Gaining the keys to new tech is the driver of MGM’s Tipico US deal.

In +More: Juroszek GiG shares buys, BBC ditches daily racing tips.

More skepticism emerges over a potential Boyd bid for Penn.

By the numbers: a look at market research in North Carolina.

’Cause I've been waiting on you.

MGM’s signal, noise

Needle point: The deal announced yesterday that will see MGM Resorts’ wholly owned subsidiary LeoVegas acquire Tipico US for an undisclosed sum is “more symbolic than needle moving,” according to the team at Deutsche Bank.

Putting their money where their mouth is: The buyout, which is expected to close in Q3 this year and was predicted by E+M in late April, “shows a continued commitment to MGM's International digital strategy,” DB’s analysts said.

“We believe technology was the primary driver of the transaction,” they added.

From the ground up: Over at JMP, the team suggested it was “notable” that MGM was going down the route of buying its way to a full complement of online provision rather than build its own capability, while at the same time avoiding having to commit to a large-scale platform acquisition.

In a similar vein, it should be noted MGM has taken the route of a JV with Playtech for a live casino product to be produced at its own properties on the Las Vegas Strip.

See you ’round the clubs: JMP said MGM has been “steadfast” in stating its commitment to the JV with Entain for BetMGM but “at some point” the two will go their separate ways. Crucially, this will leave MGM with the BetMGM brand and now, potentially, a platform to go with it..

“Said another way, the timeline to come to market with a fully functioning online gaming operation will be considerably shorter and cheaper now that it can integrate legacy Tipico technology into the BetMGM brand to create an end-to-end platform,” the team wrote.

Foreign adventures: A first test for the new platform could come in Brazil, according to the team at CBRE, who suggested MGM/LeoVegas’ plans for the new regulated market were “of interest.” MGM has previously been rumored to be close to a partnership with media group Globo about a market entrance for BetMGM.

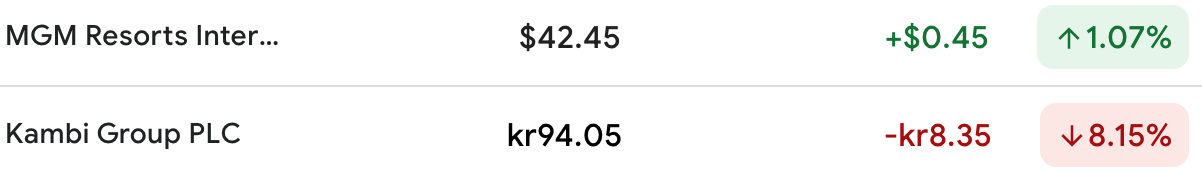

Repercussions: MGM’s shares nudged up 1% on the news yesterday while LeoVegas’ current sportsbook backend provider Kambi saw its shares take an 8% hit on the news.

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

For more info, go to www.kambi.com

+More

Buying spree: The Juroszek family, the former owner of Polish sportsbook STS, is now the largest shareholder in GiG after further buying from various family controlled entities, including the purchase of SkyCity’s stake in the business. Following a 7m+ share transaction yesterday, the various entities now control just over 25% of the company.

GiG will soon demerge. Mateusz Juroszek is a board member of the renamed affiliate business Gentoo Media, while his brother Tomasz Juroszek is on the board of the sportsbook supply arm.

Mateusz Juroszek said the family believed in both companies’ futures.

“As a family we should be the ones to stand up and show our commitment – we want to be the biggest shareholders as we believe in the businesses.”

Radio gaga: The announcement yesterday that BBC Radio’s leading morning news program would no longer carry horseracing betting tips caused the head of the Betting and Gaming Council to accuse the broadcaster of middle-class “snobbery.”

The BBC decision to bring to an end the daily racing tips item on the Today program was condemned by Michael Dugher, CEO at the industry group.

“This is sad news but unsurprising,” he told the Racing Post. “I suspect there have always been people at BBC Radio 4 that regard the racing tips as a bit ‘below stairs’.”

The Today program will from now on only include racing tips on big race days, such as the Cheltenham Festival and the Grand National.

