11 Nov: RSI builds on Q3 momentum

Rush Street Interactive, NeoGames, Zeal Network Q3s, SBC Europe day 1 review, Entain Sustain review, Digital Gaming Brand Matrix +More

Good morning, on E+M today Rush Street Interactive looks ahead to further US and Ontario launches following positive Q3s, LeoVegas moves on from Germany, Earnings in brief: Acroud, Zeal, NeoGames. Entain sustains on ESG, SBC Betting on Sports Europe - Day 1 recap, Jefferies’ Digital Gaming Matrix + More.

If you were forwarded this newsletter and would like to subscribe, click here:

Rush Street interactive Q3s

Revenue up 57% YoY to $123m, net loss $18.9m vs. $26.5m, AEBITDA loss $12.2m vs. $1m.

Advertising and marketing costs rose to $45.4m (37% of revenue) vs. $17.5m, MAUs up 26% (undisclosed number), ARPMAU $380.

FY guidance raised to $480- $500m from $465-$495m, 76% YoY growth at midpoint range. RSI has $347m cash on the balance sheet as of 30 September.

Highlights include AZ launch, New York license, SGPs in all sports betting states, launch of live casino studios in PA and NJ.

App rated: Schwartz said “mobile is king and having a top-rated app” (number 3 in Eilers & Krejcik study) helped “in sportsbook markets (and) we know (that will) have upside in the casino markets”. He added that the current RSI mobile offering was “the only part of our user experience” where there is “some friction that we're very eager to get rid of” by creating a seamless user experience combining easy log-in, geolocation and player communications. RSI’s performance got the nod from the analysts at Jefferies, who said the “quarter and the increased guidance continue to reflect strong execution and no apparent specific needs within the enterprise”.

Parlay sources: Schwartz said 50% of RSI sports players were betting on single game-parlays and being able to add extra games to SGPs from a central source (Kambi as RSI’s platform provider) made for a “pretty seamless user experience”.

“Some companies are outsourcing the same game-parlay from individual companies to help supplement their core offering. But when you do that you're really limited in your ability to cross-sell (into) multiple parlays, because you have the parlays coming from different sources. And you have two different platforms providing you a source but (it’s) not organic, you can't really settle a bet as quickly.”

Unknown province: RSI has launched a free-to-play sportsbook and casino in Ontario to build up brand awareness, but Schwartz said “no one really knows the answer” about how the regulated market might take shape in the province. “My understanding is they will actually be able to convert from the gray market to a regulated legal market environment by applying for the same license that we will be applying for.”

Casino value: With RSI set to ramp marketing spend in Q4, Schwartz said the revenue split in OSB-icasino states was two thirds casino “so I might expect that to shift a little bit towards sports”. “The other thing we've pointed out is that in terms of revenue and value, a casino player is worth something like five times what a sports-only player is, and someone who's in both is (worth) two times more in value. So there's a lot of value to those states where we have both types of players.”

** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club.

As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat.

LeoVegas Q3

Revenue up 12% to €99.4m (up 31% excluding Germany) and EBITDA was down 3.4% to €11.5m.

76% of revenue came from ‘classic’ casino, 14% from live casino and 10% from sports-betting.

October revenues declined by 5% due to ongoing issues in Germany and the Netherlands exit. The latter accounted for 6% of total Q3 revenues and “higher profitability” than average.

Brightest star: Sweden was the standout performer according to the company with record revenues during the quarter. Gustaf Hagman, CEO said that according to Swedish tax authority data, excluding the ex-monopoly incumbents, LeoVegas was the largest 'private operator in Q3. He noted that a big contributor was the launch of the Expekt sports-betting brand. Talking about the recent moves to end the Covid restrictions and its effect on channelization, Hagman said it was “good news” and would see more customers “returning” to the regulated space.

“When (the temporary restrictions) were implemented there was a negative effect of 20% or something but I’m not sure there will be that much of a positive effect,” Hagman said about Sweden. “It will be interesting to see how it plays out after the weekend.”

He’s not worth it: “Today regulation is everywhere,” Hagman intoned and regulators had “different agendas”. Nevertheless, he suggested that regulation was “short term pain, but long-term gain”, while mitigation for “significant market drops” such as Germany came from “diversification and strong growth” in other markets such as the UK, Italy and Spain (both up “high” double-digit). On Germany, CFO Stefan Nelson said the company would be “leaving that behind”.

Earnings in brief

Acroud: The affiliate provider saw revenues rose 172% to €6.45m while EBITDA rose 30.9% to €1.26m. NDCs soared YoY to 39,632, up more than sixfold. The company made a “return to live events’ during the period with the first running of the Festival Series in Bratislava, saying it is acting as a bridge between land-based gaming and affiliates. Talking about the Dutch market, CEO Robert Andersson said the market exits proved the value of the market. “I believe what has caught people’s attention is how big the market seems to be, considering the information released by many operators in conjunction with the regulation coming into force,” he said.

