Affiliate M&A is a buyer’s market – and that buyer is Better Collective

Affiliate M&A, activists get active, (not) the month in transactions +More

Better Collective dominated affiliate M&A in 2023.

Activist investors throw their weight around with Entain.

Playtech’s non-bid for 888 leaves open-ended questions.

They can afford to pick and choose.

Affiliate M&A

A recent flurry of deals suggests consolidation in the gaming affiliate space has entered a new phase.

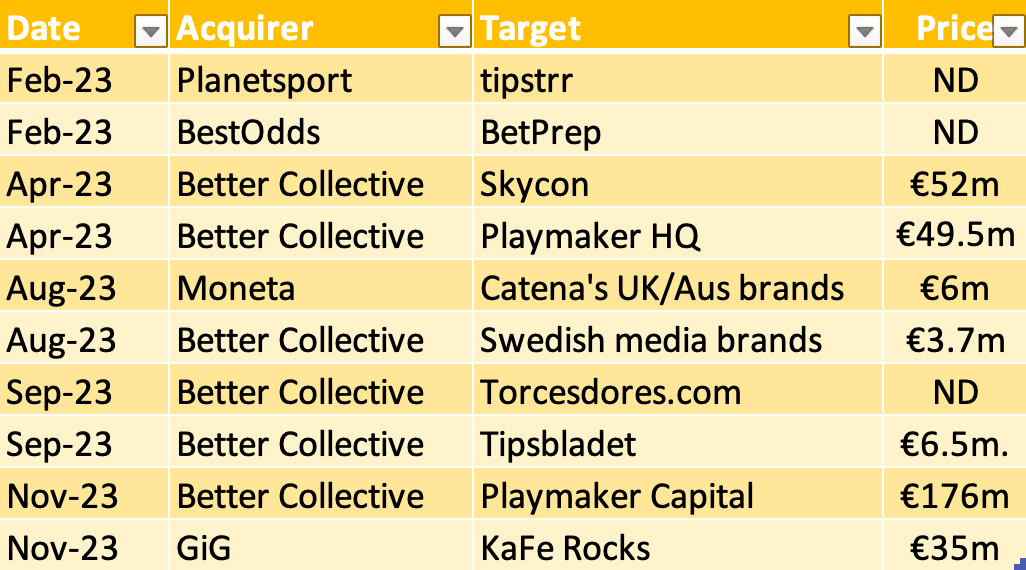

Buyer’s market: In 2023, M&A has once again been the dominant theme within the gaming affiliate space, particularly regarding the leading listed players in Europe and the US. As tracked by the gaming team at Citizens, at least 10 deals were completed over the year.

Collective effort: But if it is a buyer’s market, then what this really means is that it is one single buyers’ market. In 2023, the Copenhagen-based Better Collective dominated the gaming affiliate M&A picture, completing six out of the 10 deals tracked and accounting for €288m of the €329m worth of disclosed deals.

The largest deal of the year by far saw it buy Toronto-listed Playmaker Capital for €176m in cash and shares.

Not on the list but potentially significant is the 5% stake Better Collective bought in rival Catena Media in February.

🤝 Ten affiliate M&A deals were tracked in 2023

Source: Citizens Bank

Rack ‘em: Previous large deals include the $240m acquisition of Action Network as well as the €55m laid out on Rotogrinders and the €44m on Atemi. Esports has also been an area of activity including the €105m spent on Futbin and the €35m for HLTV.org.

At its Capital Markets Day event late last year, it said total M&A spending stood at €589m – a total that now stands at ~€880m.

According to the CMD presentation, up until this year M&A has been funded by a combination of share issuance (€249m), bank financing (€197m) and cash flow from operations (€201m).

The Playmaker deal was a combination of cash (35%) and shares (65%).

Itchy and scratchy: On its Q3 earnings call, Better Collective CEO Jesper Søgaard pointed out that M&A was integral to the company’s strategic aim of becoming a “leading digital sports media group” and the Playmaker Capital deal in November – the second-largest deal in its history – certainly scratches that itch.

