9 Jul: Weekend Edition No.4

Vegas Summer numbers, Macquarie sector note - how much for Entain?, MGM analyst update, Raketech M&A, Weekly digest.

Welcome to the latest Weekly Edition. The second quarter numbers are now looming and the calendar is now filling up with earnings dates for the rest of the month and into August. Already we have seen some key pre-announcements in the US and this week in Europe we saw pre-close trading statements from Entain and Betsson, both prefiguring very bullish upcoming statements. One aspect notable in both was what they each said about margins - see the analysis below. But first we look at what is a clearly buoyant gaming scene in the US and analysts say about whether the momentum is sustainable. Meanwhile, on the M&A front we note the price tag put on any potential bid for Entain from MGM >>> Spoiler alert - it’s higher than the January number of circa $11.2bn.

If you have been forwarded this email and would like to subscribe, click here:

Las Vegas Summer forecast

Crosstown traffic: Las Vegas demand and visitation numbers look set to continue rising this Summer, with Deutsche Bank this week saying visitor traffic numbers on the Strip for June were improving. Despite being down 27% vs. Jun19, that was an improvement on the 38% drop in April and 32% drop in May compared with the same months in 2019. The locals market however was softer than in recent months, June traffic was down around 49% vs. Jun19. Truist Securities said same-store regional-gaming revenues, excluding the Strip, were tracking 11% higher in May 2021 compared to May 2019 (13% when including Strip revenues). Truist said

“these figures and Nevada’s recent release lead us to believe the older core customer has returned, with a portion of the younger unrated player sticking around as other entertainment options return.”

Pump up the volume: If player spend patterns are maintained, Deutsche expects the Strip to record GGR growth of c.34.2% in June vs. Jun19, with visitor volumes running much higher than anticipated. The Strip’s propensity to attract higher spending players will mean more volatility when comparing visitor numbers and gaming spend, although “the two-year improvement in daily traffic trends in June likely helps slot and domestic table trends,” Deutsche Bank said. Visitation numbers are lower than two years ago, but if spending patterns are maintained DB expects GGR at Las Vegas locals to be up 15.9%. For other states, DB modelled GGR growth of 7.9% and drops of -4.3% for Louisiana, -3.6% for Missouri and -3.9% for Indiana.

By the book: Meanwhile a JP Morgan report revealed that Strip booking rates for the last week of July are 12% higher than Jul19, which translate as 52% higher weekend rates vs. 2019 and midweek rates lower by 13%. MGM’s weekend rates were up 56%, Caesars’ rates were up 26%, Wynn Resorts’ weekend rates were up 100% and Las Vegas Sands’ weekend rates were up 107%, the report stated.

Macquarie sector note

As good as it gets I: On a wider view, Macquarie analysts have looked into regional gaming trends and suggest GGR will be between 15-20% ahead of Q121 and 10% up on Q219. Noting the 6% decline in gaming operator stocks for the week, they suggest investors have baked in the expected Q2 good news and are looking to the rest of the year. They suggest, however, that notwithstanding the impact of the Delta variant, the continued recovery in the older demographic and the predicted staying power of unrated play will aid H2 results. No such optimism attends Macau, however, where Q2 ended poorly (down by 65% on Q219) after further border restrictions hindered any recovery.

The $20bn question: The Macquarie team has also updated its model on Entain/MGM accretion. Putting a 5x multiple on BetMGM 2025 revenues of circa $3.49bn, it suggests the operation should be valued at c$17.5bn by 2025, while on the non-US elements of Entain, valued at up to 2.5x 2022 EV/sales would value it at $12.2bn.

To cut to the chase, Macquarie suggests MGM “can offer up to $20bn (assuming non-US trades at 12-16x) while maintaining accretion.” Recall, the previous bid for Entain in January was pitched at c$11.2bn.

