17 May: Golden Nugget mines Michigan seam +More

GNOG, GAN, Scout Gaming Group Q1s, Esports Entertainment Q3, Aristocrat H1, LeoVegas NJ call, NJ GGR April, MI OSB and iCasino, MA April GGR

Good morning and welcome to today’s newsletter and another busy morning on the earnings front. First up, we have the overnight news from Golden Nugget Online Gaming and its first forays into Michigan, that is followed by GAN’s earnings beat, more quarterly numbers from Scout Gaming, Esports Entertainment and Aristocrat. Plus, we bring you the latest data from NJ, MI and MA. But we start with what GNOG had to say about its encouraging start in the Wolverine state.

If you were forwarded this email and would like to subscribe, please click here:

Golden Nugget Online Gaming

The top line

Revenue was up 54.2% to $26.7m while the company fell to an adjusted EBITDA loss of $3.5m from a profit of $2.9m in Q120. Net income hit $69.6m reflecting non-cash gains on warrant derivative liabilities of $81.1m.

The company maintained its full-year outlook of revenue in the range of $130-$145m.

Lights out for the territory: GNOG completed its first quarter of operation in Michigan, its first state outside of New Jersey. It also has market access arranged for sports and online casino in Colorado (via Maverick’s Z Casino) and Iowa (via the Wild Rose Casino) and is preparing the ground in West Virginia, Virginia, Pennsylvania and Illinois for market entry in H2. The expansion is being funded by circa 30% EBITDA margin performance in New Jersey but such is the progress in Michigan, chairman Tilman Fertitta said the state was on course to turn profitable in 2022, way ahead of expectations. CEO Thomas Winter said GNOG was one of only two operators to increase GGR in Michigan between March and April, gaining market share against ”high-spending” competitors. According to state data, Golden Nugget achieved 4.1% market share in April in the iCasino market. (See Michigan data below).

“When you offer only sports it is extremely difficult to get to profitability. The real profitability comes from iGaming, and this is where we want to focus our marketing expenses. In states that are offering only sports at least at the start, it is more a way for us to get set up and increase brand awareness and a player database, ahead of any expected iGaming launch.”

Get active: The average active depositor numbers were undoubtedly impressive. Active FTDs rose 386% (driven by the Michigan launch) and returning active depositors rose 49%. Total active depositors rose from 30k in Q420 to 45k in Q1. Thomas Winter said that increased spending from loyal customers was one of its growth pillars.

Going live: There were some interesting comments from Winter about live-dealer suppliers turning their collective noses up at the New Jersey opportunity back in 2015, a rejection that persuaded GNOG to build its own studio in partnership with supplier Ezugi. That facility is now being expanded by 1,800 sq ft and has six other B2B clients on board. As Winter noted drily, “the situation is different now” and with both Evolution and Playtech building studios in other iGaming states, he said there was no need for GNOG to build further studios. But the potential is there to use the new Jersey facility for other states should that be allowed by the regulators.

“Right now all these states have asked that live dealer studios be located in the state but that might change,” he said. “So if at any point we are authorised to use our own studio in other states, we will do that.”

GAN

The top line

GAN signed a five-year agreement with Ainsworth Game Technology for the exclusive rights to all current and future Ainsworth online games for an undisclosed amount. Revenues increased 263% and 12%/$3m above forecasts to $27.8m, driven by a $14.3m B2C contribution from sportsbook Coolbet. B2B revenues were up 76% to $13.5m, driven by 75% organic growth.

GAN increased 2021 guidance by $3m to $103-108m (3x revenue vs prior year). Gross profits were up 220% to $19.1m, Coolbet contributed $8.3m. Net loss came in at $4.5m vs. net income of $0.7m YoY. Adjusted EBITDA was $1.7m vs. $2.5m YoY due to increased operating costs and expansion into new jurisdictions. GAN has cash reserves of $52.2m as of 31 March.

All American: CEO Dermot Smurfit said the agreement signed with Ainsworth will give its Super RGS content distribution platform increased scale and access to 80 already highly popular US online casino games in New Jersey. “Ainsworth will be launching 15 more titles in the near future and more than 200 over the course of the deal.”