Playmaker brings with it a host of North America- and LatAm-facing media properties, including Futbol Sites and Yardbarker, generating over 200 million monthly visits.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Scaling heights

Snowball: Market watchers and participants agree the pace of M&A in the affiliate sector picked up in H2. “The space has always been very fragmented, but scale is increasingly important, as is geographic diversification,” says Sandford Loudon, partner at Oakvale Capital.

He points out that in the US scale is needed to work with the big operators.

“You also need scale to have negotiating leverage to safeguard against CPAs being driven lower by the large betting operators,” he adds.

To this point, it is no coincidence that the larger affiliate providers are keen to emphasize the extent to which they have been able to convert a lot of their North American business to revenue share. Better Collective said recurring revenue made up 61% of total revenues, with the North American team having “fast-forwarded” the transition to rev share.

“Scale offers advantages in terms of negotiating power and operational efficiencies for both affiliates and operators,” says one affiliate sector insider.

They suggest that in the US “some operators are less interested in working with smaller affiliates”.

“They are trying to compete with larger companies with more resources and better technology.”

Fallen from the pedestal

Look on my works, ye mighty, and despair: Affiliate M&A is a long-standing trend and, while the building of scale is a path being followed by many, in Catena Media the sector has its own Ozymandias and an object lesson in how not to do it.

The company completed nearly 40 deals between 2014 and 2018, including such assets as the PlayNJ websites, AskGamblers, ASAP Italia, and its last major acquisition, i15 Media in 2021.

Notably, AskGamblers and the Italian business have since been sold as Catena Media switched from being an affiliate vacuum cleaner to something more akin to a collapsing balloon.

Recent sales have seen the company pivot once again – not wholly convincingly – to concentrate solely on North America.

👀 That Better Collective stake could yet be significant.

Nothing beside remains: Sources are quite scathing about what went wrong with Catena’s roll-up strategy. “I don’t think Catena was ever built to integrate and realize synergies,” says Ben Robinson, a partner at RB Capital. “It rolled up at such a rapid pace that it didn't allow for this.”

Catena didn’t integrate and it “got messy down the line” and due diligence might have been lacking, says another source.

“Plenty of affiliates ripe for acquisition will demonstrate great revenues, but often they'll have grown fast themselves,” the source suggests.

“Due diligence is really needed to be done well to ensure that what you’re acquiring can also sustain long-term growth in its own infrastructure.”

Building blocks

Follow the leader: With the example of Catena Media fresh in the memory, the sector giants are arguably now progressing with greater deliberation over the bigger deals that are, in the process, reshaping the sector. Following the example of Better Collective, both GiG and Gambling.com seem set on buy-and-build strategies that appear to emulate the strategy of the sector leader.

Having completed the deal to buy AskGamblers for €45m this time last year, GiG took its time to digest that business before launching the bid for KaFe Rocks in November.

Meanwhile, Gambling.com is sitting on the sidelines having similarly given itself time to assimilate the early 2022 BonusFinder acquisition. But it has signaled this is a temporary hiatus.

Vaduz: On the company’s Q3 call, CEO Charles Gillespie said: “Just because we haven't announced anything in two years doesn’t mean we’re not tirelessly working in the background on some fairly interesting stuff.” He also suggested the company would “maybe raise a little capital” to fund bigger deals.

At GiG, meanwhile, its director of SEO and publishing Milorad Matejic told E+M it was “constantly evaluating new acquisition opportunities”.

“We believe that with our technology, diverse portfolio, know-how and talented people, we are able to absorb and integrate any potential M&A opportunities that may arise,” he added.

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

Return on effort

Bench press: While there is a wide range of values attached to Better Collective’s deals in the last 12 months – from €6m to €176m – for the larger gaming affiliates, ever larger price tags are more likely than not in the years ahead.

“In many cases, it is more work to buy a $10m business than a $100m business,” says one gaming affiliate corporate development source.

With the bigger businesses, there are more mature processes in terms of finance, product and HR. “You get a deeper bench of talent and you probably have more serious auditors and better financials,” the source suggests. “All in all, it can be a lot smoother of a process with fewer surprises.”

