Weekend Edition #76

$31bn-valued Fanatics’ fund raise, MGM gets an analyst upgrade, sector watch – financial affiliates +More

Welcome to the latest Weekend Edition. On the agenda for today:

Fanatics raises $700m to fund M&A war chest.

IMG Arena buys virtual sports supplier Leap Gaming.

Esports Entertainment in turmoil.

MGM set to benefit from the Vegas events schedule.

Sector watch looks at a recent FCA warning on financial affiliates.

RIP Jet Black.

Fanatics’ war chest

The apparel to soon-to-be sports-betting business has been valued at $31bn after raising $700m from investors for potential M&A.

Off the shelf: Acquisitions in the sports-betting, gaming and collectibles areas are top of the agenda for Fanatics after its latest funding round, according to reports. Two-thirds of the cash came from new investors, including Clearlake Capital and LionTree, with continuing participation from Silver Lake, Fidelity and SoftBank.

Recall, CEO Michael Rubin told a conference in October that Fanatics was readying its sports-betting debut in every major state bar New York.

At the start of this year, Fanatics bought the Topps collectibles business for $500m.

Rumors of a buyout of Tipico appear to have faded.

Likewise, rumors from last year of an interest in RSI or Betsson came to nothing.

As Earnings+More reported from G2E, there was chatter during that week about the complications of Fanatics managing multiple market entries at the same time.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group.

Get in touch with your pitch or disruptive products to plug into our investment network!

IMG’s great Leap forward

IMG Arena has snapped up virtual sports provider Leap Gaming for an undisclosed sum.

Leap of faith: The deal builds on an existing relationship between the Endeavor-owned IMG Arena and the Israeli-based company, which involved an unspecified investment. Leap was founded in 2014 and says it has relationships with 120 sportsbooks globally.

Following the deal, CEO Yariv Lissauer will become IMG Arena’s senior director for iGaming.