Not missing an opportunity, William Woodhams from Fitzdares posted on X a suggestion that rival broadcaster Times Radio could “take up the mantle” with help from his company.

Simplebet: The micro-betting provider has reported taking nearly $325m across all its operator client base and logging nearly 13m bets on the games across the NBA season, up 75% YoY.

At the post: Racecourse operator Arena Racing is teaming up with Racecourse Media Group, 1S/T Content and Tabcorp to provide a joint distribution network for international racing.

Earnings in brief

Star Entertainment: The troubled Australian casino operator said trading conditions remained challenging, with Q424 revenues expected to show a 4.3% decline QoQ and a 3.3% drop off YoY. The damage has been caused by a fall in revenue from premium gaming rooms, which were down 16% YoY.

Negotiations of asset sales including the offloading of the Treasury property in Brisbane continue.

More Boyd/Penn skepticism

Firestarter: Boyd Gaming’s potential bid for Penn Entertainment has been the subject of further analyst skepticism, with the team from Wells Fargo suggesting that while they “generally believe where there’s smoke, there’s fire, this tie up seems unlikely."

As with the note from Deutsche Bank late last week, the team at Wells Fargo also noted what could be a “complex and lengthy” deal process including various state approvals and divestiture negotiations.

Is that all? Moreover, the team noted the rumored price of up to $25 a share is similar to where Penn traded in Jul23, just before the ESPN Bet announcement.

The 25% premium to the current share price “may not be enough” to entice Penn shareholders or board, “many of whom presumably believe ESPN Bet has a viable path towards success,” they added.

“It also may not be enough to placate activist Penn investors, who may believe the company is worth significantly more than Boyd Gaming may be willing to pay."

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more…

Built for operators with an emphasis on speed and coverage, OpticOdds offers:

SGP Pricer: query top operators and instantly see how correlations are priced in real-time.

Live Alerts & API Access: get odds updates from sharp sportsbooks on best odds, arbitrage, player markets, reference lines, settlements, injuries, and more.

Market Intelligence: analyze competitor markets to see what you're missing. Drill into hold, alternate lines, uptime, and release time.

Join top operators at opticodds.com/contact

By the numbers – North Carolina

Raleigh to the cause: As the biggest and likely last new OSB state to launch this year, there is understandably a deal of interest in how the regulated market has landed in North Carolina. But according to market research undertaken by the team at bettor activation affiliate Betting Hero, the shape of the market is very little different to the 29 regulated markets that went before.

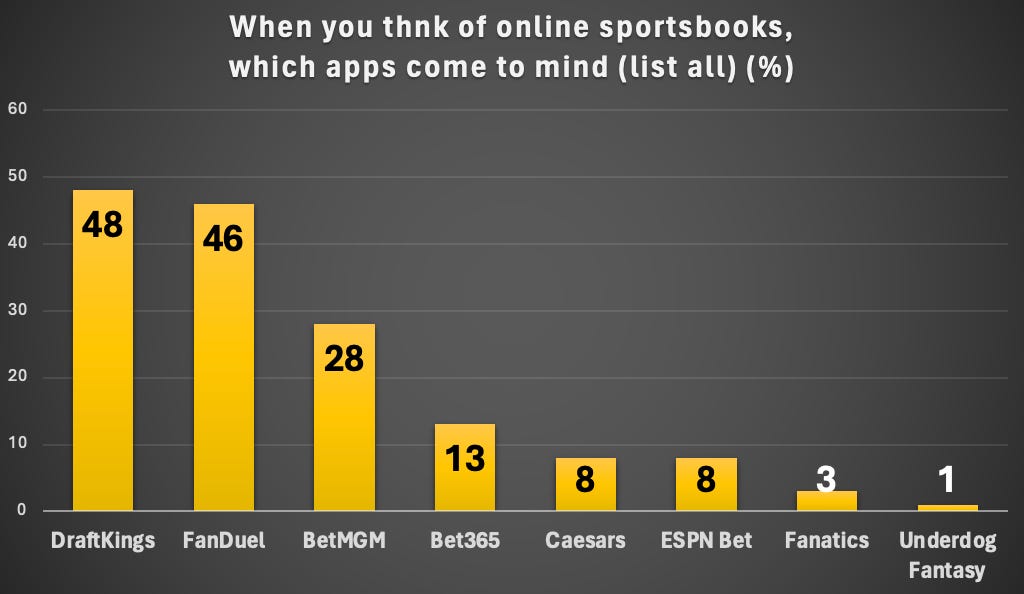

Top two: In terms of brand awareness, when asked which apps came to mind when thinking about online sportsbooks, DraftKings was just ahead of FanDuel with 48% vs. 46%. There is then a gap to BetMGM, which received 28% of mentions, and bet365 with 13%.

