Sep 26: Allwyn calls SPAC halt

Allwyn opts out of Cohn Robbins deal, the week in shares, iGaming NEXT preview, startup focus – Sparket +More

Good morning. On today’s agenda:

Allwyn blames market volatility as it drops SPAC merger plan.

Gaming stocks suffer from the market rout.

Our startup focus for this week is B2B pricing outfit Sparket.

Allwyn pulls plug on SPAC deal

Allwyn blames market volatility for failure to consummate SPAC merger.

SPAC to the drawing board: Global lottery and gaming operator Allwyn pulled its planned merger with the Cohn Robbins SPAC citing “prolonged and increasing market volatility”. Despite what Allwyn said was “strong indications of support” and up to $700m of committed investment, the company said now was not the right time to go public.

The news comes a matter of weeks after the merger appeared all but a done deal after the Cohn Robbins shareholders voted overwhelmingly in favor of the merger in mid-September.

It also followed the final confirmation that Allwyn will take over the running of the UK National Lottery as of February 2024.

The Cohn Robbins founders Gary Cohn and Clifton Robbins said the merger was a victim of a “pronounced negative turn in market psychology”.

Business case: Allwyn CEO Robert Chvatal said the feedback during the marketing period had demonstrated the “attractiveness of the business to the investment community”. In its recent Q2 earnings call, Allwyn trumpeted its success in boosting online and lottery revenues in its key markets of the Czech Republic, Austria and Greece.

The week in stocks

The worsening macro backdrop lays behind some heavy falls for sector bellwethers.

Chicken-licken: Investors “threw in the towel” last week as the sentiment judged that a hard landing for the US economy was more likely following gloomy messaging from the Fed after it raised rates by 0.75%. Leading the way was Caesars Entertainment with a 22% fall on the week, while rivals MGM Resorts and Penn Entertainment were each down over 11%.

Three-pronged: For Caesars, its exposure to both Las Vegas and the regional markets will be worrying investors as the chances of a recession later this year and into next year rise.

Meanwhile, its continued commitments to funding a loss-making online arm hover in the background.

😱Gaming sector giants cut down to size

Capitulation: Notably, Caesars has fared badly against the S&P 500, which is down 23% in the YTD; whereas Caesars is off by over 62% with most of the underperformance in the past three months.

🚨Caesars vs. the S&P 500 - no contest

Also in the firing line were DraftKings and Rush Street Interactive, which were down over 18% and nearly 20% respectively last week, as investors once again soured on online.

The effect of a recession on the behavior of online bettors is less certain but the more pressing fear for investors is the potential for loss-making operators having to tap the money markets at a time of stress.