Loudon agrees that M&A in the affiliate space is about “acquiring and integrating properly while extracting synergy and not creating an overdependence on key individuals who leave after earnout periods”.

The larger organizations are now acquiring assets, “which are not a function of people but more focused on brand, original content and proprietary technology”, he adds.

Play your cards right: As ever, the sticking point for any M&A comes down to price, but Robinson suggests that, to an extent, the arbitrage between (lower) non-public EBITDA multiples and (higher) publicly traded also “contributes to the M&A momentum”.

The corp dev insider spoken to by E+M agrees. “I would expect the current pace to continue,” they say of the current landscape.

“People seem to be talking more sensibly about valuation, which unlocks a lot of combinations that have been contemplated for some time.”

Tree of life: Still, life beyond the relatively rarefied atmosphere of high-level M&A does go on. Loudon suggests the vertical is “going through a Cambrian explosion”, while one industry insider points out that as much as the bigger entities believe they can “build fortresses, they can’t”. “There will always be space for newcomers.”

Matejic agrees and suggests new players are “always emerging on the scene, albeit not in the same numbers we saw before due to regulation”.

“A quick look at search engine results, though, reveals that there are still many smaller private companies and teams achieving great success in many markets.”

“They often outrank bigger companies, maintaining the industry’s highly competitive character.”

+More deals

Activists get active: At Entain, the news last week that Corvex has become the latest activist investor name to be added to the shareholder register heaps even more pressure on a management team that so recently lost its figurehead.

News of Corvex’s 4.4% stake came ahead of reports that, similarly, New York-based hedge fund Eminence Capital is soon to be given a seat on the board.

Two other activists – Sachem Head Capital Management and Dendur Capital – have also got stakes in the business.

Corvex is also the largest shareholder at Kindred, which itself is the subject of speculation over its direction following its North America exit and with a strategic review ongoing.

Bragg Gaming: Also under pressure from its own shareholders is Bragg, which was the subject of an open letter from Raper Capital in late November that called on management to consider a partial or complete sale of its assets in order to maximize the value of its assets.

In something of a caustic letter, Raper’s founder Jeremy Raper accused Bragg of “chronic underperformance”.

This is likely the case with regard to its early 2021 high of nearly $30, but on a YTD view Bragg has to reverse the H1 decline.

📢 Bragg’s share price performance in 2023

(Not) the month in transactions

Au revoir, for now: Playtech buying 888 was the deal that didn’t happen, at least not yet, but a story in early December in The Sunday Times suggested discussions held during the summer ultimately came to nothing due to disagreements over valuation.

Still, the potential for Playtech to effectively hive off its B2B arm to merge its existing B2C operations was thought by industry sources to be “credible”.

Obstacle course: As was noted previously, the obvious handicaps for Playtech to execute any deal in B2B remain the unresolved legal dispute with Caliente in Mexico and its Asian-based shareholder base, which has historically been reluctant to countenance any form of M&A.

Yam curious oranj: With regard to the latter, sources suggested recent Playtech board appointments have raised eyebrows. Specifically, the brief board presence of Ruby Yam is thought noteworthy. The former head of private banking at China Construction Bank was appointed to the Playtech board as a non-executive in May.

However, in a brief stock exchange notice less than two months later, the company said she had stepped down with immediate effect for personal family reasons.

Sportsbooks! Checkout some of Matchbook’s latest quotes across NFL, NCAAF, MLB & NBA:

NFL: NY Giants/LV Raiders O37.5; $107k @1.95

NCAAF: Marshall +3.5 (vs Appalachian State); $34k @ 1.83

MLB: ARI Diamondbacks ML (vs TEX Rangers); $36k @ 1.99

NBA: NO Hornets +12.5 (vs DAL Mavericks); $170k @ 1.90

Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins.

Stop being forced to limit customer stakes due to market liability.

Stop being caught out by stale prices and one sided markets.

Matchbook B2B, because the best price is for everyone.

Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.