the brand name ClutchBet in the US – will continue to operate in Iowa, Colorado and Louisiana.

It also maintained it will continue with its plans to roll out a B2B offering in Ohio as part of its “capital-lite” US market strategy.

+More

Talk of the Toon: BetMGM has extended its deal to be the official betting partner for Newcastle United in the EPL.

Entain’s Ladbrokes business in Australia has extended its promotional partnership with the Tasmanian racing industry for a further five years.

Grid eSports has signed a two-year extension to its agreement to supply official match data to Kambi subsidiary Abios.

GiG has signed a long-term deal with UK-based The Football Pools for both sports-betting and iCasino backends. It is GiG’s first deal in the UK.

What we’re reading

Handicapping the New York casino race: the NY Post on who gets a shot downtown.

Analyst takes – DraftKings

Questions, no answers: “Incremental questions” is how Deutsche Bank gently suggested some increasing skepticism over DraftKings’ long-term adj. EBITDA guidance of $2.1bn, saying it is “becoming increasingly more questionable over the next 12-18 months.”

For Q2, DB are predicting gross margins will fall YoY due to higher acquisition costs, lower than expected hold and a heavier mix of revenue from higher tax rate jurisdictions.

In trimming their Q2 EBITDA forecast to $134m from $175m, the DB team noted they view momentum in DraftKings as “somewhat stunted.”

More takes

Caesars: The team at Wells Fargo estimated Caesars could unlock ~$2bn in value from selling non-core, non-operating casino assets, including the LINQ Promenade on the Las Vegas Strip.

The LINQ could be worth up to $1bn alone given its tenants and proximity to the Strip, while the land parcel nearby could be worth up to $230m.

The analysts also believe Caesars JV stake in the Pompano casino development in Florida could be worth $300m-$500m.

Aristocrat: After listening to an investor presentation last week on the newly renamed interactive unit, analysts at JP Morgan noted the revenue target of $1bn by 2029 implied an EBITDA target of ~$230m.

The team argued that the only risk to the target comes from the lack of iCasino legislation in the US.

However, the team at Morgan Stanley said the size of the opportunity ex-US meant the revenue and EBITDA targets were still achievable.

Macau: Following meetings with the management at SJM, the team at CBRE suggested they found some comfort in the company’s confidence in China’s continuing support for the Macau market, citing the recent expansion of the individual visa scheme to 59 eligible cities from 51.

Earnings in brief

Czech your head: A newly minted Hong Kong-listed gaming entity that owns three B&M casinos in the Czech Republic, alongside hotel interests in Germany and Austria, issued its debut FY earnings for the year to Mar24.

Palasino Holdings has been spun out of a group called Far East Consortium.

FY24 gaming revenues rose 7% to HK$402 ($51m), representing 75% of total revenues. Group adj. EBITDA was flat at HK$85m.

The company is seeking a gaming license in Poland and a remote license in Malta and will launch online in the Czech Republic once it receives a license there.

XLMedia: In a trading statement the gaming affiliate provider said that, following the completion of the sale of a number of European-facing assets to Gambling.com for an initial $37.5m, the company is on course to generate $5m of EBITDA in FY24. Despite recent actions on the part of Google to derank media partnership content, XLMedia said it would continue to seek partners for new state launches.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Venture playground

Funding rounds

LinQedIn: A new platform that allows games developers to enter the real-money gaming space has raised an additional $2.3m from investors, including a16z Games Speedrun, Drive by DraftKings and Sharp Alpha.

LinQ is led by Kevin Cubitt, a former fintech CEO, and tech entrepreneur Dmitry Vysotski. The company has now raised $3.8m in pre-seed funding.

LinQ partners with game companies to publish their popular titles, handling all aspects of compliance, operations, matchmaking, geolocation and native payments.

Soft play: A new gaming innovation fund has been announced by iCasino backend provider Soft2Bet. CEO Uri Poliavich said the company would be investing up to €50m in growth stage as well as mature businesses.

Poliavich said the company was “open to dialogue” with companies that are “harnessing pioneering technologies” in casual gaming, AI and UX analytics.

Interested companies can get in contact via this link.

Startup focus – Blask

Who are you? Co-founded by Max Tesla and Dmitry Belianin, Blask launched in 2021. While primarily a remote operation, Blask boasts two offices: one in Limassol and one in Lisbon.

What’s the big idea? “The original idea was to create a Swiss Army knife for B2B iGaming analytics,” says Tesla. He believes the AI-driven tech “empowers iGaming businesses with unparalleled market intelligence.”

This includes being able to track nearest competitors, benchmark performance against relevant competitors and identifying areas for improvement and growth.

A ‘daily brand discovery’ feature enables users to stay informed about new entrants in their target markets.

What they say: “This intense, bloody-red ocean demands proper strategic and tactical decisions backed by data,” says Tesla. Operators need to know their own position but are also “constantly checking their side mirrors and taking a helicopter view of the entire market.”

Funding backgrounder: An unspecified amount in angel funding came in late 2022 followed by a pre-seed round in January 2023. Backers include Yolo Investments and Oakvale Capital.

Growth company news

A new games studio based in Sweden called Aftermath Interactive has completed a strategic agreement with a US-based law firm called Hensel Grad to develop a skill-based poker game for the US market.

US-based games studio startup Konquer’s first game is now live in New Jersey on DraftKings and Golden Nugget Online.

Calendar

Jul 19: Evolution

Jui 24: Churchill Downs (e),

Jul 25: Churchill Downs (call), GLP (e)

Jul 26: GLP (call)

Jul 31: MGM Resorts

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

🔍 With OneComply you can say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish!

- Complete your first licensing application 50% quicker

- Get real-time alerts for immediate compliance actions

- Slash legal fee costs by up to 90% with no more duplicate tasks

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.

Huge fan of you using a line from “It Says Here” by Billy Bragg.