Stock watch

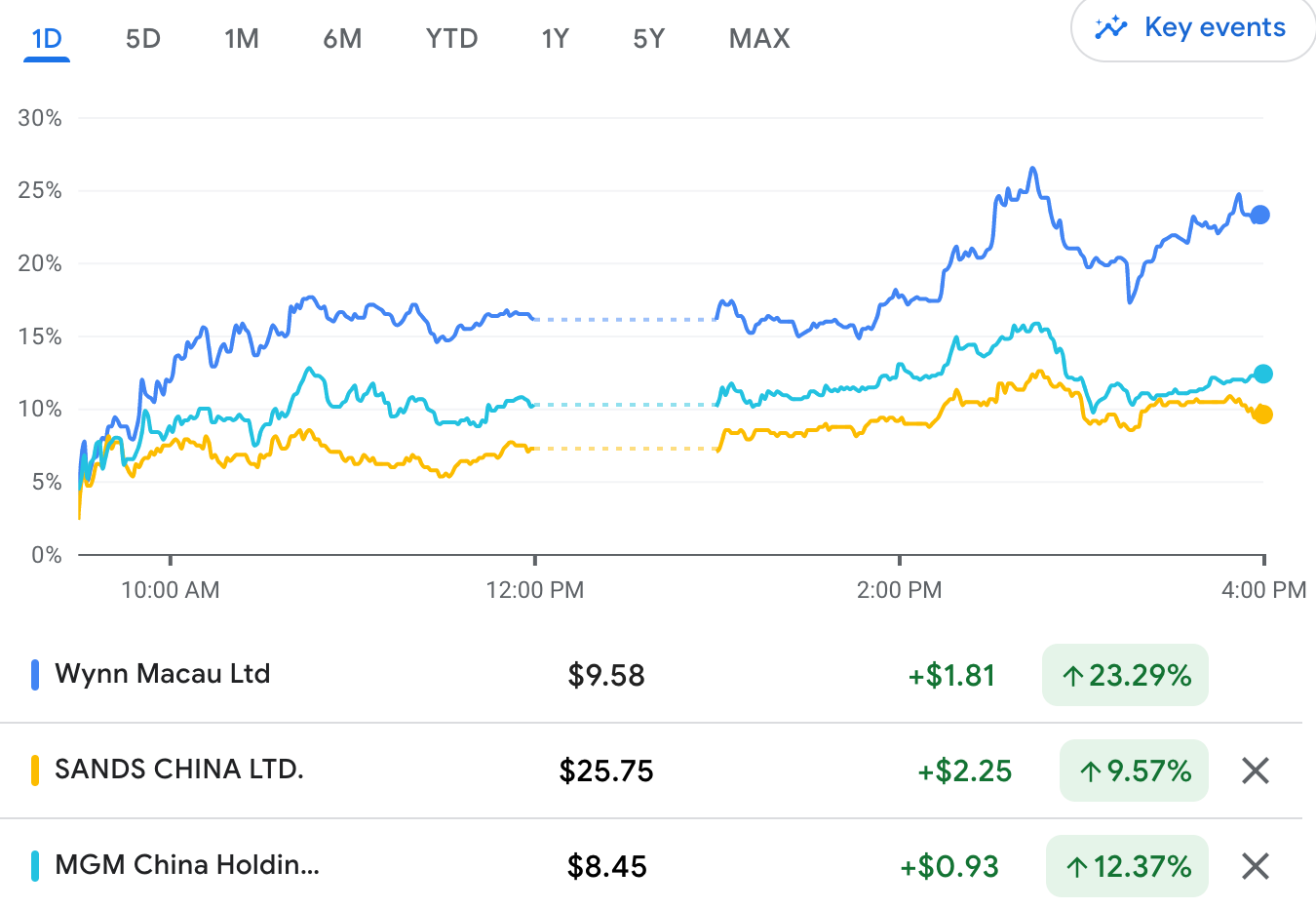

The Macau operators’ Hong Kong listings all rebounded further on Thursday on the news of an increased lifting of China’s Covid measures.

🎯Macau’s Hong Kong listings enjoy a relief rally

EE in pieces

Esports Entertainment in turmoil as CEO departs as it confirms potential iGaming exit and says it has received merger approach.

Sacked in the morning: As was broken by the Sharpr newsletter this week, Grant Johnson, the CEO and chairman of Esports Entertainment, has been given the boot. The company says it has identified several potential candidates to replace him as CEO. Jan Jones Blackhurst has stepped up from the board of directors to take over as chair.

In a LinkedIn post, Johnson said the decision came last weekend “when it was felt I was uncooperative in some objectives of the (board)”.

Sharpr claimed Gary Graham from long-term investor First Capital Ventures will become the new CEO.

A picture of turmoil: EE – which this week gained approval from Nasdaq to continue as a listed entity – also confirmed the shuttering of its UK & Ireland-facing operations SportNation and RedZone due to an “inability to generate profits”, having previously shut its Vie.gg esports-betting operation in New Jersey.

Meanwhile, the sale of its Spanish-facing online gaming operation is due to close next week. It said a “strategic evaluation” of its remaining online gambling business will look at the sale of assets, blaming “increasing regulatory burdens and competition”.

The company also confirmed it is in negotiation with a significant debt holder, which will “address the company’s default status”. The company also said its board was considering a proposal from an unnamed third party to merge its assets and focus on growing esports revenues.

We need to talk about Dave

The Massachusetts Gaming Commission wants more time to consider Penn’s license application in light of its links to Dave Portnoy.

Peace of mind: Following a meeting of the Massachusetts Gaming Commission this week, Penn Entertainment’s application for a sports-betting license is, according to the committee chair Cathy Judd-Stein, “at a crossroads”.

The issue in question is the allegations contained in a recent NYT article about Dave Portnoy’s antics and its promotion of gambling to a College crowd.

Also running into an unexpected roadblock was MGM, which confused the committee with references to its BetMGM application that won’t be heard until next week.

MGM get an upgrade

Truist raised its rating to a Buy on the potential for the event calendar in Las Vegas to contribute to outperformance.

Starting grid: Any ill economic winds that might affect Las Vegas next year will likely be offset by a solid event calendar – particularly Formula 1 – the return of midweek travelers and the more diversified attractions.

The team noted that big events such as January’s CES were impacted by the resurgent omicron variation last year, “making for a relatively easy comp” in Q123.

Expectations for F1 are that it will bring in ~170k visitors during the typically slower weekend before Thanksgiving.

Further ahead, the Super Bowl takes place at the Allegiant Stadium in Q124.

The rest is noise: MGM is getting “little to no value” recognition for its BetMGM JV, Truist suggested, but it added that, with the tide turning on profitability, investor attitudes are changing.

Owning 100% of BetMGM would be welcomed but despite recent rumors it “could be difficult to secure attractive financing for a deal of this size in the current macro environment”.

Analyst takes

Bally’s Corporation: The team at JMP said after meeting management that the iCasino app is “nearly there’ in New Jersey, where Bally’s remains confident it can win market share and that this will serve as the blueprint for other iCasino states.

CEO Lee Fenton’s history operating a successful iGaming platform in the UK, “with proven, data-driven technology could serve as a catalyst for market share gains across iGaming states,” JMP added.

The 300: Management also said the upcoming White Paper release in the UK would likely lead to consolidation in a market of ~300 competitors.

