Blackstone and HPS pony up to fund Superbet’s further expansion.

In +More: Sportradar confirms MLB deal.

Shares watch: Better Collective’s limited relief rally.

By the numbers: Eagles win sees the Super Bowl break records.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

$uperlative

Brave new world: Superbet has announced it has secured €1.3bn of new financing from existing shareholders Blackstone and HPS Investment Partners as it seeks to build on its recent success in new markets such as Brazil.

The company said the money would provide a “strong financial platform” as it looks towards expansion into new markets, M&A and investment in new tech.

Scale model: Jimmy Mayman, CEO at Superbet, said the “core vision” of the company was to “scale at pace” to become a leader in the sector.

He added that the “landmark agreement" would help the company achieve its ambitious goals.

These include Brazil, which the company has targeted with a rumored $200m marketing campaign.

The early results suggest some success: Similarweb traffic analysis for January showed Superbet on 14% share, second only to Betano with 19% and ahead of EstrelaBet and bet365 on 6% each.

Founder story: Superbet was founded by Sacha Dragic in 2009 when he launched the business with one betting shop in Romania. It launched online in 2016 and Blackstone first invested €175m in the business three years’ later.

Dragic said Superbet’s “strong financial fundamentals” provided a “solid platform to accelerate growth.”

I remember when this was all fields: Thomas Winter, now a board member at Rush Street and formerly a board observer at Superbet, said via LinkedIn that he “fondly remembers” when Dragic set a goal of making the company a “leading, multi-billion-dollar online gaming operator.”

This at a time when Superbet “had only a mere 70 betting shops in Romania and no online presence whatsoever to back it up.”

Who are you? Blackstone is a seasoned investor in the gambling sector having previously owned the Cosmopolitan in Las Vegas, which it sold to MGM Resorts in 2022 for $5.65bn.

It is currently invested in Spanish gaming group Cirsa, which it acquired in 2018 for €2.2bn, and is also the owner of Crown Resorts in Australia, which it bought in 2022 for A$6.3bn ($3.95bn).

HPS, meanwhile, is a credit investment manager with over $148bn in assets under management. It is currently the subject of a takeover bid from BlackRock.

Fincore delivers innovative technology solutions for operators and gaming studios.

Built on decades of expertise in Sportsbook and iGaming, driven by a passion for problem-solving, and powered by the latest ML technology.

Our modular and custom solutions empower you to scale, adapt, and thrive in our fast-paced industry while giving you the control and flexibility to own your platform and tailor it to your unique needs.

+More

At plate: Sportradar has confirmed its exclusive data, media content and AV content deal with MLB through to 2032. The new deal allows for the league to take up to a 1.3% stake in Sportradar. The analysts at Jefferies said the agreement “removes key headwind" for investors and suggested it pointed to Sportradar’s “position in the OSB value chain as increasingly secure and its path of earnings acceleration clearer.”

Bally’s has completed the previously announced deal with major shareholder Standard General that sees the company merge with the also Standard General-owned Queen Casino & Entertainment.

BetMGM has officially launched in Brazil in partnership with the Globo media group.

GAN: The deadline for the completion of Sega Sammy’s acquisition has been pushed back to May. Meanwhile, Sega Sammy has announced a restructure that will see all its gaming businesses – including the prospective GAN and Stakelogic acquisitions – put together in a single unit to be called Sega Sammy Creation.

Earnings in brief: Svenska Spel said Q4 net revenue was flat at SEK2.13bn ($194m) despite “challenging” comparatives in land-based casino and gaming machines. The online business was also flat. Operating profit rose 10% to SEK535m. FY24 net revenue fell 4% to SEK7.74bn while operating profit fell 9% to SEK 2.11bn.

In Earnings Extra this week

After BetMGM last week (paywall), one half of the parental double act MGM Resorts hits the tapes AMC on Tuesday.

A recent preview from Macquarie pointed out the company has a full hand of potential growth cards at present.

These include its online optionality, a hoped-for New York downstate license, the development in Japan and now Thailand as well.

Watch out for: Any comment on Macau will be closely watched given the recent disappointing data for the Chinese New Year period.

AMC on Thursday, DraftKings will release its Q4 numbers with the call to follow before the market opens in New York on Friday morning.

Last week, Bank of America lowered its estimates for adj. EBITDA for the quarter to $90m due to the well-known hold volatility issues.

But this remains at the high end of the range as the analysts believe DraftKings will have been able to adjust promo levels and market expenditures to compensate.

Also in Earnings Extra this week Catena Media, Red Rock Resorts and DoubleDown.

