7 Jul: 888 signals ‘return to normality’

888 trading update, Rank news, Illinois and Maryland May GGR +More

Good morning and welcome, 888 has announced a pre-close trading update showing B2C revenues booming. Rank has announced a new bank debt facility and there is news from yesterday on GGR in Illinois showing top three mobile market share dominance increasing.

If you have been forwarded this email and would like to subscribe, click here:

888 trading statement

The top line

B2C revenues up 11% YoY to $247m, B2B down 13% to $10m, total revenue up 10% to $257m.

Regulated markets now represent 74% of group revenues from 73% in prior year, with growth in UK, Italy and Spain among others helping to offset falls in Germany.

Sport was the big driver after the Covid-affected Q220, up 94%. Casino was up 13% YoY. Bingo and poker were down unspecified percentages compared to a strong Covid-affected comparative period.

Return to normality: 888 gave a strong hint this morning that the end of the mini-boom in online activity caused by the extensive lockdowns and other restrictions affecting leisure spend in its major global markets might be coming to an end. Specifically, the company cited the UK, where since mid-May leisure and entertainment venues have opened up and average daily revenues have fallen by approx. 20% YoY. Further regulatory and compliance changes along with the return of normalized seasonality will also impact H2.

Picture this: The company hopes the currently sub-scale B2B business will receive a shot in the arm from the recently announced Sports Illustrated deal. Recall, 888 hopes to launch a Sports Illustrated-branded sport-betting site later this year. It represents a “key pillar” of 888’s US strategy, CEO Itai Pazner reiterated today. The company also noted it has been awarded a licence in Germany. Previously, the company said Germany had seen revenues declines in Q1 of 40-50%.

Rank business update

Waving not drowning: Rank has secured a two-year revolving credit facility of £25m, further shoring up its balance sheet after a difficult year. This is on top of the previously announced £55m RCF and £108.4m term loan. Recall, Rank told the market last week that trading in the first weeks since reopening had seen its casino and bingo venues trading at “above cash breakeven”. The company said then it had comfortably met its minimum £50m liquidity test at the end of June. It also expects a payment from the taxman within the current quarter that will be “materially in line with previous estimates of circa £80m”. Peel Hunt said this morning that the new facility - and the stated plans to use it “to accelerate investment in its transformation plan” - was a sign of the company “getting ready to put Covid-19 behind it.”

Penn National analyst update

Penn state: Following Penn National’s Q221 pre-announcement at the end of June, Deutsche bank has updated its model but reiterates its scepticism over the company’s long-term prospects. Specifically, it continues to see the sports-betting and icasino business as being overvalued relative to performance to date. In addition, the analysts see “considerable risks” to the 2022 consensus adjusted EBITDAR forecasts, anticipating a contraction relative to the currently boosted 2021 margin performance. This is despite the recent addition of the Hollywood Perryville and two PA slot parlors. Recall, Penn now expects Q221 net revenue to come in at between $1.45bn-$1.55bn and adjusted EBITDAR of between $540-$580m.

Illinois May GGR

The top line

Sports betting handle was down 6% MoM to $507m and operator revenues were down 17% to $36.2m MoM, with average hold of 7.1% trending with the rest of the country. The state recorded $5.9m in taxes in May and has collected $53.3m in tax revenue since regulating sports betting in March 2020.

Mobile world: Mobile betting accounted for 95% of total GGR for operators in the state, with May being the first full month since the pandemic-related order to allow remote registration for Illinois players had been cancelled by Governor JB Pritzker. DraftKings was market share leader for mobile with 34.5% and $166.2m in handle, FanDuel was second with 32.2% share and handle of $155.6m and local operator BetRivers was third with 15.9% share and $76.7m in handle. Those three brands recorded around 89% of the total mobile revenue for the month vs. 84% in April.

Maryland June GGR

The top line

GGR rose 13% over June 2019 and was down 6.3% (-3.2% daily) MoM at $161.5m.

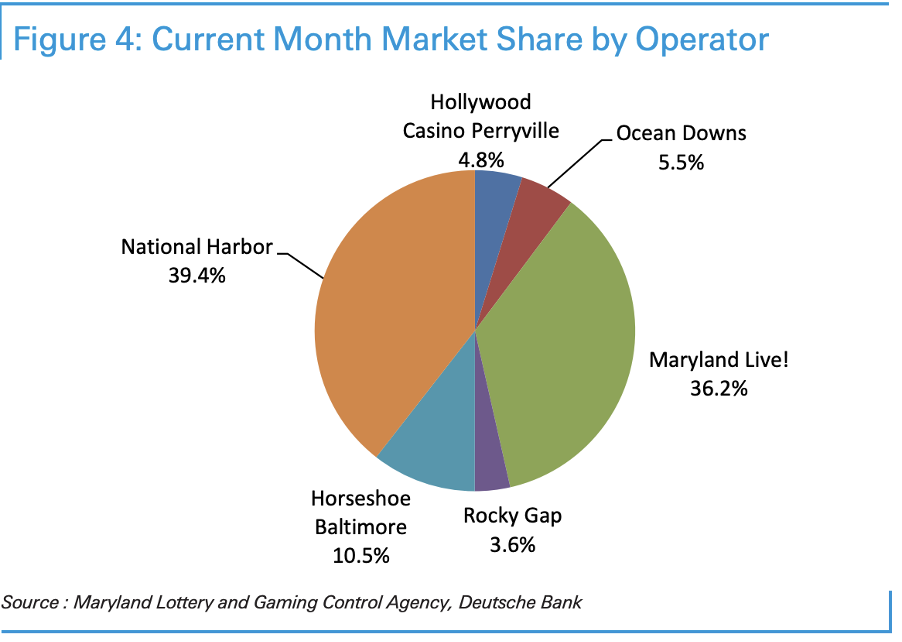

Safe Harbor: MGM’s National Harbor resort topped the market share standings at 39.4%, with GGR up 12% vs Jun19 at $63.7m. Maryland Live was in second with 36.2% market share and $58.5m in GGR, a rise of 19.4% vs. Jun19. Caesars’ Horseshoe Baltimore was third with 10.5% share and GGR of $17m, a drop of 8.9% vs. Jun19. Ocean Downs ($8.8m GGR, +29%), Penn National's recently-acquired Hollywood Perryville ($7.7m GGR, +21%) and Golden Entertainment’s Rocky Gap ($5.8m GGR, +12.5%) completed the results.

Newslines

Right price: IGT has announced a deal to provide 700 VLTs to the Western Canada Lottery Corporation (WCLC), marking the first time that The Price is Right game content will be available to consumers in Canada.

Moving the furniture: Caesars Entertainment has announced a “multi-million dollar main entrance renovation” for Caesars Palace that will involve an “extravagant entryway, redesigned gaming areas and a new lobby bar.” Construction is expected to be completed by November. Almost unbelievably, the press release said the company is “not resting on its laurels.” Sheesh.

What we’re reading

The numbers are evening out but the customer mix is positive, according to analysts.

Social media watch

It’s nae coming hame:

Calendar

8 Jul: Entain

13 Jul: Score Media & Gaming

14 Jul: Casino Beats Summit, Malta day 1

15 Jul: Casino Beats Summit, Malta day 2

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com