Zeal Network: Nine month revenues were up 1% to €65m, AEBITDA was up 155.7% to €17.6m, margins were flat at 12.2%. Germany accounted for €61.5m of total revenues. The group said the lottery market was still weak in Germany, with the Eurojackpot only reaching “the €90m mark three times” in 2021 vs. six times in 2020. The group still added 446k new customers during the period thanks to its “Vaccinated wins” campaign in Q3. Marketing budgets dropped to €18.6m vs. €25.3m in 2020 due to the weak market and would rise once jackpot amounts became more attractive, the group said.

NeoGames: Q3 revenues were up 29.7% YoY to $20.2m, net profit revenues up 233.2% to $8.3m, AEBITDA was down 3.8% to $7.5m, NGR was up 42.1% to $179m. FY guidance raised 41% to $82.5-$84.5m, compared to prior range of $75m-$79m. CEO Moti Malul said expansion in Virginia and North Carolina and the launch of sports betting Alberta on Caesars' Liberty platform would contribute to growth in North America, the group is also working on public offers in Connecticut and West Virginia, he added. In Europe it continues to work with Sazka online and launched its suite of premium eInstant games with Lottomatica in Italy.

Entain Sustain

Do the right thing: Pitching its ESG credentials, Entain CEO Jettte Nygaard-Andersen said that “sustainability is on an equal footing with our growth story”. “What truly matters to me is that customers know we have their interest at heart,” she told the audience for the event in London. As Geert Arlman, head of ESG at S&P Global Ratings said on a later panel, “in this sector, where there are perceived negative impacts and where there is a high degree of existing and pending legislation, good governance is a necessity.”

Targets: Other than the pledges around net zero on carbon emissions and around the attempt via its ARC (Advanced Responsibility and Care) program, Nygaard-Andersen also committed the company to having 100% of revenues from regulated or regulating territories by 2023. The company was already at 99%. On those territories where the regulatory process was ongoing, Nygaard-Andersen committed Entain to exiting if regulation doesn’t happen. “We have a pledge; we have a commitment,” she added.

SBC Betting on Sports Europe - Day 1

Building blocks: If anyone needed proof of how important bet builders are in the sports betting space, the standing room-only panel ‘Bet Builders 2.0 - The Next Step’ was a clear illustration. Chris McKenzie, sportsbook commercial director at 888, said “players need to be given as much data as possible because it’s about a perception of fairness: we add value by giving players insights so they can make informed bets.” In terms of the next evolution of the product, getting in-play markets and cash out right would be future challenges, although this related mainly to user experience, reducing the number of clicks and streamlining the number of markets offered.

Video killed the radio star: Yuval Benyamini, head of betting at WSC Sports, said it will soon be increasingly difficult to tell the difference between a ‘traditional’ sports media website and an online sportsbook as increased integration of video highlights into sports bettors’ user interfaces continued to blur the lines between the two. WSC works with rights holders to produce videos that acted as a “gateway” into sports betting. Nico Jansen of B2B-B2C German website Betitbest said official data and rights deals were fundamentally “altering the sports-betting food chain”, while Josh Turk of F2P games provider Low6 said his focus on Gen-Z and Millennials meant “producing UIs that mirrored the scroll down features of TikTok or Instagram.”

White room: Although many B2B suppliers had moved away from white labels in recent years, they still had a function in the industry and “often were stepping stones towards licensees getting their own turnkey solutions up and running”, said Elliott Banks, B2B UK director at BetConstruct. With in-house vs. third party discussions still raging, Oren Cohen Schwartz, CEO of Delasport, said tribal gaming interests have shown there is still a major role to be played by third-party providers in the market.

Word of the day: Pre-regulated. From ‘unregulated’ to ‘soon-to-be regulated’, the igaming industry has always been adept at finding new words to describe markets that are not regulated.

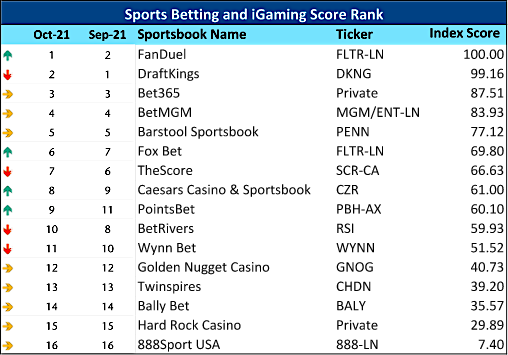

Top ranking - Jefferies Digital Gaming Brand Matrix

Jefferies’ matrix incorporates operators’ social media engagement and traffic data. Over time it “should provide insights into brand momentum and serve as a proxy for GGR,” the analysts said. In October, FanDuel topped the rankings ahead of DraftKings. Bet365, BetMGM, Barstool and Fox Bet all held their respective rankings within a ~20 point range, with the middle rankings still closely contested.

On social

Calendar

12 Nov: Weekend Edition

17 Nov: Catena Media, Better Collective Q3s

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com