Stricter regulations are expected to make it “increasingly difficult for the small operators to survive”. Note, Genesis Global announced it was exiting the UK market, confirming to iGB it closed its 14 sites earlier this week.

Regionals: November GGR was up 5.4% YoY and up 14.5% vs. 2019 to $2.6bn, countering “overly negative” expectations of a slowdown in 2023, said the team at Wells Fargo. Noting “great concern” over lower-income customers, the team found that over the past 16 months visitation and GGR trends had been “fairly similar” to properties that skew towards higher income cohorts.

Full House: The team at JMP have also initiated on the regional operator, which is soon to open its Temporary casino in Waukegan, Illinois. They believe it will “cater to an underserved” part of the state in one of the wealthiest counties. The similarly imminent Chamonix casino, meanwhile, will bring a “quality asset” to the Cripple Creek market.

Downloads: The World Cup and the launch in Maryland helped boost app downloads by 184% YoY to 545k during week 13 of the NFL Season, according to JMP.

This week on E+M

On Tuesday, we sent out the Startup Month #5 which discussed investor enthusiasm for gambling regtech ventures and also featured an interview with Meredith McPherron, CEO and managing partner at Drive by DraftKings.

Next week, Deal Talk discusses the past, present and future of the gambling sector’s relationship to the waning SPAC market.

Sector watch – financial affiliates

A recent open letter from the UK’s financial watchdog suggests it is cracking down further on the employment by CFD and spread-betting firms of affiliates.

In a letter that suggested a “significant minority” of firms within the CFD and spread-betting sector “operate business models that cause significant consumer harm”, the Financial Conduct Authority (FCA) also took aim at the activities of affiliates in the space.

Notably the FCA suggested firms target consumers for whom CFDs are inappropriate with scam and churn techniques, including fake celebrity endorsements.

Of particular concern to the FCA is the use of affiliates and introducers where “oversight is often inadequate and sometimes part of a deliberate strategy to exploit consumers”, the letter claimed.

The FCA also noted that some affiliates have been “identified as conducting regulated activities without authorization”.

Many are social media ‘influencers’ who target younger consumers with “lower levels of financial literacy for whom CFDs are inappropriate”.

Others, meanwhile, market themselves as FX ‘educators’ and ‘signals providers’.

The letter said all CFD and spread-betting firms should “consider their use of affiliates and must have robust due diligence for their onboarding and ongoing monitoring”.

“All firms should rapidly off-board affiliates that are suspected to be operating illegally or engaging in poor conduct.

Firms should not rely on the FCA to identify these issues and, where we need to do so, we will question firms’ competence.

Datalines

Illinois: Land-based casino revenues in Illinois were up 9.6% YoY in November to $113.9m. In sports betting, revenue rose 94.1% YoY to $102.1m on handle up 22.5% to $1.03bn, the first time it has reached over the $1bn mark. FanDuel accounted for 42% of GGR, while DraftKings led by handle with 34%.

New York: GGR for November hit $148.2m, up 1.8% on handle that rose less than 1% to $1.55bn. FanDuel led with 52.8% of GGR of revenue, with DraftKings second on 28.6%.

Virginia: Casino, sports-betting and historical horse-racing revenues were up 129% to $92.1m in October. Sports-betting GGR rose 365.3% to $45.5m, with handle increasing 23.5% to $528m.

In Ohio land-based GGR for November rose 2.7% to $183.6m. Casino GGR in Kansas was down 0.3% to $31.6m. In Maryland, GGR came in at $163.4m for November, up 1.9% YoY.

Portugal: Online gaming GGR hit €159.1m in Q3, up 39.3% YoY, boosted by a near 40% rise in iCasino to €89.8m. Sports-betting GGR was also up 40% to €69.3m.

Newslines

Entain has refinanced £1.13bn of term loans priced in euros and dollars, with the proceeds paying off another term loan due to exposure in March 2024.

Caesars Sportsbook is the first US betting operator to go live with Genius Sports’ Watch & Bet solution for NFL streaming.

Hard Rock International’s $1bn acquisition of the Mirage casino on the Las Vegas Strip has been recommended for approval by the Nevada Gaming Control Board. Hard Rock will redevelop the property into a 3,600-room guitar-shaped resort over the next three years.

GiG will supply its online sports-betting and casino solutions to News International.

What we’re reading

Cafe racers: The FT’s Lex discusses Japanese streamer CyberAgent’s motorcycle betting offering.

What we’re writing

No ordinary Joe: Scott Longley interviews Joe Asher for iGB.

Calendar

Dec 13: Deal Talk #5

Dec 20: Due Diligence #2

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com