Robinhood and Kalshi posit betting and retirement funds coexistence.

In +More: Fertitta to stay passive at Wynn.

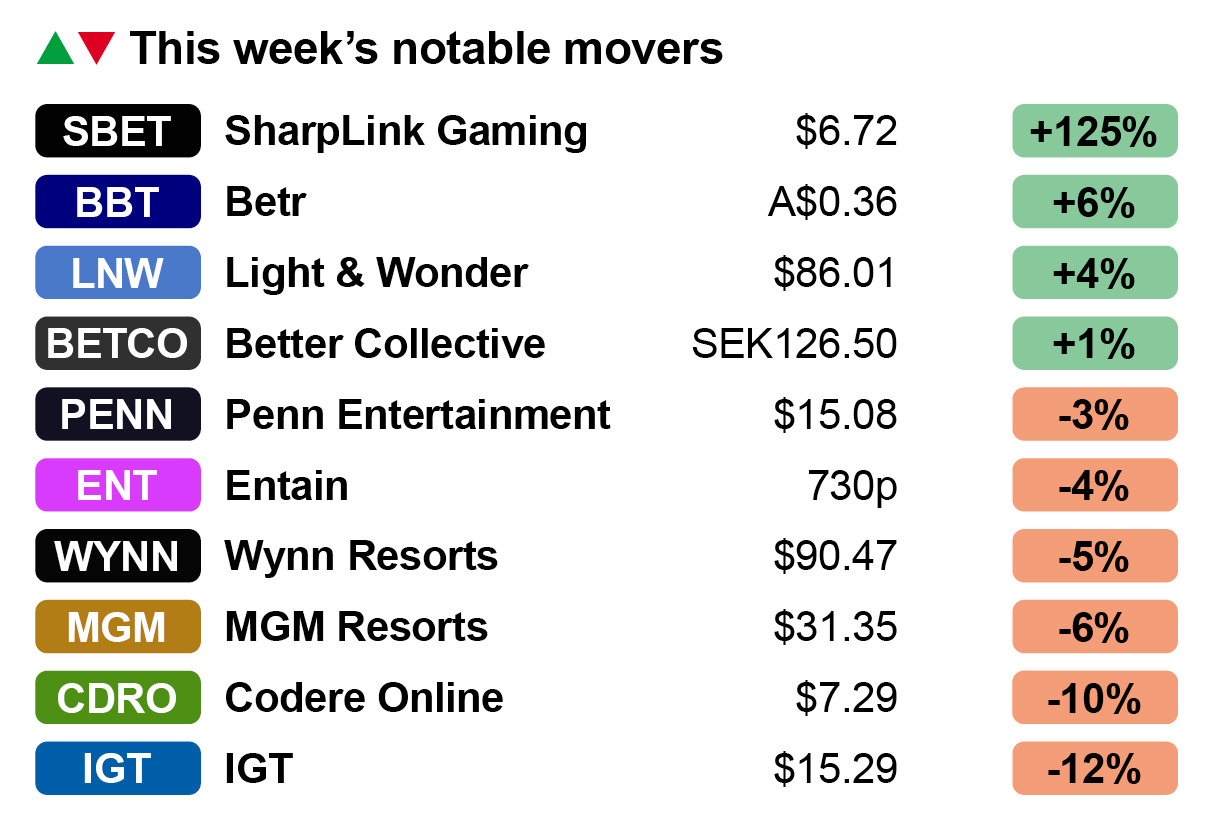

Markets: SharpLink up sharply after cash raise and crypto links.

The teardown: Penn sweats on Disney’s ESPN streaming bet.

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

Retirement plans

A place for everything: The chief brokerage officer at Robinhood and Kalshi CEO Tarek Mansour have both suggested prediction markets are a product fit for sitting alongside retirement fund offerings as part of a full suite of financial products.

Pitch: Speaking during a JP Morgan investor conference recently, Steven Quirk, CBO at Robinhood, was asked about the potential for the company’s offering to feature “betting on the PGA” and whether it might “legitimize” betting on products such as the lottery.

“If people don’t want to see it, they can configure their app not to see it,” he said of the idea of a customer having their retirement savings on an app that also “wants me to bet on who’s going to win the PGA.”

“We give them that capability,” Quirk added. “We haven’t had a lot of people that have done that yet. But it is something that we debate pretty hotly.”