🛟 DraftKings and Rush Street investors seeking lifeline

KamiKwasi

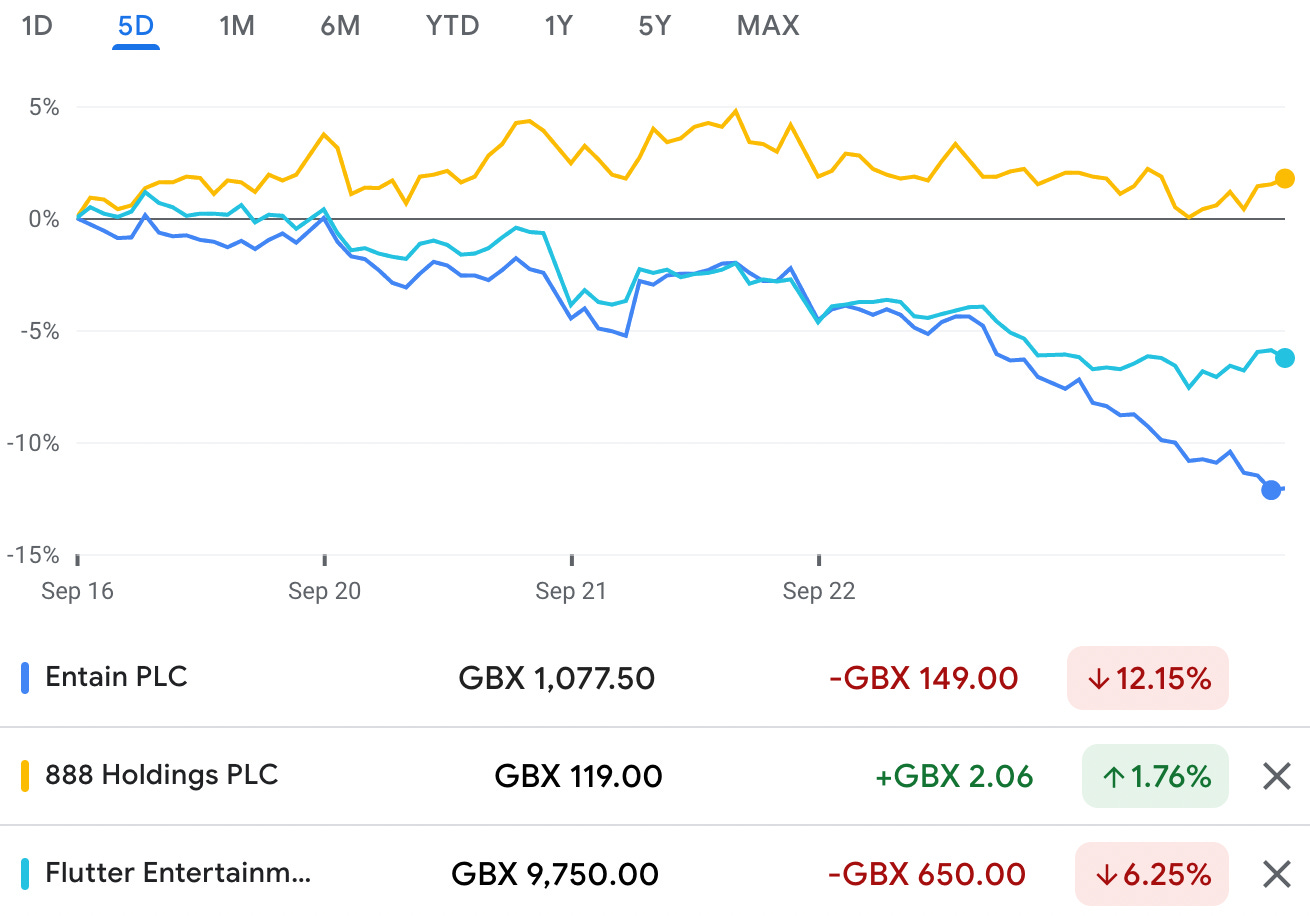

Britannia unhinged: The UK’s leading listing gaming operators suffered along with the rest of the market as the new Tory Chancellor Kwasi Kwarteng unveiled his mini-budget and promptly sent the markets into a tailspin.

Hell of a wait: Specifically for Entain, Flutter and 888, macro worries are compounded by the current regulatory uncertainty – some might say purgatory – and what that does for long-term prospects.

Entain suffered the worst, down over 12% on the week, with Flutter off by 6% and 888 – perhaps surprisingly – up nearly 2%.

On the suppliers’ side, Playtech fell over 5% despite delivering buoyant first-half earnings and talking positively about further gains for its Italian-facing Snai operations.

Selling England by the pound: The cratering pound could make UK assets look very cheap indeed when compared with dollar values for excess cash and equity.

💷 UK-listed Entain, Flutter and 888 take divergent paths during last week’s sell-off

Bucking the trend: Macau’s decision to reopen to tour groups from mainland China from November sent casino stocks surging last week, Bloomberg reports, with the region’s six casinos gaining more than 10%. Over the weekend, the authorities also said they would reinstate both package tours to Macau and eVisas under the Individual Visit Scheme (IVS).

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group, offer fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences.

For more information visit: spotlightsportsgroup.com

OSB analyst update

Wells Fargo suggests there is evidence of a “modest uptick” in promotional spend in recent weeks.

Seesaw: Looking at the promotional spend tracker data, the WF team said operators have been spending more on new customer acquisition during the first weeks of the NFL regular season. In the week ending this past Sunday, the average promo for new customers weighted by market share was up 43% .

The team attributed the rise largely to FanDuel, which has been running with a ‘no sweat’ bet of up to $1k vs. the prior offer of $150 in bet credits, and BetRivers, which is offering a $500 second chance bet vs. a prior $250 deposit match.

FanDuel’s promo switch is “meaningful”, they suggested, but added that overall the promotional environment is “tracking in line to slightly better than expected”.

Losing bet: They noted that DraftKings’ promotion of awarding a win to a money line bet on NFL teams that went up between 7 and 10 points during a game was a popular promotion. But the company reportedly took a large loss after numerous come-from-behind wins.

iGaming NEXT preview

Highlights include some future-gazing with Yolo’s Tim Heath and a fireside chat with Betsson’s Pontus Lindwall.

Ball gazing: Tim Heath is joined by Robin Eirik Read, CEO of Happyhour.io and formerly co-founder of GiG, and Thomas Haushalter, chief product officer at Evolution, as the keynote panel discusses where they think the industry is headed.

All things crypto are likely to dominate the discussion, given Yolo’s spread of interests and Heath’s appearance on Thursday in a fireside chat discussing “revolutionary web 3.0 casino.io”.