Shares watch

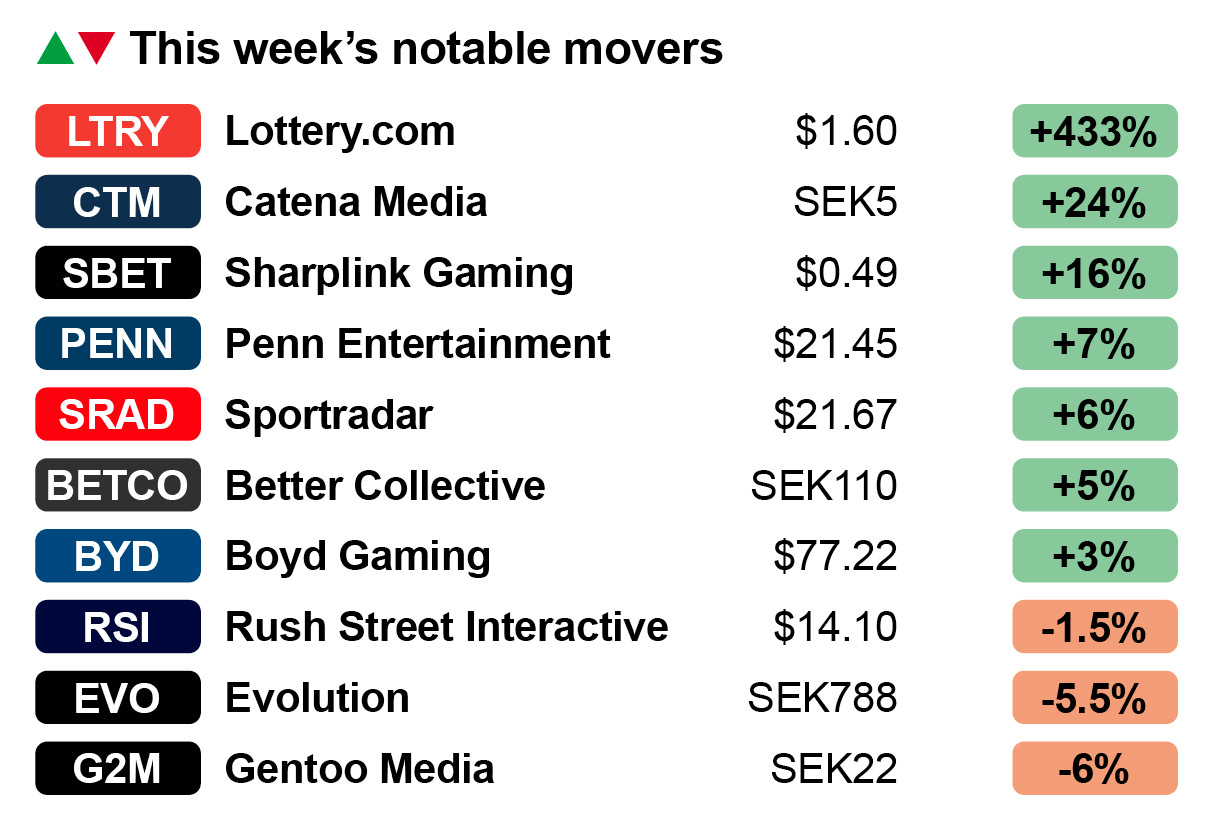

Mountain to climb: Better Collective enjoyed a 13% bounce on Thursday last week after it announced a very brief trading statement to say FY24 revenues would now come in at the top end of its revised guidance, at €371m, while EBITDA would be slightly ahead at €113m.

Recall, the revised FY forecasts came with the October warning, which prompted a 35% slide in the share price.

After Thursday’s bump, the shares gave up a further 5.5% on Friday, leaving them down nearly 64% over the past year from their all-time peak of SEK322.

Notably, Thursday’s leap was on meagre volumes, with 350k of shares changing hands.

In comparison, when it shocked the market in October over 1.3m shares were exchanged.

Winning the lottery: Lottery.com was one of the most egregious examples of the SPAC market frenzy getting ahead of itself. Having floated with a valuation of over $500m in late 2021, it descended into chaos and has rubbed along as a penny stock ever since.

The company lost its founder and CEO, was under investigation for accounting disclosures and was threatened with a Nasdaq delisting.

Meme artist: Its latest incarnation, however, would appear to be a meme stock after the share price soared over 400% this week. The cause was an announcement that it has launched international operations with “revenue generation targets in March.”

Chair Matthew McGahan said this was a “new era” for the business, adding that operations would soon commence in unspecified international jurisdictions.

Ones to watch: Rush Street was down 1.5% this week after a 2% fall on Friday, but in after-hours trading the stock was up 5%.

👀 Gaming affiliate Catena Media reports on Tuesday and ahead of the announcement the shares rose 24% this week.

