UK White Paper ‘imminent’

UK White Paper ‘coming soon’, Macau concessions awards, Lottomatica pushes on, startup focus – FanPower +More

Good morning. On today’s agenda:

The UK’s gambling White Paper could be released within a fortnight.

Macau hands out six concessions.

Lottomatica talks up the prospects for its Betflag acquisition.

Our startup focus for the week is FanPower.

UK white paper

Sources suggest the long-awaited and much-delayed UK government White Paper on gambling could finally be set for release.

White flags: The new Sunak administration has apparently resolved some internal differences over elements of the White Paper on gambling policy and is set to release its contents within a fortnight, according to multiple sources.

The rumors follow a report in the Times over the weekend on the contents of the proposals.

Stake limits on slots and ‘non-intrusive’ affordability checks are likely to feature but plans to outlaw free bets and VIP packages are said to have been dropped while the government believes a ban on EPL shirt sponsorships can be left to voluntary measures.

The crying of slot 49: The slot limit of between £2-£5 is in line with the leaked details of the White Paper in the summer as are the affordability measures.

This time we mean it: Recall, in answer to a written question, new gambling minister Paul Scully said at the start of November that the government would publish “in the coming weeks”.

Not now, nanny: Meanwhile, the Betting and Gaming Council issued a YouGov-conducted poll last week which found that 67% of UK punters believed compulsory limits “risked pushing punters to the black market”.

It also found that 70% of people who place a bet “would not be willing to allow regulated betting and gaming firms to carry out compulsory affordability checks to prove they can afford to wager”.

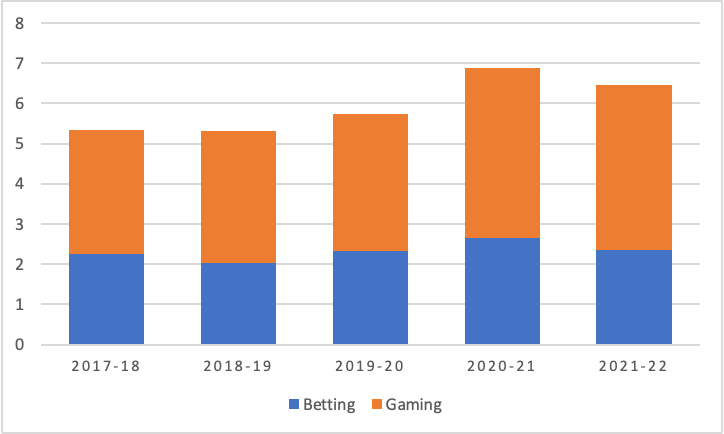

The data picture: The latest data from the UK Gambling Commission shows that GGY for the gambling sector including the National Lottery rose 10.9% to £14.1bn with land-based betting (up 105% to £2.13bn) and casino (up nearly 500% to £692m) rebounding from their pandemic lows in the previous year.

Online betting GGY was down 10.6% to £2.36bn while online casino fell 3.5% to £3.9bn while online bingo was down 5% to £183.5m.

🇬🇧UK online betting and gaming 2017-2022

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences.

For more information visit: spotlightsportsgroup.com

Macau concessions awarded

The six incumbents in Macau have all received new licenses from the authorities with Genting once again failing in its attempt.

Six get lucky: During a press conference on Saturday, the Macanese authorities said they will now enter into negotiations with the six concession holders over the details of the new contracts. The new licenses will be effective as of January and will last for 10 years.

The operators are Galaxy Entertainment, MGM China, Sands China, Wynn Macau, Melco Resorts and SJM with only GMM – a company linked to Genting – missing out.

Come on down: Analysts at JP Morgan suggested Genting might still participate via equity of JV investment “if the price was right” and if the Macau government gave its permission.

Under the terms of the new concessions, license holders must prioritize local employment, develop overseas tourism and invest in non-gaming.

Speaking at the press conference, the secretary for administration and justice in Macau, Cheong Weng Chon, said that alongside the scale of the gaming industry in Macau had come “some problems”.

“For example, the source of our tourists is too concentrated. It’s not healthy,” he added.

The Commitments: Reports earlier in November indicated the licensees would be expected to lay out up to $12.4bn between them over the next decade with negotiations apparently all but completed over how much each company will be expected to invest.

The shares week

The good news for the Macau license holders may yet be balanced by the reports of widening Covid infection rates in China.

Xi’s lost control again: While global investors will be nervous this week that the news over the weekend of protests in China over the imposition of further zero Covid measures, the worries failed to hurt the Hong Kong listings of the major US-based Macau players in Monday trading.

Wynn Macau was up over 15% while MGM China rose over 12% and Sands China was up nearly 8%. SJM rose 6.6%.

Still, analysts at Jefferies noted the continued Chinese policy “leaves uncertainty in the timing and trajectory of the visitation and volume recovery”.