Off the agenda: More prosaic concerns will be top of mind when Lindwall takes to the stage for another fireside chat, though, going by past appearances at such events, don’t expect too much to be said about Betsson’s ongoing regulatory struggles in the Netherlands and Norway or indeed its exposure (albeit via a B2B deal) to Turkey.

Panel highlights

At an interesting time for investment, the case for not running away and hiding under a blanket will be made by, among others, Tekkorp’s Robin Chhabra, Peter Heneghan from Bettor Capital and Lloyd Danzig from Sharp Alpha at 12.25pm on Thursday in the David Bruce Hall.

Later that day in the same venue at 3.30pm, Paul Richardson from Partis and David Flynn from Glitnor will be looking at the world through the lens of M&A.

When we’re speaking

Good timing: Whoever determined the agenda for Valletta can be commended for prescience with the panel being chaired by E+M’s Scott Longley discussing whether, for affiliates, streamers have too much control.

Given the news from Twitch last week, expect to hear some forthright options from Phil Pearson, Lea-Ann Johnstone and Sarafina Wolde Gabriel.

MGM fireside chat

MGM CFO says company is keen to “evaluate and perhaps proceed’ with M&A following LeoVegas completion.

Choices: Speaking at the Deutsche Bank leveraged finance conference last week, CFO Johnathan Halkyard said MGM has “long held the ambition” to translate its Las Vegas casino brands into the digital space.

Following the work done on the recently completed LeoVegas acquisition, Halkyard said there was a small M&A pipeline that the LeoVegas team had brought to the table and that MGM was “keen to evaluate and perhaps proceed with”.

Group think: In Las Vegas, he noted that group and convention business was now coming back strongly and, with visibility into next year, gave the company great confidence despite what would appear to be worsening macro prospects.

“We’re seeing a return to normalcy and a real enthusiasm,” he noted.

While suggesting MGM was “never complacent”, he said Las Vegas has “never been a better destination” for this type of business.

Analysts in brief

IGT: A phrase we are likely to hear a lot more of in the months to come is macro-resilience and this is something the analysts at Truist believe IGT has in abundance. With “healthy operating trends across the segments”, Truist said it was “comfortable” with IGT’s FY22 revenue guidance of $4.1bn-$4.2bn and $1.55bn-$1.65bn of adj. EBITDA.

Following the integration of iSoftBet, management ruled out an IPO of its digital unit due to current unfavorable market conditions.

UK analyst update: Regulus Partners noted monthly data from the UK Gambling Commission shows Entain, Flutter and 888-William Hill are down c15% YoY and OSB -26% having “taken a tough, proactive stance on affordability”. But with these measures now being lapped, OSB is entering a period of easy comps that should see an increase in betting GGY from current levels.

Startup focus – Sparket

Who, what, where and when: Co-founders Aaron Basch and Evan Fisher came to the betting space with fintech backgrounds and with the idea of creating a B2B hub for providing additional F2P and real-money betting content.

Funding backgrounder: Basch said the company has raised $825k to date from friends, family and a handful of angel investors. News on a funding round is imminent.

The pitch: Basch said the ability to easily bring on new content will help the industry capture new and current underserved audiences. “Our self-setting odds platform allows any type of new wagering event particularly outside of traditional sports to be offered to users,” he said.

One area of focus is esports where Basch said the product “fits well with most events with multiple contestants”.

He also believes there are “a ton of reality and live TV shows” that could bring on a “whole new demographic of players”.

Sparket has just started working with a tribe in California to get more testing with a real casino and should have a major partnership announcement by the end of the month.

What will success look like? Near-term, Basch said Sparket will soon be integrating new bet types and enabling the acquisition of new users from outside of the traditional sports leagues. He noted that Sparket has been pre-revenue until now but will have brought in $100k by the end of the year.

“Once we go live with the expected partner we should see that number increase significantly in 2023,” he added.

He said that ultimately the goal is to license the software to multiple operators, growing as the market expands in the US.

He added there is the potential of finding an acquisition partner that wants to explore future development plans in user-driven wagering content outside of traditional sports and web 3.0 integration.

Datalines

DC Aug22: Sports betting handle was up 15.9% to $13.1m and GGR was up 20% YoY to $1.8m. Caesars Sportsbook was once again market leader on $683.3K of GGR and handle of $5.7m.

Newslines

PointsBet has received authorisation from the Louisiana Gaming Control Board and launched operations in the state, the company’s 12th in the US.

The Swedish regulator said it will continue to work towards opening its application process for B2B supplier licenses in Mar23 despite the bill not having passed the legislature and a new government taking power.

Malta-based Rootz has received a license to operate slots in Germany.

What we’re reading

Paul McCartney’s freakish memory

On social

Calendar

Sep 28-29: iGaming Next, Valletta

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com