Allwyn buys Camelot UK

Allwyn acquires Camelot UK, muted kick-off in Qatar, Caesars the investors choice say analysts, startup focus – ZeroFlucs +More

Good morning. On today’s agenda:

Allwyn buys Camelot UK for a rumored £100m.

Kindred to challenge Norwegians in court.

Bookies predict betting bonanza despite muted kick-off in Qatar.

Caesars is the risk-on choice for investors, according to analysts.

Our startup for this week is ZeroFlucs.

Allwyn’s Camelot buyout

The deal is set to complete in Q1 next year and will see Allwyn take over the running of the UK National Lottery a year early.

Lottery balls: Allwyn has acquired the Camelot UK lottery business from the Ontario Teachers’ Pension Plan for an undisclosed amount believed to be “close to £100m”. Allwyn had confirmed it was in talks in late October.

Allwyn was due to take over the running of the UK National Lottery in April 2024 after it won a legal ruling.

Camelot will continue as a separate entity, as per the stipulations of its license.

The press release said the deal would ensure a “smooth transition” of operations from Camelot to Allwyn when the license switches.

Just last week, the company announced it had secured €1.6bn of new debt facilities. Recall, Allwyn recently called a halt to a deal with the Cohen Robbins SPAC, which would have seen the company float in New York. The company cited market conditions for the reverse.

** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution.

Find out more at sales@gig.com.

Kindred legal challenge

Kindred said this morning it will challenge the “coercive fine” that had been reinstated by the Norwegian gaming authority.

Norwegian would: The new legal challenge comes after the Norwegian regulator Lotteritilsynet reinstated its fine for illegal activities against Kindred’s wholly owned Malta subsidiary Trannel International, despite the changes the company says it has made.

Passive/aggressive: Recall, at the start of October Kindred said Trannel would “continue to passively accept customers residing in Norway”, maintaining this was in line with EU/EEA law.

The company was granted a temporary reprieve at the time, pausing the NOK1.2m a day fines.

The changes were undertaken in response to a cease-and-desist letter from Lotteritilsynet in October 2019.

Over the hills and far away: Kindred said today the Norwegian authorities don’t have jurisdiction over Trannel due to its Malta domicile and “therefore, Kindred is confident that the coercive fine cannot be enforced by the NGA outside of Norway”.

World Cup balls

As the World Cup started this weekend amid beer controversy, Flutter became the latest bookmaker to suggest betting volumes are set to defy the muted enthusiasm.

This Bud’s not for you: The two biggest UK-listed operators have tried to whip up some enthusiasm for betting on the World Cup despite the controversy surrounding the tournament ahead of kick-off yesterday.

Flutter said it was predicting the World Cup would be the biggest betting event of the year in the UK, with £300m being punted over the course of the next four weeks.

It said the total amount bet was likely to top the figures from the 2018 tournament, which FIFA estimated at the time was over €136bn.

Flutter said its biggest liability was on 125/1 outsiders the USA, with the next worst outcome being a win for Argentina.

Recall, last week the AGA suggested up to 20.5m Americans would bet up to $1.8bn on this year’s tournament.

Last refuge: Also attempting to whip up some enthusiasm was Entain, which suggested the World Cup would drive a “record number of actives, bets, stakes and first-time-deposits”.

But this was somewhat refuted by the analysts at Regulus who said that while the tournament “drives an engagement trigger… it does not necessarily drive a large increase in the number of bettors overall”.

They suggested that, in the UK, the data for 2018-19 shows the World Cup made “no discernible difference”, with new accounts up 3% but active accounts down 4%.

Q3 analyst takes

Looking over the recent earnings season, analysts say the resilience of the US gaming consumer shone through.

The team to beat: The team at Wells Fargo noted that Caesars has come ”very far, very fast”, albeit off a low base over the quarter, up 68% in the last three months. The team added that they believe Caesars has the “highest ceiling” in the sector and has been and will be “the stock to own in a risk-on environment”.

They added that the “next leg higher” will be driven by further digital improvement rather than any greater confidence in an improving macro environment.

🎉Caesars share enjoy a bounce

Interest rates: The WF team also pointed out that interest in Macau is at its highest “in recent memory”, reflecting hopes that the Chinese authorities are set to ease travel restrictions and that there is now a “line of sight” to concession renewals at year end.

Still, the team at Deutsche Bank made the point that Q3 losses across the sector are likely hit ~$558m, around $105m worse than losses in Q2.