Penn will likely be disappointed that ESPN Bet comes in equal fifth in the rankings with 8%, while Fanatics managed a mere 3% recognition response rate.

🤔 When you think of a sportsbook brand, who comes to mind?

The research was undertaken within the first month of the market opening and the data on the first app used shows a similar result, with DraftKings leading FanDuel by 33% to 32%, BetMGM back in third place with 14% and the rest trailing in behind.

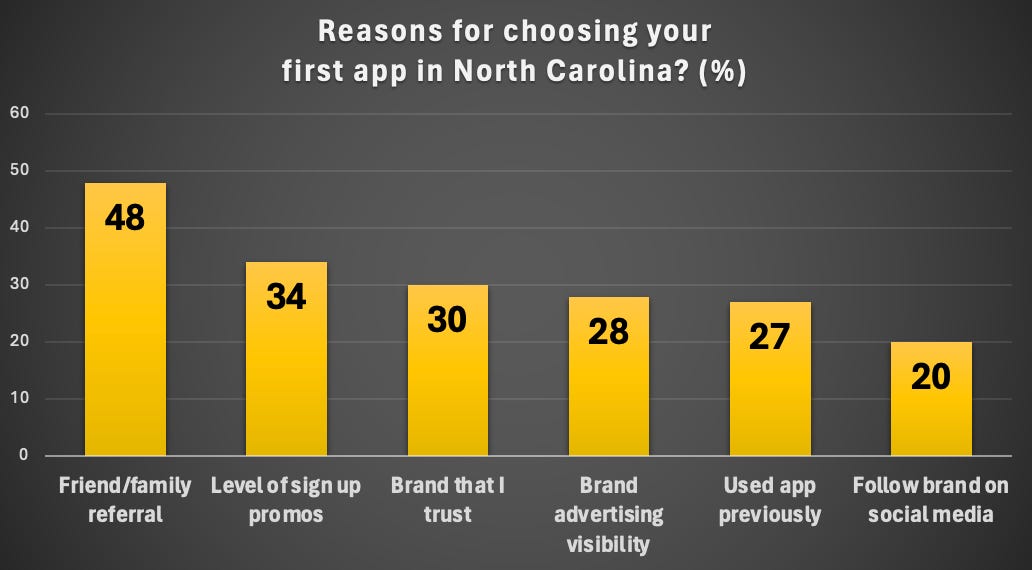

Among the reasons cited for choosing their first app, the top response was friend or family referral (48%) followed by the level of promo (34%).

Then the importance of brand kicks in, with trusted brands getting a 30% response rate, and enjoyment of TV, radio and billboard advertising and having used the app in other states coming in next.

🕺 Do you remember the first time?

Come back to what you know: So much for first-time users, but what about sustained usage post-the initial app sign up? Here it can be seen that FanDuel surges into a strong lead with 39%, while DraftKings remains on 32%; then there is a drop off to BetMGM on 11%, bet365 on 6% and ESPN Bet on 5%.

🥰 Whenever you need me, I’ll be there

Getting the basics right: Ease of practical use was the clear reason for consumers choosing their most regularly used app, with 63% saying easy deposits and payouts were the prime reason, making it the top answer.

Next up was easy account set-up (57%), then came promotional offers and brand trustworthiness.

The best odds and breadth and depth of markets on offer came in at 16% and 15% respectively, with live betting options on 11%.

Calendar

Jul 16-19: iGB Live, Amsterdam

Jul 19: Evolution

Jul 24: Churchill Downs (earnings)

Jul 25: Churchill Downs (call)

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.