4 May: BAH looks to German upside +More

Bet-at-home Q1, Sazka FY20, MGP Q1 and REIT review, Macau April GGR

M&A newsline

Better Collective and Catena Media acquisitions

Better Collective has smashed previous M&A records in the gaming affiliate sector with its $240m acquisition of Action Network. The cash plus shares deal will be financed by bank debt and the deal cements BC’s place at the very pinnacle of the gaming affiliate tree. Meanwhile, Catena Media has splashed out $39.6m ($25m up front) on Lineups.com.

The deals enhance each company’s positions in the US gaming affiliate scene as BC sees its revenue contribution from the US lift to circa $100m a year. Its guidance for 2021 revenues has also been increased to €180m from €160m.

Action Network itself is expected to achieved revenues in 2021 of “approaching” $40m (100% up on prior year) and will be “earnings positive”. The multiple of over 6x revenues confirms the impression that multiples being achieved in the US on revenues are higher than those being achieved on EBITDA in Europe.

A conference call will be held this afternoon at 15:00CET and Better Collective Q1 results are due on May 12. Catena Media is scheduled to report on May 19.

Bet-at-home Q1

The top line

GGR was down 5.5% to €30.5m with NGR down 7.4% to €23.6m. EBITDA fell by 23.1% to €6.9m. Consolidated profit was down 24.7% to $4.4m.

Guidance for the rest of the year is for GGR of between €106-118m and EBITDA of between €18-22m.

Looking to the future in Germany: In common with other operators in Germany (circa 36% NGR mix), Bet-at-home suffered a significant reversal in casino revenues after the introduction of the transitional regime in advance of the new Interstate Treaty coming into force in July. But the company was keen to suggest the long-term benefits of being an “established provider with a high-profile in a core market” would “outweigh” the short-term hit.

Gaming down: Still, the gaming hit was significant, down 28.5%. Analysts at Edison suggested Germany contributed circa 36% of NGR in 2020 with Austria worth a further 30%. Percentages for Q1 were not broken out. The company only said the new regime rules being adhered to meant that revenue losses in the online casino segment were “significant.” For reference, Flutter said Germany would cause a £20m hit to EBITDA going forward while 888 said it had seen a 40-50% decline in Germany. Market leader Entain said it had seen a “ballpark” 45% decline.

Carry on marketing: In the face of gaming revenue falls BAH increased its marketing spend by 12% to €7.4m. Advertising and sponsorship increases accounted for the rise as bonusing fell slightly (down to €2.2m and still the largest element of marketing at nearly 30% of total spend.)

Sazka FY20

The top line

Consolidated GGR was up 6% to €2bn excluding contributions from Casinos Austria (CASAG), Stoiximan shareholdings GGR was up 26%. NGR was down 8% to 1.2bn. Consolidated FY operating EBITDA was down 22% to €459m, 38% down excluding CASAG and Stoiximan. Pre-tax profit fell 27% to €260.1m. In Q420, consolidated GRR rose 12% to €597m, operating EBITDA was up 41% to €96m.

Geographically, Austria GGR was down 21% at €1.08bn, Austria lotteries up 2% at €850m, Czech Republic up 10% to €315m, Greece and Cyprus GGR down 30% to €1.1bn but Stoiximan was up 33% to €268m.

The benefit of corners: Despite the lockdowns affecting the Czech Republic, Austria, Italy and Greece during 2020 (and into 2021), Sazka said its betting and lottery businesses in those countries did not see a material impact as their physical retail channels - points of sale include convenience stores, newsstands, petrol stations and post offices - remained open. However, more affected was Greece and Cyprus where gaming halls were affected by closures in Q1, Q2 and Q4, and Austria casinos which were also closed for extended periods during the year. Many of the restrictions have remained in place into Q121.

Online drive: There was strong online growth in key markets with Sazka’s efforts boosted by subsidiary OPAP’s (43% shareholding) further stake buying of Stoiximan in November, bringing its shareholding to nearly 85%. In his comments accompanying the results, Robert Chvatal, CEO, said he was “particularly pleased” with the online progress. “The changes in consumer behaviour as a result of Covid-19 have allowed us to develop our product offering and increase our user-base faster than would have otherwise been the case, with significant increases in registrations and active users as well as several exciting product launches.” He singled out the Czech online operation where the percentage of revenues derived for online leapt from 19% in 2019 to 31.5% in 2020.