Going for broker: Similarly suggesting betting would be mainstreamed via financial product offerings such as 401(k) retirement funds was Mansour. Kalshi provides Robinhood with its current prediction market offerings, and at a Solana Accelerate event in New York last week Mansour promised more such deals.

“By the next year and a half, I think most mainstream financial brokers, where you have your 401(k), will have Kalshi markets available in-app,” Mansour told the audience.

Quirk of fate: Robinhood’s Quirk was keen to suggest that sports betting was a “huge component” of its predictions offering and was “absolutely an asset class.”

He added, moreover, that when it came to sports, Robinhood felt it had “no incentive for our customers to lose.”

“If you wager on something and you lose, I win; all we are doing is facilitating it,” he added. “We’re an exchange, basically. We’re facilitating people going back and forth on these things.”

Robbing Peter: Quirk’s arguments mirror those made previously by Mansour that players on its platform are “trading in an open financial marketplace” and they were “trading against other people.”

To pay Paul: However, this downplays the role of marketmakers such as Susquehanna International Group, who Mansour himself said bring “institutional grade liquidity to prediction markets.”

The Hood abides: Quirk did note when regulatory clarity arrives, Robinhood would abide by “whatever that clarity is, like we have done with crypto.” But he added that he believed prediction markets more broadly were being recognised as “information markets.”

“And by the way, you should assume that this has caught the attention of every exchange, every brokerage firm, every entity that sort of lies in between those two,” he said.

“They can see the interest, they can see the numbers. One billion contracts is a lot of contracts.”

Ties that bind: Robinhood’s prediction market involvement began at the time of last year’s presidential election when it tied up “initially” with Kalshi as its provider. After a brief false start with the Super Bowl in February, it went big on sports with March Madness.

When they launched, CEO Vlad Tenev said prediction markets were “fundamentally” the “application of capitalism to the pursuit of truth.”

How that applies to who wins the PGA is perhaps moot.

Bad timing: Meanwhile, the financial trading regulator, the US Commodity Futures Trading Commission, is falling apart at the seams. In Bloomberg.

Fincore delivers tailored tech solutions for the gaming industry. For 25+ years, we’ve helped clients modernise legacy platforms, accelerate product roadmaps, integrate complex systems, and turn AI into real-world impact.

+More

Patient capital: Tilmann Fertitta, who recently became the largest shareholder in Wynn Resorts and is now the new US ambassador to Italy, will not take an active role at the company, according to the general counsel at his Fertitta Entertainment. Lawyer Steven Scheinthal told the Nevada Gaming Commission that Fertitta was merely a "passive investor.” But he added this stood “so long as we believe that management is engaged in the right steps to provide value to the shareholders.”

Winding me up: The Teddy Sagi-owned Skywind is attempting to persuade the High Court in London to reverse the acquisition of In Touch Games, which it bought for £50.8m in June 2022, claiming the company was deceitful about its regulatory lapses. Recall, following two fines from the UK Gambling Commission, In Touch had its license suspended once under Skywind ownership in September 2023. Skywind is seeking up to £63.4m in payments and damages.

Data capture: Ontario has released its numbers for April showing total online GGR up 6% to C$313m ($228m), helped by a 14% rise in sports betting to C$64.5m. iCasino rose 1% to C$243m, while poker revenue fell 11% to C$5.9m.

Markets

Lazarus-like: Having completed a $4.5m cash raise from the sale of 1.5m shares early last week, gaming affiliate SharpLink can be pleased with its week’s work after the shares rose 125%, helped by a 79% leap on Friday.

In February, SharpLink announced it had bought a 10% stake in cryptocasino operator Armchair Enterprises for $500k.

The company said at the time its strategy was to become the “first Nasdaq-listed company focused on crypto gaming.”

Also on the up, the Australian-listed Betr rose 6% as confidence continued to grow in its bid to buy rival PointsBet. It is reported to have raised ~A$15.6m from a retail share issuance of the A$130m it will need to part fund the deal.

Possibly heading to bolster Australia’s listed gaming sector is Light & Wonder, up 4% after its investor meeting last week when it expressed the possibility of moving for a full listing in Sydney.

You win some, you lose some: Taking both a winner’s medal and also being a share price loser this week is IGT, which was announced as the preferred bidder for the Italian lottery. Analysts were of the opinion that, at €2.32bn, the company had been forced to bid more than it would have wished for the next nine-year concession.

Codere Online fell 10% in the week as it continued to struggle with Nasdaq over its listing compliance. See below.