Another affiliate, Sharplink, was also in the top of the charts this week with a 16% share price increase.

Analyst takes – Boyd Gaming

SmorgasBoyd: The regionals and Las Vegas Locals and Downtown operator has “something for every investor,” suggested the team at CBRE.

The team cited the “stable to slightly positive same-store trends, a deepening growth pipeline, generous shareholder return policy, robust balance sheet that provides M&A optionality, and even a bit of digital gaming exposure.”

FanDuel read across: The Morgan Stanley team said digital still beat expectations even after the one-time benefit of termination fees from market access agreements and the well-tracked Q4 hold headwinds.

This highlighted the “continued operational execution” of Boyd’s online partner FanDuel.

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

By the numbers – Super Bowl

Soaring: Active player accounts rose by 14% YoY as the Philadelphia Eagles smashed their way to a 40-22 victory in New Orleans, according to data collected by player location tech provider GeoComply.

Over the course of the Super Bowl weekend, GeoComply said it saw the creation of 724k new accounts in regulated states.

Good news/bad news: Ahead of Sunday’s matchup at the Caesars Superdome, the analysts at Macquarie predicted the game would generate $1.7bn of legal bets, up 11% YoY.

They had added that total points over 48.5 would be the largest liability for the sportsbooks, followed by the moneyline on Philadelphia at +110.

The best-case scenario for the bookies would have been a Chiefs win and an under total points.

More numbers

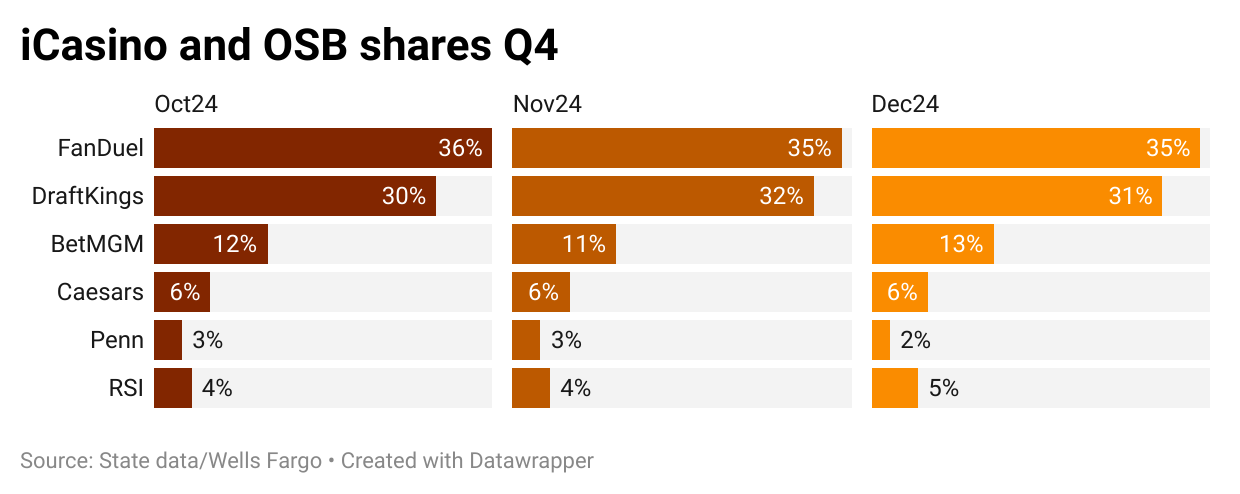

As you were: For all the ups and downs of the recent NFL season, and its effect on actual OSB GGR and NGR total in Q4, the net effect on market shares was very much neutral with only market leader FanDuel gaining any ground QoQ.

It easily retained top spot with aggregate market share across both sports betting and iCasino of 35%, up 2 ppts QoQ.

DraftKings was in second spot with aggregate share of 31%, which was flat QoQ as was BetMGM on 12%.

Lower down, Caesars was also flat at 6% while Penn Entertainment remained marooned at 3%, beaten into sixth palace by Rush Street with an aggregate share of 4%.

Join 100s of operators automating their trading with OpticOdds.

Backed by the resources of $GAMB, OpticOdds has the industry's most advanced, comprehensive odds data and is poised to drive innovation and growth like never before.

Join the OpticOdds team at SBC Rio🇧🇷 or Get Access Now⚡

Earnings calendar

Feb 11: Catena Media, Red Rock Resorts, DoubleDown Interactive

Feb 12: MGM Resorts

Feb13: DraftKings (earnings), Wynn Resorts, Mohegan

Feb 14: DraftKings (call)

Feb 18: Gentoo, GiG Software

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.