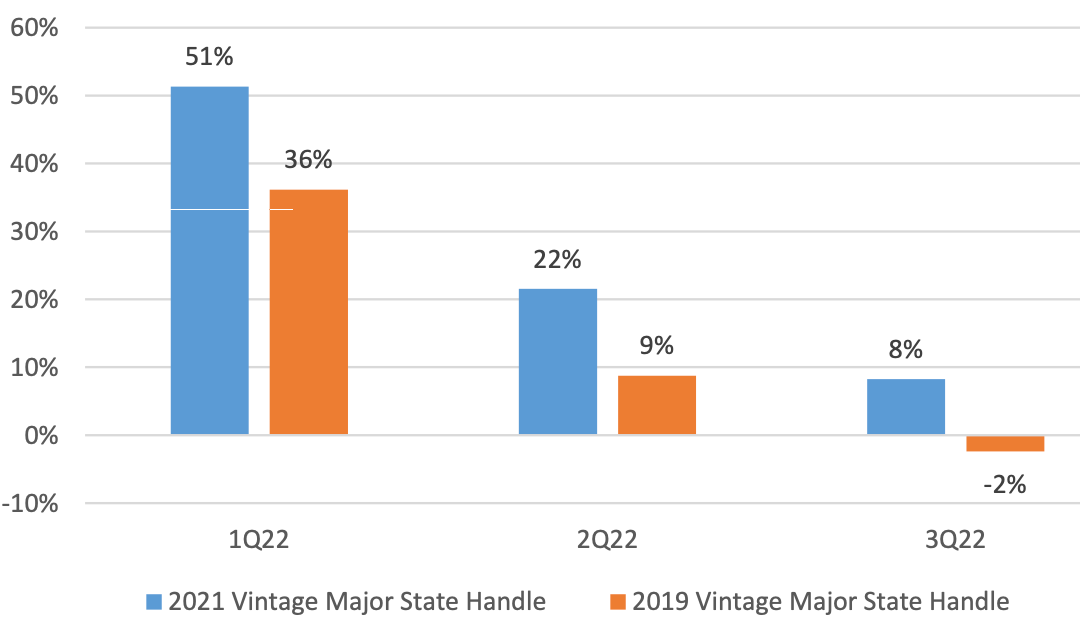

Aging gracefully: DB have also taken a look at handle trends in mature OSB states, suggesting that in states that launched either in 2021 or prior YoY handle decelerated, while in states that launched either in 2019 or prior showed negative YoY handle in Q3.

🚧Signs of decelerating handle in maturing OS states (source DB)

The shares week

Casino royale: The affiliate provider Gambling.com saw its shares rise nearly 4% on the day after its Q3 earnings, extending a rebound from the past month, which had seen it rise more than 36% to over $10 for the first time since March. Jefferies said the casino.com acquisition announced last week “completes” its US domains.

Power to the people: The analysts at Truist said on Friday, Gambling.com had demonstrated pricing power in its earnings “despite, not because of” operators’ increased focus on profitability.

Compare/contrast: Gambling.com has enjoyed a better month than its peers Catena Media, down over 13% for the month after poorly received Q3 earnings, and Better Collective, effectively flat on the month after neutrally received earnings.

🎯Gambling.com vs. Catena Media and Better Collective

Startup focus – ZeroFlucs

Who, what, where and when: Brisbane-based same-game parlay provider ZeroFlucs was launched by Steve Gray along with former Entain Australia colleague Carly Christensen.

Funding backgrounder: The company is entirely self-bootstrapped “with all funding coming from our own pockets”, and recently added Benjie Cherniak as a strategic advisor.

The pitch: Gray suggests the rush to market in the past few years has led to the development of a “stale” product set for SGPs and says customizable solutions can represent a “major opportunity”.

“We feel the major opportunity is to provide a modern, customizable solution in the SGP space, where the product offering has become stale in the past few years,” says Gray.

“SGPs haven’t visibly changed since launch – and we’re aiming to create a generational leap in the offering and experience.”

ZeroFlucs’s solution works directly from bookmakers’ own markets and odds, this way “the product can be rolled out affordably and with innovations that are not available elsewhere”.

“We’re gunning for a world without pop-up bet builders, where books can create their own markets with same-game support and follow that depth of offering through to live and in-play products.”

“In-play and micro-betting will be big areas of focus,” Gray adds. “SGP and complex betting is only viable pre-match due to the same simulation technology that lets us offer per-customer pricing, so we’re confident that as we flex into these areas it’s a modeling and sales exercise.”

What will success look like? ZeroFlucs is set to go live with the Australian bookmaker TopSport in Q1 while the response from both large and smaller sportsbooks has been positive.

Gray says the challenge currently is “around expanding the depth of the offering (more sports) and scaling our ability to support customers post-launch.”

Sorare and ANJ reach compromise

The fan token and NFT-backed card tournament operator Sorare will strengthen access to its free-play offering following discussions with France’s gambling regulator ANJ. The move comes as ANJ expressed “serious doubts” as to how the country’s gambling legislation related to Sorare’s offering of tournament cards.

It added that the “response is a transitional but essential step” before further legislative updates linked to Web3 activities.

Sorare will have to ensure it meets the compliance objectives of preventing excessive gambling, protecting minors, integrity and transparency of gambling operations.

Datalines

New York: GGR dropped 20% to $31.2m for the week ending Nov 13, handle was also down, 5.4% to $334m.

Leaders by GGR: FanDuel 55%, DraftKings 25%, Caesars 9.6%, BetMGM 5.7%

Newslines

IGT has signed a five-year contract extension with Loto-Québec to deliver the provincial lottery operator its Intelligent VLT management system.

DraftKings will launch its online sportsbook in Maryland on Nov 23rd, pending regulatory approvals.

What we’re reading

Blitz spirit: The New York Times on how “cigars, booze and money” made sports betting ubiquitous.

Further reading: Meanwhile, David Briggs accuses the piece of “sensationalist number juggling”.

On social

Calendar

Dec 6: The Startup Month #5

Dec 13: Deal Talk #5

Dec 20: Due Diligence #2

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com