Wynn Resorts was down 5% after it officially pulled out of the race to win one of the downstate casino licenses in New York.

Meanwhile, MGM Resorts was also down despite getting a vote of confidence from the Yonkers mayor for its bid to expand its Empire City property in the city.

We Rebuilt The Bet Builder – See It Live at SiGMA Asia

Faster speeds. deeper market coverage. zero downtime. billions of combinations, live bet settlement — all in one place.

Try the NEW OpticOdds Bet Builder now ⚡

Check out our other solutions –> opticodds.com

Odds Screen | Sports Betting API | Automated Trading Tools

Heading to SiGMA Asia? Let’s meet!

Listing under threat

Down to the wire: Codere Online has launched a last-minute appeal for a hearing before a panel of the Nasdaq stock exchange, after it received a further delisting notice citing its delinquency in filing its FY24 accounts.

The listing notice was received on May 16, the same day that it published its last earnings statement for Q125.

The company has requested a hearing and a further stay of the suspension of trading.

It added it has not yet received a determination regarding its request for this further stay of suspension of trading.

We’ve been expecting you, Mr Bond: CEO Aviv Sher said at the time of the earnings that a delisting notice was expected, adding there would likely be a “couple of noisy weeks ahead.”

He said the company expected to be able to file its 2024 full accounts in time for any compliance meeting, which it said on Thursday it hopes to be able to file by May 30.

Timid out: However, the company added that if Nasdaq does not grant the further stay of the suspension of trading its securities will be suspended at the opening of business on June 6.

If Codere Online fails to obtain an extension period from Nasdaq, the company noted a Form 25 NSE will be filed with the SEC, which will remove its securities from listing and registration on the Nasdaq Stock Market.

The teardown – ESPN

Fingers crossed: The under-pressure management at Penn Entertainment will perhaps be as invested as Disney in hoping that ESPN’s new direct-to-consumer streaming service will succeed and give ESPN Bet a much needed boost in the process.

Disney’s announcement a fortnight back saw the company unveil its ESPN DTC product, which was temporarily monikered as ‘Flagship’ in pre-launch discussions.

The new service will include ESPN Bet embedded within the app, alongside fantasy sports and merchandising.

Delayed broadcast: Speaking on The Grill Room podcast last week, ESPN’s chair Jimmy Pitaro repeated a phrase heard ad nauseum in the early years of post-PASPA that the offering was “in the first inning.” Not altogether convincingly, he added “we are just getting started here.”

“ESPN Bet is growing, and we are working very hard with them on an aggressive growth plan.”

Nothing is what it seams: On Penn’s recent call, head of interactive Aaron LaBerge said from a first look at the DTC offering it would allow users to “seamlessly” move between the two apps.

“We’ve been working towards that over the past year,” he said. “You’re going to now start to really see the benefits of that, especially moving into [the] football [season].”

Penn CEO Jay Snowden chipped in on the call, saying the new app offered a “level of differentiation and personalization that isn’t happening today.”

As easy as DTC: On the podcast, Pitaro acknowledged the scale of the task. “We absolutely need to build market share,” he said.

“There are leaders in this space right now that are doing a fantastic job with their product, and they have been leading the industry for a long time now, and our focus is getting closer to them.”

At the launch of the app Pitaro said the “everything ESPN” DTC app would provide users with “compelling options” to access all ESPN content within the enhanced ESPN app.

“It will be the ultimate sports destination for personalized experiences and features,” he added.

The offering will include 47,000 live events each year from all the major leagues, plus college football and basketball.

Shedding light: Analysts at LightShed forecasted the new app would reach 2 million customers by year end, which they said they “feel even more confident” about following the price reveal. Disney and ESPN “realize the importance of developing a direct relationship with their consumers,” they added.

While the existing ESPN+ has 24 million subscribers, “they are not heavy users and engagement with ESPN+ is low.”

The analysts said a key measure of success for the new app was not so much the number of users but “how much time spent occurs on the ESPN app relative to the ESPN linear network.”

Lifesaver: The ESPN DTC launch is well-timed for Penn, which is currently attempting to fend off accusations from activist investor HG Vora that it has pursued “value-destructive” online deals.

Recall a three-year break clause on the ESPN Bet partnership comes into play in fall 2026.

Before then, a proxy vote next month on HG Vora’s slate of three board nominations could possibly end in a heavy defeat for the current board.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Upcoming earnings

May 27: Galaxy Entertainment

Jun 24: FDJ United investor day

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.