🤿 Macau-facing Hong Kong listings shrug off China instability fears

Not so super: Betway and Spin operator Super Group lost a tenth of its value on Friday following last week’s earnings statement when it said FY22 revenues would be at the low end of expectations.

🚧 No way: Super Group suffers a 10% fall

World Cup balls

Sin apuestas: The Spanish minister of consumer affairs, representing the leftist Izquierda Union, went on social media on the eve of the tournament in Qatar to declare that no gambling advertising would be allowed. “The population and the younger people will be protected at last,” he tweeted.

Fight the ad fight: Meanwhile, in Belgium the National Lottery has also paused all forms of sports-betting advertising during the tournament with the minister of finance, Vincent Van Peteghem, saying in a press release that the lottery was “taking a leading role in protecting players and fighting gambling addiction”.

Recall, the Belgium government has plans to ban all forms of gambling advertising.

Lottomatica flags growth

The Betflag acquisition adds further heft to the operator’s online pivot as nine-month revenues rise 42% to €492m and EBITDA doubles to €219m.

We’re all waving flags now: Speaking of the “strong rationale” for the proposed €310m deal to buy Betflag, CFO Laurence Van Lancker said it represented a “great opportunity to consolidate leadership in online” which now represents 49% of the total EBITDA.

Lottomatica noted Betflag was predominantly an online casino brand with an estimated 4.8% market share and a 1% share in sports betting.

Adding Betflag cements Lottomatica’s position in the online gaming space in Italy with a pro forma 17.7% behind Playtech-owned market leader SNAI with 18.4%.

Lottomatica had indicated on previous calls it was looking at multiple M&A deals and Van Lancker said the pipeline “continues to be dynamic”.

He suggested the company had “ample resources” via its cash balances and an existing revolving cash facility.

As of the end of September, net debt fell to €1.13bn.

Machine mole: Speaking about the machines business, CEO Guglielmo Angelozzi said the situation had “improved” despite the post-pandemic “new normal” of revenues being ~16% lower.

“Without having a crystal ball, we have the prospect of an additional recovery which we think will be faster with VLTs and with AWPs to follow,”: he added.

Earnings in brief

STS: The Polish operator saw revenues rose 25% YoY to PLN150m while adj. EBITDA rose 39% to PLZ73m. The company said an “intense” sporting period was behind the upbeat financial performance.

Startup focus – FanPower

Who, what, where and when: Formerly known as PickUp, the Brooklyn-based FanPower is a platform which gamifies customer-led content and aims to simplify fan acquisition. The company was formed by Dan Healy, previously a partner at Prolific Interactive and he has added Adam Armstrong as COO and Jeff Brunelle as CPO.

Funding backgrounder: FanPower raised $3m in a Seed funding round led by KB Partners and with participation from SuRo Sports Capital, Sharp Alpha Advisors, Connetic Ventures, and Drive By Draftkings.

The pitch: Healy says FanPower hopes to take advantage of the shift taking place in sports around fan engagement and what it offers in terms of new revenue streams. “We add value to the content, data, gaming, and marketing departments with very little need to deploy incremental tech resources or invest in a new siloed FTP game,” he says.

He says the introduction of SMS marketing in a seamless way has been “very intriguing” as the data suggests engagement is “significantly more impactful than email marketing”.

The focus is currently on US sports organizations; the company’s partnership with NASCAR this year gained a lot of traction and FanPower was able to “see how impactful the platform can be across major sports”.

“Over 1m fan picks were tracked, we deployed across editorial, social, video, and live-at events and we were able to build a large community with the organization,” Healy says.

What will success look like? The focus right now is on expansion, says Healy, with the company well-positioned to work with “forward-thinking” teams, leagues, sports media companies and OTT networks.

Datalines

New York: GGR increased 32% to $41.2m for the week ending 20 November, with handle up 2.8% to $343.5m.

Leaders by GRR: FanDuel 53.5%, DraftKings 28.6%, Caesars Sportsbook 11.6%, BetMGM 3%

New Hampshire: GGR increased 68.5% YoY to $9m in October with OSB generating 73% of the total GGR. Handle was down 7% YoY to $91.3mm, the highest monthly total in 2022.

Mississippi: Sports-betting GGR was down 15.4% YoY to $7.7m in October while handle dropped 32.7% to $56.2m.

Newslines

TonyBet has received a license from the Dutch authorities to begin operations in the Netherlands.

Bet365 has partnered with the Raynham Park racecourse to launch an online sportsbook in Massachusetts in early 2023.

Real estate developer Thor Equities has submitted plans to develop one of the three downstate NY casinos in the Coney Island area of the state. The $3bn project has the backing of Saratoga Casino Holdings, Chickasaw Nation and entertainment group Legends.

What we’re reading

Where have all the snow crabs gone?

On social

Calendar

Nov 29: Rivalry Q3

Dec 6: The Startup Month #5

Dec 13: Deal Talk #5

Dec 20: Due Diligence #2

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com