“We want content that is proven in the US market,” added Smurfit, “there is a lot of content that is available internationally, but we don’t think it would resonate in the US.”

Upping the take rate: The deal will enable GAN to increase its share of revenues from operators that are not GAN clients currently. GAN will take licensing fees from Ainsworth’s existing operations in New Jersey and in Michigan and Pennsylvania once those are live this year. The AGT agreement was “super-critical to GAN’s Super RGS strategy” and will be a “competitive differentiator”, added Smurfit. GAN expects a 30% return on investment and a base case of 50$m in additional revenue, $12m net income and positive free cash flow from 2022 over the five-year term. Analysts at Macquarie said GAN’s “current beat/raise” was positive, but noted GAN’s lower take rate. “The delayed EBITDA commentary (we reduce our ’22/23 EBITDA by 37%/21%) may leave some investors waiting for the ‘picks and shovels’-type margins B2B operators generate.”

Peaking over the hedge: Asked about the strong contribution from Coolbet, the online sportsbook GAN acquired in November 2020, CFO Karen Flores said the group remained cautious as there is built-in “risk with sports betting, there is always volatility”. With major football tournaments like the Copa America and the Euros on the horizon, Flores said the group would continue to be cautious on sports-betting guidance as “results can be volatile and we want to hedge”.

Multi-state moves: Smurfit added that the group will continue to invest in growth to gain market share. The aim is to get the right talent in place to capture long-term multi-year relationships and while “organic B2B opportunities are numerous, interestingly we’re having discussions with single-state clients asking to go multi-state.” These are big opportunities but also “highly complicated.” “So we’re building new launch teams, upskilling and resourcing to be ready to answer the call when these major opportunities come up,” said Smurfit.

Ainsworth

As part of its own press release for the GAN deal, Ainsworth gave a brief summary fo its H221 numbers. It said it expects profit before tax of A$1m. “Ongoing improvements” post-Covid mean that group FY underlying EBITDA is expected to hit A$19m while H2 EBITDA will come in at A$13.2m, up 128% on the prior year period.

Scout Gaming

The top line

Revenues increased 54% to SEK13.4m ($1.6m/€1.3m), EBITDA loss was SEK15m ($1.8m/€1.4m). Net losses reduced to SEK9.3m vs SEK9.8m YoY. Scout’s operator trading index illustrating underlying client activity increased 164% to 2652 (vs. 1004in Q120).

Costs increased to SEK30.6m mainly due to increased marketing activity related to guaranteed prize pools. Operating losses rose to SEK17.3m (vs. SEK13.1m Q120).

From A to G: Commercial highlights included an agreement with ATG, the Swedish horse racing tote, with a launch planned during Q2; and a licensing agreement for its Euro2020 Predictor game with German-focused sportsbook Interwetten. The game is live on a free-to-play basis currently and will launch as a real-money product in time for the tournament.

Esport Entertainment

The top line

Net revenue was up 129% to $5.4m but operating losses extended to $5.6m from $0.6m in the prior year period and net losses hit $12.4m, nearly doubling on the Q320 number of $6.3m.

During the period, Esports Entertainment purchased the Lucky Dino online casino as well as the Esports Gaming League, an esports tournament provider. It also closed a $20m share offer. The company has filed for a new Jersey gaming license.

The company said it remained committed to previously communicated full-year guidance of $18m in revenues in 2021 and $70m in 2022.

Warp speed: The company is closing in on its GG circuit/Helix acquisition and also recently announced its intention to acquire Holodeck media. It said the deal would enable it to “exponentially expand our technology-driven esports wagering, tournament play and iGaming-focused entertainment company”. But as it stands, its Q1 revenue rise was due to Lucky Dino and the organic growth from the Malta-licensed SportNation and Vie.gg traditional and esports offerings. Recall, the esports-betting community is still waiting on New Jersey licensing permission.