Glatz all folks: Casinos Austria reported separately at the end of March showing revenues down 16.5% to €1.13bn and which narrowly avoided falling into the red with profits falling to less than €1m. A major restructuring is underway at CASAG (announced last summer) with long-time chief executive Bettina Glatz-Kremsner leaving in April. Sazka’s shareholding at CASAG now stands at over 55% after it snapped up a further 17% slug in June 2020 from Novomatic.

To the moon: In November, Sazka said funds advised by Apollo Global Management had agreed to provide €500m to fund further acquisitions. The company said the money would go towards funding deals in Europe and the US with a focus on lotteries. For reference, Sazka is currently also involved in a bid for the UK National Lottery.

MGM Growth Properties Q121

The top line

MGM Growth Properties recorded rental revenue of $188.3m in Q1, a 7.5% drop on the prior year figure. Consolidated net income came in at $115.4m or $0.42 per share. Adjusted funds from operations (AFFO) totalled $166.9m or $0.60 per share; adjusted EBITDA increased 2.5% YoY to $240.9m (Q1 2020 $234.1m).

MGP completed the redemption of 37.1 million shares from MGM Resorts, which reduced MGM’s shareholding to 42% and, CEO James Stewart raised the annualized dividend for the 12th time to $1.98 per share.

Vegas on track: MGP was very bullish on prospects for Las Vegas. “Vegas will get back to pre-Covid levels of activity in the first half of 2022 as the pent-up demand and people’s desire to get out and visit destinations is satisfied,” said Stewart. On the business side, the end of the pandemic being close, low interest rates, high valuations and Las Vegas being at the start of “a rapid and strong recovery mean a lot of people want to get involved in deals and REITs.” Stewart added he was “confident Las Vegas will shine in the next two years.”

Land values: When asked about the sale of the Venetian and Sands Expo and Convention Center to VICI Properties for $4bn, CFO Andy Chien said the transaction helped inform MGP of the value of its own assets. The sale was “made at a higher multiple than we were trading at the time and said to us there is meaningful upside for MGP. We also were not as far out of Covid as we are now and it pushed us towards buying MGM shares.” By way of example, Chien said two acres of the CityCenter complex had recently sold for $80m in Las Vegas “and we own 450 (acres) on the Strip, that’s inherent value in our portfolio.”

The asset light model: During its own earnings call MGM Resorts International gave no indication about divesting more of its shares in MGP. When asked about this, Stewart said all discussions were “robust, friendly and positive” but would not make any predictions. “It’s their decision: they will decide the best path in what is a high-yield business. Their desire to be asset light and sell their capital intensive business units is still on track and they haven’t commented otherwise. Timing wise it remains a corporate goal and it has to be to their benefit but it’s 100% up to them.”

Model REITs: The group added that the combination of current valuations and forward prospects and the experience of casino operators working successfully under a lease structure, rather than being owner/operator, had proved its worth.

Q1 REIT review: Analysts were bullish following the results from the gaming REITs VICI, GLP and MGP. At Macquarie, the team said there was “little to quibble over.” “Improved cost structures in regional gaming and the positive data coming out of LV underscore the attractiveness of the space,” they wrote.