Sports betting margins

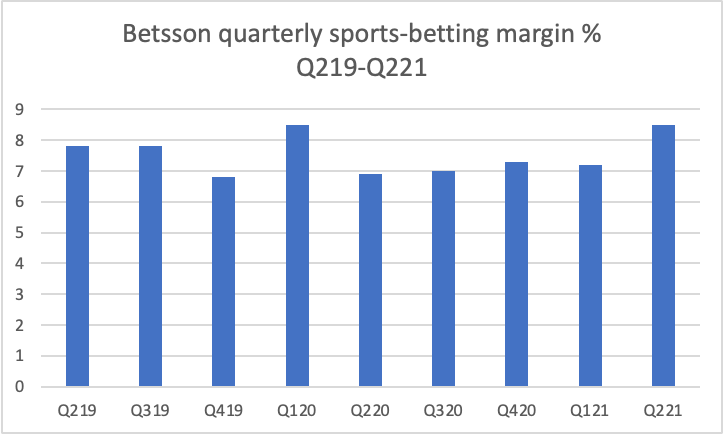

As good as it gets II: Of note this week was the sports-betting margins being talked about by both Betsson and Entain. In the case of the latter, H121 margin was up by 0.3 percentage points (0.5 percentage points in Q2) while at Betsson the company said it had seen margin hit approximately 8.5% compared to an eight-quarter rolling average of 7.4%. A look at the data from the past two years shows, in fact, that Betsson last saw margins hit 8.5% in Q120, just before the pandemic hit, and subsequently slipped back to 6.9% in the subsequent quarter and an average of the next four quarters of 7.1%.

Raketech M&A

Double up: Raketech has acquired the US affiliate P&P Vegas Group and the India-focused cricket affiliate QM Media for a total purchase price of €16m to be paid in cash and shares. Raketech said the acquisition of the US tips specialist P&P, which operates the website Picksandparlays.net,

roughly doubles its revenues from the US and QM’s Onlinecricketbetting.net will mean 5-10% of group revenues will originate from India. Overall, Raketech’s sports verticals will represent c.30% of the group’s total revenues by year-end vs. 17% at the time of its Q1s.

The company will pay €9m in cash and issue nearly 3.9m shares amounting to €7m to settle the transaction. The purchase price represents a multiple of approximately 5.6x EBITDA and 3.8x revenues for the last 12 months.

Additional growth: Raketech will leverage P&P’s network of betting experts and tipsters. Through its online, mobile and social media content Picksandparlays attracts around 500,000 unique monthly users, with revenues coming mainly from user subscriptions and sales of picks (tips), which Raketech aims to keep. It will seek to combine and monetise them with its existing commercial relationships with US sportsbooks to generate additional growth. The group said the acquisition of Onlinecricketbetting.net will enable it to reach more than 1m unique users during Indian Premier League matches and will gain a significant position in the Indian affiliate market. The deal also saw Raketech acquire a number of Nordic-focused sports assets.

MGM analyst update

Center of attention: Deutsche Bank analysts have updated their model on MGM Resorts International to reflect the moves made on CityCenter. Recall, MGM has bought out the half share of the real estate from joint owner Infinity World and agreed a sale and leaseback of the Aria and Vdara to Blackstone. DB point out the transaction removes an oft-overlooked JV, brings in around $1.8bn of more cash following the real estate monetisation and allows for better management of a key Las Vegas Strip property.

The analysts also noted the timing has been propitious; the purchase multiple for Blackstone of 18.1x is a new high for gaming real estate, beating the previous 17.3x achieved by MGM for the sale of the Bellagio real estate.

The simplification of MGM’s structure is notable bearing in mind the other big JV around BetMGM. As was noted earlier in the week by analysts at Jefferies, UK stock exchange rules means MGM can return to the table with a further bid to buyout/takeover partner Entain on July 19. Or Freedom Day as it is now being promoted in the UK.

The weekly digest

Freedom day (sic?): MGM’s ongoing and potential $20bn bid for Entain according to Macquarie’s model will continue to focus the minds of industry observers up to 19 July, aka ‘Freedom day’ (sic?) in the UK. The UK group’s strong trading update published yesterday and continued growth of OSB and iGaming share in the US will have further strengthened its hand.

Penn sceptics: Penn National’s Q2 pre-announcement at the end of June had analysts running a sceptical rule over the group’s numbers. In particular Deutsche Bank said it believed PNG’s sports betting and iCasino verticals were overvalued relative to performance to date and saw “considerable risks” to 2022 forecasts. Penn said it expects Q221 net revenue of $1.45bn-$1.55bn and aEBITDAR of $540-$580m.

Put it on the tab: Tabcorp said it planned to demerge its lottery and keno business from its wagering and gaming services arm, to create two new listed vehicles following a strategic review that could also see it sell its wagering business. The company said it would take a “significant hit” in its FY results. Staying Down Under, the future looks uncertain for Crown Resorts because of Covid-related closures, international travel bans and multiple regulatory issues.

Calendar

13 Jul: Score Media & Gaming

14 Jul: Casino Beats Summit, Malta day 1

15 Jul: Casino Beats Summit, Malta day 2

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com