Aristocrat

Just briefly: Aristocrat pre-informed the market of its H1 numbers ahead of a full half-year announcement next Monday, 24 May. It said net profit after tax (NPAT) came in at A$346m while normalised profit after tax rose 12% for the six month to A$412m. The company said stronger than expected consumer sentiment and economic conditions in the US and ANZ region had driven profit growth. Said CEO Trevor Croker: “We expect economic conditions across key markets over the full year to remain uncertain, as a result of ongoing COVID-driven volatility. We are closely monitoring key factors including consumer sentiment, gaming venue patronage and currency headwinds.” Further information will be published next week.

LeoVegas NJ launch investors call

Counting the cars on the New Jersey turnpike: LeoVegas held a call with analysts yesterday following the announcement of an agreement with Caesars to make its US debut in New Jersey. The company said it had been encouraged by investors to take the step. “They love the brand,” CEO Gustaf Hagman told the online audience. Hagman was keen to stress that LeoVegas will be entering the US on its own platform/PAM and said the company feels it can take advantage of the predicament others find themselves in with regard to third-party platforms. “We can see others struggling with third party suppliers today,” said CFO Stefan Nelson.

“Some people are changing platform and those are huge things to do. You don’t want to be in that position,” added Nelson, in case anyone was thinking that the eyes of a very competitive sector weren’t trained on DraftKings’ upcoming switch from Kambi to its own SBTech platform.

No figures on the financial impact of the US venture were given.

New Jersey April GGR

Traditional casino: GGR was down 8.7% on the Apr19 figure to $189.6m, representing a monthly sequential improvement of 2.6%. Slot revenue was down 4.7% to $138m on Apr19 and up 2.8% MoM. Hold increased by 36bps. Table games GGR excluding poker was down 16.9% on Apr19 to $50.1m.

iCasino: GGR came in at $107.7m, up 34.8% YoY but down 5.2% MoM. The market was led by Borgata (30.4%), Golden Nugget (30.1%), Resorts (18.2) Caesars AC (8.5%), Tropicana (6.8%) Hard Rock (4.8%) and Ocean Resort (1.2%.

Sports-betting: Sports wagering GGR came in at $54.8m, down 9.7% MoM. Online was worth $47.6m, down 15.7% MoM, while land-based bounced back to $7.2m, up 69%. Hold was on the high side at 7.3%. Handle of $748m was down 13% MoM. In market share terms, movement has been limited in the last 12 months; FanDuel/PointsBet lead the way with 52.9%, while the Resorts/DraftKings/Fox Bet combo maintains second place with 24.9%. In retail betting, the difference between April market shares and LTM is more pronounced with Borgata (BetMGM) gaining ground on both FanDuel (Meadowlands) and William Hill (Monmouth Park). However, the new FanDuel book at Bally’s has also made a minor move, up to 2.6% of total retail GGR from 0.6% in the LTM figures.