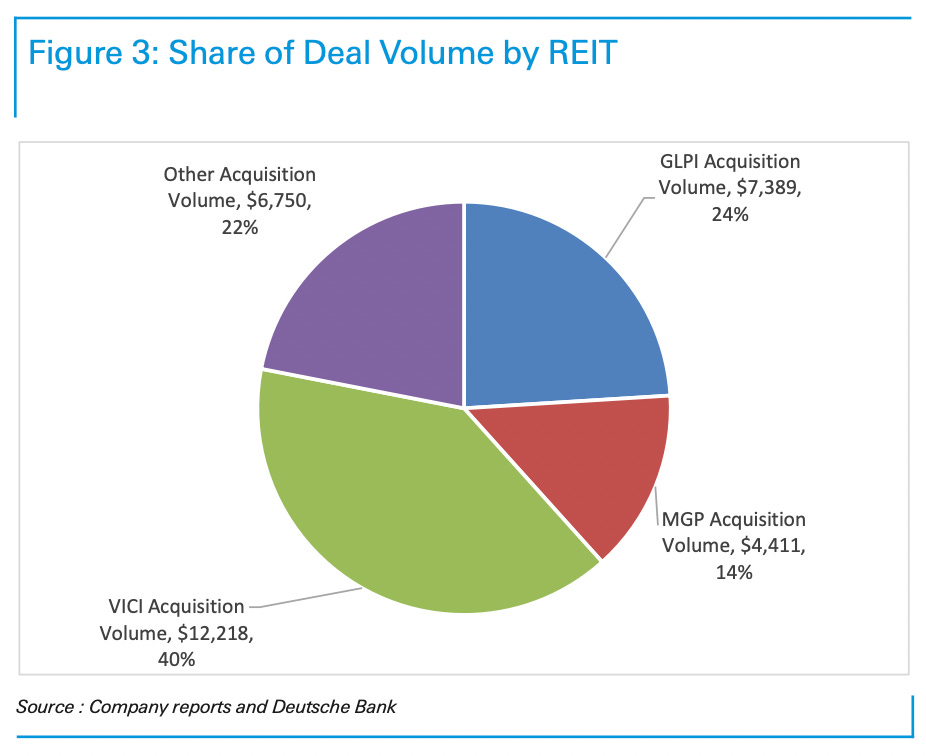

Strong gaming M&A: Deutsche Bank noted it had been a relatively strong M&A environment in Q1 with deals announced since Jan 2019. These include the Venetian deal (with VICI) as well as transactions involving Bally’s and the Tropicana (GLP) and total REIT outlays of around $16.9bn. They note that VICI has been the most aggressive with an average multiple of 13.6x rent and representing around 509% of total deal volume of circa $31bn since gaming REITs were first formed in 2013.

Truist Securities analysts said it was notable that the gaming sector has attracted new entrants into the space (DraftKings being one example). They said that MGP noted a “marked uptick” in discussions over the past month and a half, with sports-betting expansion being one driver. Truist added that VICI continues to prefer gaming assets to non-gaming, but also believes there are opportunities off-Strip and “across other experiential entertainment verticals.”

Macau April GGR

The top line

The recovery in Macau continues although the rise to $1.1bn was below estimates. GGR was down 64% on the same month in 2019. Sequentially, April was better than the comparison between March and the same month two years previous which was -68%.

Head full of steam: Visitors to Macau rose to their highest level since the start of the pandemic. The current May holiday is expected to continue at the highest levels since Covid hit last year. David Katz, analyst at Jefferies, said visitation was also likely to drop back following the past weekend. “This is in line with comments from LVS and MGM management teams during their Q1/21 results, although Melco was more optimistic and expect recovery by Q4/21, but dependent on electronic IVS being reinstated." At Macquarie, the team said they expected a stronger recovery to take hold in the back half of the year. They noted that the Covid case count in China was now well below the level at which the current tightened restrictions were imposed in January. Macquarie are ahead of consensus, suggesting 2021 GGR -46% (-50 consensus) on 2019 and 2022 +1 (-7 consensus).

Newslines

Changing of the guard: IGT has announced the departure of Walter Bugno from the company. Previously CEO, Bugno led the original merger of GTech with Lottomatica back in 2010 and subsequently was chief executive of IGT International for 10 years after the merger with IGT. Most recently he was executive vice president of new business and strategic initiatives. The press release says he resigned to pursue “new business opportunities.” IGT is scheduled to report its Q1 results on May 11.

Games association baulks at Nevada esports regulation: An attempt to regulate esports in Nevada has come up against fierce opposition from the Entertainment Software Association which includes among others Nintendo, Microsoft (Xbox), Sony, Epic Games, Activision Blizzard and Electronic Arts. “The proposed legislation in Nevada could have the unintended consequence of driving esports out of the state, which no one in the industry believes is a good thing for Nevada or esports,” said president and CEO Stanley Pierre-Louis.

In-house games push: To accelerate its in-house online games development, Penn National said it has established Penn Game Studios and has acquired Greenfield, Mass.-based HitPoint Studios and real-money gaming outfit LuckyPoint. Penn National will report its Q1 earnings this coming Thursday, May 6. Meanwhile, LeoVegas has similarly announced a new in-house launch called Blue Guru Games through its LeoVentures arm. The company is aiming to produce 20 games in the next two years. LeoVegas will also report Q1 figures on Thursday.

Taking it on trust: The FT reports that Swedish-based payment firm Trustly has postponed a €9bn float on regulatory concerns over the company’s “lack of due diligence on its end customers.” Key paragraph:

Ouch.

Earnings calendar

4 May: Red Rock Resorts, Caesars Entertainment

5 May: Gaming Innovation Group, Aspire Global, Golden Entertainment

6 May: LeoVegas, Penn National, AGS

7 May: DraftKings, Century Casinos

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com