Michigan sports-betting and iCasino April GGR

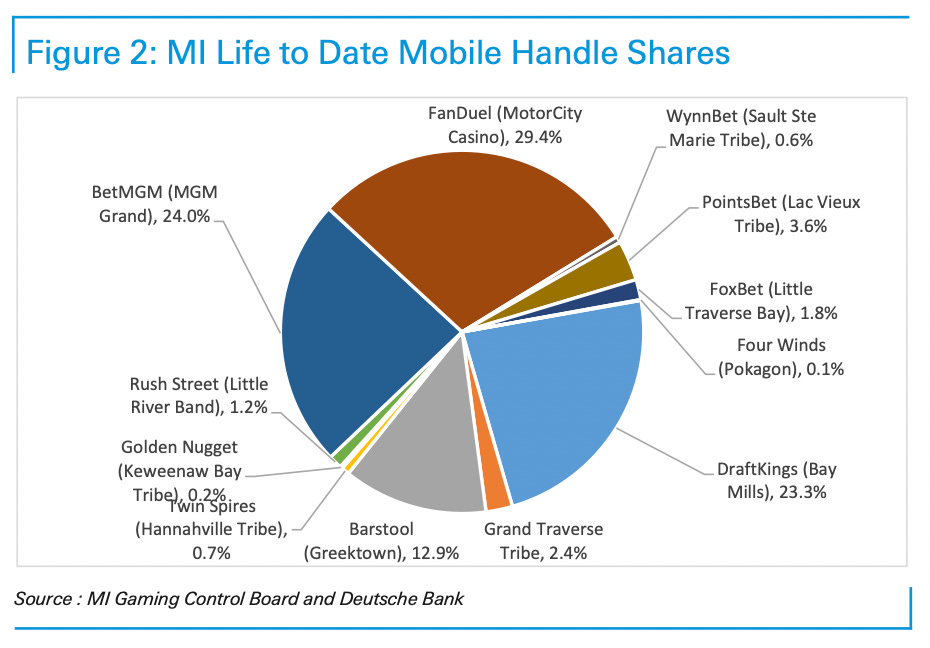

Spend, spend, spend: Michigan GGR hit $21.9m in April of which mobile accounted for $20.4m. iCasino posted GGR of $94.9m, down 0.2% MoM. Mobile handle fell 30.5% to $249.9m. Promotional spend of $9.5m accounted for 47% of mobile GGR versus around 41% in March. Retail handle hit $24.3m, around 9% of the total. FanDuel led the way with 29.7% of handle, DraftKings reclaimed second spot with 24.6%, BetMGM dropped to third place with 22% and Barstool nudged down again to 9.9% from 11% in March. Between them the top four claimed around 86% of handle, a slight drop on the 88% figure from March.

On a GGR basis, BetMGM reclaims second spot with 27% while FanDuel maintains top spot with 35%. In iCasino, meanwhile, BetMGM took top spot with 38.8% of the total take, ahead of FanDuel with 16.5%, DraftKings slightly behind at 16.4% and then WynnBet on 4.3% and Barstool on 3.6%. Looking at the figures, the Jefferies team said they were “supportive” of their favouring DraftKings and BetMGM. They added that the figures confirmed the optimism expressed by MGM during its recent earnings update. Recall, MGM has suggested it is now competing hard with DraftKings for second place across the sports-betting and iCasino piece.

This sporting life: Truist analysts noted in their April sports-betting monitor that the sporting schedule is unlikely to lend itself to substantial increases in either handle or GGR in the next three months. “We believe May, June and July will see relatively in-line results to April because of the seasonality of the sports calendar,” they said.

Massachusetts April GGR

Once more with feeling: GGR for April rose 135.9% on the Apr19 figure to $84.6m helped by the Encore Boston which opened in June 2019. Ex- that property, same-store revenues were down 4% on the same Apr19 comparative. Sequentially, GGR barely moved, up 0.8%. The Wynn Encore drove the GGR performance, posting $50.2m for the month, up 1% sequentially. Penn National’s Plainridge Park hit $12.5m in GGR, down 11% on Apr19 but up 2.4% MoM. The MGM Springfield - as announced last week due to transfer ownership to MGP - rose 0.5% on Apr19 to $21.9m, down slightly MoM.

Newslines

Known world: Galaxy Gaming, tables games and iGaming developer and distributor said revenues dipped 4.7% to $4.3m while adjusted EBITDA rose 12.8% to $1.7m. The company suffered from the land-based gaming closures throughout Q1 in its largest market of the UK but made up some of the ground with iCasino volumes in Michigan. It hopes to be further boosted by live dealer client launches in the state soon.

What we’re reading

US racing's existential crisis: “People have been racing horses since shortly after they were domesticated, which is thought to have occurred about six thousand years ago. How shortly? My guess is a week. They started cheating, by my guess, a week after that.” William Finnegan on the survival hopes of US racing in the New Yorker. The New York Times also weighed in with its non-too complimentary take on the issues surrounding the sport.

Number of the day - 10.61 billion: ESPN’s David Payne Purdum finds that some sports consumers are getting turned off by the sheer amount of sports-betting ad sports which hit that 10.61 billion impressions in the seven months to the end of March.

Post of the day

You learn something new every day.